November 2024 Update

November, 2024

Don't do something - just sit there

The equity strategies rose in a volatile October. We underperformed a little in the listed infrastructure and by too much for comfort in the global equity strategies. We have been underweight financials in the value strategy which hurt. Long term numbers remain very sound with outperformance at sensible levels of active risk.

We sold some long held big winners such as Advantest in Japan and Sprouts Farmers' Markets in the USA. We purchased Sumitomo Electric Industries, one of the few manufacturers of Core Grain Steel, which is an essential element in data centres, TSMC ADRs, and Tegna in the USA.

The UK and French budgets take both countries further toward the 1960s with higher taxes, and more government regulation and capital allocation. German companies have made noises about the difficulty of doing business there given high energy prices and regulation. If the Republicans win, we expect quite a lot of inward investment from European companies, if their governments allow it.

We feel we've done what we can in the portfolios to hedge for the increasing global political risk. Hence the title. Now we wait to see if we got it right.

Rather than pontificate on the US election results we thought we'd more closely examine the prospects for China and the HK stock market post the stimulus packages. Regardless of which side takes the White House and the House of Representatives and the Senate, it's pretty clear that China will have to find its own solutions to declining growth rates and bad debts.

First though, a couple of observations of the 'bleeding obvious' variety. 1. Diversification is more essential than ever to avoid increasingly large market swings between growth value, small, large, and various sector rotations. We can't see market volatility remaining at the low levels of recent years. 2. Currently consumer cyclicals (especially car companies and luxury goods companies) are being smashed. As are any companies that seemingly disappoint on results or guidance - ASML (not owned), US healthcare stocks, and at times the Mag 7 as in early August. This likely continues reverberating through the markets. Who knows which is next? 3. Getting the last bit of inflation out is not worth it - interest costs in USA and UK on government debt stock are already larger than defence spending. This means that inflation hedges will benefit and equities with good balance sheets which pay dividends are ideal. 4. A concentrated market such as we have now is not healthy. Favour non Mag 7!

Back to China - Australia is burdened by its apparent reliance on Chinese growth and policy. The below article written by our HK J/V partner at Tosca Funds and badly edited by Delft, sums up our thinking on the latest Chinese growth package. The markets are not being logical in their thinking regarding this package. Any stimulus is always likely to be a 'sighting shot', and need follow up. The fact that there was one at all is quite positive for China and thus Australia and certainly Australian investor sentiment.

Hong Kong is becoming investable and as a laggard will offer protection in the event of a dash to liquidity.

The sharp spike in the Chinese Stock Markets in late September caught a lot of people by surprise and triggered the usual round of self-serving advice focusing on the need to 'stimulate' the economy - followed by the (equally usual) round of disappointment. We said at the time that we saw this as a potential dip to be bought, not a rally to be chased, so with a near textbook rally, retracement and consolidation appearing, the ball in now in the Asset Allocators' court. In our view we think both that they should and that they will start to pay attention.

The key thing is that, up until now, the Chinese Government has paid little heed to the Chinese Capital Markets. We think that this is about to change. And THAT is the real story.

Is China now a dip to be bought? Is Australia about to see a change of perspective on Chinese growth?

This suggests to us that the views on China will remain 'uncertain' in the near term - with traders dominating and the supposed long term narrative shifting to support the short term technicals. Should the market form a more stable 'bottom', we suspect that the asset allocation might start to shift, perhaps in the New Year. But, more important we suspect will be the role of the Chinese authorities and the domestic markets as the 'New Buyer'.

It's not about me. Or you. Or the stock market (yet).

The Western commentators are all talking about how the stimulus is 'risking disappointment', but this is to once again believe that that the Chinese authorities care about us, or what we think. Or indeed, the Chinese Stock Market. As we noted in 'Not a Bazooka' this is not a western-style policy response because the Chinese do not have a western-style mindset. Nor, for that matter, a western-style problem. As such, they will pay no attention to the 'advice' from western economists and commentators. Far from bailing out those that supply too much - be they property developers or manufacturers of excess goods - they are taking, perhaps ironically, an Austrian approach to the economics, one of creative destruction.

As the old saying goes (and to steal from my friend Louis at Gavekal in his recent note) "the tragedy of Asia is that Japan is a profoundly socialist country on which capitalism was imposed, while China is a profoundly capitalist country on which socialism was imposed. But each will naturally drift back to its natural state."

As we look and listen to the policies being imposed on the west by the Globalist governments it begins to feel that it is now they who are finding themselves having Socialism imposed, just as China is reverting to its 'natural state'.

Capital Markets; the missing piece for China

Which brings us to the role of the stock market and capital markets in general. In the US these are central, while in China they are nowhere, indeed, they are the missing piece of the jigsaw. We believe that this latest round of so-called stimulus in China is actually all about building 'proper' capital markets, with the key point that they are as much about the 'saver' as the 'borrower'. Because of this, we think that we need to go beyond thinking about China as a trade and start thinking about it as a long term investment.

