Global Equity Strategies: August 2021 Monthly Commentary

The past month has seen a 10% increase in the official number of Covid-19 cases globally, another acceleration from the 8% growth rate recorded in the month of July.

Global equities rose about 2.5% in US$ terms and 3% in A$ as the Australian currency weakened further. The 2 global strategies returned c.2%, a little behind the benchmarks.

Economic slowdowns expected from a resurgence of Covid, a chaotic end to 20 years of attempted regime change in Afghanistan, continued tensions between China and just about everybody else, and more regulation threatened by the Biden administration, all failed to stop this seemingly inexorable rise in the equity markets. The Jackson Hole speech at the end of August was also interpreted encouragingly as merely ‘tapering the talk about tapering’.

Sentiment, IPO quality (down), and action in credit markets all point to a fair degree of complacency and thus vulnerability. We believe that ‘transitory’ as in transitory inflation is bunkum and even if the rate of price increases does subside, the level of prices is now permanently higher, as are inflation expectations.

We thus remain biased to cheaper, smaller companies, (not small caps) and thus have a bias to value as a factor. We remain fully invested and increasingly like dividends, and hard assets and sensible leverage. The experience and performance of the Chinese market which has endured tightening, regulation, and the withdrawal of bail outs has been poor. This poor performance is an example of what could befall the USA market if similar policies are introduced.

https://www.delftpartners.com/news/views/Topsy-turvy-world.html

The market in China bounced back from the double figure percentage decline recorded in July with a 3.5% gain in August. There was little response from Beijing to various speeches by Vice President Kamala Harris as she toured SE Asia for seven days. Speaking in Hanoi, Vice President Harris indicated a need to increase pressure on Beijing regarding disputed maritime claims in the region. It was also notable that a senior Pentagon official held talks with the Chinese military for the first time under the Biden administration with a focus on managing risks between the two countries. Both sides agreed on the importance of maintaining open channels of communication between the two militaries.

The price of the equity and bonds (mostly offshore investors) of China Evergrande, a very heavily indebted but large Chinese property development company, tumbled as the plug holding this edifice together looks like being pulled (mixed metaphor). Long believed to be both well connected and too big to fail, Evergrande’s imminent restructuring will introduce Chinese investors to the pain of real capitalism. A reduction of moral hazard is to be welcomed after years of implicit and explicit subsidy. How ironic that such policies come first from China and not the USA, which appears to be thinking about replicating the experience of the Weimar Republic in the 1920s.

We should have sold our holdings in Ping An and Alibaba but didn’t. We won’t here. While the rhetoric from China is damaging not least to its own interests, the evidence is that businesses not directly in the cross hairs are doing just fine. Cross hairs defined as socially unacceptable. China is not un-investable but “don’t fight The Party” as an aphorism may carry as much weight as “don’t fight The Fed”?

As we “go to press” we see that Alibaba has pledged $15.5 bn to the ‘Common Prosperity’ drive. That might help with rehabilitation don’t you think?

In Japan, Prime Minister Suga is facing a challenge to his leadership ahead of the general election that is due by November. Mr Suga’s approval rating has slumped with his handling of the COVID-19 pandemic perceived as poor. Holding the Olympics was probably a sensible way to show case Japanese society, but the inevitable resulting transmissions have been politically expensive. Despite this political uncertainty associated with leadership of the LDP, the equity market is performing well, rising 2% in the month of August and 18% in the year to date.

We invested in NTT which post the assimilation of minorities in NTT DoCoMo in late 2020, appears to have found an appealing global strategy. Notable performers were Fuji Film, which rose 10% and Hoya which rose c.15%, both essentially semi-conductor materials companies but classified as Office Supplies and Medical Equipment respectively. We like investing in companies which are misunderstood and insufficiently flowed.

European markets drifted a little higher c1%. Political risk and Euro risk will be soon appearing on investors’ radar screens. Inflation is coming in higher than expected (what a surprise given monetary policy) and some rumblings of discontent are heard within the ECB amongst the more orthodox members. We expect the Euro to weaken a little from here, and for investors to seek certainty, yield, and pricing power as an inflation and monetary incontinence hedge. We remain uninvested in European banks which will come under pressure if rates start to back up and TARGET2 imbalances become news – which they should. We are invested in basic materials companies and construction businesses such as CRH and Barratt Developments both up 5% and Heidelberg Cement down 2%.

The USA Congress passed the first infrastructure spending bill of about $1 tln, spread over several years. The next bill of about $3.5 tln will hopefully not pass in its current form since it is designated as ‘investing’ in ‘soft’ infrastructure and is essentially a government fiscal transfer to households with no material benefit to productivity.

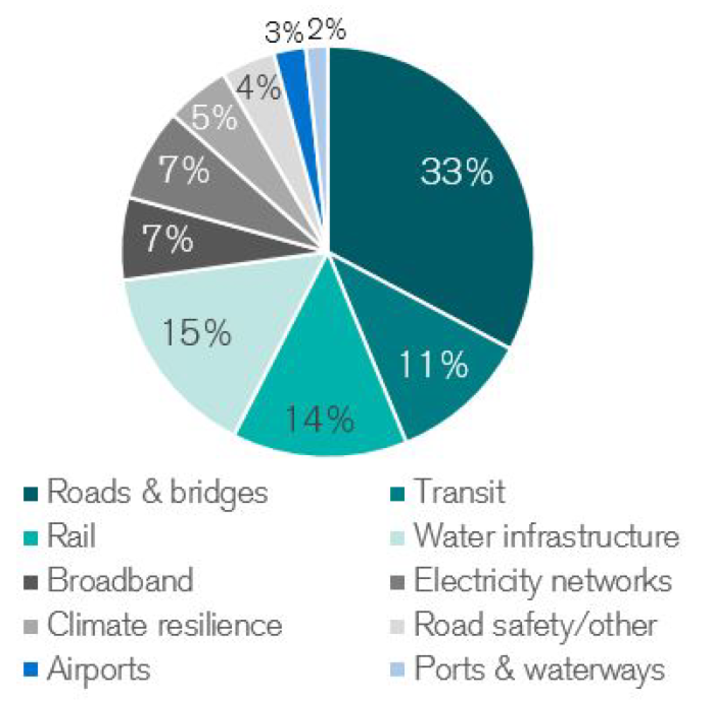

The allocation of the $1 tln is estimated by the US Senate to be as follows:-

ESG rhetoric has subsided slightly in the USA and our expectation is that natural gas is the preferred stable energy source. We remain wary of nuclear power due to political issues, despite its obvious benefits as a stable and clean source.

Williams Sonoma posted very good results as recent house purchases will require some snazzy home furnishings, and the stock rose c.20%. We own Home Depot for similar reasons. Kroger the food retailer rose c.10% as results indicated a fair degree of ability to pass on input price inflation. Quanta Services rose 15% as investors realised the addition of renewable energy to the grid will require upgrades and new technology which PWR provides. We like these kinds of technology companies hiding as industrials because the chances of a re-rating are very high.

The portfolios are value biased currently and overweight Japan, Industrials and Staples and underweight I.T. Oils and Consumer Cyclicals. The risk relative to benchmarks is modest at about 4% meaning we hope to outperform by about that much annually. This would be sufficient to keep the strategies in the first quartile of relevant peer universes.

Delft Partners September 2021