SFA Engineering - Technology and Hardware Equipment

By Kevin Smith

SFA Engineering is a leading company in the fields of material handling systems (logistics), precision equipment, technology for OLED panel manufacturing and printed electronic equipment for the manufacturing of semiconductors and electronic components. The business was created in December 1998 when spun out from the Samsung Group and has 620 employees. SFA Engineering holds 446 patents in South Korea and 88 internationally. Young Min Kim was the original CEO until 2007 then returned to that role in 2012.

Source: Barrons

Value, Momentum and Quality Comments

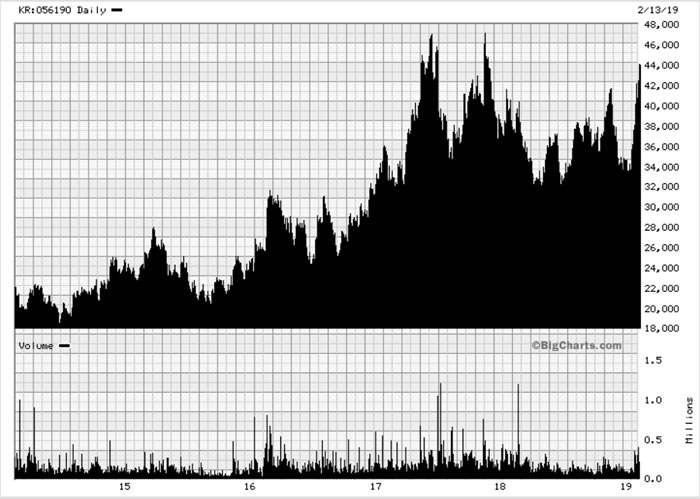

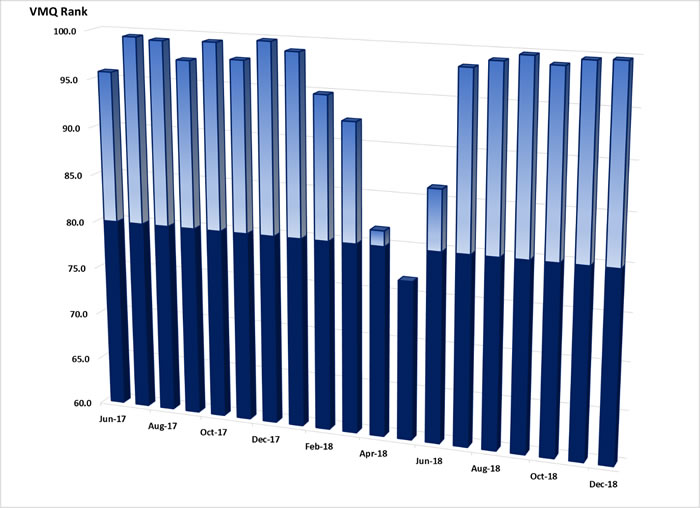

The VMQ score is underpinned by very strong value and quality measures, while momentum has been the cause of volatility in the overall score. In particular, the sharp decline in the score during April and May 2018 can be attributed to the number of analysts downgrading their forecasts for the company, this can be observed on the chart on page 5. Since June 2018 the number of analysts issuing upgrades has equaled or exceeded the number issuing downgrades, that change in momentum has resulted in the recovery in the overall VMQ scores to near maximum levels.

Accounting, Strategy and Governance Comments

Accounting

- The auditors are Samil, the Korean affiliate of PwC, the use of an internationally linked firm is a positive.

- Full compliance with the accounting standards in South Korea has been maintained since listing and all published accounts have an unqualified opinion recorded.

