August 2023 Update

Euphoria mis-placed

August, 2023

Global equity markets rose in July as investors continued to scramble to buy equity risk seemingly on the basis that rate increases are nearing an end. Investors in the bond market are discounting a cut in May 2024, but the rhetoric from the Fed is for no cuts at all next year. Our stance coming into 2023 was to remain fully invested (as usual) but to focus on less volatile stocks. We got that wrong but our positioning in Japanese technology has helped alleviate the discomfort from being underweight the US MAMAA 'tech' stocks.

The global diversified trust rose 2.6% in A$, beating the benchmark by about 0.9%. The global listed infrastructure rose 0.5% in A$ beating its benchmark by 1.8%.

The ECB like the Fed increased rates as inflation continues to remain uncomfortably above a notional 2% target. The RBA saw a change in leadership with Philip Lowe being replaced by Michele Bullock. Interestingly the frequency of decision making on bank rates will decrease from 11 to 8 p.a. If this means a deliberate REDUCTION in "forward guidance" or hinting to markets what rates are to be rather than setting rates where they should be, then we applaud. Too much effort has been put into verbally persuading and guiding rather than simply following sound money and letting borrowers decide for themselves what debt they can bear.

We think that rates should remain higher for longer than anticipated. Inflation is not beaten and reducing demand is only part of the solution. More investment is needed to improve supply.

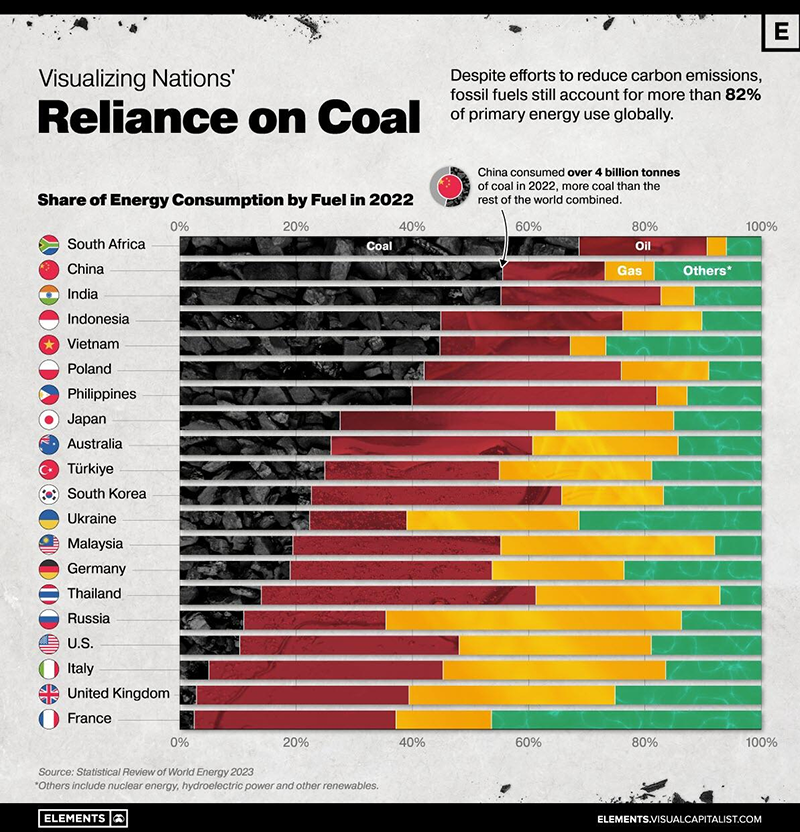

The pursuit of "Net Zero" appears to be losing steam. We have many science-based articles on the current impossibility of 'renewables' replacing organic (fossil) fuels in terms of both cost and efficacy and discussing the true environmental damage of 'renewable' technology. Happy to share. Now we note the unpopularity of the push as the cost of the Net Zero agenda and the absence of a similar push from Asia become more apparent. See chart below. The Australian government revenues are also buoyant from coal tax receipts but Net Zero is strongly in the Zeitgeist here so any climb down will have to be subtle. If only nuclear were acceptable…

Our expectation remains that oil gas and nuclear will be beneficiaries of both their political and stock market rehabilitation. Invest in Industrials which build and service the power grids as they become fully dependent on oil gas and to a lesser extent renewables. Quanta, BWX, Sterling, Cheniere, ONEOK, Tokyo Gas, Kinder Morgan, Marathon Petroleum, Dycom and OMV which recently discovered a new gas field in Austria, the largest find in 40 years, are all key holdings in either the Global and/or Infrastructure strategies.

We've been arguing in favour of Japan for a long while; and we remain positive and are enjoying the 'discovery' of its attributes. We continue to suggest investors look more closely at Japan. From our May 2023 commentary:- "In our view, global under-investment in Japanese equities offers a reason to be upbeat about the future relative performance of the market. Several factors are primed to give the market the much-needed support in the future, shaking the deflation mentality that has held back the Japanese economy and its financial markets. This week, investors' minds will be focussed on the Bank of Japan meeting. While it is a close call, the central bank may not yet be ready to change its monetary policy position. Nevertheless, we still believe that it is only a matter of time before the Japanese central bank abandons its yield curve control and allows long-term interest rates to normalise higher. In our view, the central bank's acceptance of higher bond yields would be a critical factor in generating more of an inflation mentality in corporate and household thinking. More inflation should encourage consumption and investment, reinforcing robust GDP growth. Companies have survived and some thrived by maintaining highly productive capital investment and driving costs down. Any pricing power will have rapid and meaningful benefit to the bottom line given this high operating leverage. Bear in mind the USA equity market currently constitutes 65% of the global equity market by value but the US economy represents about 15% of Global GDP."

We sold Amgen and Schneider in the Global Equity diversified strategy and increased the weighting in Tokyo Gas and ONEOK. We purchased Dycom, AENA (our frst investment in an airport operator following an on-site assessment of European air travel) and Atkore for the Infrastructure strategy.

Postive returns from Union Pacific (+13%) Alibaba Group (+22%) and Woodside Energy (+10%) aided performance.

Delft Partners August 2023

DISCLAIMER

This report provides general information only and does not take into account the investment

objectives, financial circumstances or needs of any person. To the maximum extent permitted by law,

Delft Partners Pty Ltd, its directors and employees accept no liability for any loss or damage

incurred as a result of any action taken or not taken on the basis of the information contained in

the report or any omissions or errors within it. It is advisable that you obtain professional

independent financial, legal and taxation advice before making any financial investment decision.

Delft Partners Pty Ltd does not guarantee the repayment of capital, the payment of income, or the

performance of its investments. Delft Partners operates as owner of API Capital Advisory Pty Ltd

AFSL 329133.