A look into the Delft Partners portfolio in Asia

9th September, 2020

By Kevin N. Smith, Delft Partners

Kevin Smith takes a look into the Delft Partners Asian portfolio of small to mid-sized companies, in particular the long-term holding in China Lesso and recent acquisitions of United Microelectronics and BayCurrent Consulting, all of which performed very well in July 2020, each stock rising by more than 40% for the month.

High volatility has been a feature of the equity markets in the region during the past two years, with the key events being trade tension between the United States and China and the subsequent Covid-19 pandemic with the associated disruption to economic activity across the world. Three-year annualized volatility for the Asia region to the end of July was close to 20%, well above the long-term average and a big jump from the 13.5% volatility figure recorded in the region twelve months earlier. While volatility has been at high levels, market returns have remained well below their long-term average. During the year to end July 2020 our benchmark index of small to mid-sized companies in the Asian region in Australian dollar terms fell by 3.1%, while our Asian portfolio net of all fees increased by 0.5%. It is very pleasing for us as fund managers to achieve a small positive return when the underlying markets are in decline. If you had not looked at markets in the past twelve months and had avoided all news stories you would have concluded that markets had been quiet during that time with the small negative outcome for the index. The purpose of this article is to take a closer look at our responses to three examples of highly volatile companies in our portfolio, China Lesso, United Microelectronics and BayCurrent Consulting, all of which increased by more than 40% in July, a month when the overall index recorded a decline of 2.6% in Australian dollar terms.

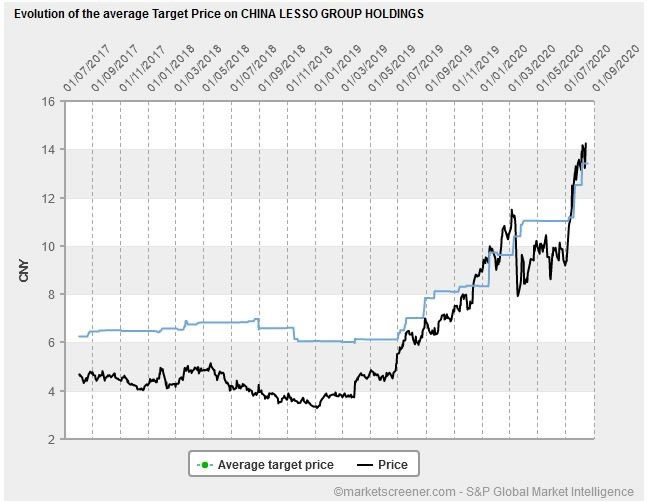

We first acquired a position in China Lesso (Lesso) in the fourth quarter of 2018 at an average price of HKD 4.08, at the time of writing the shares trade at HKD 15.50 to be the strongest performer in our Asian portfolio. During the month of July shares in Lesso increased by 48.4% from HKD 10.08 to HKD 14.96. We have taken profits along the journey, in particular for risk control purposes, it is important not to let an individual stock position grow too large in a diversified portfolio. Lesso was a major contributor to our outperformance of the index in the past year. Lesso typically has coverage provided by seven or eight analysts and the progression of the company share price versus their target prices is shown in Figure One. The analysts have struggled to keep pace with the underlying share price.

In October 2018 we concluded that “Lesso meets our standards for accounting, strategy and governance. Lesso has a strategy directed towards the development of China, the company has a strong home market in Southern China and is well placed to benefit from urbanization of the interior of China and major infrastructure projects funded by local government bodies and the national government.” Lesso has 90% of sales from plastic pipe systems, revenues grew by 11.0% and earnings per share increased by 22.5% in 2019. Figure Two illustrates the level of valuation of Lesso when we first acquired the shares in 2018 on a p/e ratio of 4.3x, the valuation has since expanded to the current (and still reasonable) level of 12.9x. With continued growth in profits expected out to the year 2022, Lesso trades on a prospective p/e ratio of less than 10x.

