December 2023 Update

December, 2023

Can we see the wood from the trees? Thoughts on 'the new new thing' to come from Governments.

November as we thought it might, saw a strong rebound as long-term interest rates fell in line with the decline in inflation as base effects became favourable.

https://www.delftpartners.com/news/views/nov-2023-darkest-before-dawn.html

The global trust rose just under 3% % in A$ terms. The Global Equity market rose 4.5% in A$ as the Big Tech rebound returned. The A$ rose about 4% against the US$ as it typically does in a "risk-on" environment.

The Global Infrastructure strategy rose 3% and outperformed its benchmark by 0.5% as the interest rate sensitive utility stocks rebounded. Our philosophy of not timing market exposure by switching in and out of cash helped in not being whip sawed.

Large monthly gains in long term holdings were pleasing but some of these are now looking very stretched on a valuation basis with even very optimistic assumptions about revenue, margins and discount rates. Portfolio turnover is likely to rise as we examine relative opportunities within the universe of c4,000 mid and large cap companies. Basic Materials, Energy, and Construction companies look very attractive. Have we seen maximum pain in China, non-Japan Asia, and are recent meetings between Xi Jin Ping and Western leaders a sign of a thaw?

Some highlights in the month were:

- Williams Sonoma + 31%

- Advantest +28%

- Dick's Sporting Goods +28%

- Deutsche Post +19.6%

- Andritz +19%

While investors are currently dealing with the vicissitudes of asset volatility and don't know from month to month whether to be 'risk on' or 'risk off', there is a danger that this short-term thinking and problem-solving clouds the view of any longer-term picture.

This article ponders the longer term.It's useful to try and identify these inflexion points because the markets are voting machines in the short term but weighing machines in the long run. Get a shift in a long-term trend right, or position yourself to not be in its way, then investment returns become a lot easier to achieve.

Our long term assumptions is that we are over the paradigm of 'reflate asset prices to achieve sustainable growth'. Interest rates are indeed going to remain where they are for a while - at least at the short end, the area where central bankers exert more control. This dubious theory of reflating the 'asset souffle to achieve private sector driven growth' resulted in ZIRP and Quantitative Easing (QE) for a long time; it was primary policy in the latter part of Greenspan's stint; and the whole of Bernanke's and Yellen's as Chairs of the Fed, as they fought the GFC and other imagined dangers of a '1930s style depression'. It was of course adopted by pretty much every central bank with the exception of Japan which invoked Yield Curve Control also resulting in suppressed interest rates.

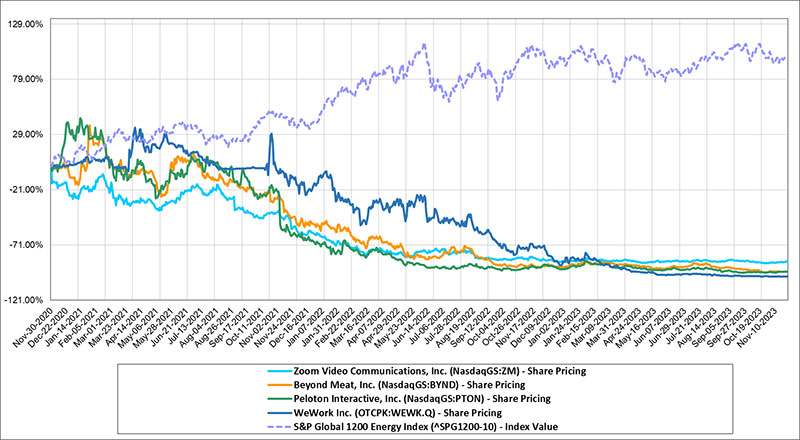

So, we had to invest in a world of 'free money' and of course got a lot of 'optimistic' business models and the usual rubbish was listed by Wall Street. We had a bubble and now have a lot of debt.

The chart below illustrates the returns from former favourites hyped at the peak of the bubble, compared to the 'dinosaur' or old-fashioned sector of Global Energy companies. Enough said?

