Global Equity Strategies: September 2021 Monthly Commentary

Global markets have once again conformed to the market anomaly of the September Effect. A modest correction was felt in all major markets with the S&P500 down 4%, Euro Stoxx also down 4% and the Hang Seng down 5.5%.

The Global Diversified Strategy fell just over 2% in September outperforming the benchmark index by c.1%. In the 12 months to end September the trust has risen 31.7% versus the index of 27.8%.

In this time Value has outperformed Growth and the Global 30 portfolio, a concentrated and value biased sub-set of the trust has risen 33%.

Inflation pressures continue to rise as disruptions to global supply chains continue to play havoc. The inflation rhetoric now seems to have shifted from the transitory to enduring. Despite recent posturing from the Federal Reserve, we believe the prospect of shifting from the current low interest rate environment to substantial and sustained interest rate increases are unlikely given current economic conditions.

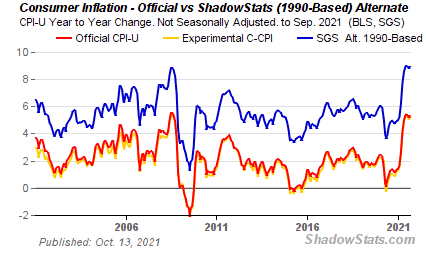

Much sleight of hand has been used to conceal the true inflation rate, but it is both unlikely, and perhaps unnecessary, for very high interest rates to be deployed as they were in the 1970s.

While many similarities superficially exist between the 1970s stagflation and today, there is a meaningful and critical difference which is the relative power of Labour vs Capital. Consequently, we see no need for large increases in interest rates to pressure companies to lay off employees and generally dampen wage inflation. We do however see regulation to reduce the power of monopolies and monopsonies and coercion of companies to raise wages. This should be a tailwind to inflation but also act as a restraint on corporate profit margins. eg the Surface Transportation Board was asked by the Biden administration to assess the lack of competition in the railroad industry. This increased regulation is a risk globally to all companies including infrastructure. There are also many bills in front of Congress to curb the monopoly platform power of the big ‘tech’ companies.

Essentially investors should seek dividend paying stocks, favour small over large, since regulation is seldom aimed at large companies, and generally avoid portfolios with positive skew aka momentum based

There will be capital controls and forced purchases of US government debt if long term interest rates approach levels which make debt servicing impossible. At 100%+ to GDP, debt levels are already close to maxed out when the new issuance is at a 3% yield, given the new net debt issuance rate of about $3.0 trillion per annum. Adding $3 trillion new debt every year, and, paying 3% of GDP in interest on accumulated debt is quite a stretch. The US is not alone in fiscal incontinence. At least the infrastructure packages now try to target segments of the economy with a sound fiscal multiplier, producing a real economic benefit?

Chinese markets to continued show volatility in September as regulatory risks regarding restructuring efforts in the economy remain. Evergrande was the easiest predicted bankruptcy ever even though predictions started about 10 years ago. The problem can be contained in a command economy. The irony is that the Chinese have addressed the issue of moral hazard, inequality and monopoly power before the Americans have.

