Latest Multi Asset Views for 2024

Ten Pointers to 2024

As we step into a new year, its crucial to understand the evolving landscape of financial markets. We look back to draw lessons and try to gauge what can be set right. We dwell on the happenings of the year gone by and try to understand what can go right - and wrong - for the markets. Below, we present ten pointers on how the markets fared and where we think we are headed.

-

2024 - A year of modest growth and lower interest rates

Looked at purely from the point of view of simple macroeconomic outlook, asset prices in 2024 should experience some positive returns. While we do not see the Fed cutting interest rates early, the prospect of lower rates should keep the markets in a constructive frame of mind. Inflation is going to be both represented as good for investors, and under stated. Equity exposure is the best hedge against wealth erosion from inflation. -

2023 was exceptional, as much as 2022 was terrible; 2024 should be more 'normal'

Market commentators have made a good deal out of the 'great' returns that the markets experienced in 2023, but much of these were just a reversal of the misfortunes of 2022. The two years taken together do little in terms of offering an insight into trend returns from markets. Do not extrapolate 2023 for 2024 expectations. -

Emerging markets to outpace developed markets…again.

The words 'emerging markets' are evermore evidently a wrong descriptor of the high growth markets of the global economy. In 2024, the IMF forecasts emerging markets to grow 4.0% versus a not-so-impressive 1.4% expected for the developed markets. In the growth markets, interest rates should see a more rapid decline, and their currencies should perform well against the dollar. The balance sheet of many growth economies remains in relatively good shape when compared with those of the debt-fuelled Western economies. Perversely the best way to access emerging markets is via multi nationals which operate globally. Japanese companies for example do a lot of business in China and seem not to suffer from capricious rulings while benefitting from growing investment and spending. -

Why risk underweighting the tech sector?

While we fully understand investors' concerns about the (rich) valuations of many tech stocks, we wonder if it would be wise to underweight a sector that could see its fortunes turn as the rollout of AI capabilities across the industry gathers seismic pace. Industry estimates forecast a compounded growth rate of more than 70% in generative AI solutions between 2023 and 2027. Again, Japan remains our preferred way of 'playing' this innovative industry. -

Be strategic not tactical.

We continue to warn investors to not spend too much time guessing or worrying about what the Fed's next move. We advise relying on strategic thinking to shape asset allocation in portfolios. It has become a mugs game to second-guess what the Fed is up to next…which even the Fed doesn't seem to know! The quite extraordinary way asset prices rallied as the year closed only underlined the risk of betting on the Fed's last statement - they reserve the right to change their mind…often! -

Alternative assets still deserve their significant place in portfolios, if you have consistent cash flow into your investment pool.

After a year of good returns from equities and bonds, it is understandable and perhaps undeniable that investors will assess the merits of holding less liquid alternative investments, or those like hedge funds with less transparency around the source of their returns. However, even as we emphasise that liquid assets did well in 2023 after a very poor 2022, alternative investments provided much more consistent returns when we combine the two years together. Remember that price is NOT risk, and there is an opportunity cost to losing the option to re-balance but see 5.! If you have consistent positive inward cash flow to your investment pot, then there is a place for illiquids. -

Geopolitics remains a dangerously large risk.

We still have two significant theatres of war, which are not improving. Indeed, many still see the risk of a significant escalation for the worse. Come spring, Russia could make more significant territorial gains in Ukraine without better support from the West for the latter. Meanwhile, should Iran become more involved in the conflict in the Middle East, it risks setting off a chain of events that no one wants to contemplate. This conflict makes us believe inflation remains hard to squash since supply chains for shipped goods to and from Asia and chemicals from Ukraine are key to food and energy price stability.

Half of the world's population will go to polls in 2024, with the outcome of the US Presidential election having the most significant impact on the world economy and politics. For much of 2024, we will be sitting and pouring over court battles and opinion polls. The gap between the two likely presidential candidates is so stark. The consequences of a new Trump administration are frightening to many, given the perceived extremity of many of the proposed policies. -

China - too big to ignore.

