Inching Towards Normal But Not Without Risks

October 2021

By Delft Partners

- Global equities holding in as bonds feel the pressure.

- Investors will need to see downgrades to global growth abate for equities push on.

- Further signs of a re-opening of global travel bode well for renewed growth momentum.

- The key risks are less than transitory inflation, particularly in energy prices and the ongoing troubles in China's property sector.

Global equities had a better week, and we believe they should marginally outperform bonds in the coming weeks. There are signs of a broader reopening underway that we expect should boost consumer confidence and spending. Consequently, we should see downgrades to global growth forecast abate. However, there are two risks to a pro-equity call. First, the spike in inflation will lead to a quicker tightening by central banks, and second, there is a marked deterioration in the Chinese economy on the back of the problems in the property sector there. We believe central banks will be worried that the pick-up in energy prices will undermine consumer spending resurgence and remain slow to tighten monetary policy. But China continues to concern us.

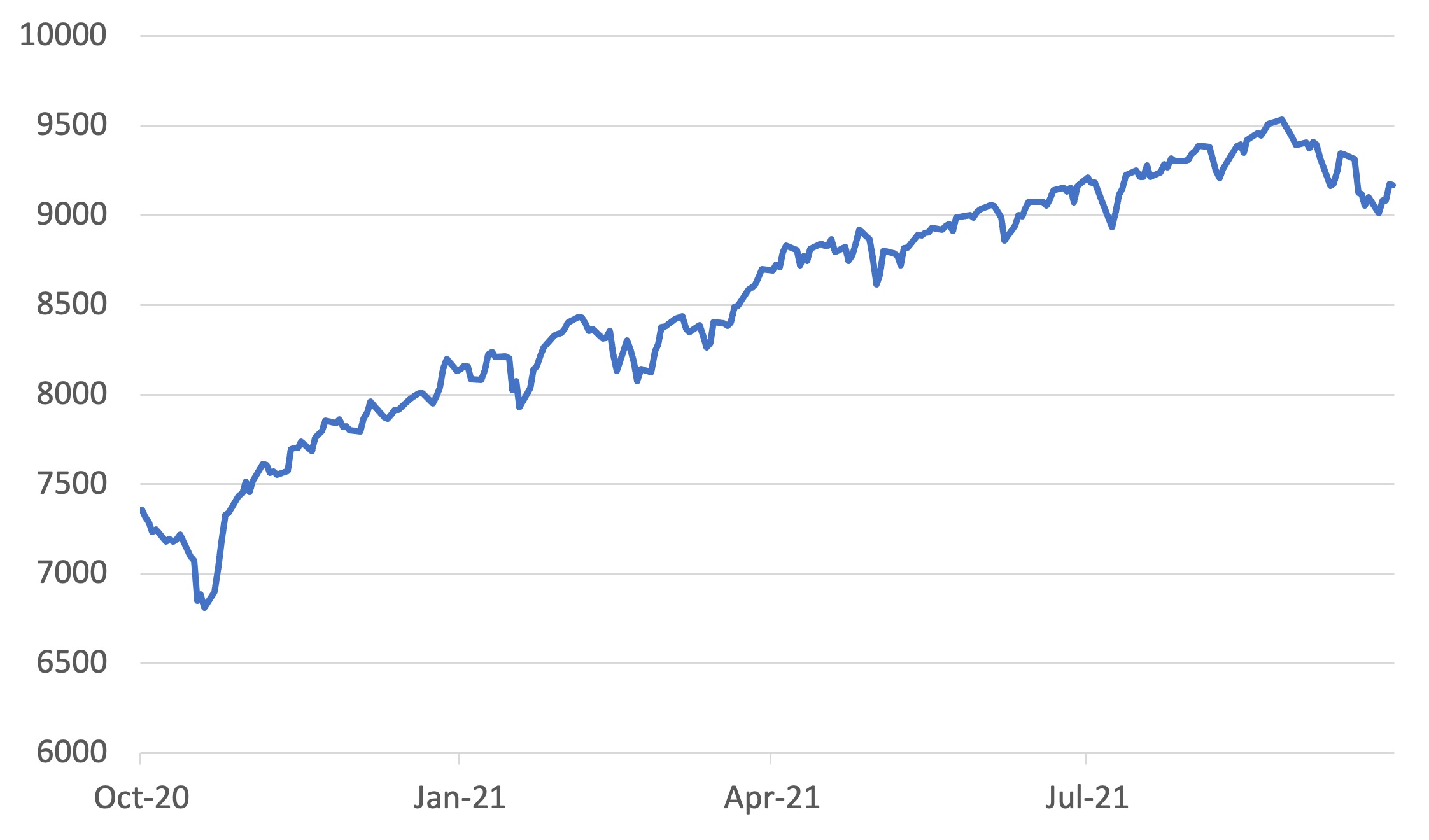

Global equities have recovered their poise but have failed to make much progress over the past five months. The surge in inflation has undoubtedly provided a drag. However, the challenges posed by the delta variant of COVID have proved to be as much a dampener. Economic activity has lost momentum; the re-openings in many economies have gone into the reverse, leading to a slowing of consumer spending and employment growth.

MSCI World Index TR (USD)

Nevertheless, the drop in COVID cases of late has been encouraging. Several governments have quickly moved towards reopening their economies, taking down a considerable number of the barriers to movement. The newfound freedom is most apparent in the considerably reduced number of countries on travel 'red lists', enabling people to travel more freely. Greater freedom to travel alone has the power to increase consumer confidence and lead to increased consumer spending and GDP growth.

While the diminished impact of COVID is a positive for consumer spending, we have to concede that the rise in inflation, particularly the recent rise in energy prices, is harmful. The increase in gas prices in the past quarter has been quite extraordinary. Gas prices are up a whopping 150% in Europe; the US has seen a 50% surge.

