April 2024 Update

April, 2024

"I've got the power"

March was a strong end to a strong quarter for risk assets. Despite a stated end to Yield Curve Control in Japan, further property price problems in China, and a core inflation rate that won't behave in the USA and Europe, soothing words from Jay Powell regarding interest rates were enough to convince investors to remain 'risk on'.

The global equity indices rose approximately 3% in US$ in March and 9% in the quarter, almost 11% in A$ for the quarter but only barely in A$ terms for the month. The strategies performed very well. The Global Diversified Portfolio outperformed by over 4.5% in the quarter, the GHC30 by c.8% in the quarter and the Global Infrastructure by 6.5% in the quarter.

Significant price moves in the month for Infrastructure strategy holdings were seen in K&O +c. 37%, Vistra +c. 31% Rubis +c. 31%, MDU Resources +c.17%, Targa +c. 15%, and Iwatani, +c. 15%. We make some more comments on the infrastructure opportunity below. This universe represents a sound way to buy yield and provides an inflation hedge in that real assets tend to preserve purchasing power better than promises from governments in the form of bond paper.

Significant price moves in global equities' strategies were seen in Dick's Sporting Goods, Valero, eBay (a recent purchase), Kroger and Atkore which rose between 16% and 26%.

In the quarter, Ebara rose c. 65%, EMCOR 61% Dick's 52% and Advantest 42%. The last we have highlighted for quite a while as a pure tech play in a market which was overlooked. Japan is now no longer an 'orphan child'. As Japan has earned more attention through its renaissance, debates rage as to whether the cause is truly one of better governance, and rewards to shareholders with a better focus on profits and sensible capital investment, or whether it's a weak Yen effect which will dissipate as the Yen reverts to somewhere near fair value (stronger). The year end in Japan is March and most companies report in May, but news flow will start to permeate from now. It will be interesting to see what Japanese companies do with buybacks and dividends. We remain overweight anticipating better treatment of shareholders by management.

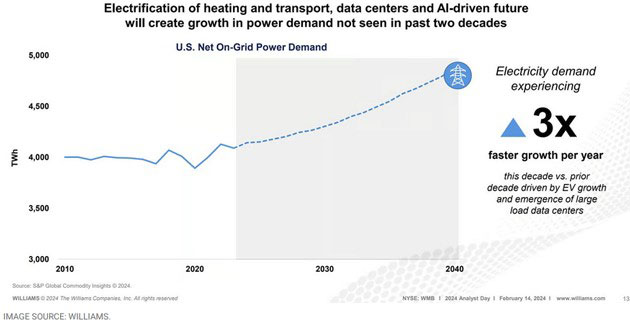

A brief comment on the infrastructure opportunity now clearly emerging for companies which build, maintain, and repair the electricity grid. First data centres, then crypto mining, then EVs and now AI have all arrived to place a burden on generation by and transmission within, a grid that is antiquated both in physical equipment and in its regulation. All of these trends, if continued at current rates of adoption are going to place enormous strain on Generation and Transmission (G&T). Renewable additions alone are definitely going to be insufficient and it's quite feasible that the whole system will come under pressure without significant overhaul and investment.

Demand from Crypto mining and Data Centres equates to roughly the 340GW of renewable capacity installed, according to the IEA, the International Energy Agency. This leaves nothing for other increased electricity usage. Chat GPT 10 is reckoned to need 10x as much power as a Google search. AI chips will do more computations and will need more power and of course more power to cool them. What we have now is not fit for purpose let alone what is expected to be demanded of it. (We refrain from mentioning the Heat Island effect on local temperature measurement errors.)

For a more detailed discussion of the issues please read below from The North American Electric Reliability Corporation. Page 10 will be enough to convince you of the challenge? Did anyone say Nuclear?

https://www.nerc.com/pa/RAPA/ra/Reliability%20Assessments%20DL/NERC_LTRA_2023.pdf

In short invest in companies that will be pitching for essential work on the grid.

Delft Partners April 2024

DISCLAIMER

This report provides general information only and does not take into account the investment

objectives, financial circumstances or needs of any person. To the maximum extent permitted by law,

Delft Partners Pty Ltd, its directors and employees accept no liability for any loss or damage

incurred as a result of any action taken or not taken on the basis of the information contained in

the report or any omissions or errors within it. It is advisable that you obtain professional

independent financial, legal and taxation advice before making any financial investment decision.

Delft Partners Pty Ltd does not guarantee the repayment of capital, the payment of income, or the

performance of its investments. Delft Partners operates as owner of API Capital Advisory Pty Ltd

AFSL 329133.