Future Tense? Or Past Imperfect?

August 2020

We don't usually pontificate on macro-economic matters. Too much relative performance is lost by portfolio managers thinking that a) they are good economists and b) that it matters for asset class returns to predict GDP to two decimal places and c) they can time market exposure vs cash. Given that d) most of them have no idea how to optimise a portfolio of stocks to try and get near the optimal risk return outcome you would have thought that portfolio managers (including ourselves) would try and learn that and shut up about sweeping economic comments best left in the pub or at dinner?

On the other hand, we are cognizant that there are times when the levels of potential economic instability are so high and everyone seems so complacent, that a good dose of economic scenario analysis is worthwhile. This is when things are risky, and we get a paradigm shift.

We are there now. So here are some pithy thoughts on what to do with equity risk.

We have too much debt now to pay it back without a level of pain that the debtors can't endure. The policy response to Covid-19 has meant we have crossed the debt Rubicon. It now seems somewhat quaint that those in hock will roll up their sleeves and pay the debt back to their creditors with the minimum of fuss; all the while enduring the necessary hardship and sacrifice to honour debts incurred; and keeping the society cohesive and without schism and the politicians that preside over this, in power. Get real - it's not possible.

The last time there was a hint at monetary withdrawal in 2018, we had a panic sell-off in risk assets and the Fed blinked first; and went back to ultra-low rates.

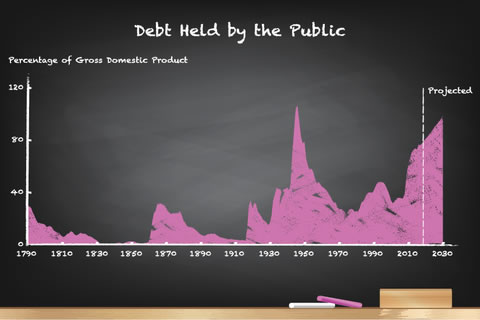

Choose a chart from any economic website on the internet and look at total debt. Any country will do. This one below is from the Congressional Budget Office in the USA. Note the last peak in the late 1940's after the Second World War. We'll come to that later. The solution to that will be the solution to this. We hope. The alternative is worse.

(There are some other plans which make sense to us - www.thepurpleplans.org but this requires political consensus. So, don't hold your breath.)

Some countries will shake their heads at the USA predicament and claim superiority, but they too have debt problems. Their personal debt maybe way too high at > 150% GDP (Australia); some look to have high government debt but corporate cash in abundance (Japan); some have alarming levels of government debt but high levels of personal saving (Italy) and some look to have an excess of debt every which way (USA and UK). Some are trying really hard to catch up in debt owing (China) and some won't admit that the assets they hold will evaporate (Germany Target2 balances). Add in the unfunded promises made to retirees and soon to be retirees, (www.pensiontsunami.com) and this looks like a nasty traffic accident coming along - everywhere.

Debt matters for equity holders because equities are at the end of the queue when it comes time to divvy up the spoils. If taxes, interest costs, and wages eat up more of the profits in the future than they do now, then there is less for you to enjoy; and at a time when the price earnings multiple on some popular stocks is not exactly leaving much room for disappointment. Add in the fact that government bonds have gone from being a risk free return to being a return free risk, where are on earth are you going to get income from your hard earned savings from which to live a dignified retirement?

Much of this debt will have to be 'forgiven'/written off/defaulted upon/inflated away. There will also be tax increases. These are the only exits. It's already happening.

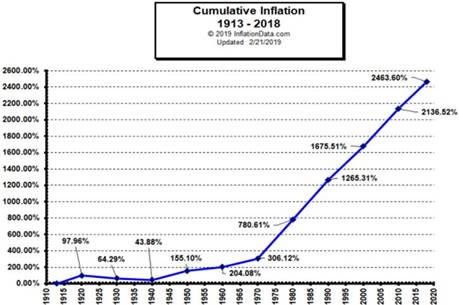

- Inflation is snuck in as 'unexpected inflation". This results in so called 'fiscal drag' whereby tax brackets don't get adjusted upwards but as prices and earnings rise, the tax take will increase as the higher earnings get taxed at the higher tax levels. (Official inflation already understates real inflation www.shadowstats.com)

- Pension benefits reduced/taxed. Retirement ages will rise, tax free pension pot allowances fail to keep pace with inflation and state pensions will be index linked to the lowest rate of composite inflation that can be manufactured - if linked at all. The logical decision will be for folks to save more money thereby depressing consumption which is not a bad remedy for those countries in perpetual current account deficits? On the other hand many economies need private consumption which accounts for as much as 70% GDP in current GDP calculation methods.

