Market Commentary for December:

Thank goodness 2022 is over. Surely it's all 'plain sailing' from here?

December 22, 2022

World equity markets fell further in December as language from central banks regarding interest rate increases gave way to further action. Even Japan made a minor change to interest rate guidance prompting some (mistaken) panic selling. US equity markets had their worst half-year in a long time. 10 Year Treasury Notes rose in price as yields declined with the expectation of a reduction in inflation. We can only see a significant slowdown in economic activity as inflation, mortgage rate rises and tighter lending standards kick in and reduce consumer spending, especially in the USA. Equity EPS will be revised down. Share buybacks will fall. Asia is at a different point in the cycle and much cheaper. The global strategies outperformed respective benchmarks for the month, quarter and year.

It won't be plain sailing from here. We're not out of the woods yet. Choose your cliche.

While base effects will help the appearance that inflation is falling, US government fiscal policy is hampering the Fed's attempt to squeeze inflation. The latest spending bill of $1.7 TRILLION includes many non-productive outlays. Simple supply demand mechanics show us heading to stagflation. In this scenario P/E ratios get compressed along with EPS downgrades.

In the absence of a fiscal “U-Turn” the chances of capital controls are looming since even higher interest rates are essentially unaffordable for most governments given recently acquired debt levels. We currently believe that the worst spending excesses will be tempered by a small Republican majority in Congress, but history tells us this may be the triumph of hope over experience. Our certainty is that one should be prepared for sticky and elevated inflation. While inflation may drop from high single digits to mid-single digits, that still represents an erosion of purchasing power of about 50% in 8 years.

We also now point out that loss making "concept' companies whose ratings have collapsed on listed bourses, are also widely held in private equity funds. Their carrying value can logically only be reduced, which of course will reduce the stated NAV of many pension values, whose exposures to private equity are allegedly 'low risk'. This will be a surprise to some. From our October missive:

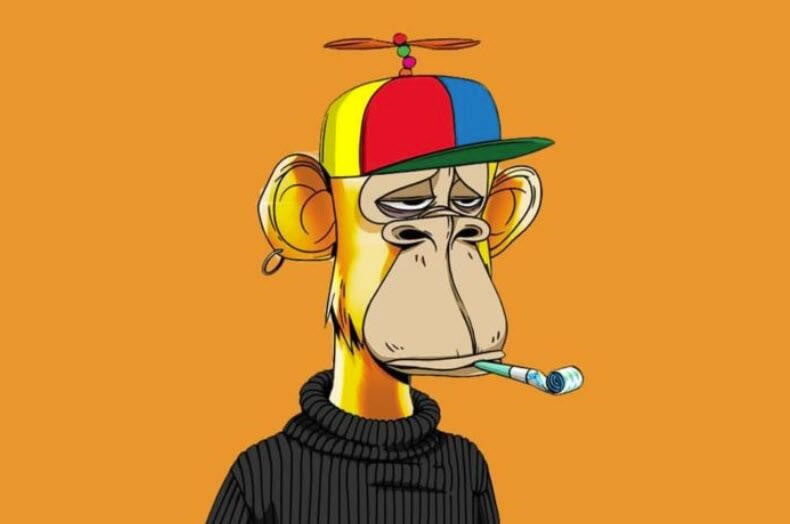

The crucial question is whether policy makers now have the moral fibre to withstand the howls of pain from those affected by interest rate rises popping the bubble. Some late cycle Private Equity deals are quite possibly next in line after SPACs NFTs, and other lunacies have cratered. We repeat again that price volatility is NOT risk. Illiquidity is no defence against a failing business. There is a meaningful opportunity cost to locking your money up. Read this.

Citing recent sources other than our own analysis:

Now, an exclusive Bloomberg News analysis offers a glimpse into one of the most opaque corners of the investing world, and the findings aren't reassuring. In many cases, hedge funds and other money managers disagree over just how to value private companies. By the end of 2022, high-flying unicorns lost more than 40% of their value from the year's peak, a sharper drop than the rout in publicly traded tech stocks and worse than the returns reported by most hedge funds in the space. Disagreements over what companies are now worth have profound implications for the ultimate investors - from wealthy individuals to pension plans. One takeaway is that even after a year of writedowns across the investment industry, more may be in store. - David E. Rovella

Our value bias in this strategy has proven very productive for the last two years even as the frenzy for FAANGS and other nonsense continued. This NFT went for US$3.4m a couple of years ago. What would it be worth today?

Remain biased to dividend paying companies, value liquidity or the ability to change your mind, and do not try to time exposure to asset classes.

https://www.delftpartners.com/news/views/faangs-for-the-memories-but-its-time-to-quake.html

We made few major trades but purchased Woodside Energy, Schlumberger, BHP and sold China Construction Bank in the quarter.

Happy New Year and the best of luck in 2023!

Delft Partners December 2022