On the Road - Again Part II Germany Calling

November 20, 2019

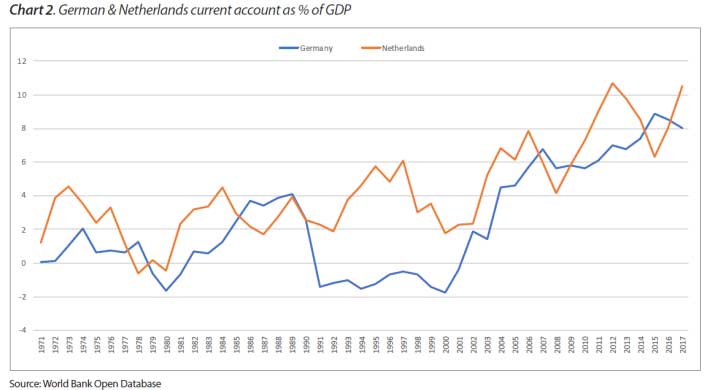

It seems that Germany is in an enviable position? Strong budgetary discipline; high levels of domestic private sector savings and consistently large and growing, current account surpluses have produced a Net Foreign Asset (NFA) position of 60% compared to 0% 15 years ago; and politically nothing happens in the EU or the ECB without a quiet consultation with Frankfurt or Berlin first.

Germany has run a current account surplus in each of the past 17 years since 2002 with the smallest being 1.4% of GDP. The consequence of these continued surpluses, that cumulatively add up to USD 3.5 trillion, is that Germany's NFA has risen from zero in 2003 to 60% of GDP now.

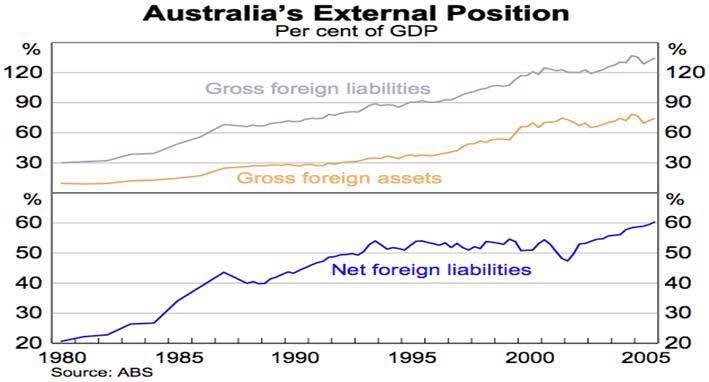

The NFA measures a country's balance sheet as debtor or creditor. To put things into perspective Australia has NEGATIVE NFA equivalent to 60% of GDP, so pretty much the reverse of Germany. Australia owes the rest of the world; Germany is owed by the rest of the world. In a crisis this has implications for currency strength, interest rates, and policy choices. Germany would seem to be in a very strong position?

There is trouble in paradise however and the problems are both internal and external. Without a resolution to these problems we believe that the prospects for corporate profit growth and productivity in Germany and thus Europe, are poorer than most other major regions and the societal consequences will be growing wealth disparity, un/underemployment, and consequently political extremism is likely to become more visible and act as a destabilising influence.

This is the second part of the trilogy based on a recent road research trip. In Germany I went to Frankfurt, Berlin and Dresden. (The last of these is a must visit). I spoke to bankers, wealth managers and people who actually make and sell things!

German companies with the exceptions of the banks, and companies in dying industries such as Thyssen Krupp, look pretty sound. Balance sheets are ok, margins reasonable, and product innovation encouraging. Daimler for example is now 'full on' with an electric car project. German companies will be here for a long time. On the other hand, company managements expect a serious slowdown; have planned for one; and will absolutely get one. Profit forecasts are going to be coming down across Europe led by Germany.

We like German based companies like Evonik which is a specialist materials company trading at a chemical company multiple, but it's rare for shares to perform well in the face of slowing revenue and a squeeze in margins which is likely to be prolonged and widespread.

We believe it will be prolonged because of denial of the problem inherent in the Euro and the decision making process/constitution of the EU, in conjunction with German intransigence about its role in this mess and its potential role as saviour which it is also reluctant to acknowledge.

We generally don't do macro and leave that to better qualified folks. Nonetheless at times the macro is so extreme, good or bad, it does influence capital markets to the exclusion of stock specifics. In Europe this is one of those times.

