January 2026 Update

January, 2026

"It's tough to make predictions especially about the future" (Yogi Berra)

With 2025 behind us and some (surprisingly?) strong returns achieved from global equities, let's ambitiously ponder the outlook for 2026. We'll address bonds too since we use bond prices and credit spreads across the yield spectrum in our assessment of equity valuations.

2026 begins with momentum; new policy support possibly only in Asia.

The easy part of the cycle is over. Markets will prioritise earnings growth first, balance sheets (including sovereigns) second, inflation discipline third.

Capital is drifting East: bonds are inflation adjusted coupon-driven, and direct investment flows driven by prospective returns on capital and regulatory clarity and consistency.

Strategic Positioning or factor tilts will matter more in 2026 because of clear regional differences in the 'friendliness' toward investment and the likely inflation reduction benefits from supply side incentives. From an industry or sector exposure basis one should build strategic weightings in commodities which are currently in short supply and the associated drivers of commodity demand, industrial and energy companies.

The weekend's events in Venezuela notwithstanding, risk assets enter 2026 with confidence and momentum. Sentiment appears constructive, not euphoric, and that distinction matters. Markets ended 2025 on a high, underpinned by steady growth and inflation that remains largely contained and in places declining. The key difference between what we see now and much of the post-pandemic cycle is that any further significant monetary easing is largely absent from the near-term outlook. Personnel changes at the Federal Reserve may lead to one more rate cut but GDP statistics would indicate that the US economy is going better. Thus, gains in 2026 will need to be earned. If corporate reporting indicates consistent revenues, sound cashflow, resilient margins, and modest earnings beats, a broad rally in risk assets, particularly in the US, appears likely in the first quarter. Equity markets do not require perfection; merely a confirmation that growth is not deteriorating nor creating inflation should be enough to maintain current levels of comfort with risk. Further out in the year we expect growth to improve Debt to GDP ratios, and a continued shift from government support for marginal industries to letting private capital do its thing. We'd like a 10% return from global equities but would settle for 8%. From bonds and credit we expect 5-7%. So in other words 'back to normal'.

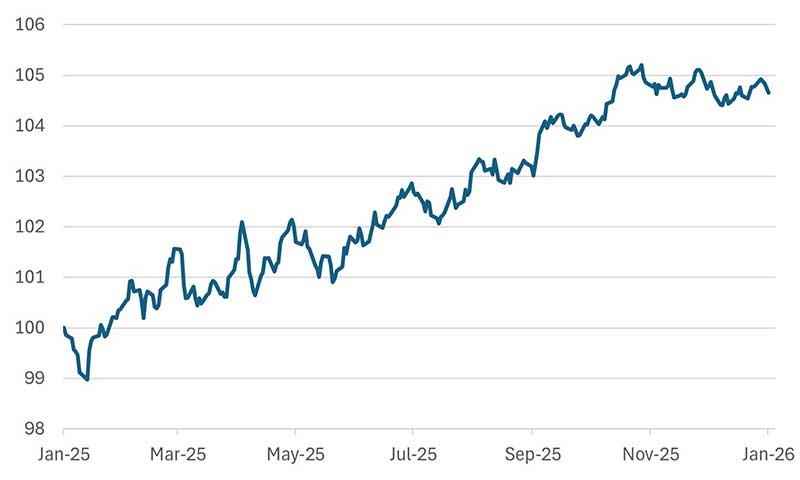

Government bonds are likely to have a muted outlook in the absence of economic stress. Sometimes muted is good! Bond returns in 2025 were respectable in real terms but unremarkable relative to equities, and 2026 is likely to see returns gravitate towards the running yield in a world where core sovereign yields are clustered broadly in the 3-5% range. High debt-to-GDP ratios across developed markets are a pressing concern, placing upward pressure on term premia and limiting the scope for sustained bond rallies. In some cases, governments are struggling to bring deficits under control, as in France; in others, markets appear willing to tolerate a degree of benign neglect (aka the Big Beautiful Bill), as in the United States. The wild card is Germany whose strong sovereign balance sheet was always the anchor for the Euro, but the Merz left leaning government appears to be on a tax and spend trajectory and while corporate tax cuts and accelerated depreciation allowances are favourable and welcome, the regulatory headwinds imposed by Brussels are not. If you think President Trump has opposition to change then Chancellor Merz has that in spades.

https://www.dw.com/en/germany-news-chancellor-merz-warns-on-business-climate-in-2026/live-75403582

The USA "Big Beautiful Bill" is not so different in its intent, but regulations are loosening in the USA not tightening.