Strategy

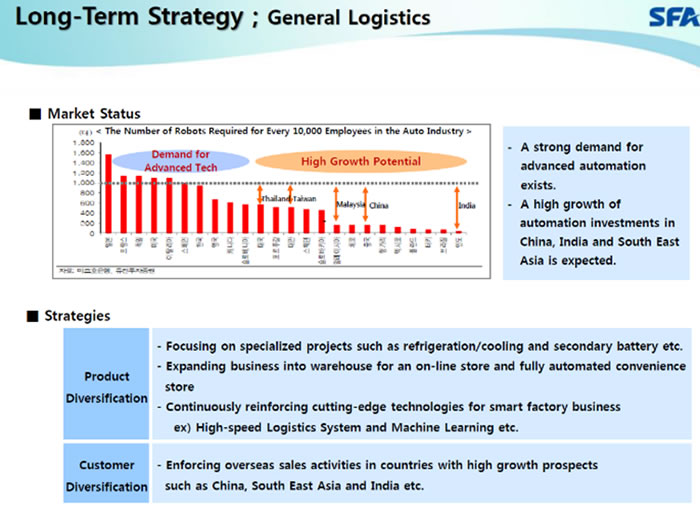

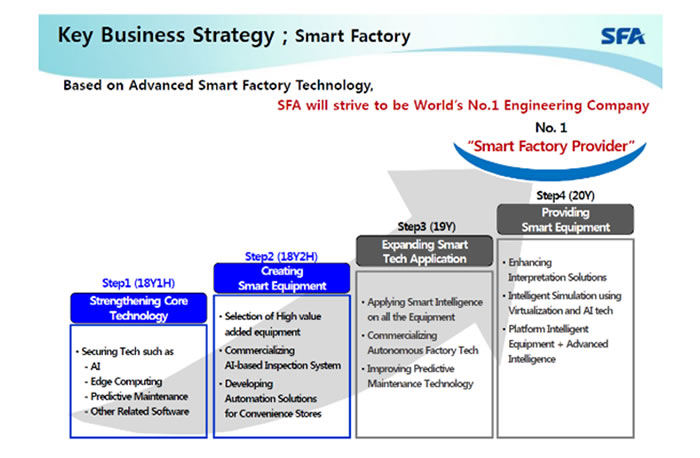

- SFA Engineering has the objective of being the number one provider of "smart factories". This objective is supported by government policy in South Korea which aims to encourage the development of 30,000 new "smart factories" by the year 2022 assisted by various grants totalling USD 3.5 billion. The demand potential for "smart factories" is illustrated by the diagram on page four showing the requirement to substantially increase use of robots in the automobile industry especially in China and India.

- SFA Engineering has a good balance of domestic and international sales, close to 50:50 in the most recent results. The business is diversified across display equipment, glass equipment, semiconductor equipment, solar/fuel cell equipment, special industrial equipment and general logistics systems. Historically the business was dominated by the display equipment business, in excess of 80% up until the middle of 2017. In the past two years the company has achieved success in other business areas especially glass equipment and the logistics business reducing the exposure to display equipment to 60% of sales by mid-2018. We support the strategy to diversify away from display equipment, especially the development of general logistics systems in the light of government policy noted above.

- The other key strategy that we support is the development of overseas markets. The ratio of new orders has swung from 75% domestically originated orders in 2016 to 75% international orders by 2018.

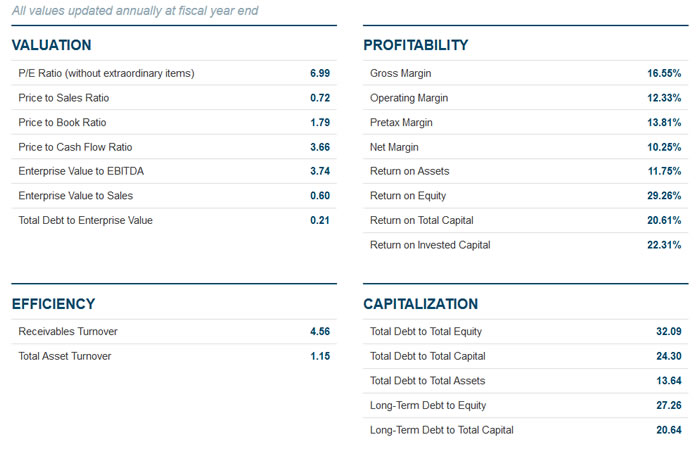

- The company has a sensible amount of debt in the business with a debt to equity ratio of 32% and interest coverage of more than 25x.

- We like SFA Engineering under the direction of Young Min Kim, the company was not as compelling in the period of 2007-2012 when he stepped away from the company.

Governance

- SFA Engineering has a Board comprising ten directors of which three are independent non-executive directors and is fully compliant with the South Korean governance requirements. The company was the subject of an activist investor attack in 2007 when Samsung Electronics was the largest shareholder. Since that time Samsung Electronics has reduced their shareholding to 10% and allows SFA Engineering to operate independently.

- SFA Engineering has articulated a policy aimed at improving shareholder returns including the buyback and cancellation of shares and enhancing the dividend payout. The current payout ratio of 22% has plenty of scope to increase.

Conclusion

SFA Engineering has developed significantly since being a small satellite in the Samsung Group empire. We particularly like the strategy of positioning the business to take advantage of increasing demand for smart factories and the moves to develop internationally.