ZIRP and QE haven't worked in the real economy either in the sense that the expected increase in private sector capital investment hasn't materialised, and that increased government fiscal stimulus has been necessary to keep the asset prices up and zombie companies alive. 'Boom bust and bail' has produced equity price gains in a limited number of stocks but each incremental dollar of debt produces less and less GDP and certainly less GDP per capita. We also have widening wealth and income inequality with which to deal. It has essentially been monetary policy for rich people.

Spend and tax as the next big thing?We sense a change in policy mix is coming; a new paradigm if you like. This will return us to the era of 'National Interests', National Champions, centrally (government) directed 'responsible' (ESG or DEI based) capital allocation and, potentially, financial repression. We've been here before - it was the 1950s and 1960s. Simply put, the folks that created this mess are now going to tell you they can fix it by fiddling more and in a different way.

So here it comes - 'I'm from the Government and I'm here to help'. AS President Regan said, the scariest words you can hear'.Emboldened by their ability to persuade markets about inflation fighting credentials, and to issue huge amounts of government debt at historically moderate nominal interest rates, we think policy makers are going to continue this 'spend now and tax later' approach. The spending will be directed at 'strategic' industries and interests and will be in the form of tax breaks, import tariffs, and public private partnerships. The CHIPS act, the Inflation Reduction Act are both examples. "Build Back Better" is really "MAGA" by any other name.

Concerned about evident rising income and wealth inequality, politicians will attempt to create a better balance between wages and profits through income subsidies for lower wage earners. They will also subsidise jobs 'at home'.

Of course, Japan, China and India never abandoned National Interest in economic policy. The return of the West to this approach will result in:

- generally lower levels of free global trade,

- less immigration competing for lower wages,

- less technology transfer,

- lower levels of capital exports (overseas capital investment)

- More regulation and monitoring by government agencies and thus higher news flow-based share price volatility. For example, did AMAT or NVIDIA break tech export rules or not? These are not events that can be analysed in the traditional sense. Management can't predict when governments decide to act and so cannot communicate this to the market. It's event risk.

- Higher hidden inflation. If you think the official inflation constructs reflect true price increases and/or no price increases for lower quality goods and services, then I have a bridge to sell you. Shrinkflation and 'Skimpflation' are both words we will hear more often!

"Skimpflation is defined as businesses 'skimping' on the quality of a product or service," says Scott A Wolla, economic education officer at the Federal Reserve Bank of St Louis.

And on Shrinkflation - https://www.mouseprint.org/category/downsiz/

For some of the most rigorous work on how the inflation basket has been manipulated check out www.shadowstats.com - The potential for capital controls in so far as persuading the markets to take all this debt at a time when the above trends are reducing potential growth rates to service this debt, may become difficult. We add a piece on what current US fiscal spending will mean for the US economy and debt markets below but if foreigners won't buy US debt, and the Federal Reserve is reducing its balance sheet and is thus also a seller, then what remains are insurance companies and banks and pension funds to pick up the slack. We have been here before, and it was the 1950s. It will be dressed up as bond purchases for capital adequacy and risk reasons but will be financial repression none the less.

The US government debt obligations have grown to over $30 trillion after a splurge in spending post GFC, Covid and now Bidenomics. This is over 120% of US GDP and has grown 3x in today's $ from $10 trillion in 1997. This 30+$ trillion is probably an underestimate for a number of reasons.

Government deficit spending, which adds to the debt pile, is c.6% GDP annually. Inflation can't erode this debt pile if it grows faster than nominal GDP! Debt servicing on this large and growing pile is estimated to be over $800 bn p.a. (ceteris paribus on interest rates) and if current spending trends and interest rates continue then will reach over 3% of GDP pa in a couple of years. This will approach US Defense Spending levels.

The US is not alone in this profligacy and Europe and China are also loading up on debt. However, the US is supposed to be the world's reserve currency. There appears to be no acknowledgement of this in Congress and thus an absence of 'governance' rather than the size of the debt pile was used as the reason for the downgrade by Fitch.

A downgrade from now all the major agencies is to be welcomed because this is an unsustainable trajectory without the re-introduction of capital controls and centrally directed lending and borrowing. If these controls were introduced, it would return us to the 1950s era which actually wasn't so bad for the population BUT was in a much less well-connected world with lower trade flows and immigration.

