May 2023 Update

Growth on top. Mind the gap.

May, 2023

Equity strategy returns were flat to up in April but lagged, some meaningfully, the indices we use to measure excess active performance. Growth beat Value. The narrowness of the US equity market rally should be a concern. Only 7 stocks account for almost 90% of the equity market return year to date. Nonetheless the market capitalisation index is the default for many investors who will proclaim again that active management is dead since the market cap index will be outperforming most active managers certainly ytd. However, please see below for our comments on the prospects for the US market vis a vis Japan. We have seen this play before. While one can be indifferent to the characteristics of a rising market, they do matter. Using a market capitalisation index 'passively' is not without risk and exposes the investor to a lot of price momentum as a risk factor. This price factor tends to mean revert, or after a strong period, provides negative relative returns. Following price momentum also creates lack of diversification in a portfolio. Essentially, the chances are high from here that price trend following will be sub optimal.

Economic data remains curious if not downright confusing. There's lot of ambiguity out there. Economists (and the Fed) use the word recession often, but economic activity is not rolling over quite as fast as some had feared. Headline inflation is declining, but core inflation remains persistent. US corporate results are surprising to the upside. Investors, meanwhile, are split into two opposite camps, the worried and the sanguine, with the markets oscillating between the two extreme views. There is a group of investors that expects inflation to persist. This group sees the Fed and other central banks ultimately being forced to raise interest rates and keep them at relatively high levels for an extended period. The other group of investors believes that inflation will be surprising to the downside very soon, and hence the Fed can lift off the brake pedal and cut interest rates through the latter part of the year. Forced to choose, we fear the destruction of the supply side with tax increases and regulation and significant (unnecessary?) investment in non-productive or lower productive investments will produce stagflation. So, inflation will remain stubborn meaning that rates will remain at best where they are now.

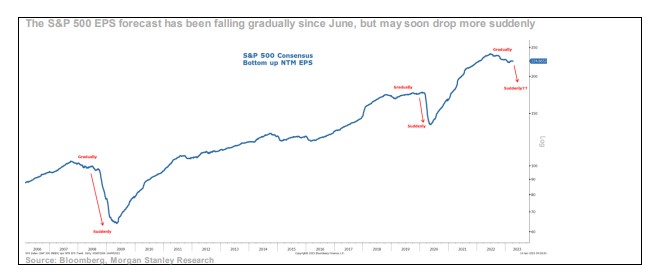

The market's confusion around trends has spread to the US corporate results season. Ahead of the earnings release, analysts had set their forecasts for a poor outcome as they expected a sharp setback in year-on-year earnings growth. However, a Bloomberg estimates suggests that of the 20% companies that have already reported numbers, more than 77% have posted profits ahead of expectations. It then begs the question as to whether the analysts have been too bearish. Let's bear in mind that the US corporate results seasons is a quarterly phenomenon where around 65% of the reports ordinarily come in ahead of market expectations…it's just that on this occasion that the percentage of reports beating expectations has been exceptionally high. One might take that trend as bullish for the overall equity market; however, we still believe that analysts are too optimistic about the level of profits for the balance of the year. With even the Fed talking about a "mild recession", it's tough to see how such economic conditions would lead to significant year-on-year increases in corporate profits through the balance of the year and into 2024.

A very brief comment on banks which continue to struggle, especially in the US. We remain underweight the sector. The contrast with the GFC rescue is clear to us. This time bond holders are being burned as well as equity holders and thus it represents more of the Bagehot playbook than we had hoped. This is not necessarily good for investors in weaker banks' paper but if this continues it means moral hazard is being removed from the system. One more comment worth making perhaps. The banks whose share prices are under most pressure are the banks whose loan books are exposed most to commercial real estate. The liquid bank shares exhibit visible daily price volatility which the underlying assets do not. Does this mean that the value of the commercial real estate is therefore immune from this valuation shift? Of course not. Yet some funds whose holdings in illiquid assets are large will claim exactly this. This is a microcosm of how the illiquid assets in a portfolio may not exhibit daily price volatility but that does not make them immune from risk and valuation shifts. Furthermore, if you wanted to now switch from illiquid real estate to buy marked down bank shares, you can't. Your illiquid asset is just that. Opportunity or lack thereof has a cost.

