Champion REIT - Diverse exposure to Hong Kong property

By Kevin Smith

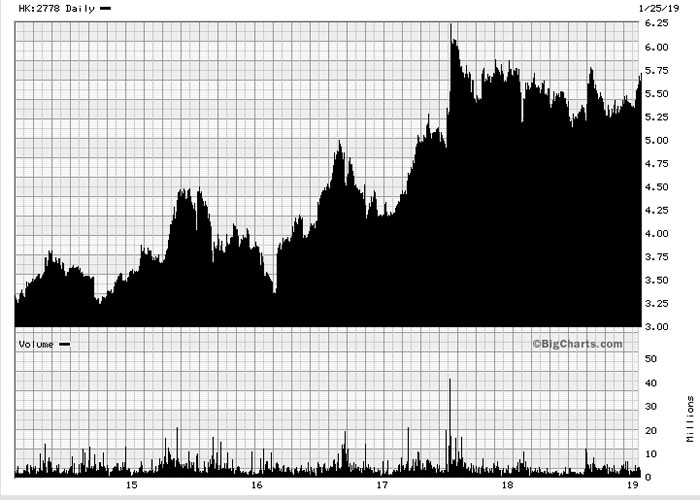

Champion REIT is a trust formed to own and invest in income producing office and retail properties in Hong Kong. The trust's focus is on Grade-A commercial properties in prime locations. The trust currently offers exposure to 2.93 million square feet of prime office and retail floor area by way of two landmark properties in Hong Kong, Three Garden Road and Langham Place, one on each side of Victoria Harbour.

Source: Barrons

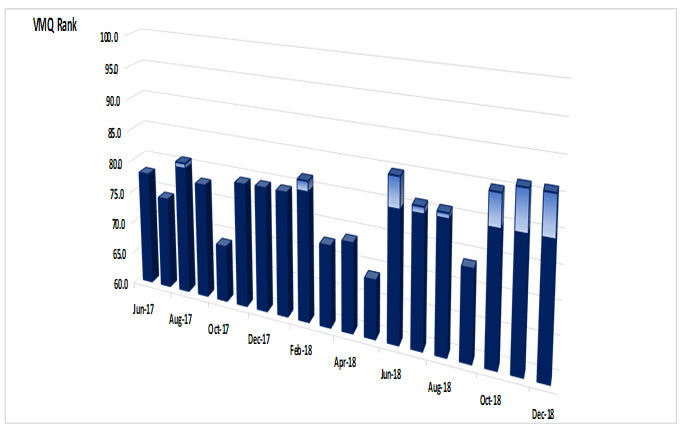

Value, Momentum and Quality Comments

- The VMQ score has shown significant improvement at 80-86 in the past six months and has maintained a level above our minimum required score throughout the period under review. The share price has proved very resilient in the face of weak general market conditions in the fourth quarter of 2018 and that has helped the momentum score.

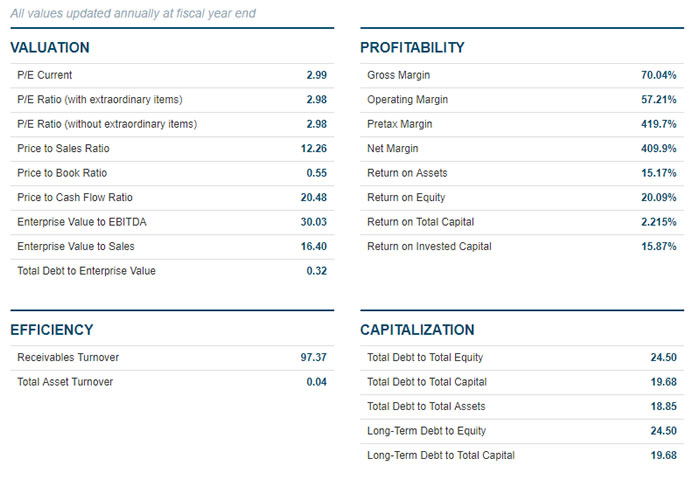

- The Trust has a modest level of debt which has been consistently declining over time, 54% of the debt is structured on a fixed rate basis and the balance at floating rates. Increasing interest rates during 2018 increased funding costs from the equivalent of 14.3% to 15.7% of net property income. Champion REIT has a very conservative capital structure which supports the quality score.

