Advantest – New acquisition for Asia Small Companies

By Kevin Smith

A world-class technology company, Advantest is a leading producer of automatic test equipment for the semiconductor industry and a premier manufacturer of measuring instruments used in the design and production of electronic instruments and systems. Its leading-edge systems and products are integrated into the most advanced semiconductor production lines in the world. The company also focuses on R&D for emerging markets that benefit from advancements in nanotech and terahertz technologies and has introduced multi-vision metrology scanning electron microscopes essential to photomask manufacturing, as well as a ground-breaking 3D imaging and analysis tools. Founded in Tokyo in 1954, Advantest established its first subsidiary in 1982, in the USA, and now has subsidiaries worldwide

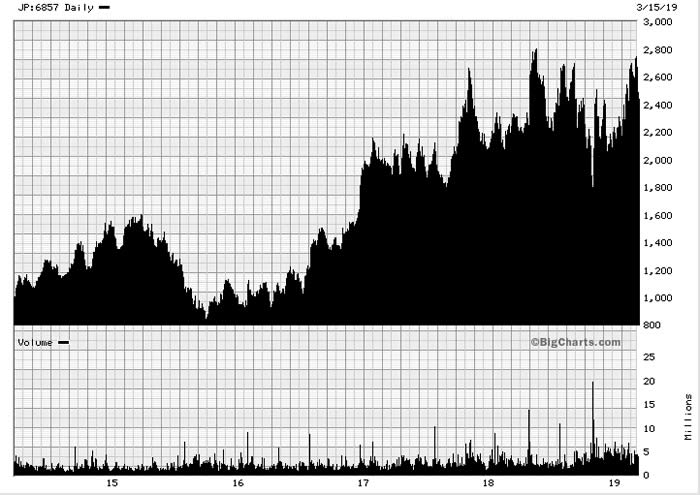

Source: Barrons.com

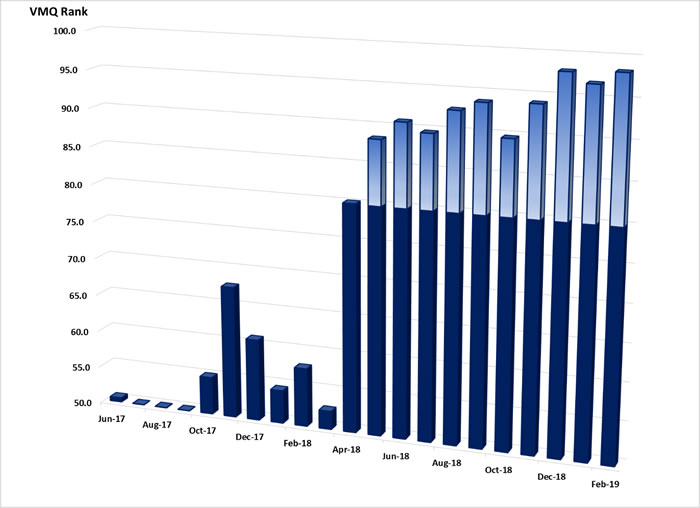

Value, Momentum and Quality Comments

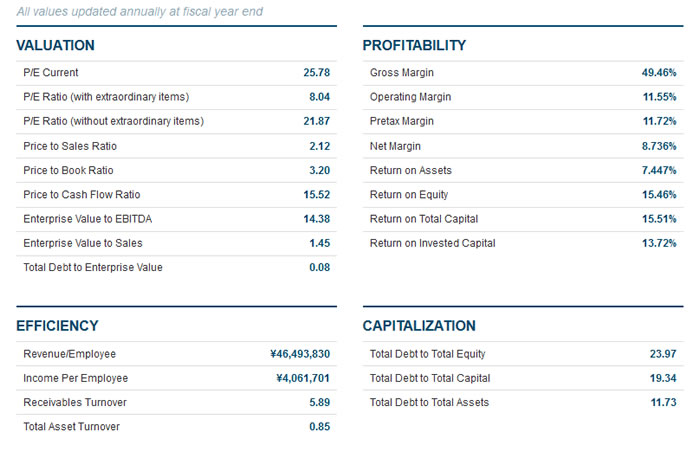

The Company has maintained very strong momentum and quality scores throughout the period, the key behind a sharp improvement in the overall VMQ score shown below is a consistent improvement to the value scores during 2018.