- 'One off' taxes will be popular and if you don't believe us then check out this from China.

According to Economic Information Daily, a news agent of XinHua, the State Council Executive Meeting (国务院常务会议) held on Wed, 17 Jun 2020, indicated that the State Council is considering urging the nation's financial system to sacrifice RMB1.5t worth of profit in support of the real economy. To put this in perspective, China's banking industry profit in FY19 was about RMB2.0t

source CCB International

Banks are always an easy target; are popular scapegoats and especially in Europe woefully under-capitalised. More on this sector later but in any outcome the banks look very likely to struggle. The UK and Australia have already imposed levies on banks based on the size of their balance sheets. - Our favourite and relatively elegant trick which is yet to be discovered by politicians (?) is to revisit the calculation of GDP and revise upwards GDP for all manner of reasons - "the underground economy can now be measured"; "adjusted for quality of life improvements our GDP is much higher"; our services sector is so much bigger than we thought and we will include domestic work in GDP". This would immediately make debt to GDP numbers look a lot better. If you think about it for a second, debt (a relatively known and hard figure) divided by GDP (a complex but artificial and little understood statistic) is a slightly crazy constraint to be using to set policy, when there is so much evidence that society is fracturing after 20 + years of the lunatic zero interest rate policy?

There is a recent example of this when the UK decided to include estimates of drug dealing and prostitution in its GDP figures. Surprisingly (sic) they were revised upwards. https://quarterly.blog.gov.uk/2014/10/15/sex-drugs-and-gdp/

If I were Italy, I would simply recalibrate GDP measurement and would be able to add about 30% to GDP, ascribing that to a discovery that the Sicilian economy and overseas remittances were a lot higher than previously calculated. Debt to GDP limit solved - let's rebuild those falling bridges since we now no longer are beyond the debt ceiling?

Consequently, Eurostat may be the next European vehicle to be hijacked for the "greater good" following on after the ECB? You can certainly expect a more European friendly rating agency network to be established - https://www.sciencedirect.com/science/article/abs/pii/S1042443118301847#:~:text=Introduction,sovereign%20debt%20crisis%20in%20Europe.

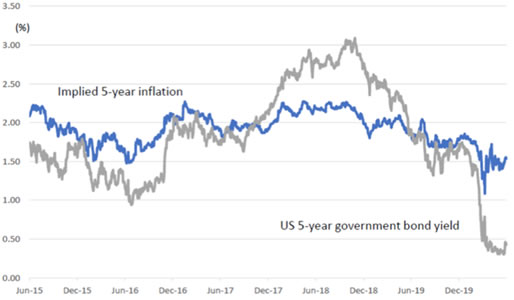

All of the above of course will lead to the 'dangerous' (for governments) circumstance that 'bond vigilantes' return and demand higher interest rates for the higher inflation rates they are suffering and here's the problem that arises. If bond market vigilantes do return and rates rise even a bit, then government budget deficits blow out. A 1% increase in European debt costs approximately equate to the EU annual budget. With government debt at 100% to GDP, a 1% rise in funding costs equates to 1% of GDP as higher interest payments.

So where are the bond vigilantes now given the below negative real yield? Probably beginning to wake up; or should be?

So, what happened in the 1950s

The 1950s was an era of quite pleasant economic expansion/recovery achieved through large scale interest rate repression accompanied by sensible infrastructure investment and other productivity enhancing capital investment. (The USA highway system for example was built in the 1950s massively increasing labour flexibility - it was however snuck through on the back of a military spending bill, so the political dysfunction in the USA is not new - plus ca change c'est la meme chose?)

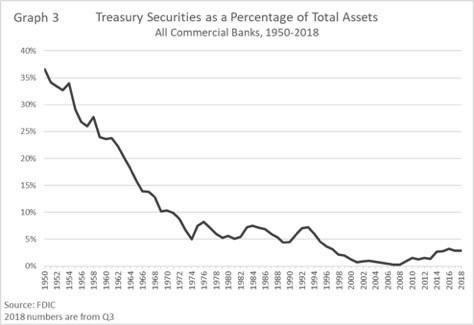

It was also a time of national industrial policy and little globalisation. Banks were 'encouraged' to hold up to 40% of their asset book in government bonds (somebody has to buy the debt to keep the yields down) and margins were consequently thin; banks less exciting and equity returns a lot lower. Yields were however suppressed on savings accounts and transferred the debt from the government. Yield curve suppression a la 1950s is already happening here in Australia, in Japan and now the USA is floating the idea.