- The trust trades on a significant discount of 47% to appraised NAV which is typical of the sector in Hong Kong with the one notable exception of Link REIT which trades at a premium to NAV.

Accounting, Strategy and Governance Comments

Accounting

- The auditors are Deloitte Touche Tohmatsu, they have issued an unqualified opinion for accounts over all periods.

- Full compliance with the accounting standards in Hong Kong has been maintained since listing in 2006.

- Property valuations are undertaken by Colliers International (Hong Kong) Limited, their approach to valuations is consistent with international best practice.

Strategy

- The trust has a simple strategy of looking to maximise the value of their investment properties and adjusting the properties held within the portfolio. In 2017 Champion REIT indicated a willingness to sell the Langham Place Office property in order to reduce overall exposure to office property within the portfolio. This is a sensible strategy which also provides the possibility of a significant special dividend for shareholders on completion. Champion REIT have shown themselves to be willing to wait for their desired property valuation rather than rushing to sell the property, we agree with this approach.

- The CEO, Ms. Ada Wong Ka Ki, joined Champion REIT in 2014 as Deputy CEO and was promoted to her current role in 2016, she is young at 37 years old and has an excellent reputation having previously worked at Citigroup and J.P. Morgan's investment banking divisions, see Bloomberg article in November 2018. Ms. Wong brings a wealth of financial structuring experience to the business and will continue the strategy of adjusting the funding strategy of the Trust.

- Champion REIT's key objectives are to provide investors with stable and sustainable distributions and achieve long-term capital growth helped by ever rising numbers of visitors from Mainland China. The Langham Place Mall is a direct beneficiary of the flow of visitors from Mainland China, rents are structured to incorporate a component of retail revenue as well as a unit charge based on area.

- Three Island Road and Langham Place Retail Mall will remain core assets for Champion REIT, once Langham Place Office is sold we can expect to see an acquisition, however, the company have shown that they will be suitably cautious regarding transaction price paid. In the meantime, significant upward momentum in rental revenue will be achieved in 2019 and 2020 from reversion of expiring leases to prices that exceed the levels from 2016/2017 when original leases were signed.

Governance

- The trust first listed in Hong Kong in May 2006 and has maintained full compliance with the Hong Kong governance standards.

- Champion REIT has seven directors, six are non-executive and of those four are independent. All of the independent non-executive directors have extensive experience in the property development industry and one (Mr. Abraham Shek Lai Him) also sits on the advisory committee of the Independent Commission Against Corruption (ICAC). The ICAC is a very effective institution in Hong Kong, there have been many high-profile actions undertaken in recent years helping to improve Hong Kong's standing in this area.

- The REIT manager Eagle Asset Management (CP) Limited consistently takes 50% of the management fee in units, at the latest interim report the manager received 12,194,412 units equivalent to 0.2086% of units in issue as payment for 50% of the management fee, the remaining HK$70,605,700 was paid in cash. In total the REIT manager now holds 7.0132% of the Units in issue. These numbers are compliant with the Trust Deed and REIT code. The parent company Great Eagle Holdings Ltd holds 65.5% of the shares in Champion REIT.

Conclusion

Champion REIT provides excellent exposure to office and retail commercial property in Hong Kong. The trust is well managed with a sensible capital structure and clear strategy for the future. There are good prospects for the significant discount to asset value to move closer to underlying NAV over time. There are no concerns from an accounting perspective. We like the fact that the manager opts to receive 50% of their fee in the form of units in the trust.