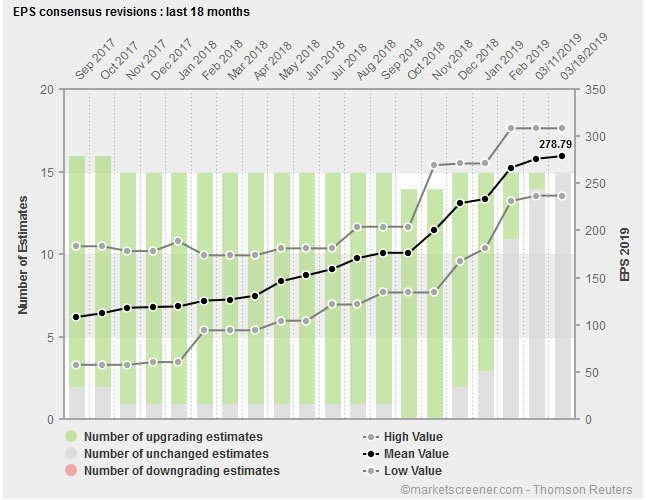

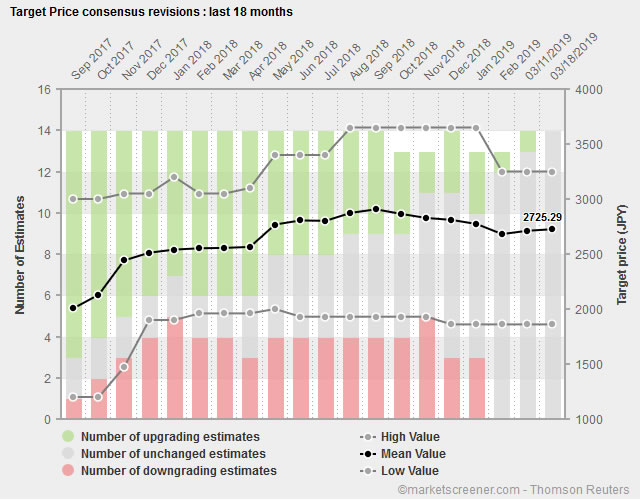

The table of earnings revisions on page four shows that forecasts for 2019 earnings have been upgraded throughout the past year. The other table on page four shows the progression of target share price by analysts covering Advantest, the consensus target is Ұ2725, versus a current share price of Ұ2440. We expect that target price to be the subject of further upgrades during 2019.

The Momentum signal has been strong. Since acquisition in late February the stock has continued to rally gaining over 25% as consensus views on earnings revisions and price targets continue to improve.

Accounting, Strategy and Governance Comments

Accounting

- Full compliance with IFRS (US GAAP prior to 2015).

- The Company has a policy of good transparency with investors and provides the most comprehensive list of risk factors we have seen from any company in the region.

Strategy

Advantest has built a business that ranks seventh in the top ten of global integrated circuit (IC) manufacturing equipment makers. This business has high barriers to entry and splits into three broad areas:

- Semiconductor and Component Test Systems accounts for 68% of sales. This is the traditional business for Advantest making testing equipment for various types of semiconductors including logic, analog and memory ICs.

- Services and Support accounts for 15% of sales, providing installation and support services for test systems.

- Mechatronics Systems accounts for 17% of sales, Advantest provides tools for fine-pitch lithography, processing and measurement using electron beams. This division also provides testing equipment for packaged semiconductor systems.

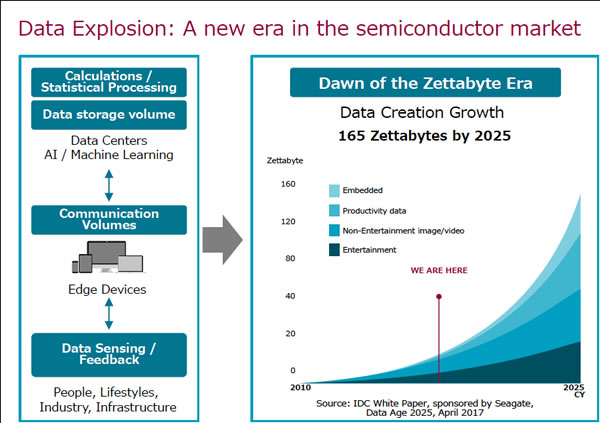

Advantest has a business that adapts to developments in the market, in 2018 the key driver for testing was for smartphone chips while demand for memory chip testing declined. The Company is prepared for slow market conditions in 2019 and then expecting the next wave in technology development to drive higher demand especially in the arena of 5G and Artificial Intelligence.

We are happy with Advantest's strategy of completing incremental acquisitions, especially where that provides a complement to the existing book of business. In February 2019 Advantest completed the acquisition of Semiconductor System Level Test Business from Astronics Corporation for USD 100 million plus an earn-out payment of up to $35 million. This business adds expertise in the field of system level testing and we were pleased to see that the eventual price paid was adjusted down from the originally announced level of $185 million plus $30 million earn-out.