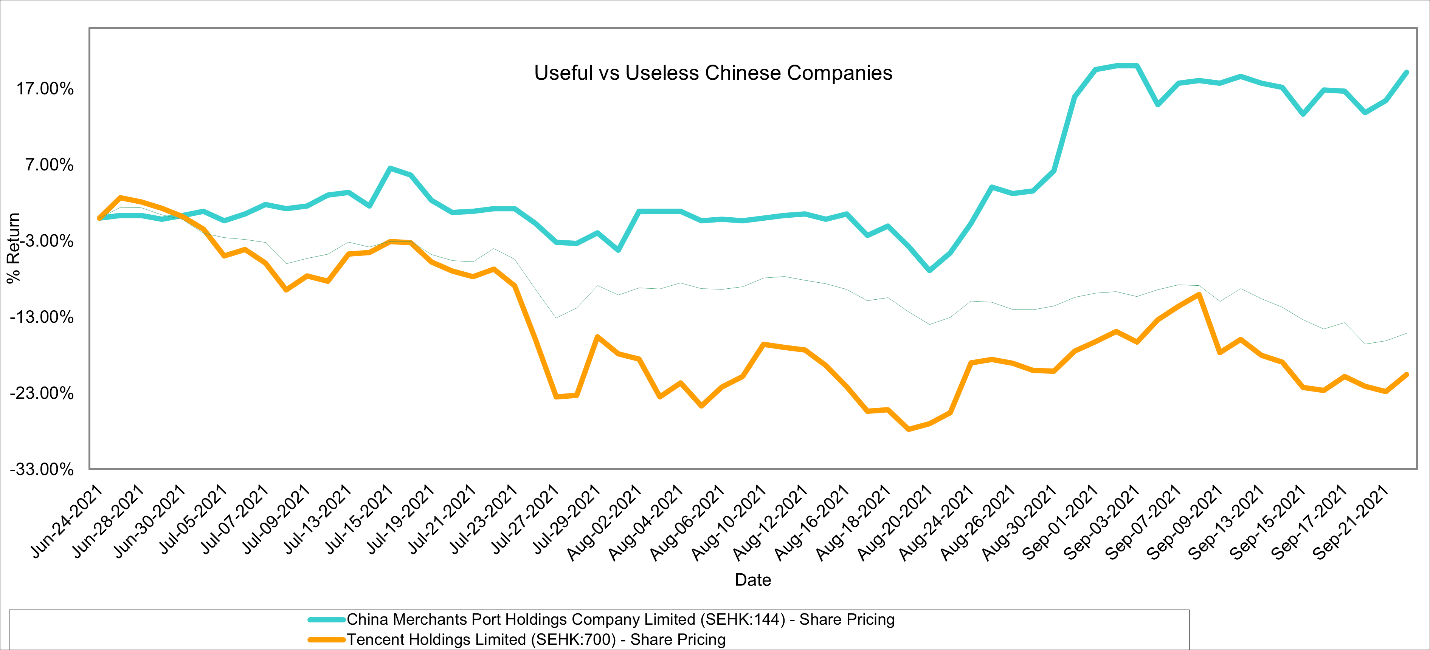

We reckon it’s ok to invest in China on a contrarian basis (we added to AliBaba as it fell) and in line with the mantra of ‘Common Prosperity’. Below we show the relative performance of a useful company cf one which operates in the now despised arena of gaming and digital time wasting in general.

Just as we say, “Don’t fight The Fed”, maybe we should say “Don’t fight The Party”. We debated this with some other fund managers via Australian Fund Monitors and you can view this here:- https://www.dropbox.com/s/o8m4sa3eu1qupwu/The%20Outlook%20for%20China.mp4?dl=0

Regulatory risks are not confined to China. The Spanish government hinted at revisiting the prices for wind sourced electricity which has shot up in price in sympathy with gas prices. This hurt the share prices of Iberdrola and ENEL in Italy. These are difficult risks to predict but our guess is that the fiscally strapped European governments will be the most tempted to change the rules of the game and hurt shareholders who believed they were investing in the desired green energy space.

Nor is ‘Common Prosperity’ as a new policy, confined to China. The UK calls it ‘Levelling Up”, Japan calls it “a virtuous cycle of growth and distribution of wealth”, the US “Build Back Better, Buy American”. Forced redistribution is coming.

Ironically the best policy for ‘the squeezed middle classes’ would be to contain inflation and yet we are looking at anything but a transitory event? You couldn’t have created a bigger mess of energy policy if you had tried. Energy prices rose dramatically for several reasons and renewables are not (yet?) capable of meeting spikes in demand. This will certainly keep inflation elevated all the way through the supply chain. Given the zeitgeist demanding ’Green’ energy and the German push to get Nord Stream 2 online we believe that gas will be seen as a clean energy (or at least a less dirty option) for at least the near future. We make extended comments on energy this month because they are a critical input to almost every part and price in economies.

We note the increasing news flow regarding nuclear power and fully expect that to be floated as a clean energy – which it is. The chart below shows the existing state of the global nuclear power generating industry, and those countries growing and those shrinking the nuclear reactor count. We invested in Fortum, the Finnish hydro and nuclear power company late in the quarter.

Net zero would seem to be a difficult task without a substantial investment in the forgotten carbon free baseload power generation of nuclear power. We expect to see public sentiment and in turn, political will to shift in relation to nuclear power. New Japanese Prime Minister Fumio Kishida has already hinted at restarting the country’s nuclear power plants (presumably after seeing Japan’s Natural Gas bills?) the majority of which have remained dormant since the 2011 Fukushima meltdown. Post Fukushima it has been the stance of the Japanese Government to no longer refurbish or construct Nuclear Plants (we expect this to change). Ageing US Nuclear plants will also see a new lease of life after the Illinois state senate approved a US$700m subsidy to Exelon to keep the Byron and Dresden plants open. Moreover, NextEra Energy has asked the Nuclear Regulatory Commission to extend the licenses for two rectors at its St Lucie Plant for a further 20 years after already receiving approval to extend the life of its Turkey Point Plant for 20 years. Should approvals at St Lucie be granted the life of these plants will have been 80 years (yes 80!) when they are finally taken offline. Whilst modern nuclear plants offer a safe and clean (mostly) source of baseload power a lack of investment in new plants in the majority of developed nations has resulted in ageing plant extending their lives despite the numerous risks attached. 57 nuclear plants are under construction globally with bulk of this construction occurring in Asia. The US and UK both have 2 plants under construction with an average age of plants of 39 and 36 years respectively and we expect this number will need to increase in the coming years. This is a competitive advantage to Asia currently and a sound reason for favouring investment there.

