October 2022 Update – A Litany of Warnings and Complaints!

Equities and bonds fell in value heavily in September. This is quite unusual. Typically, they don’t move together. All risk assets have had a tough year so far and diversification has been hard to find.

Interest rate increases are now seemingly coordinated in those countries beset with inflation. This inflation has been caused by excessive money supply growth in the affected countries. Japan China and Switzerland which did not panic and did not do endless QE have no serious inflation problems.

High levels of debt combined with tighter money mean demand destruction is almost guaranteed, as exemplified by the price of oil and copper falling from recent highs, and consumer spending getting whacked.

The US$ has been very strong illustrating the belated tightness of US monetary policy where both rate rises and QT have essentially created a global shortage of US$. This is unlikely to continue without a default by a country or corporate.

We believe the answer to the inflation problem lies not in destroying the labour market and further demand destruction, but in improving SUPPLY. In this regard the UK mini budget was a brave attempt to increase supply by reducing regulation, the benefits of not working, and to increase supply of energy. (Energy is a critical input to any economy. We remain flabbergasted by the failure to understand that electricity is not energy – Energy is the capacity to do work, and electricity is one of the results of that potential. Renewables currently supply some of the electricity which itself is a fraction of the energy needed to maintain living standards).

Markets are often wrong in the short term and the fall of Sterling is probably an opportunity once the dust settles – Doug McWilliams, an economic consultant to Delft, points out the flawed maths behind the ‘conventional wisdom’ in the UK Treasury which is strangely opposed to any change of direction in what is clearly a failing economic policy.

- https://reaction.life/the-treasury-has-got-its-mini-budget-sums-wrong/

- https://cebr.com/reports/public-borrowing-may-be-less-out-of-control-than-the-markets-think/

There are however no easy exits from the crimes to economies that have been committed in the last 20 years – for the culprit, “follow the money (supply)”? – but the end of ZIRP may provoke a return to ‘supply side economics’? – eventually? We would suggest it be called something else since the stigma may be strong? How about “PPE: Promoting Private Enterprise”?

However, it is now clear that the Biden administration is “not for turning” unless the electoral shock of a mid-term wipe-out causes a reappraisal?

The crucial question is whether policy makers now have the moral fibre to withstand the howls of pain from those affected by interest rate rises popping the bubble? Some late cycle Private Equity deals are quite possibly next in line after SPACs NFTs, and other lunacies have cratered? We repeat again that price volatility is NOT risk. Illiquidity is no defence against a failing business.

There is a meaningful opportunity cost to locking your money up.

