Jackson Hole Part II – Reality Coming?

4th September 2020

It's currently very complicated out there we think. Equity investors are getting it wrong – although maybe last night’s sell off shows that some investors are thinking?

Bond investors have it more correct but not without some detective work on our part to show how.

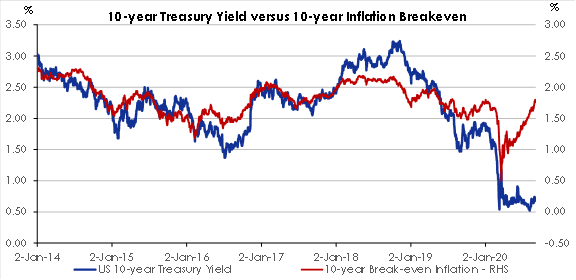

It’s NOT the level of US 10 year nominal yields that (yet) shows their correct interpretation of the situation and the JH speech – it is the GAP between the nominal yield and the implied breakeven inflation rate for Index Linked bonds in the USA. Chinese and Japanese bond markets are being more intelligent, and their yield SPREAD to the USA is wide and getting wider.

Source CCB

Source CCB

- Folks want inflation protection and can't get a real yield on the 10 year.

- So, they have (over) bought the ILBs which now yield a mind boggling negative 1+%

- And have ironically decided to give up on buying equity dividend yield (Value Infra stocks utilities, REITs etc)

- And are chasing LONG LONG LONG Duration assets such as loss making equities and high P/E equities

The GAP between the negative ILB yield and the 10 year T note is SCARY WIDE. This is actually VERY unusual. If you fear inflation and are willing to pay away - 1% PER ANNUM to get protection then the 10 year note yield (now let loose by the professed absence of YCC) has to start backing up or bond investors have suddenly lost their marbles.

Something has to give between ILBs and Nominal bond yields. ILBs may fall in price inferring a relaxation about inflation but that's NOT the Jackson Hole message. The Jackson Hole message was Average Inflation Targeting (AIT) and no Yield Curve Containment (YCC).

So, the 10-year note is the wrong price relative to the ILB; and certainly relative to true inflation? The USA yield curve is very likely to steepen. If it does it has NOT contradicted what was said at JH.

This steepening has always caused problems for ‘no profits’ (yet or ever?) and/or 'no yield' equities = Growth style.

All of this in the bond markets is about to be a NEW UNCERTAINTY on a complacent equity market and so should cause elevated volatility; sadly, again, equity teenage scribblers are about to be taken out.

If you don't like negative yields on ILBs; but do want some inflation protection and some yield which you can't get on Treasuries, the look at Infrastructure equities, Utilities, REITs, Basic Materials companies, Banks and yes even oil companies. In other words Value.

Jay Powell will be faced shortly with a taper tantrum and vested interests will be yelling at him. However, it's time to escape the purgatory of ‘ZIRP Socialism’ - so 'courage mon brave' and tell them all to go forth and multiply please.

See chart below

DISCLAIMER

This report provides general information only and does not take into account the investment objectives, financial circumstances or needs of any person. To the maximum extent permitted by law, Delft Partners Pty Ltd, its directors and employees accept no liability for any loss or damage incurred as a result of any action taken or not taken on the basis of the information contained in the report or any omissions or errors within it. It is advisable that you obtain professional independent financial, legal and taxation advice before making any financial investment decision. Delft Partners Pty Ltd does not guarantee the repayment of capital, the payment of income, or the performance of its investments. Delft Partners operates as owner of API Capital Advisory Pty Ltd AFSL 329133.