Look to the future; return to the past

14th October 2020

By Delft Partners

This is a simple recommendation to now look at listed Global Infrastructure equities as a source of dividend yield, reliability and yes, even some capital growth.

There are over 300 globally listed infrastructure companies and that list is likely to grow if we are correct about the anticipated increase in investment in the capital stock of major economies.

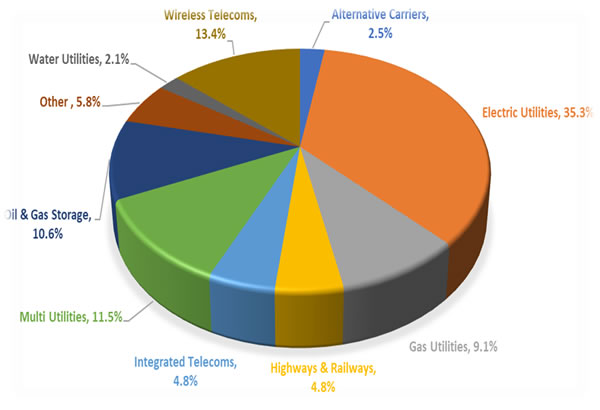

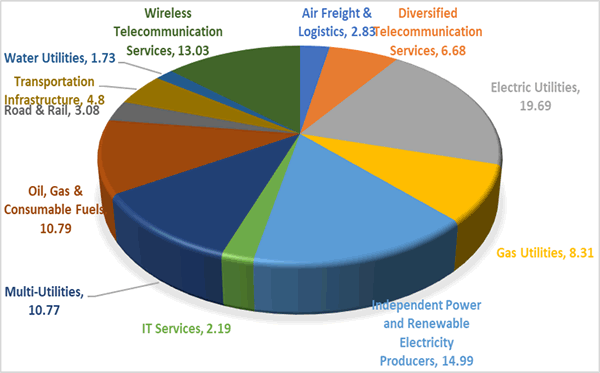

The current opportunity set is illustrated in the pie chart below.

There are some characteristics of this stock universe that should appeal to investors who wish for capital preservation and yield. Something which used to be available from government bonds, but these are no longer a risk-free return but a return free risk. Over 1/3rd of the available government bond market now yields nothing or negative in nominal terms, let alone in real or inflation adjusted terms.

Listed Infrastructure equities offer:

- Yield and likely inflation protection

- Liquidity and accessibility to your money – unlike unlisted infrastructure

- Higher predictability of revenues, cashflow and dividends than other equities

- Lower Beta risk – we calculate about 0.8 for the universe

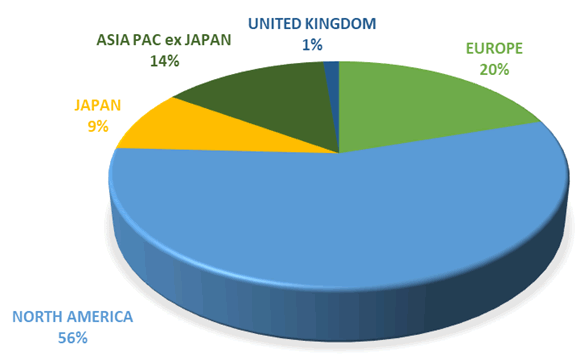

- Global diversification with diverse regions and sectors from which to choose

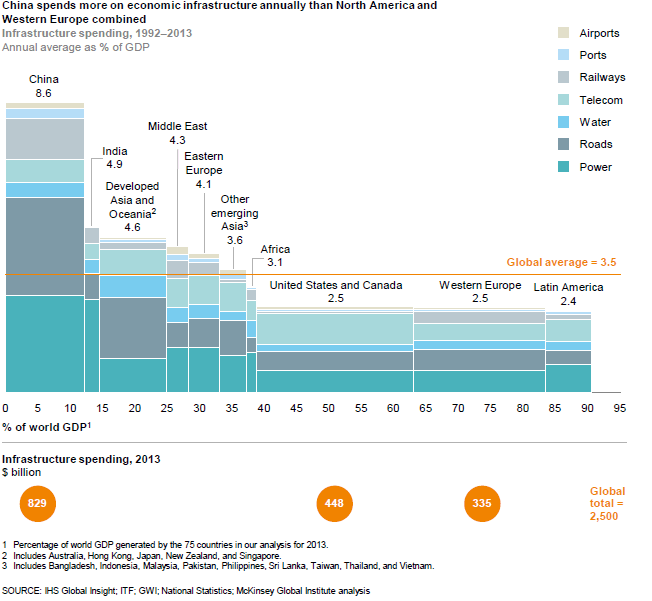

This increase would be a welcome return to investment levels required to maintain capital stock; and which used to be routine. It’s in the last 25 years or so in the West, that investment has failed to keep pace with urbanisation and population growth. It has been clearly flagged by policy makers that they would now like to play catch up.

