Reflecting on Policy Errors in the Administration of Hong Kong

September 7, 2019

By Kevin N. Smith, Delft Partners

Kevin Smith takes a look at some of the underlying economic and political issues that have contributed to mass protests in Hong Kong which go well beyond the initial trigger event of the proposed extradition bill.

In the past three months we have seen bouts of mass protests in Hong Kong some of which have been officially designated as riots. There appears to be no end in sight to these protests and that is having a detrimental impact on the economy and stock market. I spent seven years living in Hong Kong over two spells between 2001 and 2011 and observed first-hand the peaceful mass protest when 500,000 people took to the streets on 1st July 2003 in opposition to the proposed anti sedition law known as Article 23, in this case the government quickly backed down and withdrew the legislation. The fear with that piece of legislation was that even mild criticism of the regime in China could be interpreted as a breach of Article 23 and subject to harsh penalties.

The recent problems in Hong Kong are an example of unintended consequences from proposed legislations aimed at bringing an alleged murderer to justice. The murder took place in Taiwan and the suspect then fled to Hong Kong to escape from the Taiwanese legal authorities. The reaction of the government to introduce a law aimed at having this murder suspect extradited to Taiwan was on the face of it a sensible response, however, this action steered Hong Kong into one of the great unresolved geopolitical issues of the past seventy years.

In 1949 the Communists won the civil war against Chang Kai-shek’s Kuomintang (KMT) nationalist government, with the KMT retreating to Taiwan. The Communists appeared to be prepared to invade Taiwan and complete the purge of the KMT, however, with the United States standing with Chang Kai-shek and the KMT, they held back from the final invasion. A recently declassified CIA report dated 13th October 1950 identified that the invasion force of 600,000 combat troops from 3 Field Army were undergoing training for the planned amphibious landings. The CIA report stated the “Communists feel that because of the Korean situation the Taiwan invasion will be postponed indefinitely”. Here we are seventy years later with an unresolved geopolitical dispute and since China views Taiwan as part of its territory, a renegade province, that simple extradition legislation in Hong Kong to bring an alleged murderer to justice, opens the way for extradition from Hong Kong to China. This was an unacceptable outcome for millions of residents of Hong Kong, and a clear example of unintended consequences.

The Hong Kong administration under the leadership of Chief Executive Carrie Lam did quickly respond to the first wave of mass protests by shelving the extradition legislation and that would, under normal circumstances, seen an end of the situation. However, the protests have continued and become more violent and disruptive to the Hong Kong economy. There are at least two underlying causes for the escalation in protests, first a growing desire for democracy and second, a reaction to levels of inequality that have been allowed to expand to the most extreme levels ever seen.

1) Democracy at Snail's Pace

When Hong Kong ceased to be a British colony in 1997 the transition to full Chinese sovereignty was to be delayed for fifty years under the Basic Law. During this transition period Hong Kong operates as a Special Administrative Region (HKSAR) of China hence the term “One country, two systems” with the HKSAR enjoying autonomy for all issues except foreign policy and defence. The same process was adopted in 1999 when Macau ceased to be a Portuguese colony. Article 45 of the Basic Law sets out the desire to achieve universal suffrage without specifying the timeline or process. The first Chief Executive of the HKSAR, Tung Chee-wha in 1997 ruled out free, direct elections for at least a decade and put the date of 2012 on the table. The 2012 date passed without the introduction of universal suffrage and while the numbers of people permitted to vote in HKSAR elections has been expanded, a pre-selection processes remains in place to ensure that the Chief Executive and members of the Legislative Council are acceptable to Beijing. The current Chief Executive of HKSAR is very unpopular and has experienced a faster rate of declining support than her three predecessors. The chart shows that the pattern of support for each Chief Executive is similar, they start at their most popular and then decline in popularity as time passes. It is also noticeable that the first two Chief Executive were significantly more popular at the beginning of their respective terms than the successors, Leung Chun-ying and Carrie Lam.

Pre-selection of the candidates for Chief Executive is undertaken in Beijing by the Election Committee, a 1,200 strong electoral college to ensure that candidates are acceptable to the Communist Party. While this pre-selection process remains in place Chief Executives of HKSAR will continue to be seen as taking direction from Beijing. The current round of protests in Hong Kong has universal suffrage as a key demand. It is extremely unlikely that the demand for universal suffrage will be satisfied, so this will be a source of ongoing tension. To quote Jonathan Robison in his article for the Centre of Strategic & International Studies, “one country, two systems should not be viewed as a framework for liberal democracy, something Hong Kong never had under the British, but as a compromise over what the Communist Party can tolerate.” Thus far Beijing has been showing restraint regarding the protests in Hong Kong, 30 years has passed since the terrible events in Tiananmen Square, the current regime looks more likely to be able to reach an accommodation rather than the use of troops for the type of heavy handed response seen in 1989.