Since currency union needs fiscal union needs political union and Europe only has one of the triumvirate (at the moment?) the differences in competitiveness and resultant accumulating trade surpluses and deficits are not being recycled effectively within the Euro zone. By effectively locking some parts of the Eurozone into an overvalued currency, without the necessary fiscal transfers to alleviate the problem, the single European currency project has produced extraordinarily high levels of unemployment and income stagnation in some Eurozone countries with the consequent squeeze on fiscal positions and hence unsustainable government indebtedness. The irony is that in order to undergo an "internal currency devaluation" the countries with an overvalued exchange rate need deflation and yet the indebtedness they already carry means such a downward move in price levels would most likely result in default. This default would most likely occur via the failure of banks in debtor economies (Italy etc) to repay debts owed to banks in creditor economies (Germany, NL etc). Things will be nasty anyway and nastier if this debt default occurs. Euro interest rates are already at zero; even negative, and so some creative thinking is needed at the ECB and in Brussels where budgets are reviewed. In short Europe needs a fiscal solution; not more interest rate 'stimulus'.

If there is a purpose to economic policy making, it is surely to facilitate the realization of economic potential. If that is so, then the Euro has failed, and the obsession with preserving it has produced poor policy. Consider that unemployment in the Euro area, seven years after the Euro crisis broke, is still 8% and like so much else in the Euro area, the aggregate or average hides a large dispersion underneath. Unemployment in Italy remains above 10%, in Greece it is still at 18% and in Spain 13%. In Germany and the Netherlands, it is just 3.3% and 3.2% respectively. Consider also that in real terms, the economy of Greece in 2018 was the same size as it was in 2000 and in Italy the economy is the same size as it first reached in 2004. Not surprisingly, such poor economic performance has been accompanied by the rise of political extremism and the discrediting of the current economic system. The European elections were a reminder of the degree to which the population at large has lost faith in the European project.

Even in Germany political extremism is apparent because there is a growing realisation that they are likely to be paying for any bail out - something to which they never signed. As always, severe economic problems find their way to blaming 'foreigners' and immigrants. Pegida (a genuinely nasty anti Islam party) had rallies while we were in Dresden and they were alarmingly well attended. Since we left Dresden in mid-October the rallies have continued and Dresden city authorities have voted to declare a "Nazi Emergency".

More moderate protests about interest rate policy forced on the Germans by the ECB appeared in the media when the ECB Governor Mari Draghi was likened to a vampire, sucking the life out of German savers with his negative interest rate policy.

Basically - "Count Draghila sucks our accounts dry and during his tenure we have lost billions"(Bild is a tabloid like the Herald)

His successor Christine Lagarde will have to be creative since the ECB is now out of ammunition to support the weaker economies in Europe. It is getting close to the "end game" and something has to change. Sadly there is an obvious solution only the Germans are reluctant to play the game - perhaps understandably so. This reluctance represents the internal German barrier to positive change for the better. The Germans could underwrite the sorry indebted mess with their strong balance sheet, and provide fiscal transfers on a European wide basis. This however means trashing the German balance sheet to save the reckless 'Southerners". This possibility, even likelihood, is gradually being realised in Germany and there is a lot of massaging of the public mind-set to be done to make it palatable. It will be a slow process and meanwhile unemployment continues at dangerous levels.

One of the likely German demands in exchange for this debt backing guarantee is likely to be a change in the way the EU is governed. The Germans are likely to want more influence. This is for historical reasons "sensitive", and so we have an impasse which is damaging to the economy and employment and wages.

The spiral down continues with no circuit breaker except perhaps for Brexit. One of the ironies of the UK leaving is that the EU organisation will be forced into structural change; and thus worth being a member? A sort of reverse Groucho Marx conundrum?

We completely understand that the EU and the Euro are political constructs and so can be held together far longer than any economic justification. However if and when the Sellotape holding the Euro together splits, the outcome will be binary - ether very bad (widespread default by the European banking system) or very good (debt pooling with German backing in exchange for a significant change in the governing apparatus and decision making in the EU).

Consequently on a risk adjusted basis, return prospects look a lot better elsewhere in the World and we remain convinced that we are correct in having minimal exposure to the Euro; European industrials; and most certainly zero exposure to the European banks.

From Europe I went to Hong Kong and Part III will be released shortly! Interesting times in Asia too!