In the Victorian and Edwardian eras, as much as 20% of the economy went on public works – bridges, railways, hospitals, schools, sewers, parks, and then roads.

Check out the below chart where it is clear that the West has fallen behind Asia.

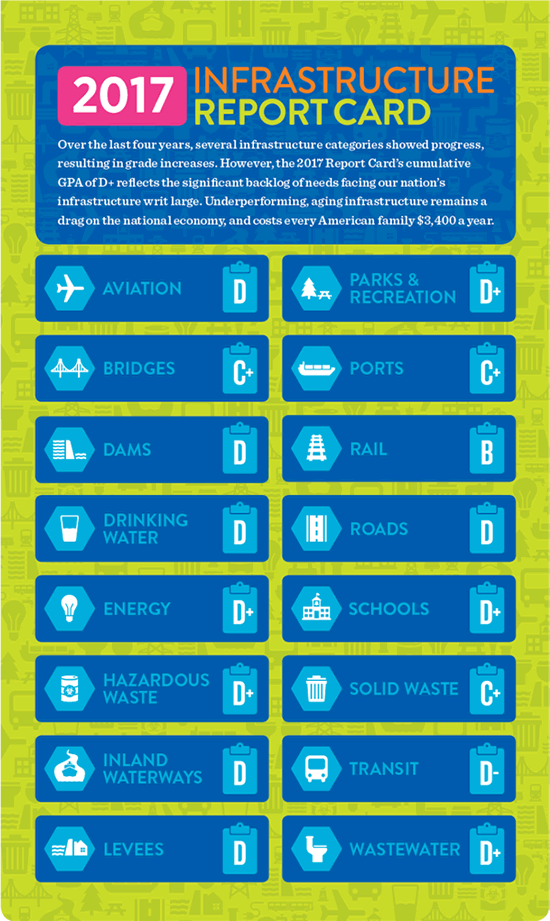

The paucity of investment has not surprisingly caused economic problems. The table below, compiled by the American Society of Civil Engineers, will tell you all you need to know about USA infrastructure. This report comes out every four years. We highly doubt the grades will be better next year.

Both Republicans and Democrats have committed to spend more on infrastructure, so this represents an investment with a good political hedge built in; unlike others such as healthcare stocks or even technology companies.

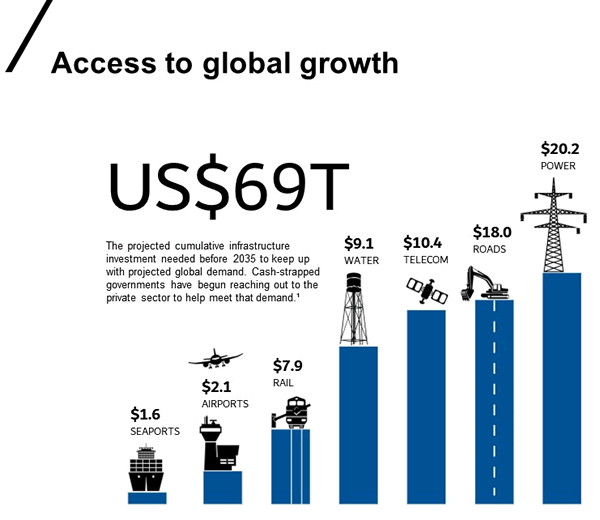

In terms of the increase in spending it is huge. Almost $70 trillion is calculated as being needed in the next 15 years to play catch up and to cope with increased populations and required connectivity. Some of this will come from the private sector and this is why the number of listed opportunities will increase. As active managers that is a good thing in that it provides opportunities for stock selection to work. For all investors it means they will have to consider how to get representation in this sector.

It could be relatively soon that there are over 400 global listed infrastructure companies – there aren’t as many liquid listed companies in the Australian stock exchanges.

The chart below divides this anticipated investment into the major categories.

Source: Russell

Source: Russell

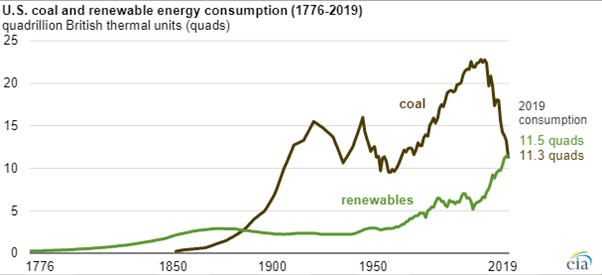

Additional attractions of investing in this area for some, will come in the form of cleaner types of infrastructure investment, and “renewable” as an investment theme.

Quietly the USA now produces more electricity from renewables than it does from coal. This is happening now under a Republican administration. Europe likewise is getting there. China’s solar installation is the highest in the World.

