New acquisition for Global High Conviction - Sony Corporation

April 11, 2019

By Kevin Smith & Robert Swift

Sony Corporation (Sony) is a world leader in designing, manufacturing, and selling electronics and entertainment products. Sony engages in the development, design, manufacture, and sale of electronic equipment, instruments, devices, game consoles, and software for consumers, professionals and industrial markets. Its operations are carried out through the following segments: Mobile Communications, Game & Network Services, Imaging Products & Solutions, Home Entertainment & Sound, Semiconductors, Components, Pictures, Music and Financial Services. The company was founded by Akio Morita and Masaru Ibuka on May 7, 1946 and is headquartered in Tokyo, Japan.

Sony was recently included in the Global High Conviction strategy.

The reasons for the purchase are:

- Increasing M&A in USA content ownership (AT&T, Hulu, Disney etc)

- 5G launch in 18-24 months will make platforms desirous of more content

- Play station V will generate excitement amongst the global gaming community

- First major share buyback for Sony should provide ongoing price support

Value, Momentum and Quality Comments

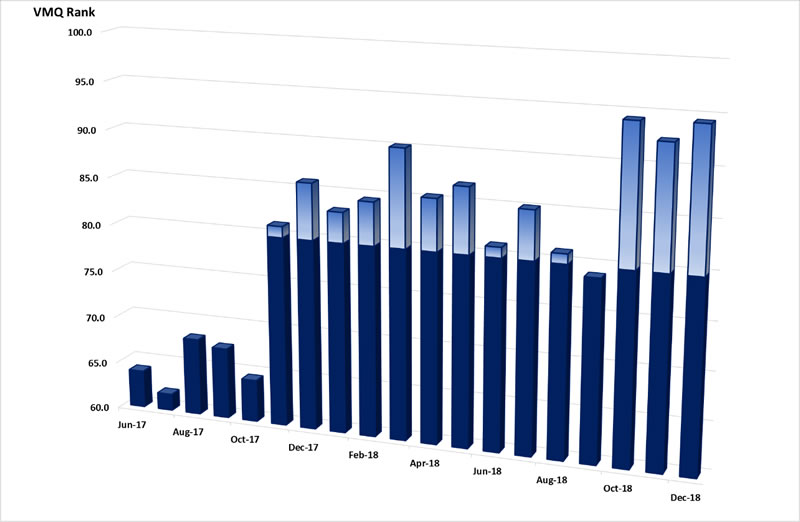

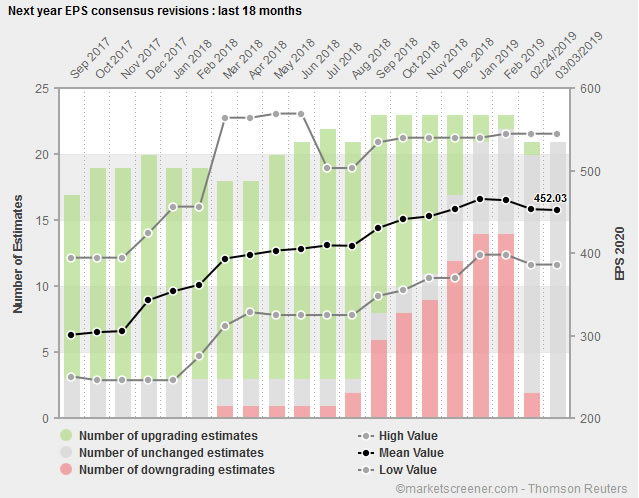

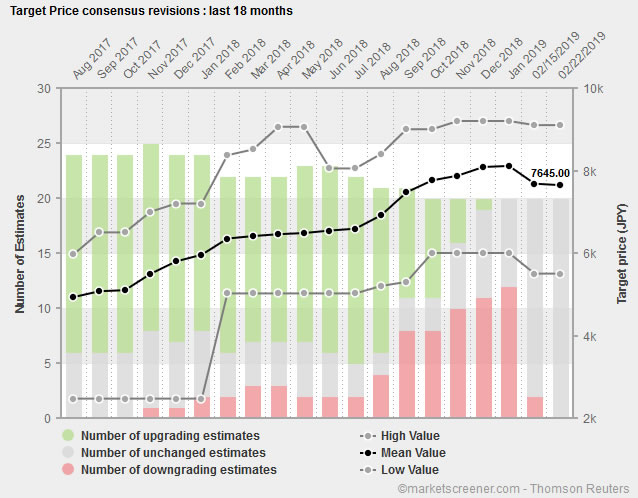

The VMQ score for Sony has improved substantially during 2018 over 2017, the scores achieved in the final quarter of 2018 are particularly impressive. Sony has achieved a very strong momentum score throughout the period, you can see from the charts that earnings per share and market share price targets have followed an upward trend during the past 18 months.

