Stock of the Month Report: Sushiro Global Holdings

November 22, 2019

Sushiro Global Holdings (SGH) is a sushi restaurant chain with history dating back to July 1975, however, the current conveyor belt sushi format that has underpinned growth was introduced in 1984. SGH delisted from the Tokyo (second section) market in 2012 and formed a strategic alliance with UK private equity house Permira (spun out of Schroders). In February 2015 Koichi Mizutome was appointed President & CEO and the current corporate structure of SGH was implemented in March 2015. SGH has 10% market share in the Japanese market for sushi restaurants operating 541 stores in Japan and 25 internationally in Korea, Taiwan, Singapore and Hong Kong.

Accounting, Strategy and Governance Comments

Accounting

- The accounts for SGH and nine subsidiaries are prepared in accordance with IFRS.

- SGH operates a nine person internal audit team that reports directly to the President.

- The key difference between IFRS and Japan GAAP is the treatment of Goodwill, the latter requires a write-down schedule and the former does not. With Goodwill of JPY 30.371 million in the SGH balance sheet, this represents 23% of total assets. We recognise the advantage to SGH from using IFRS versus the local GAAP with respect to Goodwill held on the balance sheet. Given the growth trajectory of the company towards international markets, the consistent use of IFRS across the business is justified.

Strategy

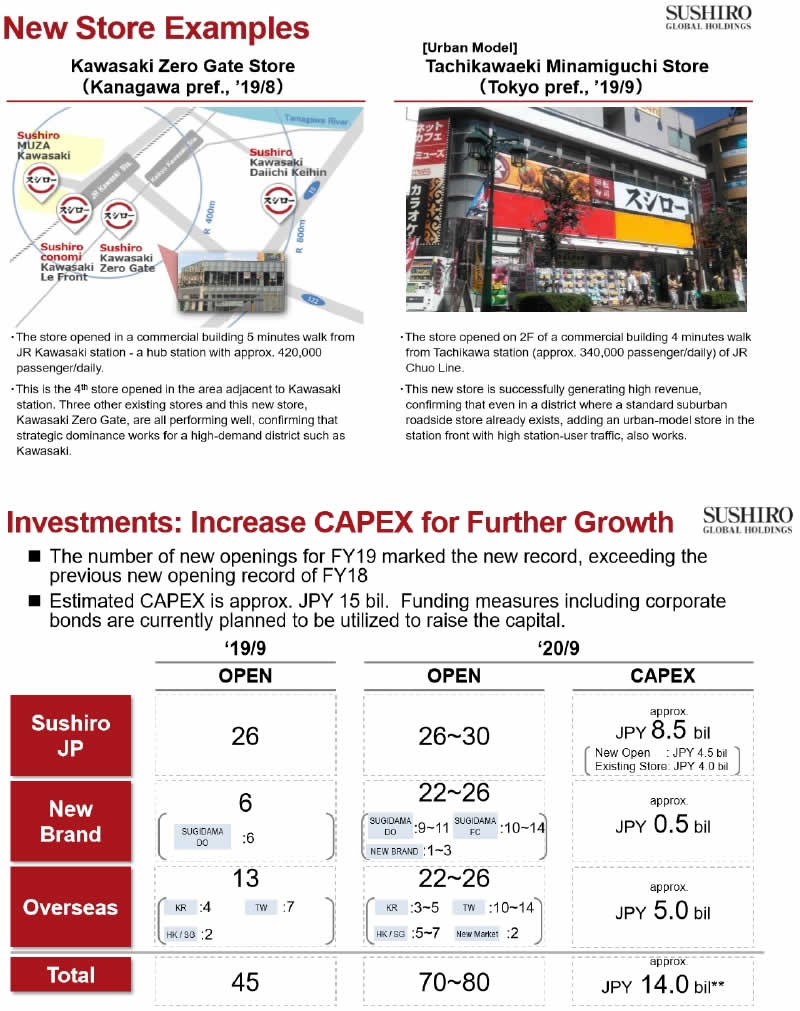

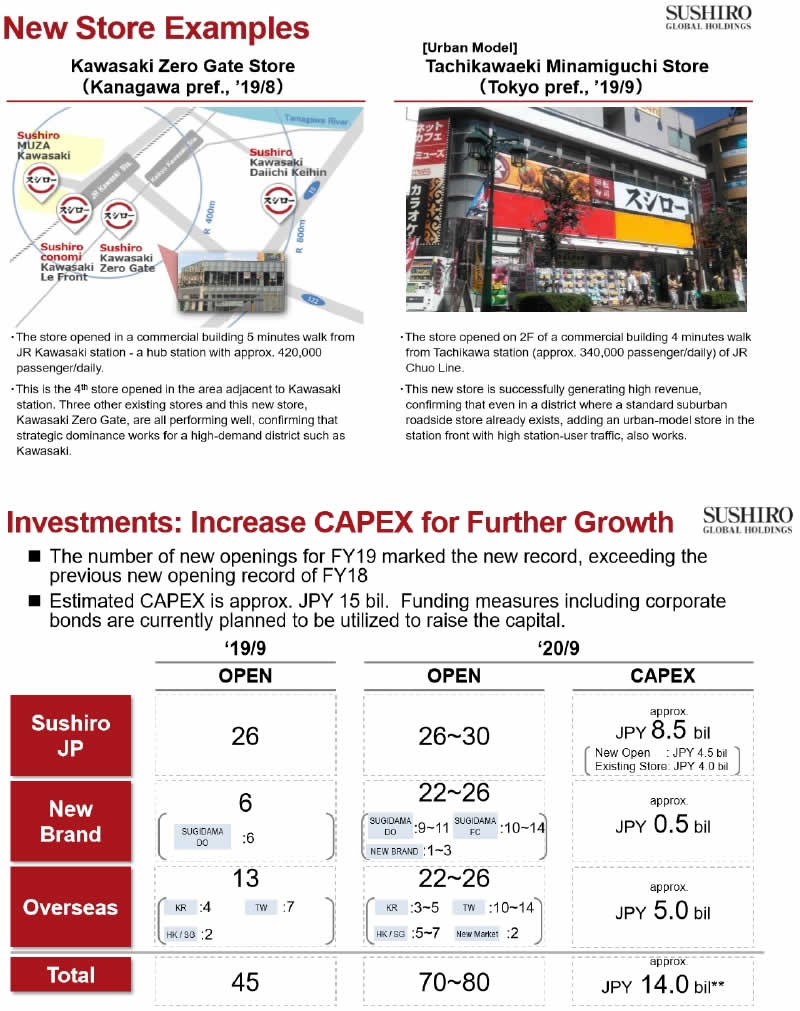

- SGH has demonstrated a strong business model and excellent platform for growth. Results for the year to September 2019 showed revenue growth of 13.8% and net profits increased 24.1%, while like for like sales increased 7.4%. SGH has a strong presence with 541 restaurants in Japan spread across 47 prefectures. The Sushiro conveyor belt sushi restaurant brand is growing nicely with 26 new stores opened in 2018/2019.