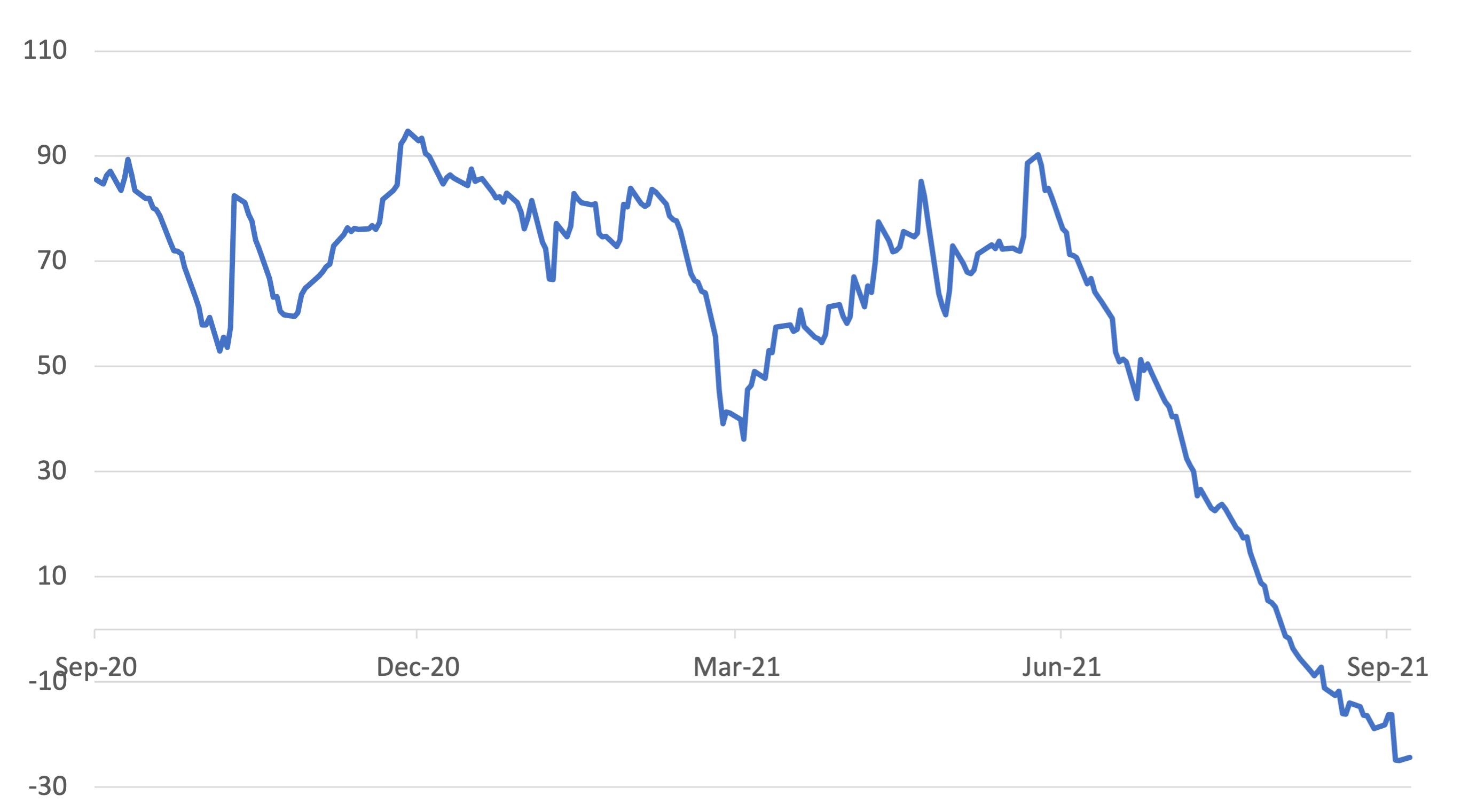

As Chart 2 shows, the recent spate of economic data has often been below expectations. That could be about to change as the current round of downgrades to GDP forecasts washes through the system. Daily US COVID cases peaked in the latest wave on the 3rd of September and fell steadily since. However, it's not just about the daily cases. It is about the reaction of governments to the COVID situation. In the UK, the daily COVID count has been around 30,000 for the past three months; however, the government has just substantially reduced barriers to overseas travel. Indeed, people from the UK can now travel to Singapore and vice versa. At the weekend, the Singapore government pleasantly surprised the country by relaxing the restrictions on overseas travel with travel lanes opened with eight countries. Singapore now has travel lanes for fully vaccinated passengers from the US, the UK, Denmark, France, the Netherlands, Spain, Italy and Germany.