The Stock Market is central to US culture as the Billionaire Class that run the country would quite literally not exist without it. China, not so much.

The stock market is extremely important in the US, it is, quite literally, the foundation of the wealth of the richest people in the country - and thus by extension those that run it. Without it, they would be 'merely' rich industrialists and the centi-millionaire CEO class merely well compensated managers. It's the wonders of options and stock based compensation that have delivered us the 'top' end of the wealth distribution. (As well as Private Equity, but that is a whole different post).

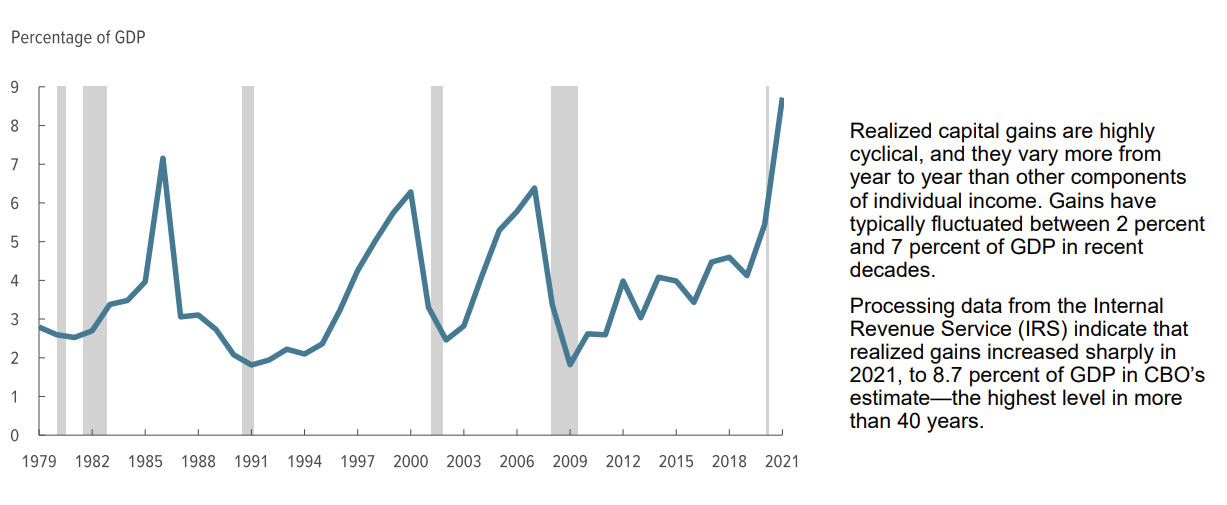

Meanwhile, the long term investments of much of middle class America are also heavily tied into the US stock market making for a powerful wealth effect, while financial services, including the financial media that talk about China, also view Wall Street as the centre of the world. And finally the US Stock market is important for the US Government finances as it benefits from the Capital Gains Tax received - which is an often overlooked reason why the Bond markets are correlating with equities - lower equities means lower taxes, which means more debt issuance.

Capital Gains Taxes an important source of US tax receipts

Source Congressional Budget office

None of this is (currently) true in China. The Chinese population currently have less than 5% of their wealth in the stock market and the people that run the country are self evidently not the billionaires. The Government is not dependent on capital gains taxes, nor is the market used much for raising investment capital. Currently most investment is funded from internal cash or bank lending. Perhaps most importantly for our argument, there is not yet a proper savings and investment system that can recycle domestic saving into domestic investment and it is this missing piece that we think the latest initiatives are actually focused upon.

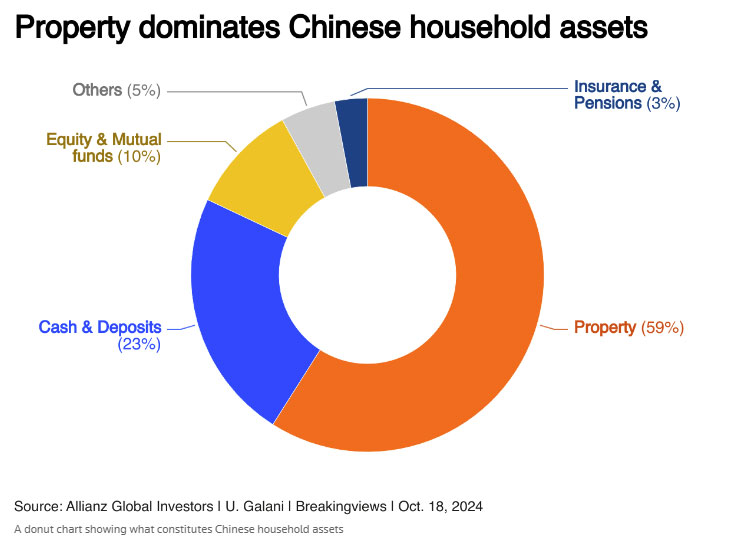

What is wrong with the Chart is not that the Chinese own too much property, but that they have too much cash and they do not (yet) participate in Capital Markets.

