On Hearing The Senate Has Gone Democrat

8th January 2021

By Delft Partners

Following the Georgia Senate elections it looks like the Democrats will have a majority in both Houses. This has positive implications for a coordinated economic policy. We have argued (along with others) that continued and increasing central bank intervention to manipulate interest rates and prevent the necessary and inevitable write-offs of bad capital allocations, are not really capitalism. What we have endured is 'monetary policy for rich people' - for well over 20 years actually. The idea that keeping asset prices inflated will kick start a productive growth surge is bizarre. Additionally worrying is that each clear failure of this policy is met with more of the same policy. What did someone say about the definition of madness?

Frustration with the resultant wealth inequality and poor prospects for advancement (aka 'populism' to the sneering 'liberal' media) manifested itself in a vote for an outsider who was not up to the job and we now have an insider who may be. The whole policy manifesto has however been changed by the outgoing President and 'Build Back Better' doesn't seem too different in spirit from 'Make America Great Again". Certainly the Democrats have grasped the need to embrace the "lower and middle classes" and have dropped the disastrous 'deplorables' moniker. We believe a 'National Industrial Policy' continues in the USA as does the attempt to isolate the Chinese military from capital markets. We think you'll get a more civilised dialogue but no change in recent policy goals.

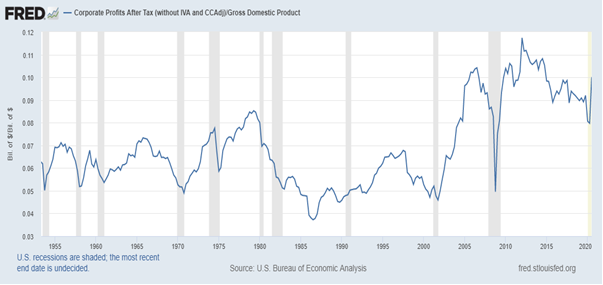

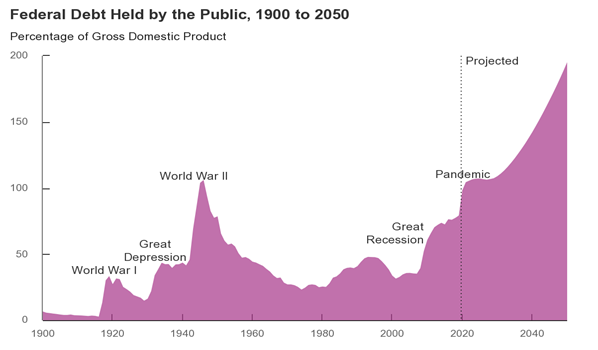

What has been lacking is fiscal policy to repair the dilapidated state of infrastructure; improve productivity and generate jobs other than those in the 'gig economy'. We may now get this - hopefully in Europe too. The markets seem to think so. The 10 year note has broken 1% on the way down, and the equity market has seen a shift to domestic, smaller cyclical companies as expected beneficiaries of targeted spending. The three charts below will show you that a) corporate profits relative to wages have peaked in the USA and b) that increased fiscal spending from here will make the WW2 debt levels seem a walk in the park, and that c) the shape of the yield curve is changing.

The yield curve will steepen further and test the Fed's appetite to deal with a taper tantrum. We don't think breaking 1% is a big deal. The SHAPE matters more; at 1.5% we will be back to 2017 when we had a serious "taper tantrum". Watch out if / as we approach this level. The equity market will continue to rotate into Value and Smaller companies.

Our portfolio positioning and some words on portfolio construction

- We look to have survived this Senate shift and an expectation of higher yields and fiscal spending quite well. Our portfolios were resilient even strong overnight. Our investment process disciplines, portfolio construction techniques, and risk controls have worked.

- We always argue that diversification and position sizing matter - this is once again evident

- We see again that price momentum is beneficial but if the only factor emphasised in stock selection, is dangerous. Your portfolio manager should be diversified in stocks, sectors, regions and factors.

- For example. we have been underweight in banks with fears over inadequate bad loss provisioning and the impact of a flat yield curve on profit margins but we never had zero weight in financials, which are a key constituent in our client assigned benchmarks. We instead invested in HK Exchanges, Orix and Nomura in Japan, MFC in Canada and Legal and General in the UK. These are all now performing strongly. We never took a large systematic 'bet' in our portfolio construction.

- Valuation matters and thus be prepared to walk away from manias. The recent appetite for SPACs is alarming.

- We think 'True technology' is fairly priced and attractive and the digital media companies whose revenues come from advertising $ are not these.

- Medical technology is undervalued

- Japan and Asia are undervalued.

- Infrastructure stocks are undervalued - they are an excellent alternative to negative yielding sovereign bonds. Green energy is coming in the USA in Europe and in China. These stocks have outperformed the typical mega cap favourites. We own some of these. So should you.

- The yield curve in the USA and ultimately elsewhere, will continue to steepen and the implications for equity styles and profits are immense.

- This steepening yield curve will test the Fed's resolve and at some point politicians and investors will be addressing the issue of "centrally mandated capital allocation" to fund these deficits.

- Essentially we are talking about capital controls being reintroduced. It could be the 1950s all over again?

- It seems to us that taking more risk in stock selection is now worthwhile. Time to shift.

DISCLAIMER

This report provides general information only and does not take into account the investment objectives, financial circumstances or needs of any person. To the maximum extent permitted by law, Delft Partners Pty Ltd, its directors and employees accept no liability for any loss or damage incurred as a result of any action taken or not taken on the basis of the information contained in the report or any omissions or errors within it. It is advisable that you obtain professional independent financial, legal and taxation advice before making any financial investment decision. Delft Partners Pty Ltd does not guarantee the repayment of capital, the payment of income, or the performance of its investments. Delft Partners operates as owner of API Capital Advisory Pty Ltd AFSL 329133.