China, as the second largest economy in the world, just can't be ignored even if 2023 was a real disappointment. Chinese asset markets remain a key element of some of the major indices. While some asset managers have increasingly pressed for ex-China mandates, many of the major global stocks depend for their growth on a vibrant Chinese economy, Chinese buyers, or Chinese suppliers. Chinese equities remain on our buy list because the 20-year low valuation over discounts much of the bad news, and things are improving with authorities incrementally providing support for the economy. The Chinese economy will likely grow 4-5% this year. Excluding the property sector, Asia credit did quite well last year. -

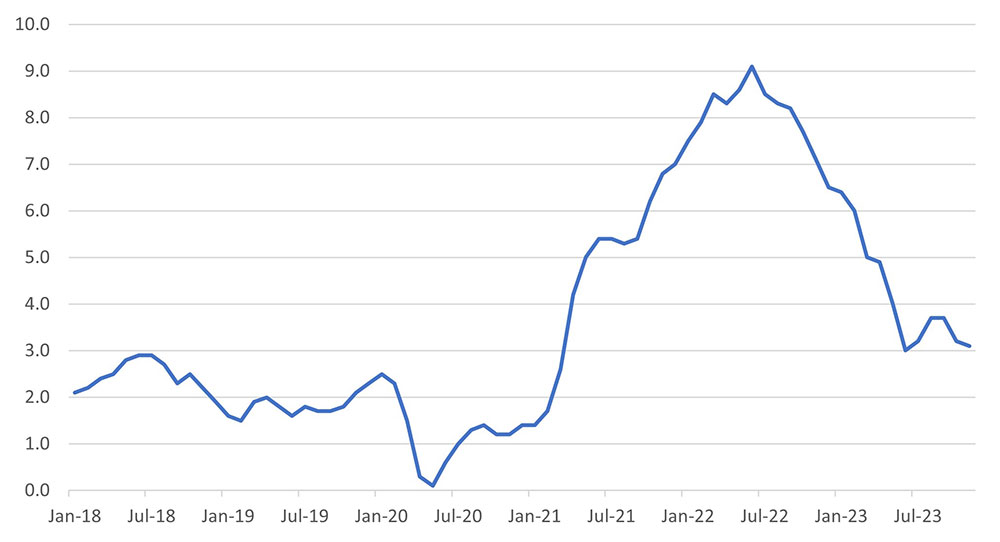

Inflation will remain key to market mood.

It is no slam dunk that global inflation will gradually ease to what many central banks have long contemplated, but typically it will be around the 2.5% level. Geopolitics could still spoil the game and push commodity prices higher. Wage growth is still relatively strong, with labour seeking to cover the loss of real incomes in recent years. Profligate government spending and an absence of productivity gains will underpin inflation expectations. Although inflation pressure has abated due to simple base effects, we suspect it remains a source of volatility for both rates and equities.

US Inflation down but not out

Source: Bloomberg -

Buy the value or the good stories.

At the end of last year, there was a sense that investors were seeking better value in markets. Indeed, it was significant that the Dow Jones 30 managed to keep pace with NASDAQ in terms of returns in the year's closing months. The Russell 2000 index of mid-sized and smaller companies rose sharply, (outperforming the S&P 500 by over 4% in December 2023, and more when the loss-making companies were excluded). Beaten-up sectors such as regional banks and REITs have started to perform better. There is apparent value in China, as we have already mentioned, and indeed across Asia including Japan which remains our favourite "fishing ground". We recommend avoiding loss making concept stocks because while many have gone under in 2023, there are still a large number of listed unprofitable companies - 40% of the Russell 2000 and even 15% of the S&P 500 are currently loss making.

DISCLAIMER

This report provides general information only and does not take into account the investment objectives, financial circumstances or needs of any person. To the maximum extent permitted by law, Delft Partners Pty Ltd, its directors and employees accept no liability for any loss or damage incurred as a result of any action taken or not taken on the basis of the information contained in the report or any omissions or errors within it. It is advisable that you obtain professional independent financial, legal and taxation advice before making any financial investment decision. Delft Partners Pty Ltd does not guarantee the repayment of capital, the payment of income, or the performance of its investments. Delft Partners operates as owner of API Capital Advisory Pty Ltd AFSL 329133.