Figure One: China Lesso Share Price Versus Average Target Price

Source: marketscreener.com

That expansion in multiple explains the majority of the return achieved in the past two years. We are happy to retain a position in the company since our original reasons for investing remain intact, the company continues to score well on our measure of VMQ (valuation, momentum and quality) and high standards of governance are being maintained. Lesso remains a key beneficiary of the urbanization of the interior of China which 25 production bases located across 16 provinces in China and a nationwide sales network of more than 2,000 exclusive distributors.

Figure Two: China Lesso Valuation History and Forward Estimates

Source: marketscreener.com

United Microelectronics Corporation (UMC) manufactures and markets integrated circuits. The company provides wafer manufacturing, assembly, testing, mask production and design services. UMC operates 12 fabs that are located throughout Asia with a maximum capacity of more than 750,000 8-inch equivalent wafers per month. The company employs approximately 19,000 people worldwide, with offices in Taiwan, China, United States, Europe, Japan, Korea and Singapore. In Q3 2019, UMC ranked fourth in the pure semiconductor foundry industry with 6.7% market share (source: Trend Force). UMC manufactures semiconductors using advanced production processes for customers based on its own proprietary integrated circuit designs. UMC’s wafer fabrication process includes services such as design, mask making, testing and assembly services. We believe UMC will transform into a specialty foundry changing its business model and focus on 28nm, 40nm and 8" foundry products, which will result in significantly improved profitability by reducing capex and R&D.

We built our initial position in UMC during May 2020 at an average price of TWD 15.15. There are 20 analysts producing forecasts for UMC, in July 2020 there was considerable positive earnings surprise when second quarter earnings were reported some 56% above the market consensus that is derived from those 20 analysts. The share price of UMC responded by rising 40.6% during the month of July to close at TWD 22.35. We did not buy our position because of any particular insight regarding the next set of quarterly results, our timeframe is to take a view over several years. We do not make forecasts for an individual quarterly earnings period however we look to form a judgement regarding the likely success of the strategy being employed by the company we are assessing. For UMC, the company scored very well on our broad categories of value, momentum and quality and as noted above we liked their strategy of becoming a specialty semiconductor foundry with the scope to increase profitability. The earnings increase that surprised the investment analysts in the second quarter results was a vindication of the company strategy albeit somewhat earlier than we had anticipated. Figure Three shows that the market is now expecting continued growth of earnings in the next two years with a prospective price earnings ratio of 11.5x. Since we take the view that the company strategy as far from complete, we are retaining our position in UMC.

Figure Three: United Microelectronics Corporation Valuation History and Forward Estimates

Source: marketscreener.com

BayCurrent Consulting Inc. (BayCurrent) is a comprehensive consulting firm based in Japan. BayCurrent is engaged in designing and implementing strategies relating to information technology, global growth, marketing, mergers, joint ventures, alliances, governance implementation and turn-around management. BayCurrent has grown rapidly in recent years with the annual results reported to the end of February showing revenue growth of 36% and earnings growth of 91% over the previous year. We started to have a serious look at the business when the valuation dropped below 20x price to earnings in recent months and decided to build a position in early July at an average price of JPY 8,858. We then watched the share price rise by 49% in the space of three weeks to JPY 13,216 at which point we sold the shares. It is very unusual that we have a holding period of just three weeks, more typically we will hold a position for three years. In this instance the 49% share price increase put the valuation up to 31x expected 2021 price/earnings which was more than our tolerance for value. We will be happy to have another look at the company if the valuation drops back to a reasonable level.

Figure Four: BayCurrent Consulting Inc. Valuation History and Forward Estimates

Source: marketscreener.com

In conclusion, while the Asia regional returns have been subdued in the past two years, we have seen some extreme levels of volatility with individual stocks moving as much as 50% month to month. This article has provided three examples of stocks held in our Asian portfolio that have increased by more than 40% during the month of July. Share price movement of that magnitude will always prompt us to review our position, in two cases, China Lesso and UMC we retained our holdings on the basis that our view of the respective strategies remains intact and the valuation isn’t too high. In the case of BayCurrent the 49% upward price move in three weeks pushed the valuation above an acceptable valuation level and we sold our position.