July 2024 Update

July, 2024

Is 'political risk' just the excuse needed to cut rates?

Global equity markets rose again. Whatever happened to 'sell in May and go away"?! Looking more closely it doesn't seem a healthy market; nor one based on an improving economic backdrop. The concentration of the US market is now far greater than it was in the dotcom era. 10 stocks continue to dominate. Their balance sheets are indisputably strong with many holding net cash. Thus, their managements' ability to buy back shares, increase dividends and fund capital expenditure is unquestioned. It's just that 'trees don't grow to the sky'; something can go wrong and sentiment regarding momentum can shift. They might make bad capital allocation decisions such as the one Apple made in its search for a car? Lina Khan at the FTC might be successful in reining in some of the oligopolistic practices? Most probably the sheer gap in performance and valuation will cause a reversal?

Momentum based strategies and the cap weighted indices are now very driven by the momentum factor, can have rapid reversals.

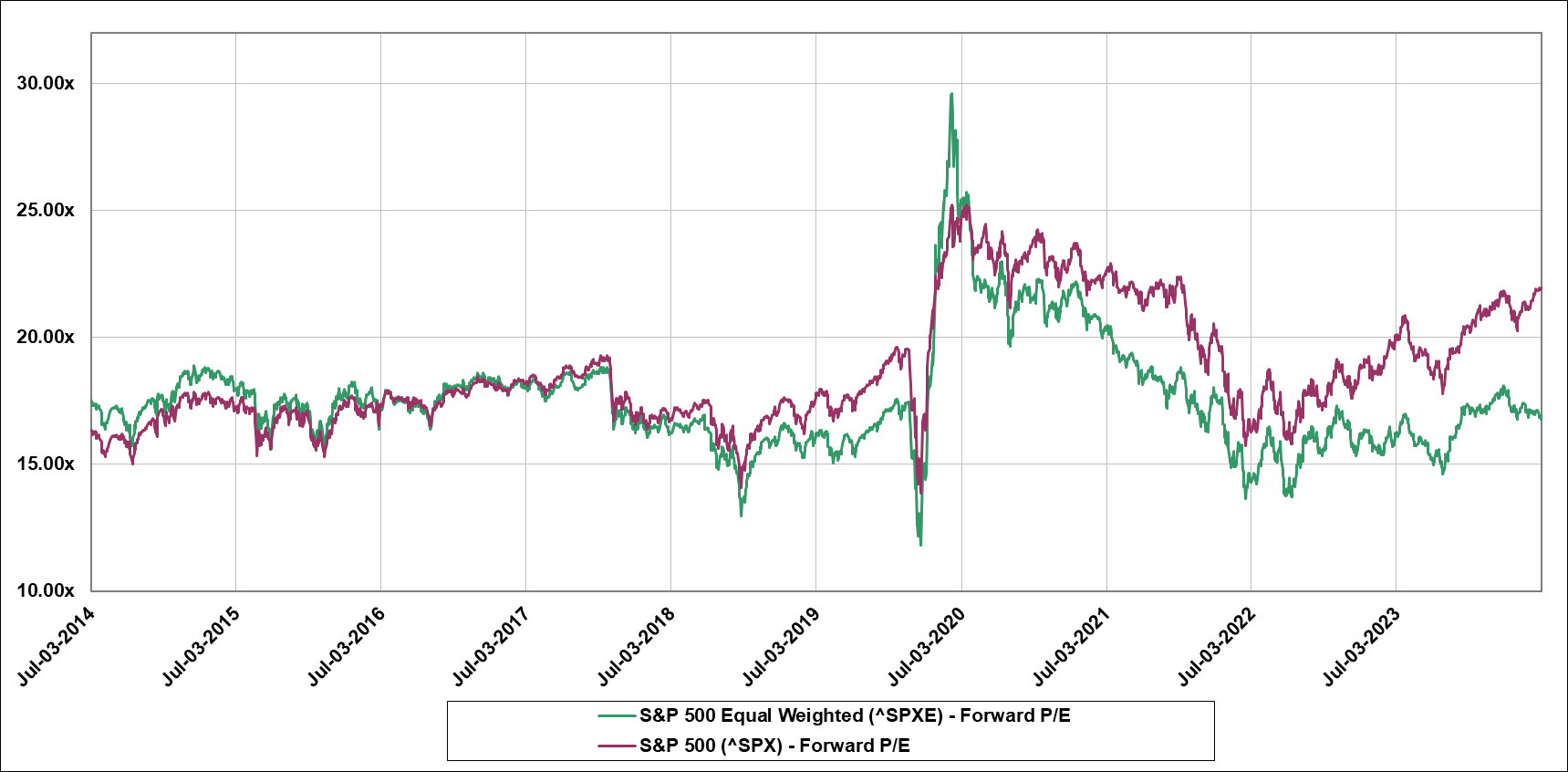

However, Growth style indices outperformed Value by over 4.5% in June alone; over 5% in the 2nd quarter. Thus the forward estimate of P/E between the equal and cap weighted S&P 500 over the last 10 years is at a record high. A lot is being discounted in these Growth stocks. See the chart below.

In the real economy 'Bidenomics' is increasing debt, debt service costs, and hasn't raised productivity (yet?). Job creation is strong according to some surveys but even these show the private sector struggling to create jobs. It is these jobs that would drive the economy sustainably forward. We wrote about the confusing and confused nature of economic statistics in May.

https://www.delftpartners.com/news/views/may-2024-market-commentary.html

Our guess is that central banks would love to cut rates and while inflation is too stubborn for them to do so on a rational basis, the comments from the ECB, the BoE and the Fed regarding political risk have made us wonder whether a change in political hue at the forthcoming elections will enable them to state that this "political risk" is sufficient for them to act, regardless of the inflation consequences?

Any lowering of interest rates will surely improve the outlook for these stock market laggards which now comprise about 490 stocks in the S&P 500. They're cheaper and many are just as likely to maintain profitably as the top 10.

