October 2024 Update

October, 2024

Never mind the Quality; Feel the Breadth!

World markets rose again in the 3rd quarter. Interest rate cuts by The Fed and then China's PBOC late in the quarter, helped move basic materials stocks, infrastructure stocks and Chinese stocks rapidly higher. We got the interest rate cut wrong because we didn't expect one at all, but still benefitted from long exposure to these industries. In September there was a broadening out of the market and a vicious short squeeze in China and Hong Kong stocks. Anhui Conch Cement rose 35%, Alibaba 27% ENN Energy 18%. A broader market is a sign of strength and increases the likelihood that valuation, as a predictor of returns will matter more than the last couple of years where momentum as a factor has dominated.

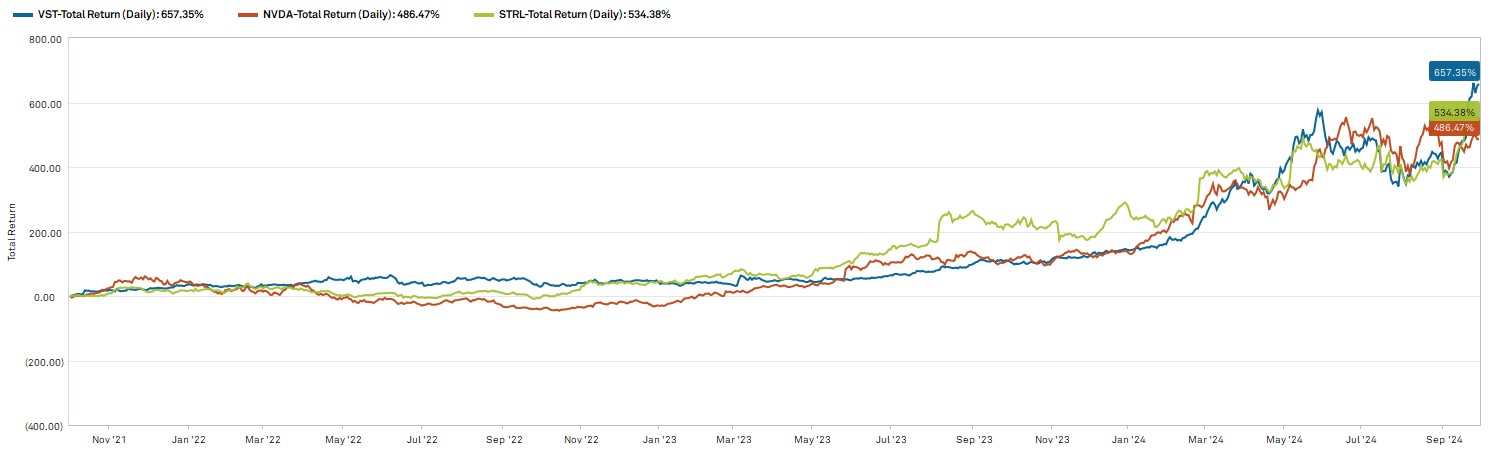

The Fed has probably been spooked by the downward revision of jobs data but is cutting in the face of statistics that point to continued economic strength and persistent inflation. Given this long-standing Continued Reflation of Asset Prices policy, sovereign bonds are essentially a return free risk and income strategies such as listed equity infrastructure provide a better source of inflation hedged income. The AI obsession appears over although shares of companies that provide the power to run AI equipment manufacture and computations, performed spectacularly. Utilities outperformed Tech. Microsoft and Constellation Energy agreed to restart 3 Mile Island, the nuclear power plant. We purchased Hitachi in q3 to add to our nuclear exposure. We have long argued Nuclear is THE solution. Our listed Infrastructure strategy captures this most effectively. Interesting to note that Vistra a Texas utility, and Sterling Infrastructure have now outperformed Nvidia over 3 years? Tortoises and Hares?

The Infrastructure theme has been (finally) catching other investors' attention. In the 3rd quarter, Vistra rose 38%, Constellation Energy 30%, (on the planned restart of 3 Mile Island to supply power to Microsoft) Capital Power 26%, and Xcel Energy 22% - all in US$.

The next American Society of Civil Engineers' quadrennial report on the state of USA infrastructure is out next year. Following Hurricane Helene, dams in North Carolina and Tennessee were close to failure. Hard to see how the 2025 report will give a better grade than the 2021 report which was a C-?

Given the attempt by China to kick start its economy with rate cuts and fiscal stimulus we anticipate more interest in the Materials sector, where we own CRH, BHP, Schlumberger, and Heidelberg Materials, and the Energy Sector. Nuclear Power will take a few years to be 'road ready' and instead of using coal, politicians should admit errors, rehabilitate oil, and gas exploration and production. We're positioned for this. Crude oil stocks are quite low, the Biden administration has released oil from the Strategic Petroleum Reserve to keep a lid on prices in the election year thus artificially dampening prices, and the Middle East is again erupting.

The Japanese Yen strengthened, and the Japanese market was very volatile. We believe fears regarding loss of competitiveness from currency appreciation misplaced. The Yen on a PPP basis is cheap. The decision on the new LDP leader spooked Japanese equities on the last day of the quarter which was quite annoying after a strong run and outperformance!

In Europe, the decline in living standards, in part caused by unnecessarily higher energy prices, is causing protest votes and demands for a return to pre-'green' policies. Western consumption and private sector capital investment is being hurt by stagnant incomes, regulation, and rising prices. A report into the loss of competitive positioning in the EU was delivered by Mari Draghi. Suffice it to say that the critical issue of the fiscal strain caused by the "green" energy shift was glossed over, as were the negative consequences of more state directed capital. From afar it looks like Europe is embracing a Chinese solution to its economy just as China has discovered it doesn't work.

We wrote last quarter, "elections in the EU look like returning a more traditional or right wing set of representatives"; this turned out to be accurate. The German economy is struggling from high government- imposed costs and companies are considering re-locating. The ECB will cut interest rates again, and this will benefit companies that meet needs not wants ie Infrastructure in Europe. Shares of companies in the European auto industry (VW, Stellantis, Aston Martin) have been in steady downward trajectory and offer classic value traps. Profit forecasts continue to be cut. We have no direct exposure to Car companies, but of course the industry is a significant provider of orders and work to many other sectors and weakness will have spill-over effects which we'll try to minimise. A good task for a sophisticated risk model. The German economy has contracted in 4 out of the last 7 quarters even as the population has grown in size. It's not a recipe for stability.

We made more trades than normal in the month in our strategies. We added to US Utilities, AEP, NRG, AECOM, and to healthcare stocks HCA and Tenet. We purchased Italgas in Italy. We added to EMCOR. We sold NYK in Japan, Atkore in the USA, and trimmed Vistra and MDU after strong outperformance and to reduce tracking error.

Hedge US election risk by investing in industries which both parties favour. Visit our website for frequent updates.

Delft Partners October 2024

DISCLAIMER

This report provides general information only and does not take into account the investment

objectives, financial circumstances or needs of any person. To the maximum extent permitted by law,

Delft Partners Pty Ltd, its directors and employees accept no liability for any loss or damage

incurred as a result of any action taken or not taken on the basis of the information contained in

the report or any omissions or errors within it. It is advisable that you obtain professional

independent financial, legal and taxation advice before making any financial investment decision.

Delft Partners Pty Ltd does not guarantee the repayment of capital, the payment of income, or the

performance of its investments. Delft Partners operates as owner of API Capital Advisory Pty Ltd

AFSL 329133.