- SGH is developing a casual dining brand called Sugidama which offers scope to expand into a different pricing segment of the market in Japan. International expansion is a major strategy for SGH, currently Korea is the only market that has been developed with more than 10 restaurants, while Taiwan, Hong Kong and Singapore are under development. Revenue from the international business is expected to rise from 5% to 10% of total reve- nue during the current medium term business plan. Taiwan will provide the main geography for growth in the next few years, this is a high confidence strategy for SGH in the near term. In the longer term the international growth strategy will focus on Singapore followed by North America.

- SGH considered a merger in 2017/2018, however, the management decided to terminate discussions with Shinmei Holdings, the operator of Genki Sushi restaurants when terms for a deal couldn't be reached. We are happy with the decision to walk away from that merger given the strong underlying growth in the business. Shinmei Holdings held as much as 32% of the shares of SGH during the merger discussions, that holding is now reduced to 6.6%. Shinmei Holdings is the largest shareholder on the register, other large shareholders tend to be investment manage- ment groups. International investors own 25% of SGH which is lower than the 30% average for Japanese equities overall. The structure of shareholder register wouldn't impede a future consolidation transaction.

Governance

- Full compliance with the Governance Code in Japan with four outside independent directors on the Board comprising eleven directors in total. The Board meets on a monthly basis.

- The outside directors form the majority of the Remuneration and Nomination Committee which operates as a sub-committee of the main Board. The outside directors are all suitably qualified in the fields of accounting and law, while one of the directors has business experience in the highly regulated arena of pharmaceuticals.

