Stock of the Month Report: Sugi Holdings Co

January 22, 2020

SUGI HOLDINGS CO. LTD. (Sugi) is a Japan-based holding company mainly engaged in the management of retail pharmacy stores. Sugi is engaged in the sale of medicines, health foods, cosmetics, daily necessities and prescription preparations. Sugi also operates visiting nursing stations that closely cooperate with regional medical institutions and social welfare operators, through the provision of visiting nursing services and in-home nursing care support services. In November 2019 Sugi operated a total of 1,271 stores (including nursing stations) and employed 6,237 full-time in addition to 10,456 part-time staff.

Accounting, Strategy and Governance Comments

Accounting

- Full compliance Japanese GAAP accounting standards which are largely equivalent to IFRS. The accounts are overseen by three outside auditors in accord with standard practice in Japan.

- Sugi pays a full corporate tax rate in excess of 30%.

- Sugi publishes earnings on a quarterly basis, updating full year earnings per share and dividend per share forecasts with each set of results. Sugi also publishes monthly sales figures, therefore providing better transparency than is typical in Japan.

Strategy

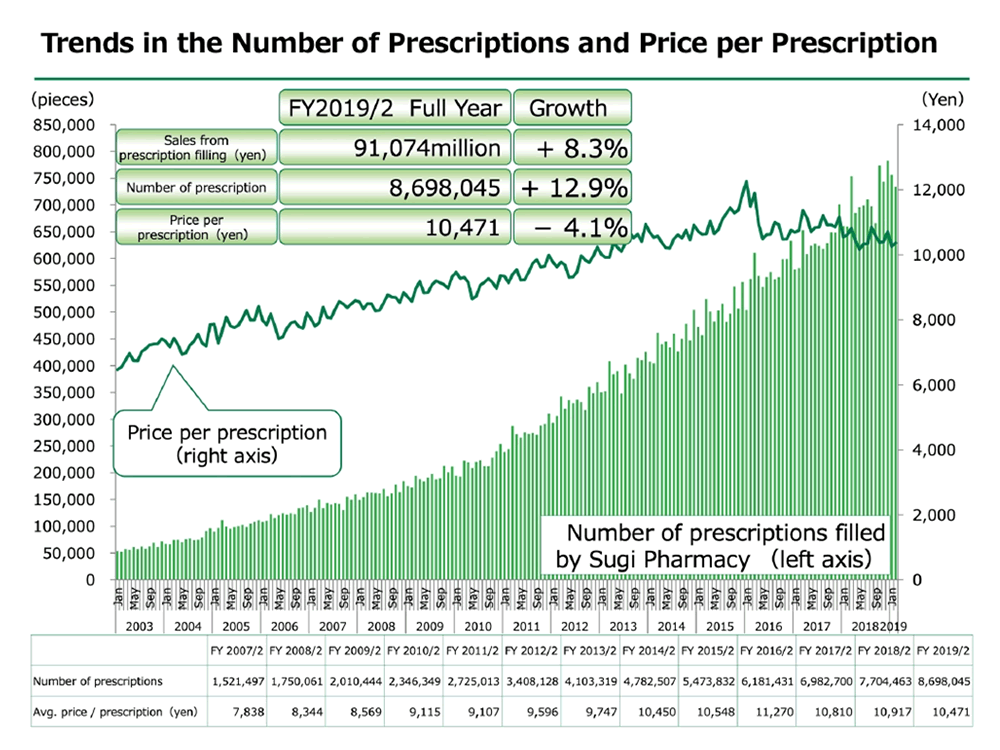

- Sugi has an excellent history of growth and has sensible plans going forward that doesn't rely on increased prescription values. The average prescription value for Sugi peaked at ¥ 11,270 in 2016 and had fallen to ¥ 10,660 in the quar- terly reporting for Q3 2019.