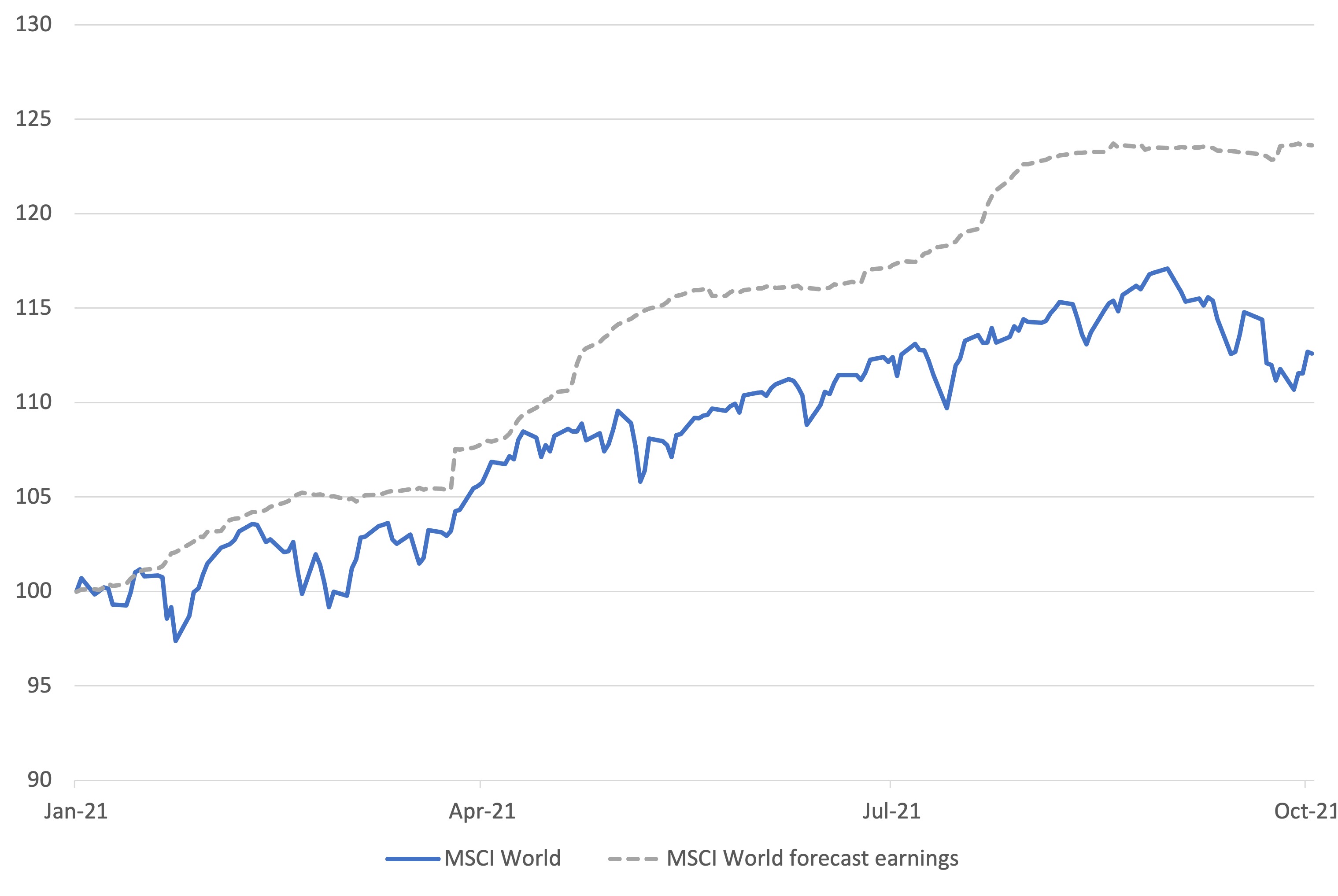

The pause in the equity markets' advance has led to a more substantial gap between the rise in the level of consensus corporate profit expectations for 2021 and the level of the global equity index (Chart 3). The expected level of corporate profits has risen nearly 24% year-to-date, yet the global equity index is up just 12%.