The chart, from Allianz via Reuters, highlights the current dominance of property in the Chinese household balance sheets and while this sort of chart is often used on hyperbolic YouTube channels to show how badly the economy will be affected by a 'property crash', in our view it actually misses the point, not once but twice. First, there has not been a property crash - there has been a bursting of a speculative bubble by property developers. Second, high levels of property assets is a function of houses that are lived in - China has close to 100% ownership of housing and as a 'store of value'. The real takeaway from the chart is the trillions of RMb held in cash.

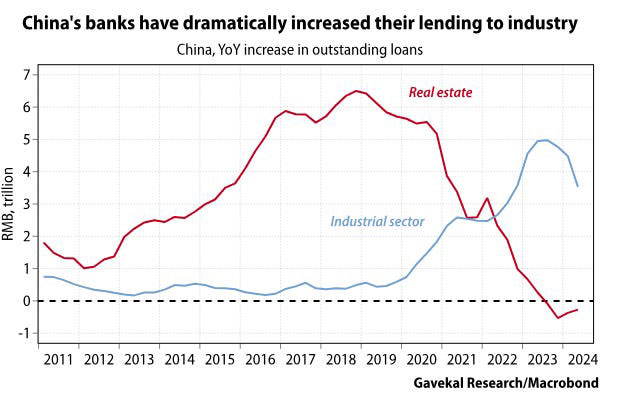

To take these points a bit further. As we have previously noted, the collapse of the Chinese property developers (not the property market itself) post 2021 was a deliberate policy in China that western 'investors' (speculators) didn't understand, since in their mental model, the investors are always bailed out. When Xi reminded us all of the concept of Common Prosperity and the fact that "Houses are for living in, not speculation", Chinese banks took note and as the Chart from Gavekal shows, there was a quite deliberate switch in Bank Lending. From Real Estate to the Industrial Sector.

It was around this time of course that US Covid stimulus cheques were being pumped into Robin Hood accounts and Wall Street Bets were pushing effectively bankrupt companies like Gamestop up fortyfold. Meanwhile, as the Magnificent 7 MegaCap tech stocks and crypto first swooned and then soared, bank lending in China poured into the industrial sector, ultimately delivering the new Chips from Huawei, the new EVs from BYD and Xiaomi and innovations across the board in AI, robotics and automation, intelligent manufacturing and low-altitude aviation. No need for IPOs (or NFTs), Chinese investment capital was sourced domestically from cash and the banks.

Chinese economic growth has been fuelled by cap-ex funded by cash, not equity.

Meanwhile, Chinese listed companies currently have around Rmb18trn ($2.5trn) in cash, while almost half the stock market are State Owned Enterprises. GS calculated that a 10% increase in dividends would deliver $32bn to the government - a more reliable source of revenue than trying to tax capital gains.

However the point is not just about raising capital, or even about allocating it efficiently - where arguably capital markets are more efficient than banks - but about providing the assets on the other side of the balance sheet to savers and investors. Filling in the missing piece of the economic structure.

As noted, because the people who run China are (quite clearly) not the billionaire donor class, they also think and behave differently and have no desire to 'stimulate the economy' to ensure excess supply clears at a higher price, essentially bailing out producers by encouraging consumers to go into debt. Indeed, it is the very opposite. The latest moves, in our view are really about providing sufficient liquidity for the property market to clear at lower prices - while at the same time effectively delivering more social housing.

Meanwhile, we believe that these latest moves are also about building a savings and investment system for long term social provision. China undoubtedly wants a set of 'capital markets with Chinese characteristics' which means that in the same way he said houses are for living in not speculation, stocks are for long term growth not speculation and thus likely to focus on cash flow, quality and income, rather like the old UK market in fact - before Gordon Brown and the Treasury got involved.

This latest 'stimulus' looks to us therefore to be the start of a long term story that is building. If as we believe the so called weak hands have moved to strong hands (see the note we wrote back this time last year ) then long term investors should definitely start to get involved ahead of what we suspect will be the asset allocators starting to move in the New Year.

Delft Partners November 2024

DISCLAIMER

This report provides general information only and does not take into account the investment

objectives, financial circumstances or needs of any person. To the maximum extent permitted by law,

Delft Partners Pty Ltd, its directors and employees accept no liability for any loss or damage

incurred as a result of any action taken or not taken on the basis of the information contained in

the report or any omissions or errors within it. It is advisable that you obtain professional

independent financial, legal and taxation advice before making any financial investment decision.

Delft Partners Pty Ltd does not guarantee the repayment of capital, the payment of income, or the

performance of its investments. Delft Partners operates as owner of API Capital Advisory Pty Ltd

AFSL 329133.