April 2023 Update

Banks once again in strife

April, 2023

Global equity markets rose during a volatile first quarter of 2023. The flow of funds towards risker segments of the market indicated a cooling of recession fears despite tightening monetary conditions. The S&P Global BMI rose c.2% in March and rose almost 8% in US$ terms in the quarter. The A$ weakened a little. We remain unhedged. Growth outperformed Value by a large amount. As is typical in periods of severe credit contractions, the banking sector was the conduit for and victim of the sell off.

Silicon Valley Bank and Credit Suisse captured the headlines as the former was declared bankrupt with the FDIC taking charge, and the latter was forcibly purchased by UBS as a going concern, as the Swiss authorities decided to cauterise the steady decline in share price and outflow of deposits at CS.

Communication from the US Treasury regarding deposit insurance for the banking system was confused and confusing. The Swiss did a better job although the forced liquidation at zero value of the c. $17bn in CS AT1 bonds caused a complaint or two until the small print was studied. The UK and Euro area authorities consequently made a strong statement regarding the seniority of bonds to equities under their legal structure. The Swiss may have done Euro area bank investors a favour by forcing a clear statement regarding support in the case of deposit flight/write-downs. Based on the CDS for Deutsche Bank as we write this, the resolve of the ECB may well be tested.

We wrote a memo on behalf of the US Fed last month https://www.delftpartners.com/news/views/memo-on-svb.html and note that the ‘Bagehot playbook’ has been sort of, implemented here by the Swiss.

UBS looks to have been forced into a purchase of Credit-Suisse, but cost cutting is likely and there is a global franchise in fund management to be created between them.

The US Fed and Treasury have yet to provide a clear statement regarding the extent of support over and above the FDIC deposit guarantee of $250,000, although the remnants of SVB have already been purchased by First Citizens BancShares (FCNBC). At a discount to prior asset value this seems a standard high yield/junk write-down. Both they and the FDIC will share in any losses and gains on SVB commercial loans from the written down value. This seems elegant and fair but the ascent of the FCNBC share price tells us that some investors think they got a bargain.

FCNBC now have over $200bn in assets. Three years ago, they had $40bn in assets. Let’s see if they have the systems and people to cope.

The issue now for US bank investors is whether banks below $250bn (the systemically important number) in assets are going to be encouraged to merge or whether the largest banks are going to be “persuaded” to prop up the system with bids for any subsequent failures or encouraged to break apart into risky and less risky activities as per our UBS comment above. We think the former more likely.

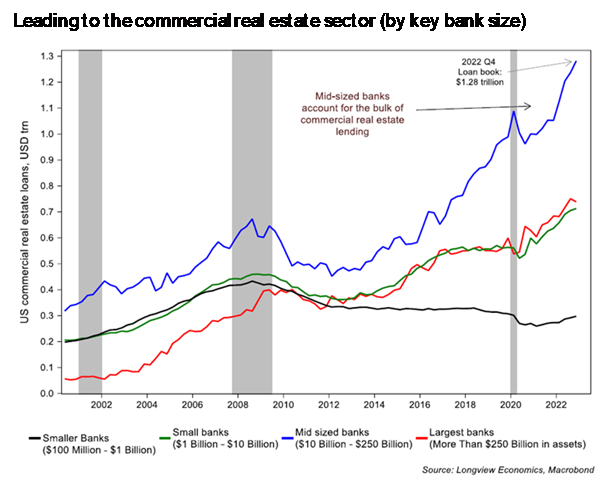

Incipient problems are now clear in commercial real estate where the US office vacancy rate is approaching 20% and the price of the mortgage-backed securities as represented by the CMBX contract are trading 30% below par. The 30% number represents the typical loss in a high yield instrument. Reality is setting in.

Elsewhere the Chinese and Saudis reminded everyone of the inefficiency and excessive cost of renewable energy in the West by striking a deal whereby Aramco ships oil to China and invests in two Chinese oil refining businesses. Perhaps some of the oil will be purchased in Rmb which would raise an interesting question about the $US?

Other positive developments in China were the apparent thawing between Jack Ma and the CCP such that Alibaba will be allowed to split to create value. The shares rose over 13% in March.