A change in the US Presidency will also likely mean fewer regulations, incentives to the private sector to invest, and a return to optimism in the export energy sector. We believe we are well positioned for this with holdings in Valero, Exxon, Cheniere Energy among others. Our stance on the US power grid and the need for re-investment remains constructive.

Our strategies have performed pretty well so far this year. The GHC30, a Value portfolio of 30 stocks has outperformed its benchmark by over 3%; GLIN a global listed equity infrastructure strategy by over 4.5% and even the diversified global equity strategy managed to the cap weighted index, has matched that return despite a poor June.

We remain fully invested and prefer to take active risk in misunderstood companies such as Ebara, Kurita Water, AMADA, and Shin-Etsu Chemical in Japan.

During the quarter we made a few trades to refresh the portfolios and maintain active risk at a prudent level. Schlumberger was a new purchase. A global company listed on the NYSE, it engages in the provision of technology for the energy industry worldwide. The company operates through four divisions: Digital & Integration, Reservoir Performance, Well Construction, and Production Systems. The company provides field development and hydrocarbon production, carbon management, and integration of adjacent energy systems; reservoir interpretation and data processing services for exploration data; and well construction and production improvement services and products. In other words, it is the leader in finding, proving up, and managing the stuff in the ground and oceans, which when extracted, and/or linked to the grid, improves the quality of life and the environment. It trades on a forward P/E of about 14x earnings.

Delft Partners July 2024

DISCLAIMER

This report provides general information only and does not take into account the investment

objectives, financial circumstances or needs of any person. To the maximum extent permitted by law,

Delft Partners Pty Ltd, its directors and employees accept no liability for any loss or damage

incurred as a result of any action taken or not taken on the basis of the information contained in

the report or any omissions or errors within it. It is advisable that you obtain professional

independent financial, legal and taxation advice before making any financial investment decision.

Delft Partners Pty Ltd does not guarantee the repayment of capital, the payment of income, or the

performance of its investments. Delft Partners operates as owner of API Capital Advisory Pty Ltd

AFSL 329133.