Source: US Energy Information Administration

Source: US Energy Information Administration

We have adopted the (corny?) theme of 3R’s for the global infrastructure opportunity–

- Renovation of existing capital stock;

- Reinvigoration of economies through productivity enhancing capital investment

- Renewables – cleaner, sustainable, opportunities for innovation

Our current portfolio is invested in many sectors

And many regions:-

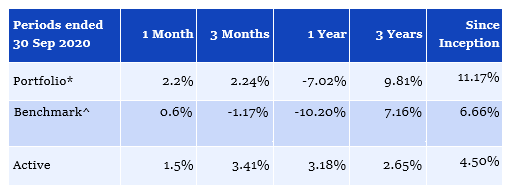

And performance has been good

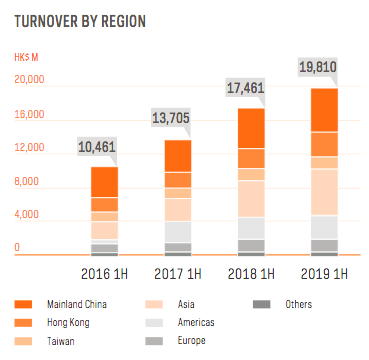

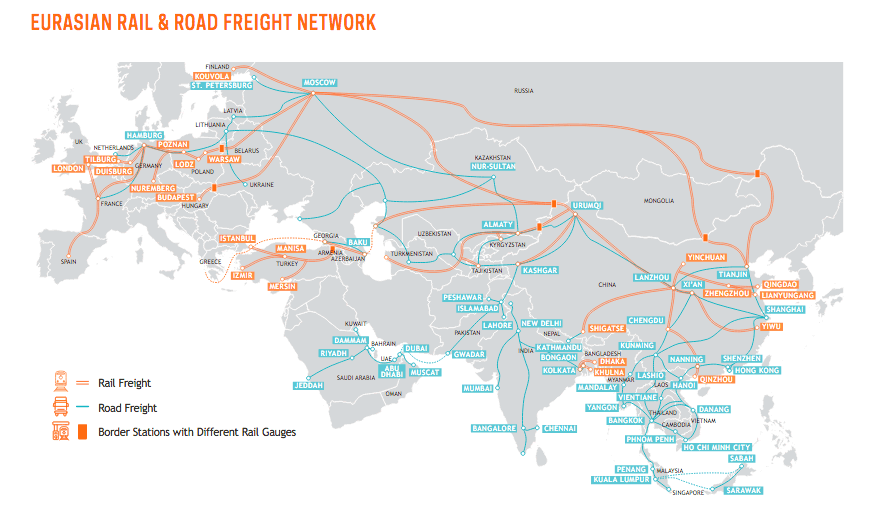

A stock we would highlight is Kerry Logistics – (636:HK). We own this in the Asia strategy and in the Global Infrastructure strategy. The more detailed note is available on request; the highlights are below. It’s been a good stock to own; there is more to go for because the logistics’ supply chains are going to change as we see the continued switch from global sourcing to politically directed sourcing. Companies may have to sacrifice optimal sourcing where optimal means ‘just in time’ and to switch to optimal sourcing where ‘optimal means ‘robust’ and able to cope with politically motivated instructions from governments?

Although has recently been strong

It has a broad network and a diversified revenue base.

And it was carefully assessed by our team from a fundamental perspective. The Accounting Strategic and Governance lens we use for the analysis of all companies in our portfolios gave us no concerns.

Accounting, Strategy and Governance Comments

Accounting

- KLN is audited by PwC covering a network of operations in 53 countries, there are no qualifications to the accounts.

- Full compliance with accounting rules is maintained in each jurisdiction in which KLN operates. The most recent interim results were compliant with Hong Kong Accounting Standard 34.

Conclusion

The era of ever lower interest rates has produced little sustainable growth. Global economies need fiscal investment to correct this. If Covid-19 has a bright side, it is the excuse to unleash public fiscal spending. This is happening. The better led economies will spend on productivity enhancing projects including broad infrastructure enhancements, and thus be better prepared for the next version of the global economy. These economies will pull ahead and attract more people who wish to participate. Investors who catch this early will prosper too.

DISCLAIMER

This report provides general information only and does not take into account the investment objectives, financial circumstances or needs of any person. To the maximum extent permitted by law, Delft Partners Pty Ltd, its directors and employees accept no liability for any loss or damage incurred as a result of any action taken or not taken on the basis of the information contained in the report or any omissions or errors within it. It is advisable that you obtain professional independent financial, legal and taxation advice before making any financial investment decision. Delft Partners Pty Ltd does not guarantee the repayment of capital, the payment of income, or the performance of its investments. Delft Partners operates as owner of API Capital Advisory Pty Ltd AFSL 329133.