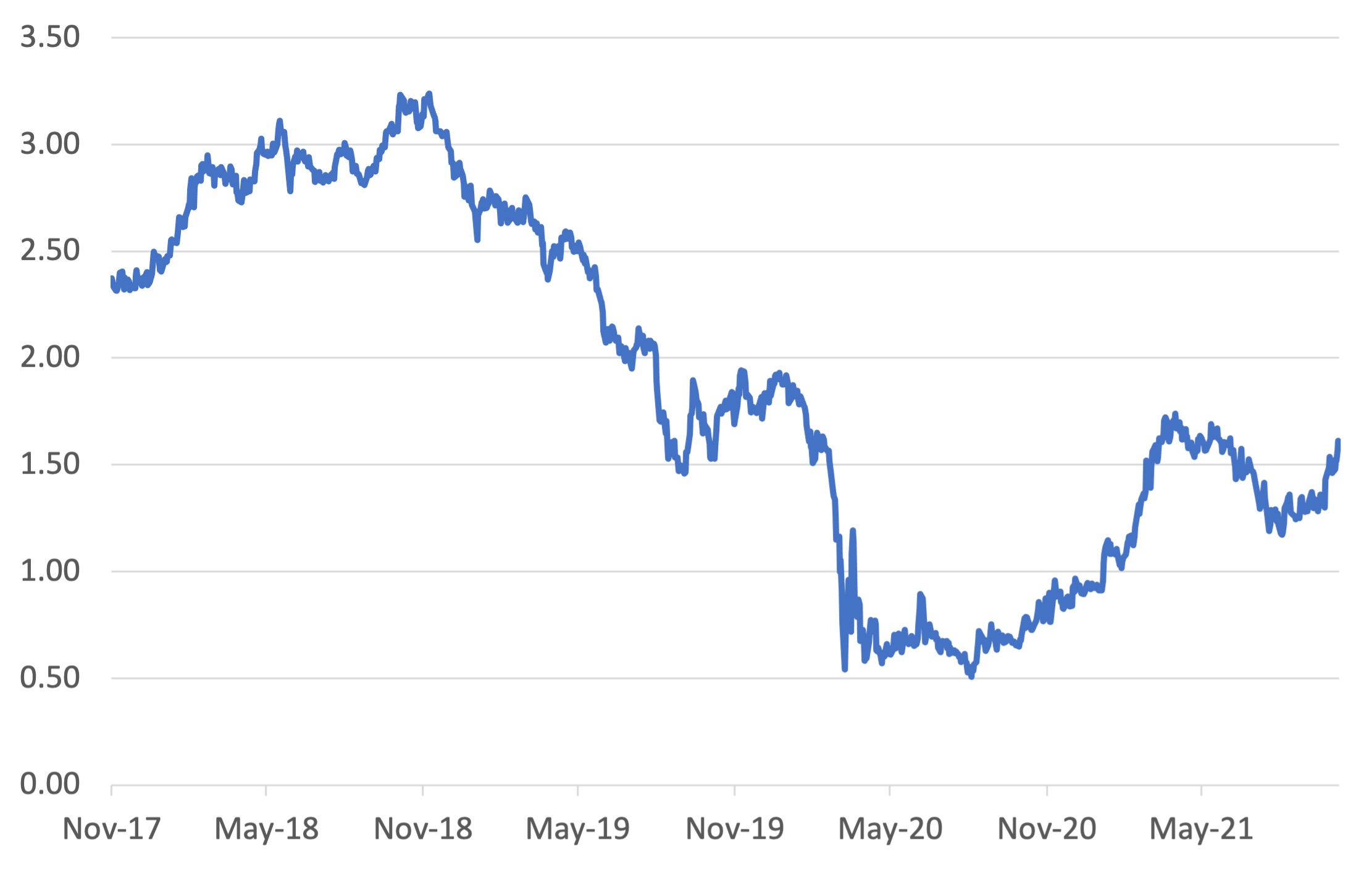

We expect investors to take a more positive view of the upside for equities. With bond markets under pressure from higher yields, equities remain the asset class of investor choice. The market sees the spike in global inflation as much less transitory than before. The quick pace of the US 10-year bond yield rise suggests it may have further to go, potentially through the 1.70% level in the coming days. It is noteworthy that the spike has occurred at a time of weakening global growth. Given that backdrop, consider where the yield might be if we have a recovery in consumer spending, ongoing higher-than-expected energy prices and a global re-stocking cycle, all meeting still dysfunctional supply lines. Even though last week's headline US employment growth disappointed the market, the stronger-than-expected working hours and wage growth figures kept the bond market from rallying.

The most significant global risk to a more positive tone to the global asset markets is the Chinese property market angst. It has almost become a game of chicken between investors and the government to see who blinks first. Evergrande equity is suspended, and its debt is trading in the low 20 cents in the dollar. Across the Chinese property debt market, prices have fallen on the news that Evergrande's problems have led to a buyers' strike at property development sites. Property development unit sales are down on average by 35% year on year. Property developer liquidity is being squeezed by a lack of pre-sales, an offshore bond market that has largely dried up and an onshore banking market that is at its limit.

The great hope among investors is that the Chinese government will step in and relax onshore banking limits. However, that may require them to compromise on the three red lines that they set as the de minimis requirement for companies to be on the right side of regulations to receive funding. At this point, it is reported that 50% of the top 30 developers are in breach of at least one of the red lines.

DISCLAIMER

This report provides general information only and does not take into account the investment objectives, financial circumstances or needs of any person. To the maximum extent permitted by law, Delft Partners Pty Ltd, its directors and employees accept no liability for any loss or damage incurred as a result of any action taken or not taken on the basis of the information contained in the report or any omissions or errors within it. It is advisable that you obtain professional independent financial, legal and taxation advice before making any financial investment decision. Delft Partners Pty Ltd does not guarantee the repayment of capital, the payment of income, or the performance of its investments. Delft Partners operates as owner of API Capital Advisory Pty Ltd AFSL 329133.