Bonds remain relevant for income and portfolio stability, but risk and return expectations need to be firmly grounded.

Illiquid assets remain heavily advertised as a panacea but unless exits (trade deals and IPOs) widen in 2026, we'll see more rollovers and dubious valuations therein.

Chart 1: Global Aggregate Bond Index Struggling to Generate Return rebased to -1Y =100

Source: Bloomberg

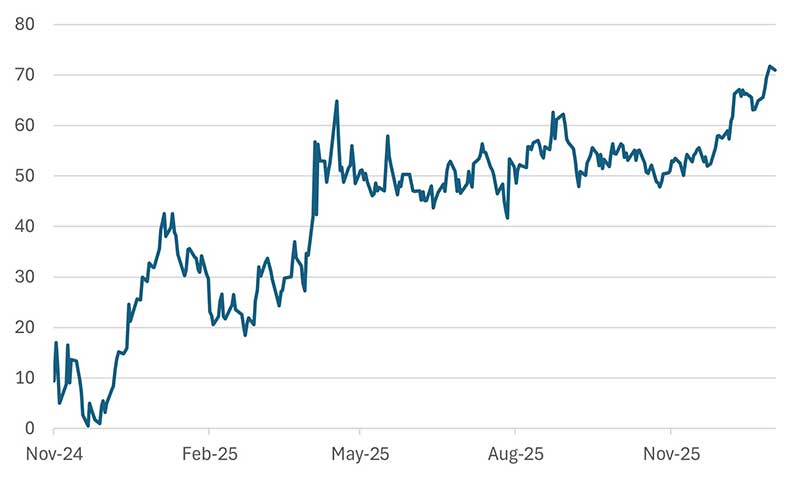

One of the most significant risks to markets sits not in growth data but in how institutional credibility is perceived. The impending change in leadership at the Federal Reserve carries the risk of a perception, fair or otherwise, that the policy independence of such institutions is being diluted. With lingering inflation uncertainty, any sense that monetary policy is being pushed too far, too soon could lead to a sharp uptick in long-dated yields. In those circumstances, markets would respond not by cheering easier policy, but by demanding a higher risk premium. A move in the US 10-year yield towards 4.5% would challenge equity markets, particularly the US, where valuations remain elevated and tolerance for higher discount rates is limited. Earnings may hold up, yet multiples need not. Equity investors should pay more attention to the credit markets where prices and refinancing difficulties often useful early warning signals.

