October 2023 Update

Bondfire of the Vanities?

October, 2023

World markets fell in September and in the 3rd quarter. The weak Australian $ helped mitigate the declines for unhedged portfolios. The US market cannot continue to see such a narrow spread of rising to falling stocks. 7 stocks account for pretty much all of the rise in the USA market year to date. Our main source of tracking error in the Global Diversified strategy remains underexposure to these 7 US stocks which comprise 1/3rd of the market capitalisation.

Problems for investors continued in that government bonds also declined in value and the correlation between these and equities remains positive. Thus a typical bond equity mix is less diversified than recent history suggests.

Our global diversified strategy outperformed by over 1% in the month as did our global listed infrastructure.

Rising yields on government bonds are the cause of this equity sell-off. Bear steepening is evident in most major bond markets as the realisation that rates have been too low for too long and that the supply side of the economy is deliberately impaired, have created inflation and inflationary expectations. These have to be killed and too late policy makers are trying to shut the stable door.

We expect inflation to continue to run hot everywhere although base effects will help temper increases from here, as will slowing growth in monetary aggregates. Money supply is faltering, and the first-round effects of the slowdown are being felt in consumer spending and levered asset price deflation, most notably Commercial Real Estate Values in the USA. Many of the transactions in this market are showing significant double digit % price declines over the last few years. This can only have an deleterious impact on banks' loan portfolios. Given that their bond portfolios will also be showing losses on a mark to market basis, we continue to think there will be a better entry point for banking shares and remain significantly underweight this sector.

Official interest rates may not go much higher, but our expectation is that they will stay higher for longer, a clear message from central bankers to which market participants have not been listening. They will have to. US 10 year note yields are approaching 5% a multi year high.

We anticipate (hope?) that the Bank of Japan becomes clearer about the end of Yield Curve Control. The Yen is very undervalued but in the short term interest rate differentials tend to dominate, and these are currently working against the Yen. We anticipate long term rates in Japan will start to rise as they have everywhere but China. China's economy is worrying many investors but signs of a shift are emerging. We may touch on this in next month's update.

If it's not woke, don't fix it?On the positive side there is clear step back from some of the most expensive and deleterious Net Zero policies. The poorly managed transition and mistaken attitudes to nuclear power, now mean that coal fired power stations are being re-started. Given that we believe air quality is the serious global issue, this is a ridiculous development and is a direct result of bad energy policy. Regardless, this shift is likely to lead to support for commodity prices, oil prices and oil stock P/E multiples, and stocks in the Materials sector. Despite China's economic problems, it is interesting to note the resilience of the commodity complex. We sold AES a "green energy" utility a while back in all strategies and are underweight Nextera Energy in the global infrastructure strategy currently. Both got whacked this last month. Our other holding TransAlta Renewables received a bid. Sometimes it's good to be both lucky and smart?

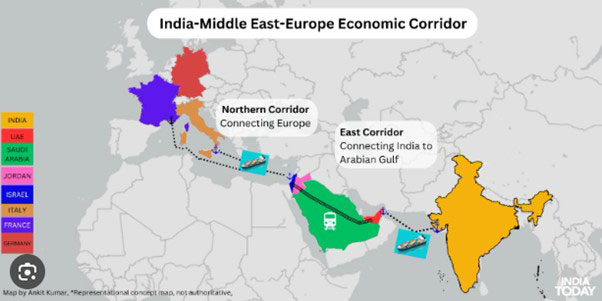

Another positive development somewhat under reported is the announcement of a Middle-East India economic corridor. This appears to be an attempt to rival the Chinese OBOR project, and of course, may fail, but has led to an interesting rapprochement in the Arab -Israeli world and of course provides an investment thematic to be promoted - this should help the ratings of materials companies, oil companies, engineering/industrial companies and of course infrastructure specialists. As we go to press the Hamas assault on Israel has of course changed the near term outlook.

We remain underweight banks, although did invest in UBS which rose 30% in the quarter, and overweight oils and industrials. The latter because there is much hidden technology within companies placed under this classification. We remain unhedged for Australian investors.

Delft Partners October 2023

DISCLAIMER

This report provides general information only and does not take into account the investment

objectives, financial circumstances or needs of any person. To the maximum extent permitted by law,

Delft Partners Pty Ltd, its directors and employees accept no liability for any loss or damage

incurred as a result of any action taken or not taken on the basis of the information contained in

the report or any omissions or errors within it. It is advisable that you obtain professional

independent financial, legal and taxation advice before making any financial investment decision.

Delft Partners Pty Ltd does not guarantee the repayment of capital, the payment of income, or the

performance of its investments. Delft Partners operates as owner of API Capital Advisory Pty Ltd

AFSL 329133.