Japan as a Safe Haven for Equity Investors

October 16, 2019

By Kevin N. Smith, Delft Partners

A recent trio of articles* published by Bloomberg have highlighted that the Japanese equity market is changing with:

- Improved governance of companies

- Investors reducing exposure to cash in favour of equities

- Recent “safe haven” status in the face of global volatility

We have maintained a positive view regarding Japanese equities for the past year and we express that view with an asset allocation in favour of Japan in excess of 50% in our Asian regional portfolio, whereas many of our competitors continue to avoid Japan altogether.

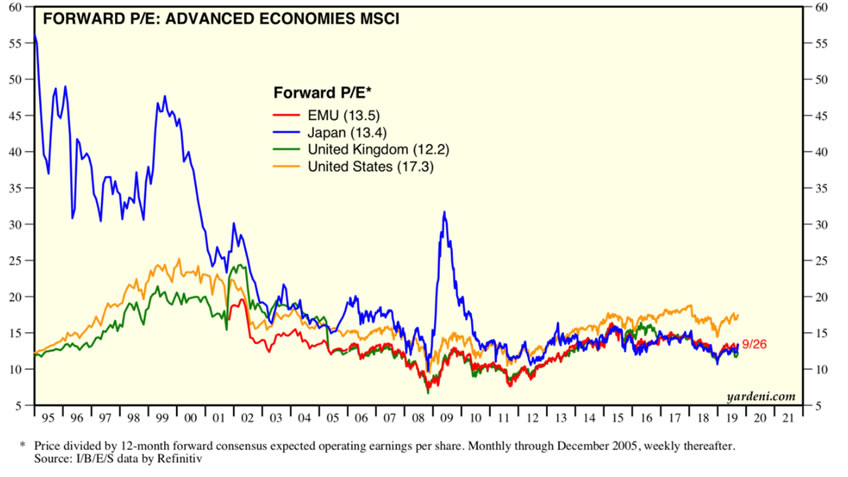

After three decades of valuations that were far too high, the valuation has returned to an attractive and sustainable level in Japan. According to Yardeni Research, Japan has a forward price earnings ratio of 13.4x which is a significant discount to the 17.3x valuation of the United States. The equity market in Japan has traded in a sensible valuation range of 10x to 15x throughout the past decade and the excessive valuations of 40x, 50x and 60x earnings are in the past.

The Bloomberg article by Ronald W. Chan “Typhoons, Trade War, Taxes…Yet Japan’s Still a Haven” points out that valuations are supportive for equities, Topix earnings are expected to grow 5% this year and the market trades at 1.1x book value while the S&P trades on 3.2x book value. The equity market in Japan has demonstrated resilience in 2019 despite clear signs of a slowing economy, the trade dispute with South Korea, the impact of two major typhoons and a sales tax increase from 8% to 10% on 1st October. While each of these negative events has played out, the yen has shown signs of strength and there is growing evidence that companies are becoming better managed. Japanese companies are making record profits as a share of GDP, margins are near all-time highs and corporate sales growth is outpacing the rate of nominal economic growth.

The other key factor that Chan highlights is the acceleration of share buy-back activity, running at the rate of JPY 9 trillion (equivalent to USD 83 billion) in the current year which is six times the rate recorded in 2013. Unlike many of their United States counterparts, Japanese companies typically maintain a balance sheet with net cash and make those share buy-backs from cash reserves not borrowed money. Chan concludes that “Japan can serve as an island of stability amid global turmoil” and we agree with that view.

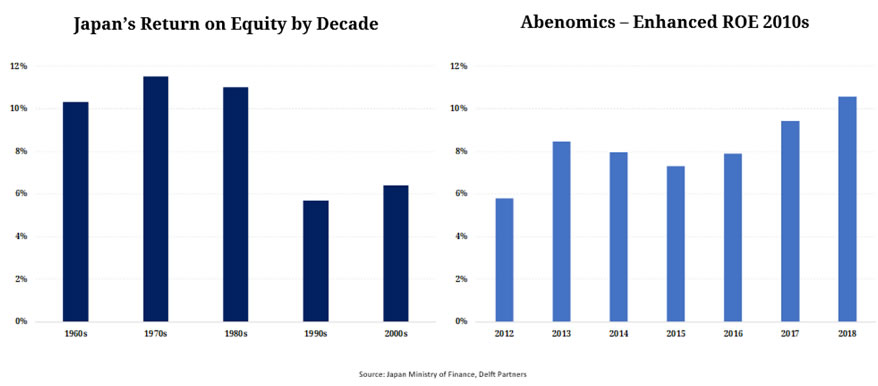

Japanese companies no longer hide behind a defence of cross-shareholdings. Clear evidence of better management can be seen with return on equity data which is back into double figures for the overall market for the first time in more than two decades.