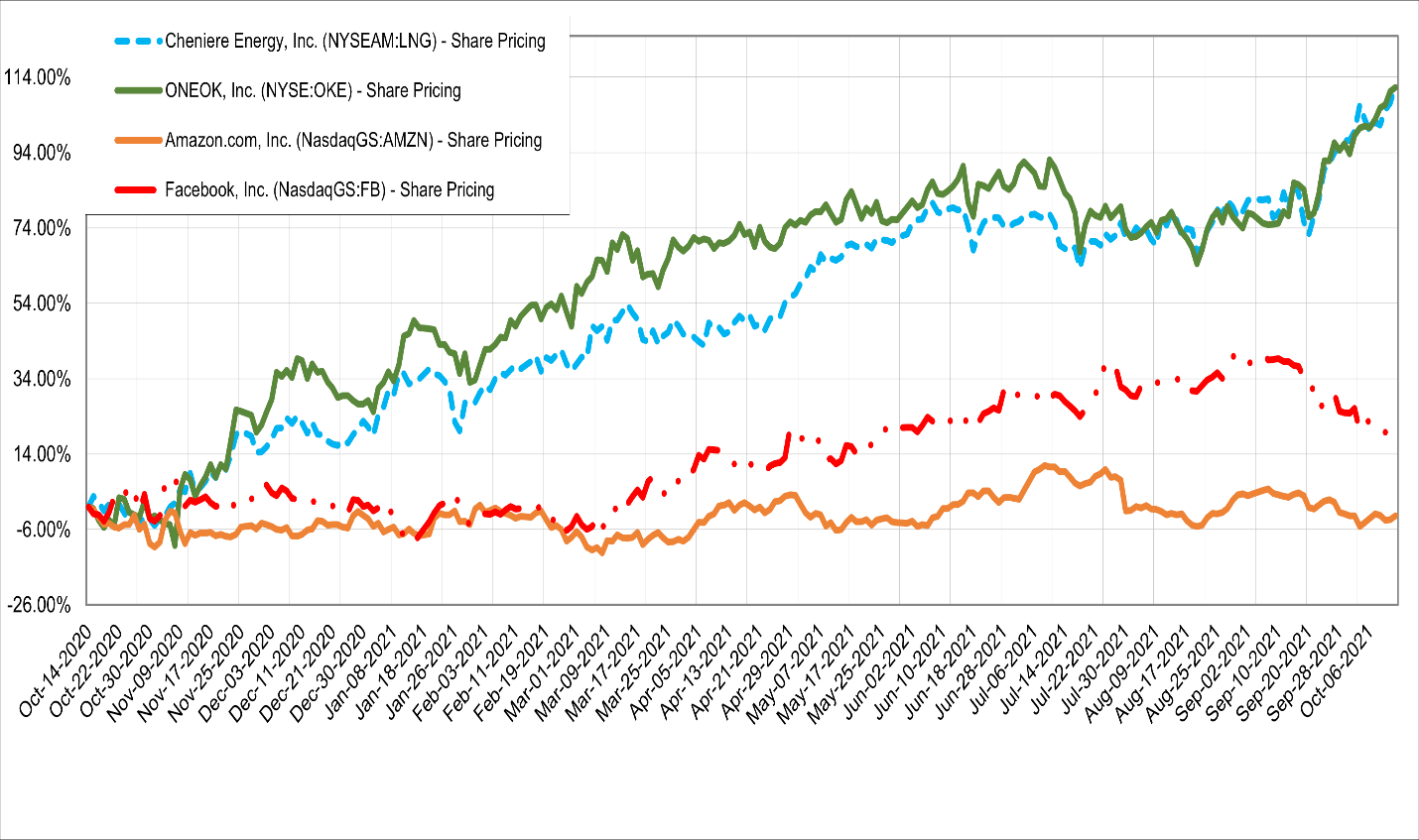

The approaching Northern Hemisphere winter will keep upward pressure on energy prices. If we were asked, we would recommend that a switch to Carbon Neutral be only done when sustainable energy technology can provide base and peak load power. Currently it is not. As such continued investment in traditional but cleaner than coal energy sources would make sense. We show below how the prices of ONEOK, a gas pipeline company and Cheniere, a LNG producer have outperformed everyone’s favourites, Facebook and Amazon, in the past year. They also have the additional benefit of negative skew for a portfolio.

Corporate profits remain elevated relative to wages. Expectations for long run returns should be tempered by an acknowledgment that this balance needs to shift. Nonetheless, equities especially value, small and Asia will outperform bonds, cash and gold.

Delft Partners, October 2021