Keep Calm and Carry On?

March 20, 2020

We are trying to remain calm ourselves, let alone reassure our investors. However, we think that years of experience will enable us to navigate this financial, economic, and social shock. We have been inundated with opinions on what to do and what happens next and so can imagine adding to them with a lengthy article is likely to end up in the ‘delete’ folder immediately. Consequently, as briefly as we can here is what we believe and are recommending.

We believe the short term is unknowable, despite a lot of articles claiming that X or Y will happen, BUT we do know that people recover from this virus; that QE is coming (again) to reduce unnecessary insolvencies, and that the economy will grow again at some point – so we do know there IS a long term; you should focus on this.

There has been no hiding place in risk assets – Value Growth Technology Utilities – all have been whacked about the same, as investors have again gone to the equity market ATM to raise cash and have not discriminated. We were defensively positioned; believed it would be a smaller correction to the benefit of what we owned; but we have been hit and it is scant consolation we have outperformed our benchmark by 4% month to date.

See the chart below which compares the S&P 500, NASDAQ and Global Utilities.

Source: Refinitiv

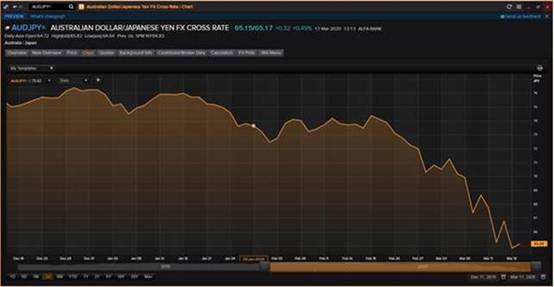

Cash and long duration govt bonds have been good places to be. As have the currencies of Net Creditor nations such as Japan; the Yen has appreciated considerably. Therefore please stay diversified across numerous assets at all times and please appreciate that Australian bank share prices are closely correlated with Australian house prices and employment levels (ie NOT very diversifying for most Australian investors) We also repeat that Japan’s debt is large but owed to themselves; meanwhile they own a lot of other country’s debt as assets. They are a Net Creditor Nation and have a strong currency. Australia owes money to the rest of the world, is a Net Debtor Nation and the A$ is consequently a weak currency in a crisis. You probably need more outside the A$ albeit not at this price after this collapse? See the chart below which shows the AUD$ vs Japanese Yen over the last month.

Source:Refinitiv

Hold that thought on long duration assets because that is what equities are too, albeit with no guaranteed redemption date or price.

So, if we have completely lost maybe 6 months of earnings but with interest rates very low, what is the present value impact on the value of a long duration asset such as equities, whose real value lies far in the future based on years of discounted earnings and dividends power? It’s minimal. Given that we are likely to see plentiful liquidity offered by central banks, there should be no shortage of cash to cover the shortage of cash flow. This market is all about sentiment on near term earnings forecasts and of course they will be coming down. While some companies may be permanently impaired, and not all of these will receive a bailout, most companies will survive. The stock market is currently dumping indiscriminately.

We know from experience that the equity market tends to inflict maximum pain on the maximum number of people. You’re in when you should be out and vice versa. Maximum pain this time would be a V shaped bounce which would be ‘inconvenient’ since we all want time to carefully consider the winners and losers post the impact of the virus. This may be time we don’t get, and we shouldn’t look to finesse our re-entry? It would be most painful to miss an opportunity to buy risk 30% lower than where we were, even if we don’t quite get the exact day to do so?

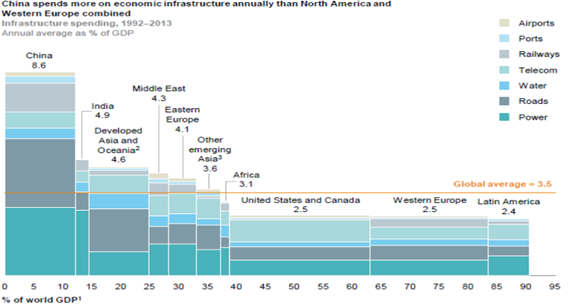

Therefore, we should consider whether it is possible to get a V shaped recovery in markets and/or the economy? Looking at the Hong Kong SARS experience in 2003 the answer is YES. There is a precedent for a rapid economic recovery from a virus which has clearly worked its way through a population and gone beyond peak infection rates. Certainly, it’s possible for the markets to ‘go V’ since they are a discounting mechanism and tend to move before the increase in economic activity is evident. We DO get that this is a global slowdown and thus unlike the SARS experience, there is no external source of demand. This is why a fiscal boost is needed – to provide the source of demand. See below for the possibilities for an upgrade on dilapidated roads bridges, hospitals, schools. (Shame we don’t have interest rate room for manoeuvre after 10 years of ZIRP)

Source: TS Lombard

At a time when everyone believes this market malaise will last for months, which it might, there is a distinct possibility it won’t. Consequently, our stance is to recommend that investors stay diversified across asset classes but INCREASE equity risk toward the following equity assets.

- USA banks where we have had no exposure but will review immediately following sharp falls and Fed support

- Infrastructure and fiscal expansion related stocks – see below which we have shown many times in presentations.

Source: HIS Global Insight; ITF;GWI; National Statistics; McKinsey Global Institute

If there is no consensus to update the failing Western infrastructure now, through large fiscal programmes, then there never will be.

- Technology which is true technology and not advertising $ related ‘technology’.

- Overweight exposure to Japan and Asia, and

- Utility stocks will provide stable income although we do not expect their share price recovery to be V shaped!

As ever any questions, please get in touch with any of us at Delft Partners.