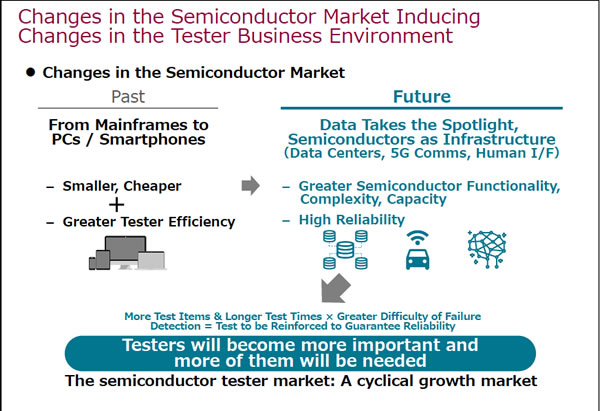

The following material demonstrates Advantest's view of the market growth opportunity, increased capacity and improved reliability standards will increase resources devoted to testing within the industry.

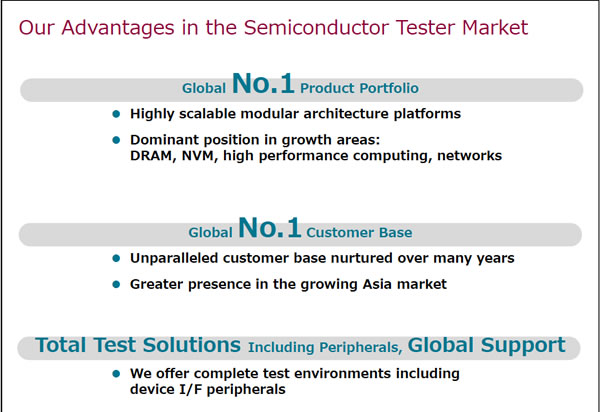

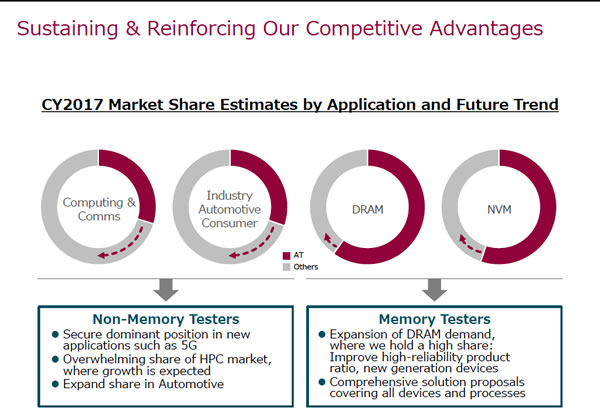

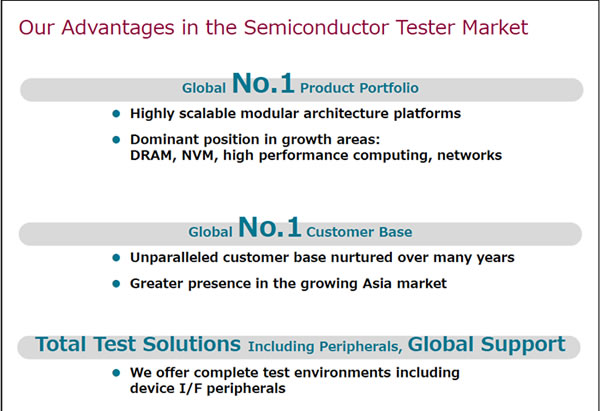

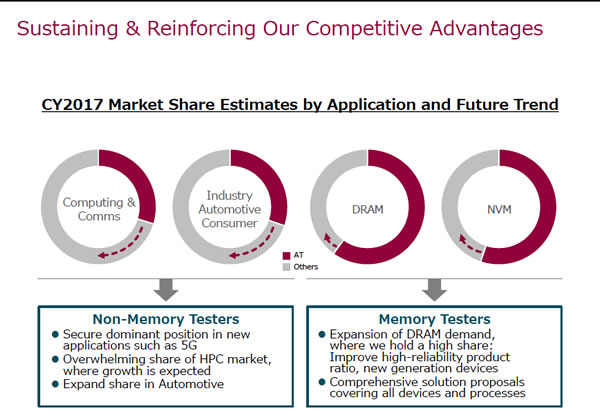

The following tables provide an illustration of Advantest's positioning in the market place, particularly their competitive advantages in terms of product portfolio and client geography. The Company's medium-term plan shows their expectation of substantial increases in market shares in the computing and consumer segments together with the automotive market.

Governance

- At the end of January Advantest provided clear guidance regarding their dividend policy which will target a payout ratio of 30%. The Company upgraded their dividend forecast for the current year from Ұ75 to Ұ88.

- The Company has a well defined governance code first enacted in November 2015 and revised in December 2018.

- Full compliance with the Governance Code in Japan. The Company has four outside directors on the Board comprising nine Directors in total. The Company holds thirteen Board Meetings per year and has applied term limits for the Directors.

Conclusion

Advantest is a world class semiconductor test equipment business that has demonstrated an ability to adapt their offering in a changing market for technology products. The business has a strong management structure, communicates well with investors and has the capacity to deliver strong investment returns based around a strategy that should see increasing market share in a growing overall market for testing equipment and support.