Stock of the Month Report

July 25, 2019

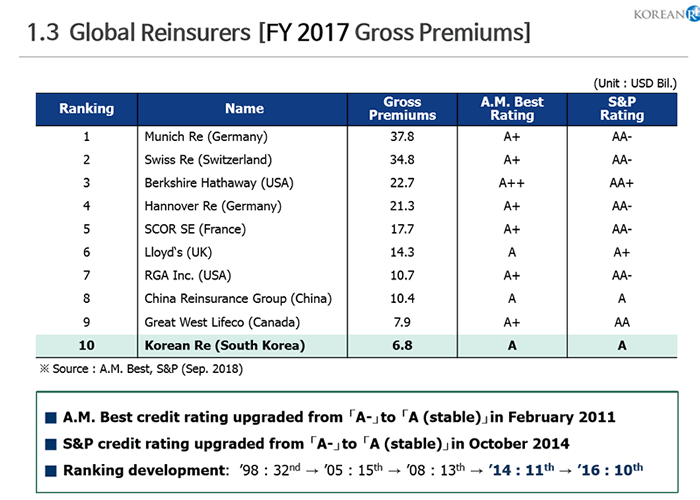

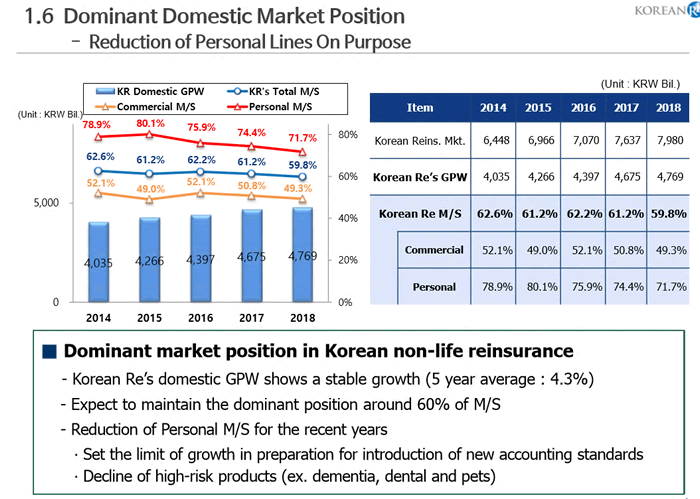

Korean Re is the tenth largest reinsurance company globally and second largest reinsurance company in Asia with ambitious plans for growth across the world with the ultimate target to be a top 3 global reinsurance business. Korean Re was founded in 1963 and has built a strong platform in the South Korean market with market share in excess of 60%. The President & CEO, Jong-Gyu Won has been with the company since 1986 and was appointed to his current position in 2013.

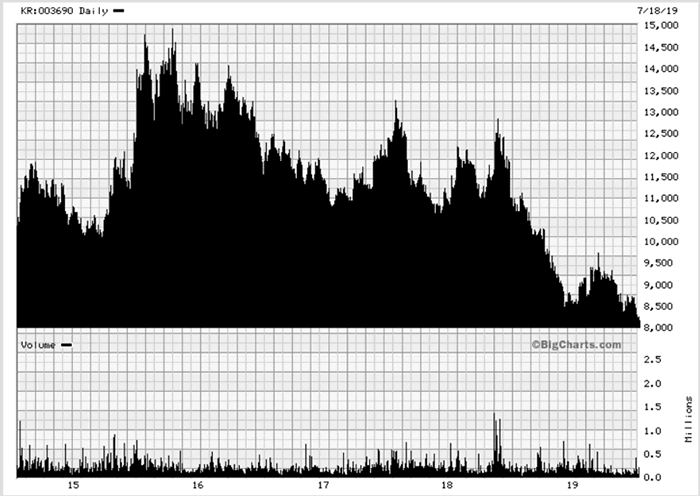

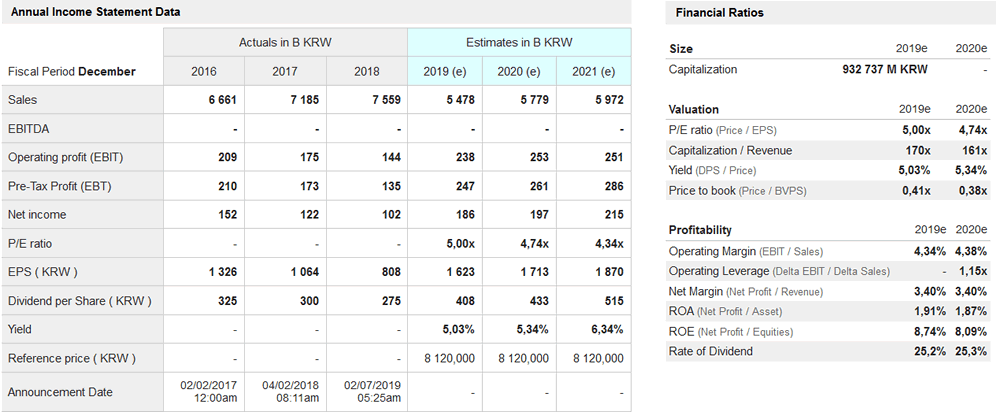

Source: Market Screener

Accounting, Strategy and Governance Comments

Accounting

- The local associate entity of Ernst & Young (EY) audit the accounts, use of a big name accounting firm is a positive.

