Global Infrastructure Spending Emerging as The Focus

June 30, 2020

As countries emerge from covid lockdown we will start to receive lots of news from companies, surveys, economic data, etc. Much of it will be confusing and conflicting. We will need to be careful in not jumping to hasty conclusions. There has been no business for three months in lots of product categories so we will inevitably see some initial pent-up demand as businesses re-open which may superficially sound good, only to slump to much lower than average levels in later months.

Unless a vaccine is rolled out in the near term many areas of business will struggle to operate at anywhere near pre covid levels – travel, leisure, retail, certain manufacturers, etc. A lot of workers are still furloughed, but as these schemes come to an end (governments simply can’t afford to run them for too long), so companies will face crunch decisions as to whether they take workers back or make them redundant.

As we have said from the start of the crisis, we remain of the opinion that after the initial spike in business resumption, the recovery is likely to be gradual and unemployment to remain high for some time. We have seen a strong rebound from the bottom in stockmarkets, but we should be cautious about reading too much into the move. A lot of trading is technically driven – hedge funds opening or closing short positions on stocks can create significant rallies in stocks. We think some of the cyclical, most covid affected areas of the market have moved up too much.

Most governments have moved quickly to put in place measures to maintain the productive capacity of their economies – providing liquidity to companies, furlough schemes for workers, etc. However this still not make up for lost demand and GDP levels are likely to be below 2019 levels for some years. So governments are going to need to do more to stimulate demand or be the demand itself.

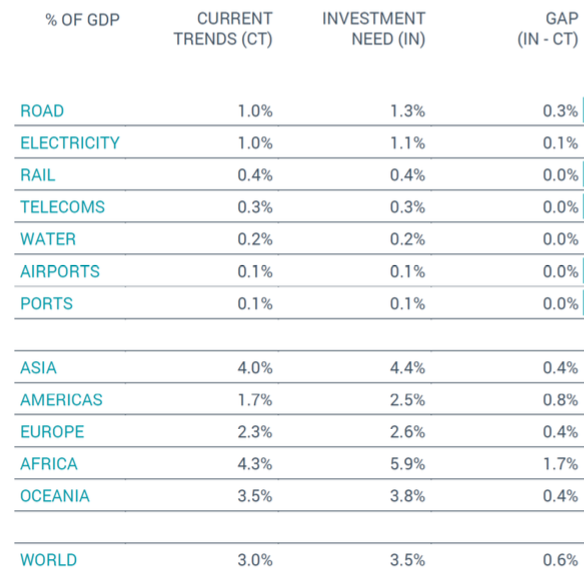

One area that governments have underspent for decades in many countries is infrastructure. Anybody who has been to China will have seen how far behind much of the developed western world is in terms of infrastructure. Infrastructure is a broad set of industries that include electricity (renewable energy increasingly required by new legislation), water, communication networks, road, rail, airports, oil supply and transportation, port facilities, storage, etc. The economics consultancy firm, Oxford Economics, in a large global study in 2017 estimated that the world needed to spend approximately US$94tn to 2040 with Asia and the Americas requiring the biggest expenditure. Failure to invest in Infrastructure impedes economic growth – in places like India electricity supply can often be unreliable; transportation bottlenecks cause delays and raise costs; dirty energy causes pollution and health risks, etc.

Covid has been a tragic human and economic event for the world. It has left a big hole in the global economy. So this would provide an opportune time for governments around the world to fill the hole with much needed spending on crumbling infrastructure where

underinvestment has occurred for decades. Fortunately bond yields for most developed economies are very low, so funding is cheap.

| 10Y | 30Y | |

|---|---|---|

| USA | 0.7 | 1.4 |

| EU avg. | -0.27 | -0.03 |

| UK | 0.16 | 0.6 |

| JAPAN | 0.02 | 0.6 |

| CANADA | 2.91 | 3.59 |

| AUSTRALIA | 0.89 | 1.73 |

1 Source: Refinitiv, 25 June 2020

The Trump administration announced a plan to spend US$1tn on infrastructure on 15 June and more details are likely to be announced in July and it’s likely to focus on roads and bridges. The main drawback with infrastructure spending is that they take time to plan and implement when the economy needs an instant injection of demand.

1 Source: Oxford Economics 2017

1 Source: Oxford Economics 2017

The Oxford Economics study showed that the greatest need for more spending compared to trend was electricity (both in capacity and cleaner energy) and roads in terms of sectors. Geographically all regions needed greater spending with Africa and the Americas.

Delft Partners believe global infrastructure is an attractive investment space particularly in the current climate of uncertainty. Many companies have significantly cut their dividend payments or suspended them entirely. This could well turn out to be one of the biggest “dividend recessions” in history and it may well take many years before global dividend levels get back to 2019 levels. Infrastructure companies like utilities, road & rail franchises, etc tend to have above average and more stable dividend payments. Decent income yields have been in demand ever since bank interest rates plummeted and the relative scarcity in the current climate will make infrastructure stocks very attractive. Delft’s own Global Infrastructure fund currently yields 4.5% and this is set to grow by over 5% per annum on current forecasts.