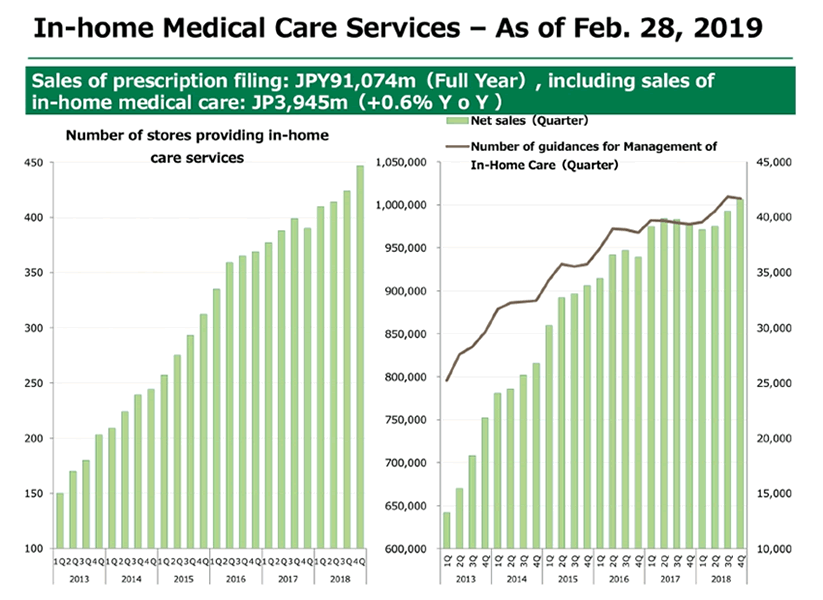

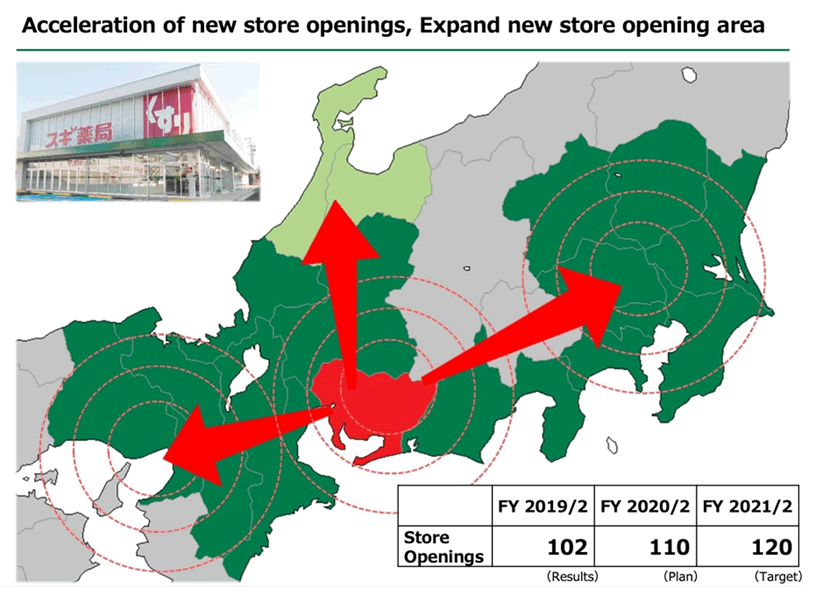

- Sugi has a strategy directed to growing the number of stores, the Q3 accounts indicated a total of 1,271 stores which is expected to rise to 1,290 by March 2020 an 8.4% increase from the March 2019 total of 1,190. Growth rates of new stores varies by region with the more mature regions of Chubu and Kansai growing at a 5% rate while the Kanto and Hokuriku regions are growing at a double digit pace. Growth is directed towards the Sugi branded stores, the company had an earlier alliance (2005) and then merger (2013) with Japan Co. Ltd which brought in stores branded "Japan". The "Japan" brand looks likely to be phased out over time. Sugi has a target for 110 new stores in 2020 and 120 new stores in 2021. In addition to building new stores Sugi is increasing the number of stores providing their "home care" visiting service which has a positive impact on revenue per client.

- Sugi is gradually increasing the sales area of their stores, in 2014 the average sales area was 578 m2 which is expected to achieve an average of 603 m2 by the end of 2020. Sugi has a total of 16,693 full and part-time employees with 62.6% employed on a part-time basis. The ratio of part-time employees has increased from 57.7% in 2014, which gives Sugi more flexibility in the management of the business. Sugi's annual investment in new stores amounts to •14,500 million and the spend on existing stores is ¥3,000 million which combines for a total equivalent to USD 160 million. Sugi's investment rate is running at twice the rate of depreciation and is funded from internal resources.

- Sugi has achieved very good diversification of sales with prescriptions accounting for 21.7% of the total, there is a good spread across other categories including healthcare products (20%), health foods (19%) and beauty products (21%). The gross profit margin for prescriptions exceeds all other categories at 38.5% versus the overall average of 31.2%. Sugi has managed to improve the overall gross margin from 29.8% in the past year.

Governance

- Sugi has three independent directors on the Board comprising seven directors. The Sugiura family control 32.5% of the share capital and they have three family members sitting on the Board. Continuing involvement of the Sugiura family is a positive for the business.

- In June 2019 the Board announced a possible business integration with Cocokara Fine Co. Ltd. In August 2019 the discussions were terminated without an agreement being reached. The Board took the view that prospects for their business were better without the prospect of an eventual merger of a business that is 50% the size of Sugi. We prefer Sugi looking to grow their business in the existing manner with- out taking on a relatively large and complex merger.

- Sugi is fully compliant with the governance regulations in Japan.

