Global Infrastructure Strategy: July 2020 Commentary

July was characterised by a weak US dollar – many markets were down or flat in local currency terms except the US market which had another strong month for all risk assets. USA Equities rose strongly countering the weakness in the US dollar. The Australian $ rose 4% against the US$ as did most major currencies.

The Global Infrastructure portfolio rose by 5.65% in US$ terms (1.65% in AUD terms). The benchmark (a 50:50 blend of Core and Extended Infrastructure stocks) rose by 3.99% in US$ terms.

Governments around the World are looking to boost their respective GDP levels in response to the Covid pandemic. With Infrastructure spending having lagged for decades, higher infrastructure spending makes a lot of sense as it improves the efficiency and cost levels of economies. A number of countries have already pledged to spend more on infrastructure and many more are likely to follow.

The Covid pandemic has created a period of great uncertainty for many companies and many now struggle to give earnings guidance. Most infrastructure and utility companies are able to provide much higher reliability of earnings and maintain good dividends and with sustainable yields well in excess of those available from government bonds, should continue to prove to be very attractive for investors.

We continue to prefer quality equities with strong balance sheet and above average earnings stability. We have said from the outset of the crisis that the recovery is going to take some time. No sooner have countries eased lockdown and we are already seeing rising cases and reintroduction of some lockdown measures. This is bound to vary from country to country and the success of governments to contain outbreaks through good monitoring measures (track and trace, etc). A game changer would be an early vaccine and with over 100 possible vaccine candidates worldwide and early trial successes for a number of them, we should not be too negative and caught up in the near-term news on cases.

In the near term however, we believe markets are in some sense in denial of the difficult road ahead.

What are these signs of complacency?

- USA market concentration is extreme with 5 stocks now accounting for about 20% of the S&P 500. This essentially means that the market capitalisation index in the USA is a highly price momentum-based risk exposure. Such exposures work well until they don’t. Narrow market breadth is always a warning sign.

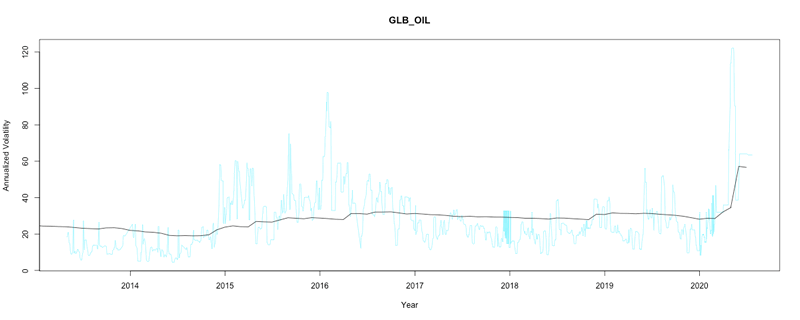

- The volatility in certain asset classes such as oil is rising. This typically indicates an imminent ‘shock’ to the system. No one is expecting an oil price rise but if it occurs you can be reasonably sure we will see a back-up in bond yields and elevated inflationary expectations.

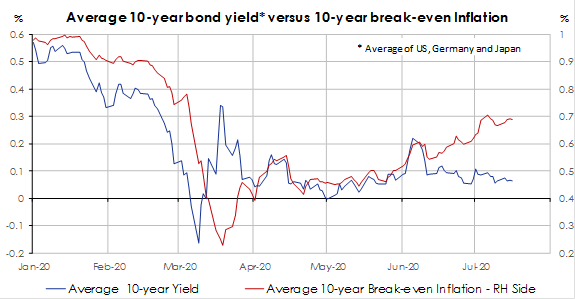

- Inflationary expectations are building. Breakeven inflation forecasts are rising as seen in the growing difference in yields between Index Linked and nominal bonds. Something is wrong in market assumptions here and we would not be surprised to see inflationary expectations jump as soon as q4. In that Infrastructure companies can pass through some of these price increases they will offer some protection against an uptick.

- The Euro has bounced as the EU appears to have moved to fiscal unity essentially meaning that Germany’s credit rating can now be applied to the bankrupt periphery. Given that the EU Covid recovery package amounts to less than 1% of GDP and that the Italian banks need over E600bn to be recapitalised we think we are "not out of the woods yet".

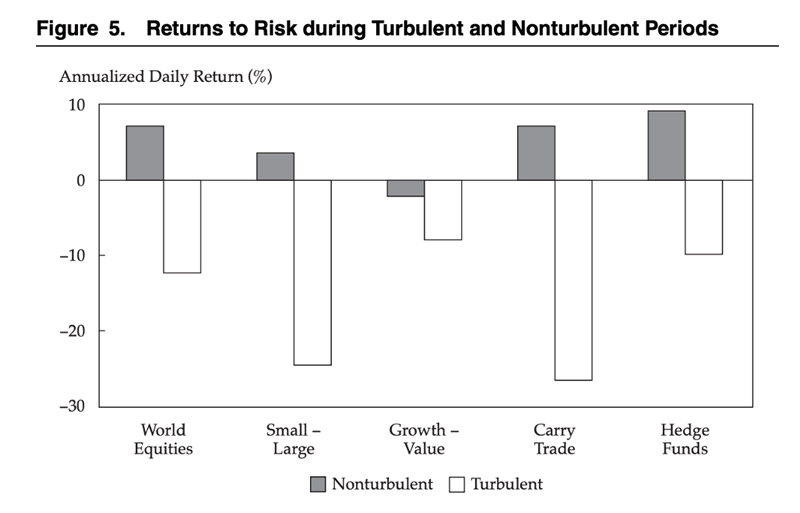

We now show a chart of asset class returns during turbulent and non-turbulent periods. We are due for another period of doubt. Our defensive positioning seems prudent.

Source: Northfield Risk Systems

Source: Northfield Risk Systems

So, we therefore suggest that investors remain diversified; become a little more defensive in equity positioning; and favour dividend paying companies and those with strong balance sheets.

The Top 10 positions in the Global Infrastructure portfolio are as below and we remain overweight Electric Utilities and Wireless telecoms sectors. In July we added AT&T from cash.

| Company Name | Country | Portfolio |

|---|---|---|

| Verizon | USA | 4.6% |

| China Mobile | China | 3.9% |

| Southern co | USA | 3.3% |

| NTT Docomo | Japan | 3.2% |

| Iberdrola | Spain | 3.2% |

| Northland Power | Canada | 3.1% |

| PPL | USA | 3.0% |

| Dominion Energy | USA | 2.9% |

| TC Energy | Canada | 2.8% |

| Nextera energy | USA | 2.8% |

| TOTAL | 32.7% |