- SGH has long-term debt of JPY 36.2 million that is equivalent to the 77% of the equity held in the business, the debt burden is sensible given the growth profile of the business and is properly managed. SGH have indicated plans to adjust the current mix of debt which will reduce overall financing costs.

Value, Momentum and Quality Comments

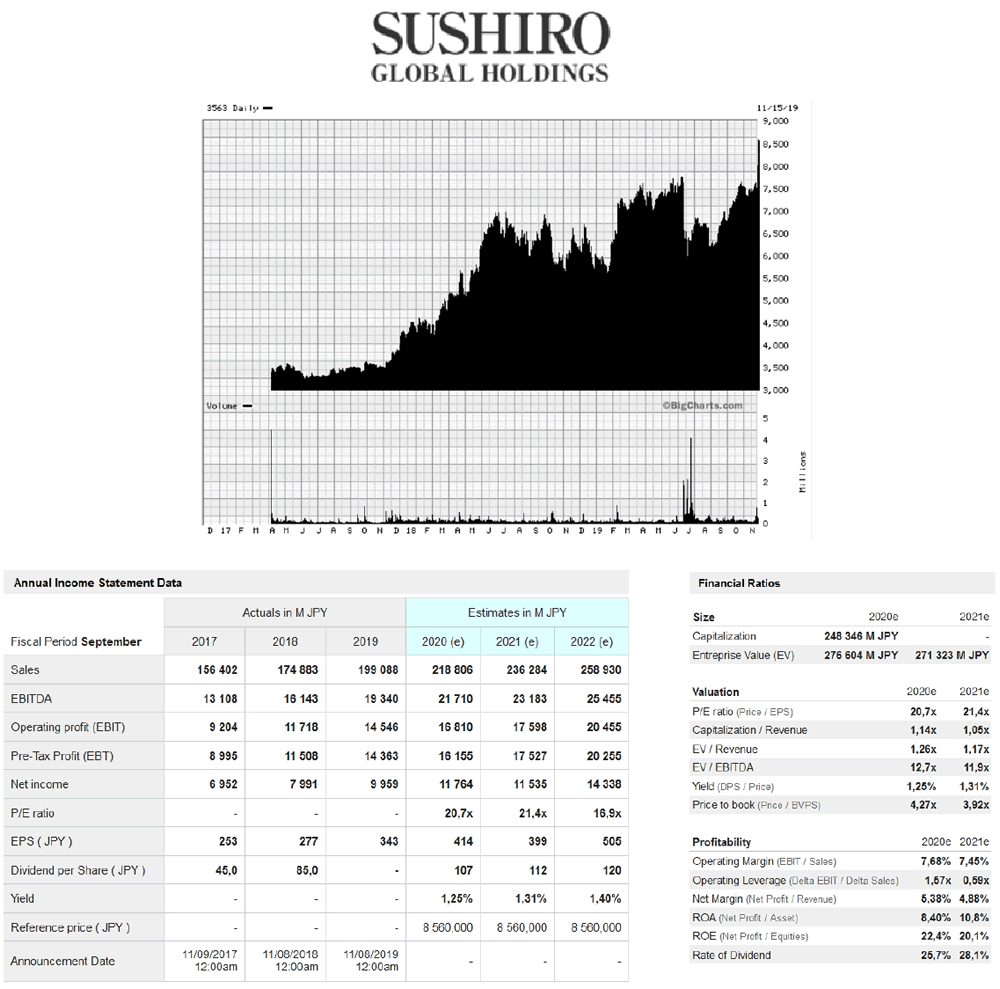

SGH has an overall VMQ score in the top 20% of our regional universe, with particular strength in the areas of momentum and quality. SGH has a very strong return on equity of 22% which has been consistent over time and contributes to the quality score. The strong momentum score has been boosted by a persistent trend of upward revisions to earnings.

There is limited analyst coverage of SGH, just 4 analysts providing regular forecasts which is low for a company capitalized at USD 2 billion with a strong growth profile. In the past 12 months forecasts for 2021 earnings per share have increased by 25%, however those estimates still indicate a flat earnings per share outcome which we believe underesti- mates the likely outcome in that year by at least 10%. We believe the prospective market p/e multiple is nearer to 15x in 2022 versus market consensus at 16.9x. This provides good scope for the value component of VMQ to improve in the next two years while we expect the strong quality and momentum characteristics to be at least maintained.

Source: Market Screener

Source: Sushiro Global Holdings Co

Source: Sushiro Global Holdings Co