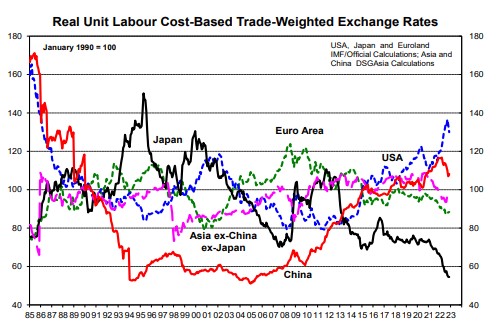

In our view, global under-investment in Japanese equities offers a reason to be upbeat about the future relative performance of the market. Several factors are primed to give the market the much-needed support in the future, shaking the deflation mentality that has held back the Japanese economy and its financial markets. This week, investors' minds will be focussed on the Bank of Japan meeting. While it is a close call, the central bank may not yet be ready to change its monetary policy position. Nevertheless, we still believe that it is only a matter of time before the Japanese central bank abandons its yield curve control and allows long-term interest rates to normalise higher. In our view, the central bank's acceptance of higher bond yields would be a critical factor in generating more of an inflation mentality in corporate and household thinking. More inflation should encourage consumption and investment, reinforcing robust GDP growth. Companies have survived and some thrived by maintaining highly productive capital investment and driving costs down. Any pricing power will have rapid and meaningful benefit to the bottom line given this high operating leverage. Bear in mind the USA equity market currently constitutes 65% of the global equity market by value but the US economy represents about 15% of Global GDP. Crude and imperfect but it's extreme. The Japanese market peaked at 44% of Global market cap (albeit with Japan at a smaller % of Global GDP than the US is now) and its relative performance since that peak has been poor on average (there have been some pockets of excellence).

Features of the peak in Japan now evident and obvious years later?

- Real Estate and land prices very elevated relative to incomes; a subsequent meaningful decline

- High bank exposure to over-valued assets and equity erosion

- Central bank action to reduce money supply

- Liquidity trap with no incentives to invest

- Poor capital allocation - such as "bridges to nowhere" in Japan (eg The Hamada Marine Bridge) or "The Inflation Reduction Act" in the US

Do any or all of these elements look similar to the US now?

The Japanese corporate sector has already shown signs of reform. Likely record share buybacks this year would be a testimony to the progress in corporate governance improvement underway in corporate Japan. At the start of the year, the Tokyo Stock Exchange announced proposals to put further pressure on listed companies to improve their standards for listing under three headings of Prime, Standard, and Growth. Failure to meet the standards would force the companies to de-list and lose access to equity funding. The essence of the measures is to force companies to improve their returns and be mindful of the cost of capital. Too many Japanese companies trade below their book value because of their poor returns on capital. Encouragement of more M&A would be a bonus. The Yen is also seriously undervalued.

From DSG Asia:- Japan in black

We made some small trades in the month. We trimmed NYK the Japanese shipping company after a 20% upward price move; likewise Iwatani. We added to AT&T after a price fall on results which we deemed ok but the market not. It will be a slow road back perhaps from a series of disastrous acquisitions by this telco but it's cheap and management does know how to run a telco if not a media conglomerate.

We remain fully invested in equities since they represent the best hedge against elevated but not extreme inflation. We favour companies that meet needs rather than wants. We like dividends as proof of profits.

Delft Partners May 2023

DISCLAIMER

This report provides general information only and does not take into account the investment

objectives, financial circumstances or needs of any person. To the maximum extent permitted by law,

Delft Partners Pty Ltd, its directors and employees accept no liability for any loss or damage

incurred as a result of any action taken or not taken on the basis of the information contained in

the report or any omissions or errors within it. It is advisable that you obtain professional

independent financial, legal and taxation advice before making any financial investment decision.

Delft Partners Pty Ltd does not guarantee the repayment of capital, the payment of income, or the

performance of its investments. Delft Partners operates as owner of API Capital Advisory Pty Ltd

AFSL 329133.