The challenge is now to position portfolios to avoid the elevated chance of ‘blow-ups’, regulatory change and duration risk where the intentions of central banks as regards interest rate policy are now more opaque. Asset write-downs are likely to hurt consumption and thus economic momentum and earnings. Favour companies that meet needs over wants for the moment. This is essentially because there is no trade-off between sound money and a sound banking system. The San Francisco Fed published a report recently in which they showed how monetary incontinence leads to banking crashes. In other words, a period of higher interest rates is required to SAVE the banking system from further troubles. Not all will make it.

Global Equities

The global equity portfolios are very underweight banks and financial stocks. We recommended that investors look to infrastructure companies if they desired defensive portfolios with attractive dividend yield and inflation protection. We still recommend exposure to LISTED and therefore liquid Infrastructure equity. However, we do see significant weakness in certain banks as an opportunity and are looking at regional US banks and larger Europeans closely. Our focus will be on liquidity and quality of the deposit base rather than capital structure or tier ratios. The banking shares that fell the most were the ones with the mismatch in duration and liquidity between assets and liabilities. The capital ratios seemed fine and had passed stress tests so using those as a guide wasn’t helpful. We own Regions Financial, UBS (a purchase on the panic surrounding CS) and find Fifth Third and Truist the most interesting not the least because of their geographical strength in the robust SE USA.

The global strategies added a little to Regions Financial in late March and purchased more Applied Materials and Teradyne, two attractive semi-conductor stocks.

In a very volatile month, the Japanese technology companies Shin-Etsu Chemical and Hoya rose strongly as did Intel which was buoyed by promises of money from the Chips Act in the USA. We view the Japanese technology sector as very attractive – cheap with a strong likelihood of increased orders as companies look to strengthen semi-conductor supply chains.

Global Listed Infrastructure

The Infrastructure portfolios enjoyed a resilient month, vindicating our view that the asset class would provide good downside protection. Our underweight exposure to the green energy stocks such as AES and NextEra Energy helped performance. Numerous robust academic studies now prove the deficiencies of wind and solar power. Our expectation is that oil and gas become clearly indispensable. Carbon capture infrastructure may become much bigger as an industry and investable.

We made several trades in the Infrastructure strategy during the month, buying Veolia, Sterling Infrastructure and ENEL, and selling Norfolk Southern after the train derailment, and Wisconsin Energy.

Future Food and Agriculture

Food and Agriculture underperformed global equities during the quarter and fell sharply during March. Food prices have continued to ease in 2023 but risks remain as inventories are still at low levels. The sector has seen earnings downgrades after a prosperous 2022 which will be difficult to replicate. Much of the underperformance in the strategy stemmed from fertilizer companies with prices of NPK inputs falling. This is mostly a normalisation of the highs of last year and partly the return of seasonality. Despite downgrades to 2022 earnings, valuations for these companies remain attractive and cashflows will continue to be higher than pre-pandemic levels. Activist investor Ubben suggested Dutch listed nitrogenous fertilizer producer OCI 10x current levels spiking prices.

Falls major grain prices have done little to hurt farm economics which remain attractive due to a commensurate drop in the cost of inputs. Rising rates will likely have an effect on small farm sales for agricultural machinery over the medium term because of this we have maintained our underweight agricultural machinery stocks over the quarter.

Asia Dividend Champions

The equity income-oriented Asia Dividend Champions strategy performed well during the quarter adding almost 6% and comfortably beating its benchmark and broader Asian equities. Materials and technology stocks in Japan, Australia and Taiwan were the standout performers while some Australian listed food and agriculture stocks along with some HK property/conglomerate names were a drag. There were a number of dividend surprises across the portfolio during the quarter most notably Indonesian listed United Tractors where the dividend declared reflects an annualised yield of 24% (and this on top of an ongoing buyback). Turnover in the portfolio for the quarter was minimal, but at the margin we added to some HK listed China stocks while slightly reducing our weights in Australia and Taiwan. At the end of March, the portfolio had a weighted average dividend yield of 6.8% and forward PE ratio of 8.6 times.

Delft Partners April 2023

DISCLAIMER

This report provides general information only and does not take into account the investment

objectives, financial circumstances or needs of any person. To the maximum extent permitted by law,

Delft Partners Pty Ltd, its directors and employees accept no liability for any loss or damage

incurred as a result of any action taken or not taken on the basis of the information contained in

the report or any omissions or errors within it. It is advisable that you obtain professional

independent financial, legal and taxation advice before making any financial investment decision.

Delft Partners Pty Ltd does not guarantee the repayment of capital, the payment of income, or the

performance of its investments. Delft Partners operates as owner of API Capital Advisory Pty Ltd

AFSL 329133.