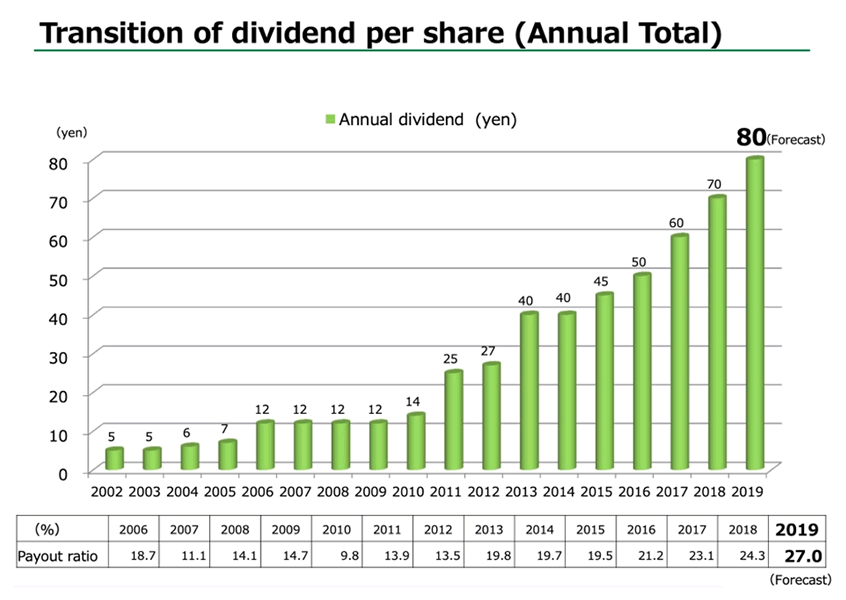

- The dividend payout ratio has increased during the past decade, hitting a low point of 9.8% in 2010 to the current level of 27%. There is scope for further increases in the dividend payout ratio.

Value, Momentum and Quality Comments

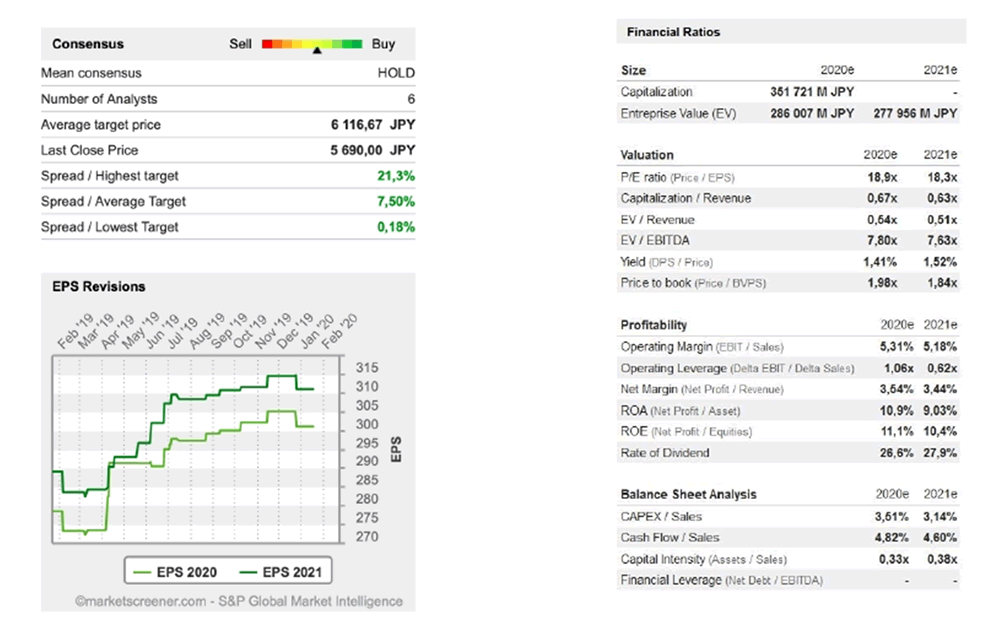

- Sugi has a long history of delivering revenue and profits growth by expanding the number of stores. The company has developed from filling 500,000 prescriptions per annum in 2003 to 8.7 million by 2019. Sugi operates in a sector that attracts high valuations, the forward P/E of 18.3x is reasonable versus the sector average in excess of 20x.

- Return on capital employed in excess of 11% helps to underpin strength in the score for quality. The company has a strong balance sheet with no debt and generates positive free cash flow each year. The company can comfortably fund the new stores expansion programme from operating income.

- There are just six analysts covering the stock and they have upgraded their 2021 earnings forecasts by 9% in the past year. The company has delivered positive earnings surprise in each of the past three years, in 2019 the actual earnings exceeded expectations by 9.8%.

Source: Market Screener

Source: Sugi Holdings Full Year Results 2019

Source: Sugi Holdings Full Year Report 2019