In the 1950s the commercial banks were essentially obligated to hold 30% of their assets in government debt. This was the case elsewhere.

The 1951 Treasury Federal Reserve Accord allowed the debt from WWII to be monetised. It ostensibly gave the Federal Reserve independence but actually required the Fed to coerce commercial banks into helping suppress the yield curve. Inflation was over 20% and the 3 month T-bill rate rose but a series of interest rate controls kept savings rates well below inflation. https://www.federalreservehistory.org/essays/treasury_fed_accord

In this scenario banks will be safe, but assets and profits will grow more slowly. Dividends will be suppressed to keep capital ratios high. Nationally strategic industries will be bailed out, limited in scope, and encouraged to employ more people than they should? The French aerospace industry for example has already been declared strategic and the share prices of the listed companies - Dassault Aviation, Safran etc fell pretty sharply on the news the French State was going to get more involved.

Consumer cyclical stocks will be 'on their own' and any financial leverage will be dangerous for investors. It is also likely that non tax paying companies will find themselves under the regulatory microscope and having to cough up more tax.

Boring is back it seems. General Mills, Verizon, Kimberly-Clark - all start with a decent yield and getting 7-8% p.a. from there is a lot less precarious than starting at zero yield?

The 1970s

On the other hand, we may stuff it up and accidentally or even deliberately unleash inflation? It's what some folks are proposing - the MMT mob. If this happens then the lack of trust in fiat money will lead to capital flight and thus repression will be necessary in the form of capital controls, dividend controls and even bank bail ins of depositors' money to recapitalise the banks. No country wants capital to escape driving inflation even higher; and so on will come the controls - temporarily you understand while we have this nasty bout of speculation driven by foreigners/hedge funds/my political enemies.

Check this chart out below for just how biased toward inflation policy making has been since the 1970s. Gold was and can be again confiscated so be careful of thinking this is safe.

Printing money worked so well in Zimbabwe? These notes are only about 5 years apart in issuance.

It could happen. It's not in the consciousness of investors now, but the monetary base M3 in the USA (remember that?) has been growing alarmingly (+20%) and given the predisposition for central bankers to behave like larcenists, we may yet see the 1950s jump straight to the 1970s - serious and visible inflation. Monetarism is "so 1980s" but the complacency around inflation is alarming. As Tim Congdon points out, the demobilisation of troops after World War 2, placed millions of men into the work place and would have been expected to keep wages in check? Didn't happen that way and inflation ran at 20% for quite a while.

Inflation will result in capital flight from the most indebted countries first and we advise only invest in assets in hard currencies backed by strong Net Foreign Asset positions (assuming you can invest in these before the capital controls come on). We may come back to this issue of capital controls in another article.

Prepare for a rerun of the 1950s and if that doesn't work we will be returning to the 1970s.

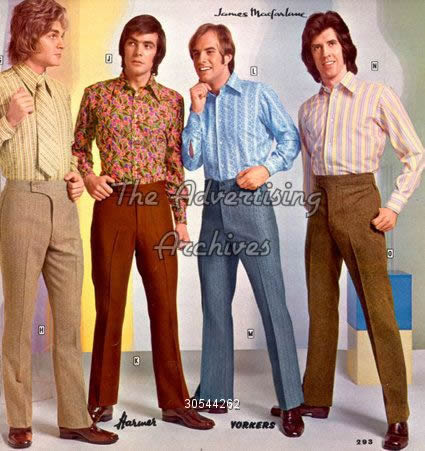

Just in case you needed reminding of the 1970s... we know what we prefer!

DISCLAIMER

This report provides general information only and does not take into account the investment objectives, financial circumstances or needs of any person. To the maximum extent permitted by law, Delft Partners Pty Ltd, its directors and employees accept no liability for any loss or damage incurred as a result of any action taken or not taken on the basis of the information contained in the report or any omissions or errors within it. It is advisable that you obtain professional independent financial, legal and taxation advice before making any financial investment decision. Delft Partners Pty Ltd does not guarantee the repayment of capital, the payment of income, or the performance of its investments. Delft Partners operates as owner of API Capital Advisory Pty Ltd AFSL 329133.