Chart 1 Popularity of Chief Executives in the HKSAR

Sinking Support Carrie Lam's popularity rating has plunged amid weeks of protests in Hong Kong.

2) Policy Errors Have Generated Mass Discontent

The extent of the current protests isn’t just about the desire for democracy. In two decades of recognising SARs in Hong Kong and Macau, the Chinese authorities have respected the Basic Law and allowed both colonies to thrive financially, Hong Kong as a global financial centre and Macau as a gambling city. In less than 20 years Macau has grown from a fraction of the size to six times the turnover of Las Vegas. Hong Kong and Macau have been so successful that they would top the tables of net creditor nations in per capita terms if they were counted as “nations”. Macau with a population of 600,000 has per capita net foreign assets of USD 250,000 and Hong Kong with 7.5 million population has per capita net foreign assets of USD 177,000. As a point of comparison, the very successful German economy has created per capita net foreign assets of USD 20,000. However, tremendous economic success has been an unequal affair, for the past decade Hong Kong has recorded a Gini coefficient above 0.5, scores above 0.5 indicate extreme inequality. Hong Kong’s current Gini coefficient of 0.539 is significantly higher than Singapore at 0.458 and the United States at 0.411.

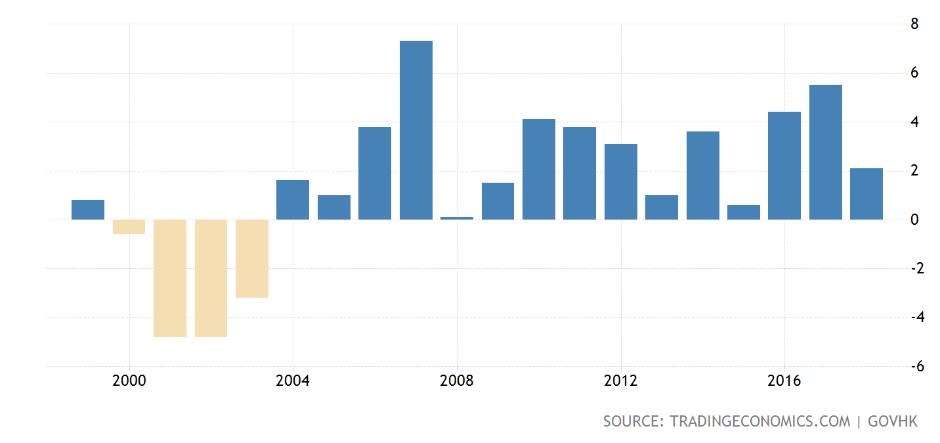

The low tax regime in Hong provides a paradise for expatriates with very few people paying the top rate of 17% salaries tax while investment income, capital gains and consumption are completely free of taxation. I am a strong advocate for free markets and small government and Hong Kong delivers one of the best examples of the ideal low tax/small government economies. With a working population of 3.5 million only 1.26 million pay any tax whatsoever and the government consistently delivers a surplus, see Chart 2. The government’s policy response to budget surpluses is typically to look at ways to reduce tax revenue or provide give-aways and tax holidays, at one level that is great, however, in the context of persistent inequality this may be judged as a policy error. Hong Kong’s simple tax system was implemented in response to Britain’s call for monetary support in the early stages of World War II, the broad structure of taxes hasn’t changed since the 1940s.

The major policy change in the post-war years occurred in 1983 when the Hong Kong dollar was pegged to the USD at a rate of HKD 7.80. The peg has operated efficiently for four decades, for most of that time the Hong Kong dollar has been somewhat undervalued and as a small open economy that structural currency value imbalance isn’t a problem for the major trading nations. By pegging the Hong Kong dollar to the US dollar, Hong Kong automatically adopts the monetary policy of the US Federal Reserve.

Chart 2: Fiscal Position of the HKSAR Government

In a world of ultra-low, near zero interest rates imported from the United States there has been a dramatic impact on the value of property in Hong Kong, see Chart 3. At current levels, the average property price is twenty times the median income level which is more than double the rate in a city like Sydney. How did valuations move to such extreme levels? Low taxation and ultra-low interests are part of the explanation and the third element that Hong Kong shares with Macau are money flows from China. Both SARs share a land border with China and every day money is carried across the border (mostly illegally) and enters the financial system.