Sony has an excellent score for quality largely due to the return on equity in excess of 20% that the company has achieved and been able to sustainably maintain.

Sony's forward P/E multiple of 12x is in line with the market, so the value score for the company is close to the average.

Accounting, Strategy and Governance Comments

Accounting, Strategy and Governance Comments

- Sony presents accounts on the basis of GAAP and the annual report is provided in the form of a 20-F disclosure to the United States SEC.

- The Sony accounts are audited by PricewaterhouseCoopers, accounts over all time periods have been unqualified.

- The Company has benefitted from various one-off events in the current year that have seen the tax charge drop to less than 4%, a return to the more normal 20% level is expected in subsequent years.

Strategy

- Sony has built a strong business with global diversification, 30% of sales are within Japan, 21% in both the United States and Europe, 20% in the rest of Asia and 8% in the rest of the World.

- Kenichiro Yoshida was appointed President and CEO in April 2018, the 11th in the history of the company. Mr. Yoshida has a long history of working within Sony and his management style is a continuation of that of his predecessor Mr. Hirai. Continuity of management is a strength of Sony Corporation.

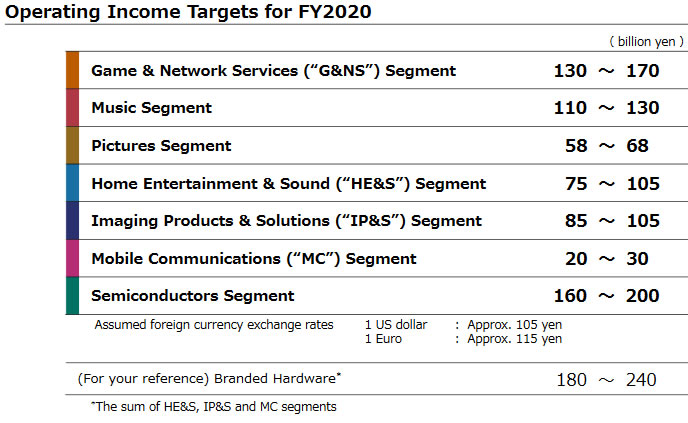

- One of the early actions of the current CEO was to increase ownership of the EMI music business to 100%. We view this as a positive development providing a short-term boost to earnings and more importantly signalling the music business as a key segment for Sony, see the table on page 4.

- Aside from music, it is also apparent from the table on page 4 that the key drivers for the business looking forward are Game & Network Services, Home Entertainment & Sound, Imaging Products & Solutions and Semiconductors. We believe that the company is following the correct path by reducing reliance on the Pictures (movies) and Mobile Communications segments.

Governance

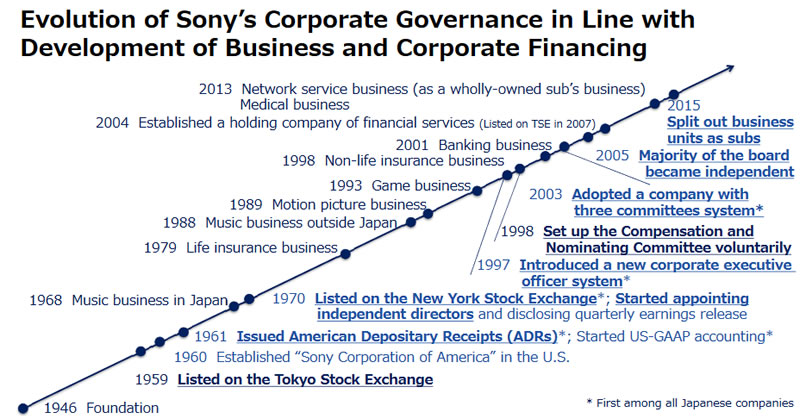

- Sony has a Board comprising 12 people with 10 independent or non-executive directors. Sony moved to having a majority of independent or non-executive directors in 2005.

- The Company has established clear rules regarding maximum tenure (nine years) and qualification standards for independent and non-executive directors.

- In early February 2019 Sony implemented a buyback programme of 100 billion yen, equivalent to 2.36% of outstanding shares running until 22 March 2019. This is a first for Sony and shows that the management is taking steps to improve returns to shareholders. We would like to see the dividend payout ratio lifted towards the 30% level.

Conclusion

The current management of Sony have given the company new impetus in terms of strategy direction and returns to shareholders. Results in the current year are somewhat flattered by one-off items and tax credits, we can look past those numbers to see a business that is set up to generate strong returns for shareholders. Sony continues to lead the field in Japan in the area of governance, we particularly like the term limits on tenure. We would prefer the company to increase the dividend payout ratio which at 7% is much lower than we expect from a company of this standing.