Transalta Renewables - you can have yield, growth, and ESG exposure?

November 14, 2019

The search for income is becoming more frenzied. Very low cash rates and yield curves that have been massaged downwards by central banks' policy has left the yield on the safest assets below the official rate of inflation, and well below the actual rate of service sector inflation, that typical buyers of safe assets (retirees and ageing pensioners) experience.

Older investors like and need income for obvious reasons. Consequently the fall in real yields on safe assets to negative rates has created a dash into lower quality bonds and other risk assets that may yield a little more but may not be suitable? This hunt for yield is becoming a frenzy and like all frenzies will probably end in tears.

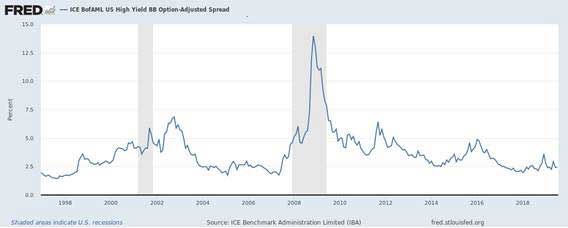

See below for the chart of the spread of non-investment grade or high yield bonds over US Treasuries. Not the lowest it's ever been but not a big cushion?

We would also note that there is an enormous amount of corporate debt ($10+ tln) and almost $2 tln has to be refinanced annually in the next 2 years [BIS 2019 annual report] and this may not happen smoothly. Given that almost 40% of this debt pile is BBB- or not investment grade then there may well be a wobble. If there is a wobble then the yield premium on the risky assets may well have to rise - also known as a price fall! If this happens, lower quality issues will fall in price more.

Additionally be aware of course that the coupons on this debt do not change. There is no prospect of an increasing dividend from corporate bonds as an inflation hedge and so sometimes taking extra risk from equities is worth it IF there is the potential for dividend growth to be in excess of inflation.

For some reason policy makers are trying to get visible inflation higher and if they do, then you may need a suitable inflation hedge. Bonds have typically not been good at this.

So what to do?

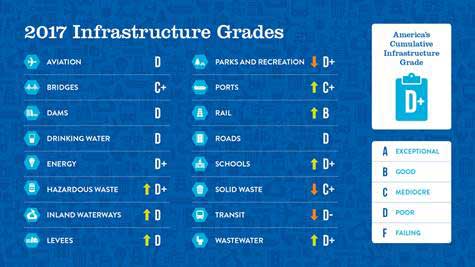

One area of the equity market which has benefited significantly from this yield seeking frenzy has been infrastructure assets. Given the problems that banks have had in making normal profit margins with a flat yield curve and additional regulation, we have preferred to invest in mis-priced infrastructure equities rather than 'cheap' banks. To be sure, the prospect of interest rate tightening or a steepening yield curve will see some selling in infrastructure stocks after such a strong run, but many of them have revenue sources which are not so tightly price controlled, and there is a significant need for all parts of the infrastructure network to be upgraded particularly in the USA Europe and Australia. You can't have high rates of population growth and not invest in roads, bridges, hospitals, schools - at least not if you want a decent and fair economy? We show again in the slide below just how poorly rated is the USA infrastructure network. If you want to see what is a very cold analysis of the problem then visit https://www.infrastructurereportcard.org/

America's Infrastructure Report Card 2017 | GPA: D+

www.infrastructurereportcard.org

The American Infrastructure Report Card from ASCE provides a look at America's infrastructure problems, such as bridge, water, transportation and more.

There are however, still some under-valued companies, one of which we highlight here. It has the significant coincidental benefit of being heavily involved in renewable energy. It also has a decent balance sheet. We own it in the Global Listed Infrastructure Strategy.

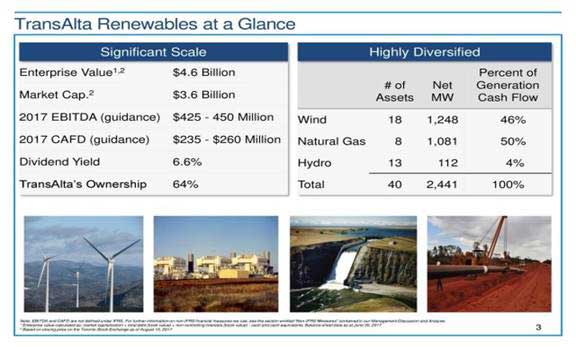

Transalta Renewables, ticker code RNW on the Toronto Exchange, was spun out of Transalta Corporation in 2013 via an IPO. Transalta still holds a c. 60% equity stake.

RNW operates power generating assets in gas, wind and Hydro so very clearly a clean energy and/or renewables business which currently command a valuation premium. Its main asset base is in North America but it also operates a gas facility in WA, Australia and remains committed to Australia.

Check out the table below drawn from the latest company presentation:-

Our stock selection process identified RNW as attractive for yield biased investors especially with respect to dividend and dividend growth potential and its Refinitiv based ESG score is acceptable but, perhaps more importantly, is getting better over time. (For a discussion of our approach to ESG check out the Delft Partners Website)

So once we ascertained that the generation facilities had secure long term purchase contracts (an average of 11 years); the company had the cash flow to invest and continue to make acquisitions of similar renewable power generating assets; and the operational efficiency was sufficient to deal with adverse price and regulatory changes we felt comfortable investing.

If anything the regulatory environment is likely to be supportive with renewable targets, carbon pricing, and stricter thermal coal standards. Add in some decent technological improvements to make solar and wind cheaper to produce and store and there is a strong case to make for a supportive external environment.

So what is the risk?

Leaving aside execution problems, the risk we see is that the parent company TransAlta on-sells some projects into RNW at prices which harm the interest of the minority shareholders - us.

There are wind and gas projects in which RNW has a minority interest and which may be 'dropped-down" into RNW from the parent at disadvantageous prices. This is sadly common (especially in Asia) so we will be monitoring this.

At a P/E of 14x it is not especially cheap BUT we think the earnings stream is very secure with the external backdrop being so supportive. This stock should have a lower discount rate or higher P/E than other less clean power generators. Revenue growth is very modest currently but we expect acquisitions to continue. Our valuation model has a long term 3% growth rate assumed with a stable to slightly lower EBIT margin. So with a 6% yield on RNW and a stable business with efficient facilities, the issue for investors will be sustainability of that dividend. One of the guaranteed price destroyers with a dividend stock is a dividend cut. Free cash flow will be stable even though the company can't consolidate all the cash generated from its economic interest in the assets We have modest expectations for dividend increases but even with no growth and constant payments the yield and strategic value of the clean assets makes RNW an attractive investment for income biased investors. Choose this rather than a 'high yield' bond backed by a company with financial and operational leverage risks!