Chart 3 Comparison of Average Property Prices

One of the joys of living in Hong Kong is seeing old style banking halls still in operation, with rows of tellers undertaking cash transactions with clients. In the period when I lived in Hong Kong from 2001, I would see increasing numbers of bank clients making enormous deposits in cash over the counter. At that time, I was CEO of an international investment management business based in Hong Kong and we would experience Mainland Chinese visitors showing up at our reception desk every day wanting to invest their cash. My office was on the 53rd floor or a 79-storey building so it wasn’t easy to walk in from the street. We turned away all offers of this type of “investment”, but many institutions weren’t and aren’t as scrupulous with their anti-money laundering rules. Huge amounts of Mainland money have ended up in the Hong Kong financial market and property market helping to push price levels to their current and extreme levels.

There are clear policy lessons that Hong Kong should learn from Singapore. Singapore is a very wealthy city state open market economy with similarities to Hong Kong. Singapore has per capita income of US$65,000 versus Hong Kong at US$49,000, some 32% higher while property prices in Singapore are on average 27% lower than Hong Kong, these differences create a gulf in affordability. Singapore has allowed their currency to float and it had appreciated dramatically in the past two decades. Singapore operates a provident fund the CPF requiring compulsory savings for those in employment up to the age of 55 at 20% of salaries for employees and 17% for employers. Those contributions can be used to fund house purchase, health care and retirement. Hong Kong efforts to implement the Mandatory Provident Fund (MPF) at a capped 5% contribution rate are clearly insufficient to create the desired outcome.

While MPF contribution rates need to progressively increase towards the level achieved in Singapore, direct action is also required with respect to the property market. Singapore has implemented a subsidised housing and direct building programme through the Housing Development Board that has kept the prospect of property ownership as a realistic goal for the younger generation of Singaporean workers.

The traditional approach to tackling housing affordability in Hong Kong has been directed at varying stamp duty and regulatory restrictions on lending limits operated by the banks. These policies have failed to control property prices and has left a whole generation of young adults in Hong Kong in despair regarding their ability to ever enter the property market. The government should be using their strong financial position to deliver affordable housing and if that means it ceases land sales to private property developers for the time being then that is a price worth paying.

Investment Conclusions

In response to the mass civil unrest the market in Hong Kong has declined by 7% in the month of August and by 13% since the end of April. We are maintaining our investments in Hong Kong and have confidence that appropriate policy responses will be found that eventually allows a return to normal conditions. Our Hong Kong portfolio trades on a forward P/E of 7.8x which is a significant discount to our regional portfolio of small to mid-sized companies on a P/E of 9.7x. The broad Asian regional and global large capitalisation indices currently trade on forward P/Es of 12.8x and 15.8x respectively. A lot of the “bad news” is reflected in current equity prices in Hong Kong.

Hong Kong has achieved a 12% per annum return in the past 30 years and that includes periods of dramatic falls associated with Tiananmen Square in 1989, the 1997-98 Asian Crisis, the dot-com bubble that burst in 2000 and the GFC in 2007-8. The current market valuation is very similar to the levels that prevailed in the aftermath of those terrible events in Tiananmen Square in June 1989, back then the Hong Kong market was priced as if there would be zero value in 1997 after the handover of sovereignty to China.

Since 1997 China has allowed capitalism to flourish in Hong Kong, however, as we have indicated, policy errors have been made allowing too much influence from external factors on the domestic property market that has pushed valuations far too high. Traditional measures to control the property market haven’t worked and will not work while the currency peg remains in place and/or US monetary policy remains ultra-loose and money flows from China continue at current levels.

I agree with the call by billionaire businessman Sir Michael Kadoorie for Hong Kong to unite and work together to relieve the desperation and despair of the city’s youth. In his front-page open letter in the South China Morning Post he stated; “It is the responsibility of us all to rebuild trust in the community and create hope for the younger generation.” Hong Kong will find a path through these problems, when businesses unite to help a floundering government a successful outcome can be achieved. The current tax system in Hong Kong is an example of businesses stepping up and suggesting a better path than the initial proposal for a 50% payroll tax that came from London in the early stages of World War II. While the current problems facing Hong Kong are much worse than finding an optimal tax outcome in support of a war effort, a broad coalition of businesses supporting the government will help Hong Kong to steer towards the right path. The Hong Kong market will remain volatile, but we take comfort from current low valuations and an equity market that has always rewarded the patient investor.