Capital controls would be necessary because the marginal buyers of US debt, foreigners, would become averse to funding these deficits unless rates rose higher to compensate them for risk of inflation and/or default. Higher rates at 120%+ debt / GDP mean higher annual outlays to pay for the debt. It becomes a vicious cycle. Japan and China own c 25% of o/s US debt. Recent auctions indicate less enthusiasm from these countries to buy US debt. Thus, rates will rise to attract other buyers including domestic investors. Higher rates increase debt servicing costs. So, if something can't continue forever it will stop.

The stoppage will happen in perhaps three ways. They are not mutually exclusive.

- US fiscal probity returns, and government spending is cut in real terms. This of course will exacerbate any slowdown since government spending 'helps' activity. A better option would be for useless programmes to be eliminated while keeping productive ones. The Net Zero obsession for example is very damaging.

- US government spending (CHIPS Act, Inflation Reduction Act etc) turn out to increase the growth rate of the US economy. Debt to GDP stabilises as GDP grows faster than the debt pile. Rates stabilise.

- Capital controls and fiddling with the inflation series (it is done repeatedly anyway) obligate US institutions and Social Security and other government agency pools, to buy debt at artificially low rates but ones which satisfy the prudent requirement insofar as they are near or above the newly reduce inflation series. This will be accompanied by more MAGA or Build Back Better subsidy programmes.

We prefer 1 and 2 together. Corporations are currently spending c$1 trillion on buy backs which could be better utilised on capital investment. Less government and more private enterprise would achieve 1 and 2 most easily. It is unlikely Democrats believe this and so without change we go to 3.

Conclusion - start this programme for equities in 2024. Equities are still the best hedge against persistent inflation.We may well be wrong and often are. However, one can invest in equities in a way that provides a decent return if we're too pessimistic, as well as benefitting if we are correct in the long-term shift to more government. Of course unlike bonds, equities will provide some inflation protection and thus should be part of the portfolio of risk.

From an equity perspective therefore invest in:

Quality/Profitable mid cap firms. The Russell 2000 in the USA, excluding the loss-making firms, is an optimal choice. The loss-making companies in that index account for an astonishing 25% of companies (based on the last 3 years) and thus the profitable ones are on a significant P/E discount (the P/E is 12.5x) to the S&P 500 which is dominated by "The Magnificent 7" at high P/Es. Equal weighted indices have already begun to perform better relative to the capitalisation weighted ones. If one seeks equity risk then it's highly unlikely that the mega caps outperform the mid-caps from here as much as they have done? If the whole equity market is de-rated then there is less to lose from a P/E of 12.5? One might as well be hung for a sheep as a lamb?

Companies which meet needs and not wants since these will be harder to tax and regulate further. They will also provide an inflation hedge in that any product price rises will be harder to avoid by switching consumption preferences. In this area we still like Infrastructure companies energy providers and Basic Materials businesses.

Japan - much is changing at the corporate level with share buy backs rewarding shareholders. Companies are keen to enter the Nikkei 400 index which is weighted based on how well a company is managed for shareholders. https://indexes.nikkei.co.jp/en/nkave/index/profile?idx=jpxnk400 In a world where bureaucrats will have more say on how a company can operate with respect to 'national interest', one might as well invest in a country where the bureaucrats are well trained and have done a fairly effective job, rather than one where they are unproven?

Delft Partners December 2023

DISCLAIMER

This report provides general information only and does not take into account the investment

objectives, financial circumstances or needs of any person. To the maximum extent permitted by law,

Delft Partners Pty Ltd, its directors and employees accept no liability for any loss or damage

incurred as a result of any action taken or not taken on the basis of the information contained in

the report or any omissions or errors within it. It is advisable that you obtain professional

independent financial, legal and taxation advice before making any financial investment decision.

Delft Partners Pty Ltd does not guarantee the repayment of capital, the payment of income, or the

performance of its investments. Delft Partners operates as owner of API Capital Advisory Pty Ltd

AFSL 329133.