The Bloomberg article by Shuli Ren “Cash is No Longer a King Trading Strategy” highlights that investing in Japan isn’t just about company buy backs and dividends, companies with strong revenue and profits growth are becoming a feature of the market.

The Bloomberg article by Shoko Oda “There’s a New Hedge Fund for Badly Governed Companies in Japan” highlights a planned long-short hedge fund that will look to buy the best 30 undervalued companies with good governance and short the 60 most expensive companies with poor governance. Japan introduced the Stewardship Code in 2014 and Governance Code in 2015, we have yet to see the full impact of those requirements priced into Japanese equities. While the media tends to focus on high profile scandals, the latest being executives of Kansai Electric Power admitting to receiving more than JPY 320 million in bribes, the underlying behaviour of management is improving under the requirements of the twin Codes.

Another key change in Japan is the rise of activist shareholders, buying significant stakes in companies and demanding changes in strategy, structure and management. A recent survey by Nikkei found that 139 new stock purchases in the first eight months of 2019 were made with the intent to encourage companies to change how they do business. Several of our portfolio positions have seen the entry of activist investors including Open House (Taiyo Pacific Partners), Kyushu Railway (Fur Tree Capital Management) and Kanamoto Company (Michael Burry of “The Big Short” fame); in each case the activist investor is adopting a collaborative approach with the company, an approach with a much greater chance of success in Japan than the traditional combative nature of activist investors in the United States and Europe.

International investors have been net sellers of Japanese equities in each year since 2015 and the volume of net sales has exceeded USD 50 billion equivalent in both 2017 and 2018. While the rate of net selling has slowed in the current year to USD 3 billion per month there is no immediate sign of a change in direction. Despite the near constant wave of international selling, the equity market in Japan has achieved an annual rate of return of 11.1% since 2013 only marginally behind the 12.1% annual return achieved by United States and well ahead of the European and Emerging Markets which recorded returns of 6.4% and 4.7% respectively over the period.

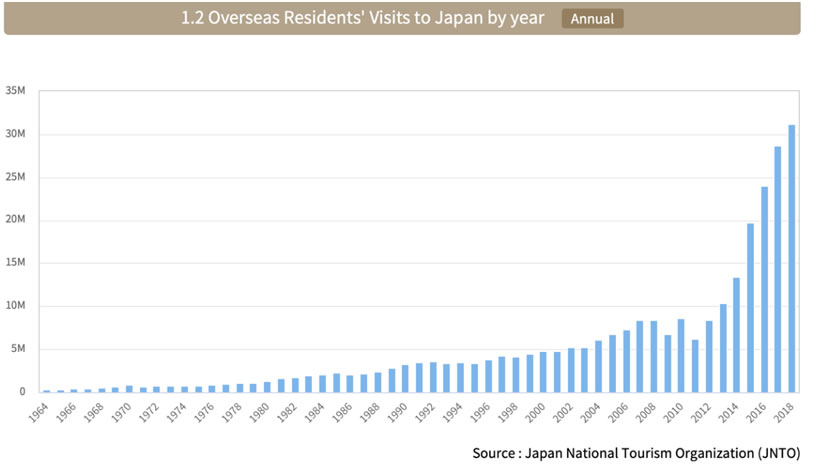

We believe that international investors will become net buyers of Japanese equities in the next two years when the transformation that has taken place in corporate governance under Prime Minister Abe becomes apparent to investors around the world. Japan has been transformed as a major tourist destination in the past decade, see chart, with more than 30 million tourist arrivals recorded in 2018.

Looking back, the 10 million tourist arrivals recorded for the first time in 2013 at the time was a major milestone. Tourists from China are now arriving in Japan at the rate of more than 1 million per month and that number is rising at a rate of more than 15% per annum. While tourist from China are a key driver to the total growth number, we can expect arrivals from the United States and Europe to be significantly boosted by the 2020 Summer Olympics in Tokyo which will be a great opportunity for international investors to be reminded of the merits of investing in Japan, a market that has changed dramatically since many of them previously invested in that market.

*Bloomberg Articles:

https://www.bloomberg.com/opinion/articles/2019-10-06/japanese-investors-sour-on-dividends-as-cash-loses-appeal

https://www.bloomberg.com/opinion/articles/2019-10-03/japan-stocks-retain-haven-lure-amid-trade-wars-taxes

https://www.bloomberg.com/news/articles/2019-10-03/there-s-a-new-hedge-fund-for-badly-governed-companies-in-japan