March 2025 Update

March, 2025

The World Turned Upside Down?

(a popular refrain originating in the 17th Century and used henceforth by those disliking change)

The new US administration's mantra of "move fast and break things" appears to be working. Add in the German election result which portrays the country as it was before unification, and 'it's a whole new ball game." Where on earth are we going?!

Knowing where to start analysing the investment opportunities and risk is virtually (in the true sense of the word) impossible. A good plan is to diversify. If you didn't realise the market is beginning to be worried about momentum as an extended risk factor, then the fact that AT&T has outperformed NVIDIA over the 12 months to end February is a wake-up call. Be diversified.

It's also becoming clear that the US Administration doesn't care about pleasing the 'legacy media' or the 'intellectual geopolitical heavyweights' meeting in Davos, nor paying respects to what was done previously. Regardless of what you think and any 'anchoring problems' you may have as the last 20 years is swept away, as an investor you have to adapt. The market can remain irrational longer than you can remain solvent so to speak.

Our concerns and ponderings revolve around the following:-

The Kalecki profit equation.

With DOGE aiming to take 2$ trillion out of US government spending of $6 trillion, the negative consequences of reduced demand, and thus profit, need to be compensated by changes in spending by other parts of the economy. One, some, or all of Private spending, Company spending (capital expenditure) or Foreign spending (current account balance) need to replace the loss of impetus from the reduction in the government contribution. It's clear to us that private sector capital investment needs to rise in the US and may well do so. This will also help improve productivity. Maybe a $1 trillion increase would therefore more than compensate for the loss of government spending?

Interestingly share buybacks are running at about $1 trillion p.a. currently….this makes us think that if MAGA is achievable then a support for the market in the form of buybacks is replaced by a support for the economy in the form of private sector investment. Increased capex intentions have been flagged by technology companies, so we hope they follow through. We doubt any significant cuts will be an easy transition albeit a much needed one.

Our conclusion - if cuts in government spending are made and not replaced by something else of equal benefit to growth, then a US economy already weakened by debt, will weaken further. Rates will be cut and profitability reduced. The US$ will fall. Even the transition to private spending from government spending will cause equity volatility to rise as the certainty of buybacks is replaced by the uncertain pay off to increased investment. The MEGA 7 may not be so well placed with MAGA? Another reason to diversify.

Geopolitics - the speech in Munich at the Security Conference, by Vice-President Vance, to a range of dignitaries, laid bare the rift in thinking and the new priorities of the US compared with European expectations of more of the same. No punches were pulled on election interference, trade, freedom of speech and democratic values, and defence. Tariffs, and the demands made of The Ukraine to make peace are not conventional tactics post WW2. The conclusion - The US is quite prepared to revisit and abandon the post WW2 structures for which they perceive they pay and Europe free loads. Europe has already stated they will find money (they don't have) to increase defence spending such they can stand toe to toe with the US and be independent. This is barely compatible with high levels of social security spending nor ESG principles which have seen listed military stocks shunned and inefficient power supplies hamper arms production. You can't make weapons without digging stuff up and having reliable power. ESG will morph into something else as necessity and expediency prevails. ESG stocks will come under further pressure to change or be further de-rated. BP have already done a U-Turn. If European governments (aka Germany) find the money, materials, commodity, and organic sourced energy stocks seem pretty well placed to be rehabilitated.

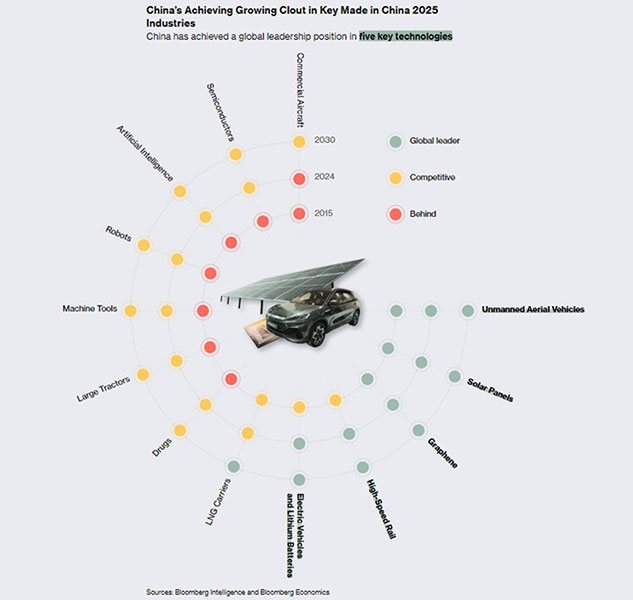

China next - toward a Mutually Agreed Dependency? Removing the 'distraction' of Russia, The Ukraine, and allegedly now Iran, will allow the US to focus on China. China is being isolated IF Russia and the USA cosy up. Strengthening ties with Japan further isolates China. On the other hand, China has quite capable industrial and technological skills and even advantages. See the chart below for an assessment of their capabilities and areas of global leadership.

Mutually Assured Destruction or MAD was the slogan used to describe the nuclear weapon stand-off between the USSR and the USA in the 1970s. MAD prevented the lunacy of war and allowed the West to outgrow the Communist Bloc and provide an enviable increase in the standard of living. (Pace the JD Vance comments about lost values in Europe). Mutually Agreed Dependency (MAD II) between China and the USA is this era's opportunity for stability. Remove the tension created by intellectual capital theft, assume that usual spying and defence procurement will continue, and there is much to gain from freer trade and investment. It's not going to happen quickly, and we assume (hope?) that the recently announced tariffs of 25% are a tool to promote negotiations. To a President who thinks of himself as a deal maker, every country problem is a deal to be done (and one to screw if possible). The best short-term opportunity? Japan, and perhaps Hong Kong. Virtually the first dignitary to meet Marco Rubio, the Secretary of State was Japan's Foreign Minister Takeshi Iwaya. The two agreed to take the U.S.-Japan alliance to "new heights" and touted the importance of trilateral ties with South Korea and the Philippines. "We agreed to continue to work together to take the Japan-U.S. alliance to new heights and to work closely together to realize a free and open Indo-Pacific," Iwaya said following the meeting. Iwaya, who a day earlier became the first top Japanese diplomat to attend a U.S. presidential inauguration, was visiting Washington for talks with officials in President Donald Trump's new administration as Tokyo looks to lay the groundwork for a leaders' summit with Prime Minister Shigeru Ishiba in the coming weeks.

Performance in February was poor as our positioning was negatively impacted by 'events'. The diversified Global Trust fell 1.4% in A$, underperforming the benchmark by 1%. The Global Infrastructure strategy was hampered by the block trading sell-off of energy stocks as the fears of reduced data centre spending spread. Even at reduced levels of data centre demand, the US grid needs re-investment and the forthcoming March 25th release of the quadrennial report on US infrastructure by the American Society of Civil Engineers, is unlikely to see a grade above C.

Delft Partners March 2025

DISCLAIMER

This report provides general information only and does not take into account the investment

objectives, financial circumstances or needs of any person. To the maximum extent permitted by law,

Delft Partners Pty Ltd, its directors and employees accept no liability for any loss or damage

incurred as a result of any action taken or not taken on the basis of the information contained in

the report or any omissions or errors within it. It is advisable that you obtain professional

independent financial, legal and taxation advice before making any financial investment decision.

Delft Partners Pty Ltd does not guarantee the repayment of capital, the payment of income, or the

performance of its investments. Delft Partners operates as owner of API Capital Advisory Pty Ltd

AFSL 329133.