On the road - again. The UK.

(With apologies to Canned Heat and Jack Kerouac)

November 12, 2019

So I had the pleasure of a trip to Germany and the UK recently. This is the first of three articles on that road trip. For the more senior readers the title may resonate? (I actually never really liked the book; quite liked the music).

We now think the post Brexit (assuming it happens) outlook for the UK is better for domestic investment than consensus believes. Any new government post the December General Election will be desperate to show some growth momentum and the easiest lever to pull, with the biggest multiplier effect, and with the most pressing requirement, is to boost the supply of housing stock.

Consequently, our most recent purchase for the Global Equity High Conviction strategy has been a position in Barratt Developments the UK housebuilder of mid sized homes at "mid sized" (sic) prices (is there such a thing anywhere now?) on a prospective P/E of less than 10x and yield of over 7%.

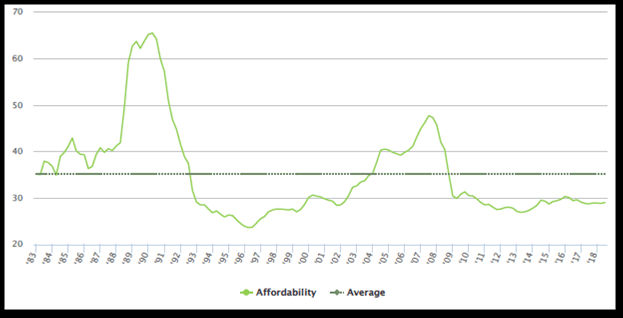

Barratt Developments is a nationwide UK housebuilder and by number of units, the largest in the UK. It builds a full range of housing from starter homes through to luxury apartments. It operates both green and brown field sites and so is able to provide city centre regeneration or capitalise on changes in land use; something the next UK government is going to have to address. The UK population has grown significantly over the last 20 years through immigration and this has put a massive upward price and congestion pressure on the housing market. Housing starts are running at about 140,000 pa but demand is believed to be about 230,000 as measured by new household formation. Since the laws of supply and demand still apply, prices are high and will rise higher causing political unrest if not addressed adequately. Tight local controls on planning permission and builders allegedly hoarding land banks have not helped in this respect. The central government has therefore started to loosen planning regulations and a lot of political pressure is being put on housebuilders to use their land banks. Banks are being encouraged to lend for house purchases. With the UK mortgage affordability index running at attractive levels for mortgagees it is only Brexit and local council decision making sclerosis that is preventing a re-apparaisal of the sector. (see chart below) Both major political parties are committed to building more social housing and will need the major housebuilders' cooperation. There seems little point in either main party making the UK housebuilders a "whipping boy". Consequently we think the time is right; little downside and plenty of upside.

Halifax Mortgage Affordability - Repayments as a % of income to Q3 2018

Data Source: Halifax

For additional background on the prospects for the UK and in support of our stock purchase, we make a few observations below on what we saw on the road in the UK and from conversations regarding the economic outlook post Brexit.

(We also visited Germany and Hong Kong so observations from there will be in subsequent articles.)

We went significantly beyond the boundaries of the M25, the orbital motorway around the London 'remoaner bubble', so can attest that intelligent people have coherent reasons for voting for Brexit!

On the other hand while in London we also bumped into protest marches for Remain and have to say some slogans are worth posting. Brits don't protest publicly much but when they do...

Here are the more humorous/witty ones:-

- "Pulling out doesn't work (ask my Mum)"

- "My mother in law lives in Spain; please don't make them send her back here"

- "The only single market I want to leave is Tinder"

and less articulate perhaps:-

- "Bollocks to Brexit"

- "F*** Off Boris"

The more objective economic analysis actually seems to come from mostly outside the M25 and is encapsulated by Stewart Paterson of the Hinrich Foundation and from analysis by Cambridge University which casts doubt on the robustness of the UK Treasury modelling about the negative consequences of Brexit, (certainly the OECD and IMF work appears superficial) as well as their conclusions.

On balance they argue that the UK will not 'crash' out and nor will the economy fall into a deep dark hole as widely predicted.

The outlook for stocks is therefore going to be ok notwithstanding the risk of a widespread asset confiscation by a Labour party.

(The Cambridge papers are "full on" but available should you want them!)

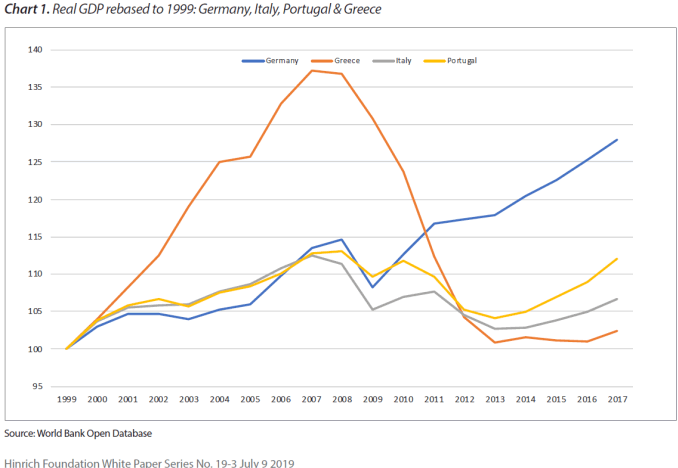

As Stewart points out, the initial exit will leave the long term trading relationship to be negotiated, so nobody really knows anything about the size of the potential benefit from leaving the 'single market'; the UK has its own currency and tax policies which add considerable flexibility - something the UK Treasury flatly ignored and more importantly, did not declare that it was flatly ignored. The risks for the UK appear to be the extent to which Europe, a major trading partner, implodes. In contrast to the UK, Europe is in an irreversible economic bind and the Euro is currently a doomsday machine for the deficit countries such as Italy. Check this chart below.

Unless and until Germany is prepared to adopt fiscal unity and back the debt of the deficit countries and provide constant fiscal subsidies then it remains mired with growing intra regional inequality; risk of banking collapse and political extremism from both ends. As we write this we note with interest some concessions that the Germans are ready to make regarding EU wide banking deposit insurance. However a long road ahead for EU wide reform awaits and we will write about our German observations next.

Let's repeat our views on the Euro. Currency union needs fiscal union needs political union.

For the moment we think that certain stocks in the UK are over sold; have reasonable prospects; people will still want to move to, and work in, the UK and years of neglect and underinvestment in regional infrastructure and housing stock make it an attractive multi-year investment proposition.