Chart 2: Basis points steepness of the US Yield Curve 10-year less 2-year

Source: Bloomberg

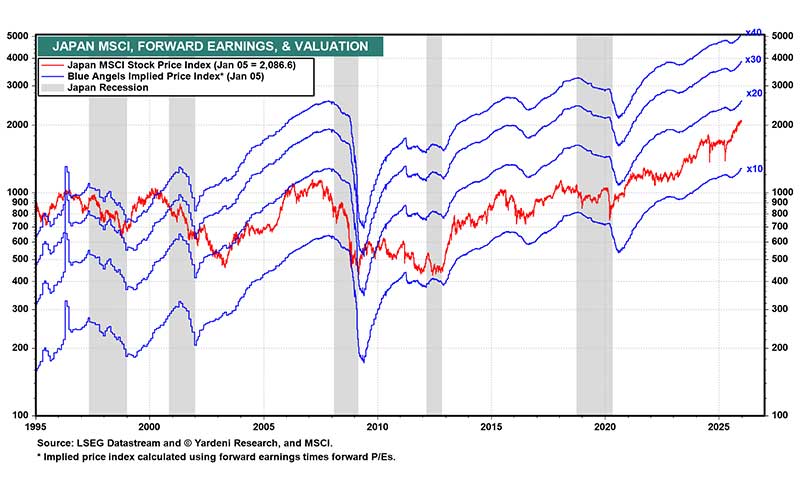

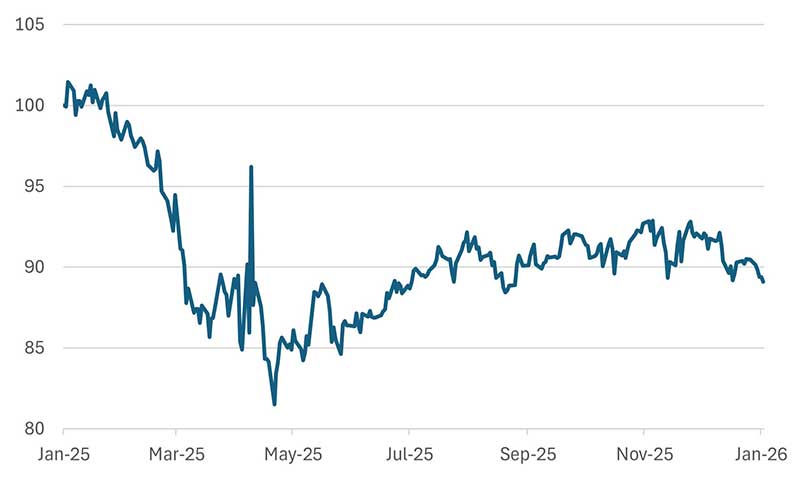

Alongside this, we continue to see a gradual and rational flow of capital from West to East. Tactically, the US may retain the upper hand early in the year, but we intend to slightly further increase weightings in Eastern equity markets at the expense of the US. Japan, Korea, and China all enter 2026 on more reasonable valuations, with fiscal and monetary policy flexibility that is increasingly scarce in the US. Lower oil prices and a softer dollar bias support this shift, while Asia's growth dynamics, remain compelling when viewed through a longer-term lens. Capital rarely moves because it is invited; it moves because it is better treated. China's heavy investment in technology and green infrastructure continues to shape its future competitiveness, irrespective of short-term sentiment swings. As was gently pointed out to us recently, the Chinese company Xiaomi has built a capable smart phone, (3rd in market share behind Apple and Samsung) parlayed that technology into a globally competitive car, and has plans to further its autonomous driving and unmanned aerial vehicles capabilities. In May 2021 the US Department of Defense admitted the company was not connected to the PLA.

The fact that it has hired ex Google executives, uses Qualcomm Snapdragon technology, and sells products in the US via Amazon, would suggest our thesis of MAD 2 or Mutually Assured Dependency between China and the US has validity?

Apple's car project failed after 10 years and $10 billion of R&D. It's AI (Siri) appears to be struggling. In which would you rather invest?

The Xiaomi SU7 - Wikipedia

The main problem in China is the 4 2 1 demographic, and while immigration could be a quick fix, which young person would wish to emigrate to China under the current regime? A continued high level of capital investment in China is essential, and the 'surprise' could be the consumer.

The structural improvement in the Japanese economy, and some corporations' new-found friendliness to, and respect for shareholders makes this a multi-year overweight.

Chart 3: A modest P/E for participation

Chart 4: MSCI US beginning to lose out to MSCI EAFE - relative performance of US equities to World ex US.

Source: Bloomberg

Note: MSCI EAFE = MSCI Europe, Australia and Far East

Some Sector thoughts:

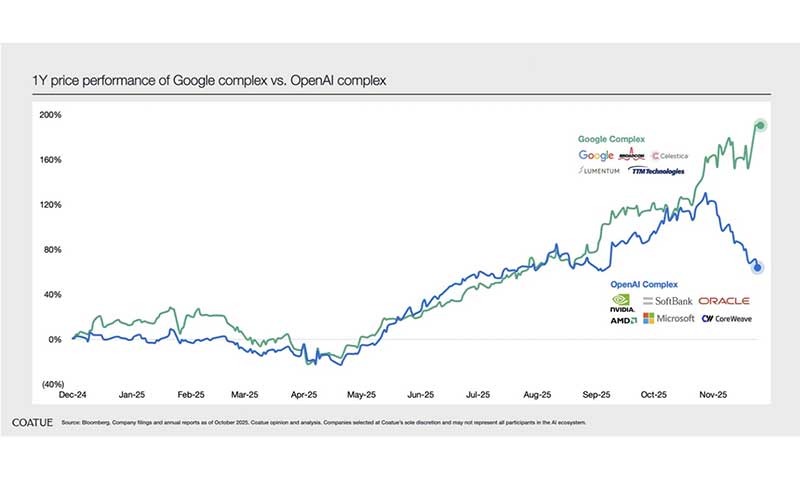

Technologyremains investable, but the risk does not lie primarily in listed market leaders. Valuations in the listed market for leading technology companies are still just about defensible relative to expected corporate profits growth rates. The vulnerability sits in liquidity across the wider ecosystem. The scale of capital deployed into private technology, AI ventures and tech related private credit means that it would take little to trigger a sharp reassessment. McKinsey estimates global data-centre capex needs could reach $6.7tn by 2030, with $5.2tn of that for AI-capable data centres. OpenAI sits at the epicentre of this ecosystem and must continue to raise capital as data-centre infrastructure scales. A failed or delayed funding round, for any reason, would have meaningful consequences for the sector. The Google AI complex is beginning to outshine that of the OpenAI. Will the US government remain absent from any calls for a bail out? (we hope so). Will Middle East wealth funds provide the necessary capital?