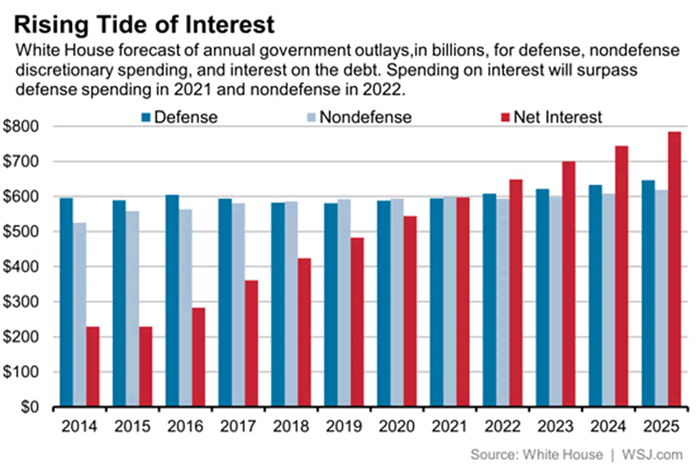

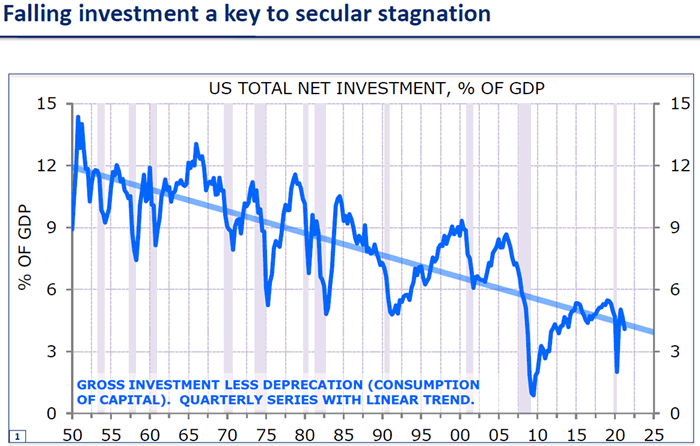

Due to delays in monetary tightening and the absence of any supply side measures to incentivise private sector capital investment which would grow the economy, we are getting concerned that stagflation is being created. Destroying demand and reducing supply will invariably do it! Consequently, the dangers of more intervention are rising. At current levels of interest rates, the US debt servicing costs will become larger than the Defense budget. This is very unlikely to be allowed to happen and thus interest rate suppression and the forced purchase of government debt at artificially low rates (certainly below inflation) beckons. Other measures would be massive tax hikes and/or price controls. We have been here before and the 1950s was it.

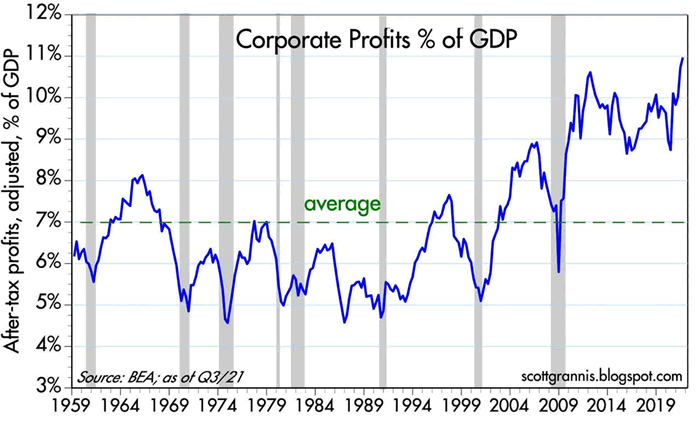

Robert Reich has been lobbying Congress regarding excessive corporate profits.

He is correct (see chart below) but the remedy is private sector investment which raises productivity and creates jobs. We wrote about this some time back. Currently the US corporate sector spends about $900bn on share buy backs – these are being disincentivised with a proposed 1% tax in the Inflation Reduction Act, but a better way to get PPE going would be to incentivise capital investment with a tax credit or accelerated depreciation allowances.

Invest in companies that meet needs not wants, favour profits over concepts, BUT remember that holding too much cash is likely to lose you money in real terms. Invest in risk assets when it feels most uncomfortable to do so. October might be a good month?

Fedex, not owned, illustrated the impact of a rapidly slowing economy on earnings with a profit warning. They then illustrated the problems of inflationary expectations and lack of competition by raising prices an average of 6%! General Mills, the food company, raised profit forecasts, as did Cheniere, also owned, the LNG producer, carrier, and storage company. Staples and energy companies, which we believe will be ‘rehabilitated’ by the stock market have been sound investments. If we are correct about capital investment, then Basic Materials and Infrastructure companies too will begin to outperform.

Delft Partners October 2022

DISCLAIMER

This report provides general information only and does not take into account the investment objectives, financial circumstances or needs of any person. To the maximum extent permitted by law, Delft Partners Pty Ltd, its directors and employees accept no liability for any loss or damage incurred as a result of any action taken or not taken on the basis of the information contained in the report or any omissions or errors within it. It is advisable that you obtain professional independent financial, legal and taxation advice before making any financial investment decision. Delft Partners Pty Ltd does not guarantee the repayment of capital, the payment of income, or the performance of its investments. Delft Partners operates as owner of API Capital Advisory Pty Ltd AFSL 329133.