March 2024 Update

March, 2024

Keep on Truckin'?

February was another very strong month for risk assets, with many major world equity indices hitting fresh record highs. That included the S&P 500, which surpassed the 5,000 mark for the first time, as well as the Nikkei, which surpassed its previous record from 1989. In part, that was because of continued excitement around AI. The S&P 500 (+5.3%) and the STOXX 600 (Europe) (+2.0%) both rose but Asian indices saw the largest gains, with the Nikkei up +8.0%, and the Shanghai Comp (+8.1%) had its best monthly performance since November 2022. The narrowness of equity market returns in Europe and the USA should be a source of concern not celebration. The USA effect of the "Magnificent 7" or "Significant 6" is well known but perhaps the fact that 10 European stocks account for 20+% of the Stoxx 600 not so much?

The Global Infrastructure Strategy outperformed by over 2% in February alone, and the global equity strategies beat or matched benchmarks meaning decent outperformance in the last 3 months of this frenzy. We typically don't outperform in high momentum markets so this is both unusual and pleasing.

With inflation still above target and surprising on the upside in the US, investors pushed out the timing of future rate cuts, and sovereign bonds lost further ground. Sovereign bond yields rose further, and US Treasuries (-1.4%) posted their worst monthly performance since September. Similarly in the Euro Area, investors reduced the expected cuts by December from 160bps to 91bps, and Euro sovereign bonds fell -1.2%. In Japan, expectations grew that the BoJ might end the negative interest rate policy as early as April and yields on 2yr JGBs were up +9.7bps to 0.17%, marking their highest level since 2011. In addition, US regional banks continued to struggle, as investor concerns persisted about commercial real estate. Current transaction prices in CRE indicate 'marks' should be at least 30% lower in Commercial segments. US regional banks lost further ground, with the KBW Regional Banking Index down another -2.8%, bringing its YTD decline to -9.5%. New York Community Bancorp led those declines, with a -25.2% return in February, taking its YTD decline to -52.7%. [Stop Press: NYCB received a $1bn capital injection. This is a private sector solution and one which is to be preferred to a public bail out. Prior equity holders will most likely get 'hosed' which is the play book]

We remain underweight banks and our financial exposure comes from insurance companies and listed fund managers such as AMG and T Rowe Price. We anticipate M&A activity to underpin already cheap valuations for fund managers. If markets keep rising, then revenues will pleasantly surprise as costs are cut. If markets have a hiccup then M&A to cut costs will ensue.

Our base case scenario is that inflation remains above target but rhetoric from central banks remains "committed to seeing it fall back on average". This is because further rate rises to quell inflation are politically impossible given that debt servicing outlays are rising above spending on critical areas such as US Defense. The likelihood of a Trump presidency will also mean further fiscal pressure on Europe as NATO members there are "persuaded" to bring defence spending up to agreed levels. None of this looks good for sovereign bonds. US fiscal spending is as if they are at war and thus our worst case is capital controls to force the purchase of debt as you see in time of war.

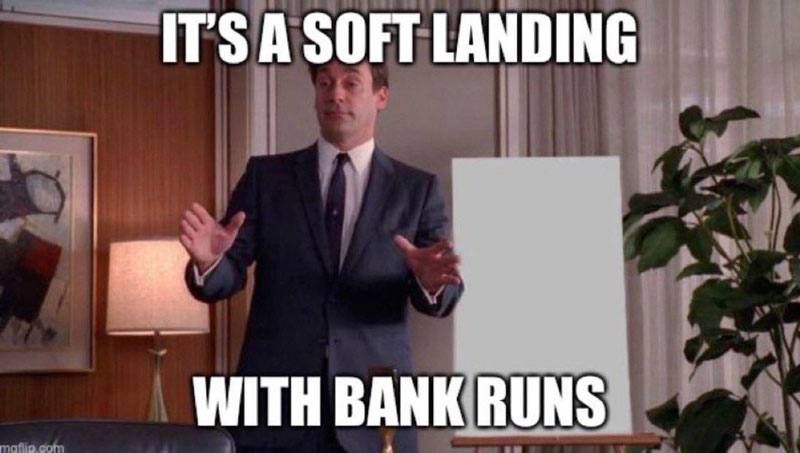

For the moment however it's a party and we're all trying to pretend that we're not Chuck Prince. This image best describes the mood?

Global data is still robust and hopes for a soft landing continued. Even poor data doesn't prevent a rally and the China and HK markets rose strongly even as the Chinese growth model crumbles. We added to HK/China by investing in Swire Pacific.

AI remains the only game in town (although it isn't - see below), and while we wonder what happened to the euphoria surrounding block chain, the Magnificent 7 were up +12.1% in total return terms, which was their best monthly performance since May 2023, and Nvidia surged by a further +28.6%, which followed their strong earnings release towards the end of the month.

Holdings in Ebara, Emcor and AMAT rose c.39%, 36% and 26% respectively and the Infrastructure strategy outperformed (actually to an alarming degree and so we'll be reducing active risk shortly) helped by holdings in industrial infrastructure stocks such as Sterling Infrastructure (+c. 45%) and nuclear power utility Constellation Energy (+c.45%).

Like we said it doesn't have to be all about Nvidia.

Next time unless anything untoward happens we'll posit the best way to hedge the US election and any change in policies.

Delft Partners March 2024

DISCLAIMER

This report provides general information only and does not take into account the investment

objectives, financial circumstances or needs of any person. To the maximum extent permitted by law,

Delft Partners Pty Ltd, its directors and employees accept no liability for any loss or damage

incurred as a result of any action taken or not taken on the basis of the information contained in

the report or any omissions or errors within it. It is advisable that you obtain professional

independent financial, legal and taxation advice before making any financial investment decision.

Delft Partners Pty Ltd does not guarantee the repayment of capital, the payment of income, or the

performance of its investments. Delft Partners operates as owner of API Capital Advisory Pty Ltd

AFSL 329133.