We favour Japanese and Korean technology. It's relevant with production capacity, is an important part of the global eco system and the valuations much more attractive.

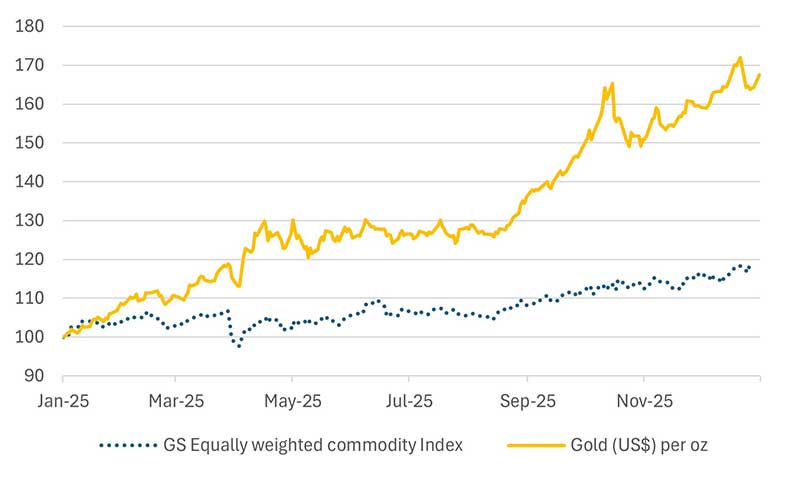

Commodities are reasserting their role in portfolios.

Precious metals continue to offer reassurance in a world marked by geopolitical strain and institutional uncertainty, and further upside in gold and silver remains plausible. Beyond that, strategic commodities such as copper are benefiting from competition for supply driven by electrification, data infrastructure, and energy transition policies. Without investment in the grid, there will be no consumption of the data from AI or no AI data produced. At current levels of grid investment, the AI snake will eat itself. Grid investment, secure, reliable, power supplies and energy reserves look to be a very safe investment theme. Did anyone mention Venezuela? We have run an infrastructure strategy successfully for many years to focus on this opportunity.

Chart 5: General Commodities lag Gold but for how much longer?

Gold and GSCI equally weighted Index rebased to 100

Source: Bloomberg

In an increasingly multipolar world where different blocs of buyers compete for access to crucial commodities spikes higher in commodity prices are likely to become the norm. A broad range of commodities increasingly look strategic rather than cyclical. In portfolio terms, this is less about inflation hedging and more about strategic optionality, and allocations are likely to rise meaningfully from past norms. We also believe there is a significant opportunity for active managers to access significant alpha to enhance returns. Four decades ago, commodities often accounted for around 15% of global portfolios. That allocation no longer looks implausible.

Risks to this view lie in the interaction of several adverse outcomes rather than any single shock. A renewed inflation surge, a loss of Fed credibility, earnings disappointment driven by margin pressure, a liquidity event in technology or private markets, or a geopolitical disruption to energy or commodity supply chains could combine to produce a more volatile and uneven market outcome. None of these risks alone would necessarily derail markets, but together they would challenge the expectation of a constructive start to 2026 and reinforce the need for portfolios built for uncertainty rather than precision as the year unfolds.

Delft Partners January 2026

DISCLAIMER

This report provides general information only and does not take into account the investment

objectives, financial circumstances or needs of any person. To the maximum extent permitted by law,

Delft Partners Pty Ltd, its directors and employees accept no liability for any loss or damage

incurred as a result of any action taken or not taken on the basis of the information contained in

the report or any omissions or errors within it. It is advisable that you obtain professional

independent financial, legal and taxation advice before making any financial investment decision.

Delft Partners Pty Ltd does not guarantee the repayment of capital, the payment of income, or the

performance of its investments. Delft Partners operates as owner of API Capital Advisory Pty Ltd

AFSL 329133.