- Unqualified accounts over all time periods, no issues raised by EY.

- Full compliance with the South Korean accounting standards K-IFRS and the Insurance Business Act.

Strategy

- Korean Re has an ambitious long term plan called "Vision 2050" to be global top 3 up with the likes of Berkshire Hathaway, Swiss Re and Munich Re. Korean Re has a dominant local market share in South Korea around 60% in a market that ranks as the seventh largest insurance in the world. The CEO was recently quoted "we are confident that robust footholds are being built in different regions in a way that boosts our growth in the years ahead".

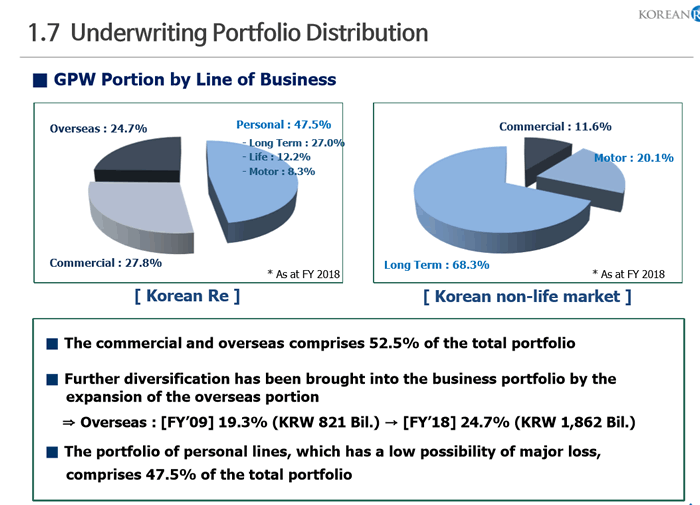

- Korean Re joined Lloyds in 2015 in a special purposes syndicate in partnership with Beazley. Korean Re subsequently took advantage of regulatory changes in Malaysia that saw the opening of Labuan as a financial centre opening a reinsurance operation in that jurisdiction in 2017 followed by Dubai in 2018 and Switzerland this year. We like the steady pace of expansion which is measured and comfortably accommodated with the existing balance sheet.

Governance

- Full compliance with the South Korean governance standards.

- Korean Re has three independent non-executive directors on the Board which is significantly better than the norm in South Korea.

- The payout ratio of 30% has increased from 25% in the previous year and has scope to rise further.

Value, Momentum and Quality Comments

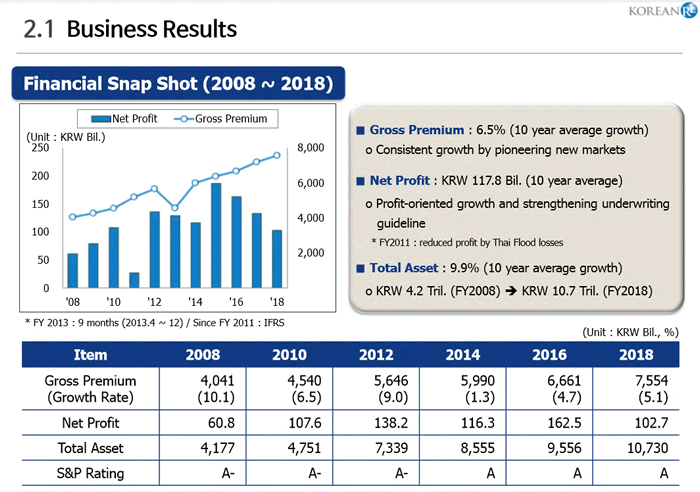

- Korean Re trades has a very strong balance sheet. In December 2018, the rating agency AM Best reaffirmed Korean Re's "A" rating based on balance sheet strength, operating performance, business profile and enterprise risk management. The "A" rating from AM Best has been in place since 2002. The company has a conservative risk based capital ratio of 211%.

- Korean Re shares trade on a significant discount to the market in South Korea and versus the international peers at just 5x price to earnings and 40% of book value, the shares should at least double in value to reach the international averages.

- The return on equity of 4.7% is consistent with international reinsurance peers, the company has set a target of 9% which is an ambitious level that gives us comfort that they will not chase growth at any price.