Global Listed Infrastructure August 2021 Monthly Commentary

The past month has seen a 10% increase in the official number of Covid-19 cases globally, another acceleration from the 8% growth rate recorded in the month of July.

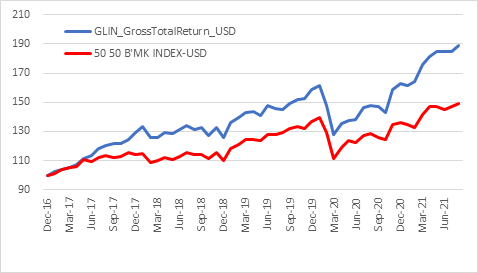

Global equities rose about 2.5% in US$ terms and 3% in A$ as the Australian currency weakened further. The global infrastructure benchmark we use, a blended 50:50 mix of core and extended definitions, rose about 1.5%. The strategy returned 2.5% in US$ and continues a period of pleasing relative and absolute returns.

Economic slowdowns expected from a resurgence of Covid, a chaotic end to 20 years of attempted regime change in Afghanistan, continued tensions between China and just about everybody else, and more regulation threatened by the Biden administration, all failed to stop this seemingly inexorable rise in the equity markets. The Jackson Hole speech at the end of August was also interpreted encouragingly as merely ‘tapering the talk about tapering’.

Sentiment, IPO quality (down), and action in credit markets all point to a fair degree of complacency and thus vulnerability. We believe that ‘transitory’ as in transitory inflation is bunkum and even if the rate of price increases does subside, the level of prices is now permanently higher, as are inflation expectations.

Infrastructure equities would seem to provide a fair degree of valuation and inflation protection with a running dividend yield well in excess of that available on global bond markets.

The market in China bounced back from the double figure percentage decline recorded in July with a 3.5% gain in August. There was little response from Beijing to various speeches by Vice President Kamala Harris as she toured SE Asia for seven days. It was notable that a senior Pentagon official held talks with the Chinese military for the first time under the Biden administration with a focus on managing risks between the two countries.

The price of the equity and bonds (mostly offshore investors) of China Evergrande, a very heavily indebted but large Chinese property development company, tumbled as the plug holding this edifice together (mixed metaphor) looks like being pulled. Long believed to be both well connected and too big to fail, the imminent restructuring will introduce Chinese investors to the pain of real capitalism. Offshore investors will get burned too.

We don’t yet know whether the pain will be proportionate and ‘fair’ between local and foreign investors but, can hazard a guess. Nonetheless, a reduction of moral hazard is to be welcomed after years of implicit and explicit subsidy. How ironic that such policies come first from China and not the USA which appears to be thinking hard about replicating the experience of the Weimar Republic in the 1920s.

https://www.delftpartners.com/news/views/Topsy-turvy-world.html

While the rhetoric from China is damaging not least to its own interests, the evidence is that businesses not directly in the cross hairs are doing just fine. Cross hairs being defined as socially unacceptable. China is not un-investable but “don’t fight The Party” as an aphorism may now carry as much weight as “don’t fight The Fed”? Our holdings in the essential services of energy and ports did quite well with Kunlun Energy rising over 20%, China Merchants +11%, and China Longyuan about 8%.

In Japan, Prime Minister Suga is facing a challenge to his leadership ahead of the general election that is due by November. Mr Suga’s approval rating has slumped with his handling of the COVID-19 pandemic perceived as poor. Holding the Olympics was probably a sensible way to show case Japanese society, but the inevitable resulting transmissions have been politically expensive. Despite this political uncertainty associated with leadership of the LDP, the equity market is performing well, rising 2% in the month of August and 18% in the year to date.

We sold NYK in August. The shipping stock has risen over 200% from the start of the year and while profit expectations keep rising and the P/E remains low, the leverage of the profits to freight rates is enormous, and there has been no removal of shipping container carriage supply nor massive increase in demand, ‘merely’ a logistics snafu which is short term in nature and will be fixed. Once fixed, or even looking like being fixed, expectations of falling container rates will likely drive the stock down. We remain invested in other logistics companies such as Sumitomo Warehouse which rose 11%.

We re-invested into NTT in Japan, the broadband digital infrastructure carrier, and E.ON the German based utility company.

European markets drifted a little higher. Political risk and Euro risk will be soon appearing on investors’ radar screens. We expect the Euro to weaken a little from here, and for investors to seek certainty, yield, and pricing power as an inflation hedge. This should benefit infrastructure companies such as recently purchased E.ON which has a strong retail business and is currently passing on significant price increases.

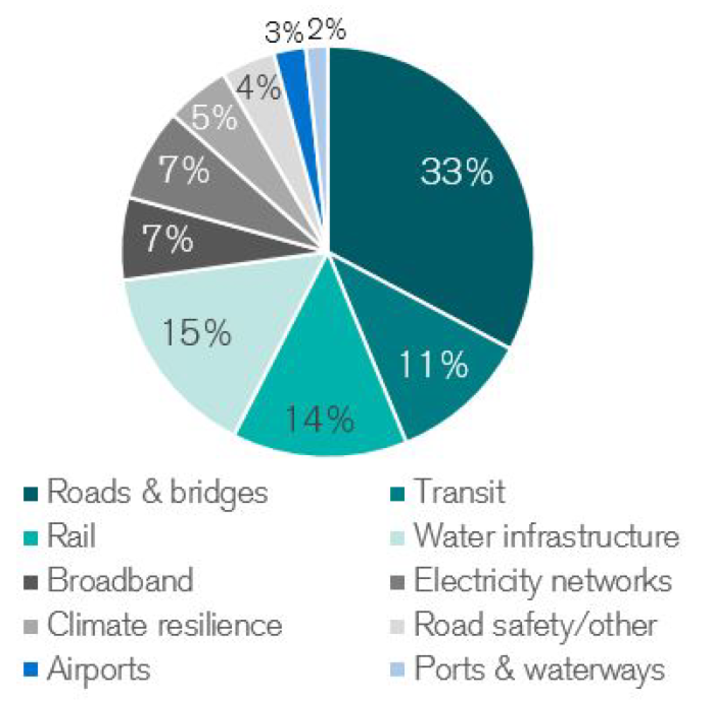

The USA Congress passed the first infrastructure spending bill of about $1 tln, spread over several years. The next bill of about $3.5 tln will hopefully not pass in its current form since it is designated as ‘investing’ in ‘soft’ infrastructure which is essentially a government fiscal transfer to households with no material benefit to productivity.

The allocation of the $1 tln is estimated by the US Senate to be as follows:-

ESG rhetoric has subsided slightly in the USA and our expectation is that natural gas is the preferred stable energy source. We remain wary of nuclear power due to political issues, despite its obvious benefits as a stable and clean source. We added to DTE in August in the US. Notable performers were Iron Mountain the data storage REIT, which rose over 10% and NextEra Energy which rose 8%.

The portfolio is currently overweight Energy companies, and Utilities, and underweight the IT and Telecom sectors. Risk, as measured by expected deviation from the benchmark return, is about average at 4.5%, meaning we hope to outperform our benchmark by this much over the next year. If we underperform then our downside should correspondingly also be limited.

The chart below shows the benefits of managing risk and accumulating outperformance of the benchmark in a consistent way. Annual US$ based returns since inception in late 2016 are running at about 13% for far less volatility than other equity assets.

Delft Partners May 2021