Market Commentary for October: US Consumer stretched and watch out below for EPS revisions

November 28, 2022

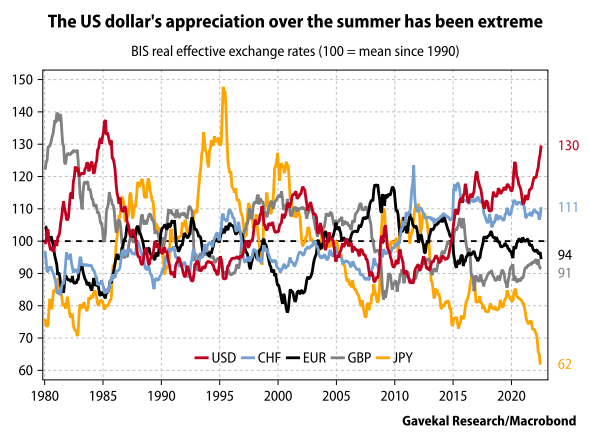

In what has been an 'unusual' year, October didn't produce its customary wobbles, but experienced a sharp rebound in the price of risk assets. An inflation print of "only" 7.7% was enough to send global equities higher, long term yields lower and a 'risk on' stance almost everywhere. The US$ fell.

The Global Trust rose just under 8% in A$ terms and the Value-biased Global 30 strategy rose over 8%. Value again outperformed Growth. We expect this to continue albeit in a choppy fashion.

We made a few trades in the month within our strategies. We removed China Construction Bank and reinvested into Woodside Energy. We also bought Schlumberger, Nippon Yusen, the Japanese shipping company, Targa, an oil and gas infrastructure business and Exelon, a US Utility. Our stance on basic materials companies, as 'useful if not essential' remains positive and the nerves surrounding Net Zero (which if implemented will lead to Year Zero?) are presenting attractive investment opportunities.

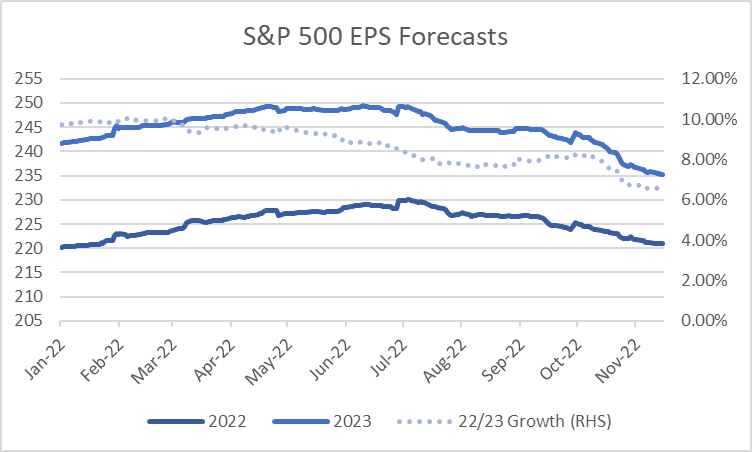

We remain cautious in our risk stance but fully invested. This means we favour stable revenues, dividends, and good balance sheets. Earnings forecasts are still too high in the US (and elsewhere) and will have to come down. The US$ is now quite extended. It is vulnerable to the tempering of expectations regarding the terminal rate of US interest rates.

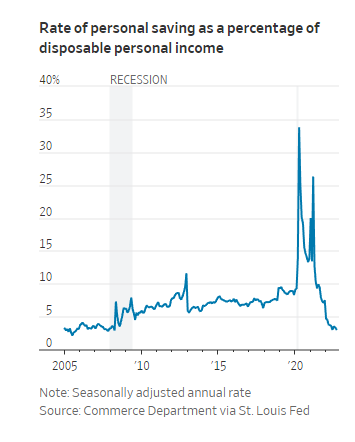

Data released last week shows that US households have become much more concerned about the inflation outlook. Somewhat paradoxically, though, they are trying to maintain their living standards by aggressive credit card spends. According to a New York Fed survey of consumers, inflation expectations for 2023 have risen to 5.9%, half a percentage point higher than that recorded in September. Longer-term inflation expectations have also edged up. The three-year and five-year expectations for inflation increased to 3.1% and 2.4%, respectively.

Due to the higher cost of living, Americans are depleting their savings and retirement accounts. Many are turning to credit cards and other forms of loan options to pay for goods and services in a vain attempt to maintain their standard of living. According to the Federal Reserve, household debt in the US recently rose at its fastest pace in 15 years. Outstanding balances on credit cards grew to more than 15% year-on-year, the highest increase in more than 20 years. The total amount of American household debt reached $351 billion for the third quarter, the most significant jump in debt since 2007. The total debt owed in the US is a record $16.5 trillion. The most significant contributors to debt originated from mortgage and credit card balances, which rose to $11.7 trillion and $930 billion, respectively.

As rates go higher the pincers of inflation and higher debt servicing costs are likely to produce the recessions which will lower EPS expectations,, everywhere.

We are therefore not "out of the woods" yet.

We recommend 3 ways to deal with the debt debasement, interest rate squeeze, and de-globalisation challenges which will cause heightened price volatility in the medium term.

- Try not to lock up your money in illiquid assets. Removing the ability to switch between stocks and across asset classes when prices will be volatile, is a costly mistake.

- Cash is not a way to maintain spending power. It is highly likely that inflation will continue to run higher than cash rates. Invest in dividend paying equities that meet needs not wants. This will provide better inflation protection. This is a Value style.

- Timing asset entry points is very hard and should be done only occasionally. A lot of money can be lost through FOMO investing and transaction costs from overly aggressive trading.

Delft Partners November 2022