Sell in May and go away?

May was another volatile month in which it was eminently possible to lose money or make money depending on which day you bought or sold. The diversified global equity strategy rose about 1.5% in A$ terms. The Global Listed Infrastructure Strategy rose just over 5% total return in US$ and about 2.3% in A$ terms. Global Markets were essentially flat in US$ terms and down a little in A$ terms as the A$ rallied a little.

We're happy with that result, especially as our positions in China and Japan performed better as the Covid lockdown looked to be ending. Japan rose c2% depending on which index is measured and China about 3%. Australia fell c2.5%.

We recently suggested to forget the FAANGs and learn to QUAKE. https://www.delftpartners.com/news/views/faangs-for-the-memories-but-its-time-to-quake.html

In May these stock showed share price changes of:

- Quanta $116 to $119

- Union Pacific $234 to $220

- Amada Y1014 to Y1034

- KLA $319 to $365

- Enbridge $44 to $46

We did point out the benefits of being the tortoise in the investment race as well as the increasing need to focus more on investing in companies that met needs rather than wants. In May that was apparent. There's more, much more, to come in investing in companies that perform a useful purpose. https://www.delftpartners.com/news/views/favour_needs_not_wants.html E.g. California politicians are proclaiming a climate crisis with a water shortage and imminent rationing as the consequence. The fact that the last time California completed a new dam/reservoir was 1980 and in that time the population has grown from c24m people to over 39m people, appears not to be a relevant factor to the politicians. What can we say?

Consequently they will look to a sub optimal solution (shorter showers and other irrelevant instructions) before stumbling upon the correct one which is to encourage reinvestment in the capital stock of the state. California is not alone. It is this delay (stupidity?) which allows smart investors to make their investments NOW before others have finally decided to sell their SPACs. At some point even politicians will discover the root cause and plan accordingly? At that point the stocks directly involved in building repairing designing and maintaining physical assets will be getting a lot of attention and continue to rise even if they have already outperformed handily.

We gather it's not 'pretty' out there. SPACs NFTs Cryptos and anything on a price to sales valuation of over 10x have been (appropriately) "enjoying a correction".

The chart below shows you what happens in the long run to anyone who systematically invests in companies with a P/S of over 10x. You might as well buy bonds because they at least don't have the volatility? The only thing you might get from this cohort of stocks is bragging rights at a friend's cocktail party about which hot stock you have just been told to buy? Most of the time though it's the fund manager who does best from this kind of investing. "Where are the clients' yachts?" is the correct riposte.

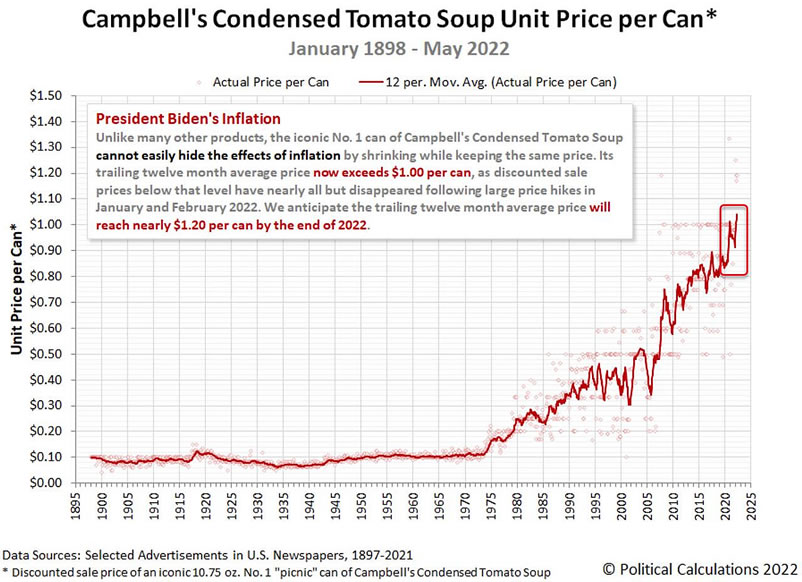

Long duration bonds haven't been a great place to be either and many a client will go "wtf!!@*?" when they see that any lengthy maturity in government bonds has cost them a c.20% capital loss in the last 18 months. Inflation is increasingly apparent and interest rates have backed up accordingly. (Inflation never went away - see www.shadowstats.com and the price of a tin of Campbells soup chart below) The price and availability of central bank money is going up and down respectively. We have seen the end of QE and nearly free money. Rates aren't even above inflation yet and one can already hear the pips squeak? https://www.inspiringquotes.us/quotes/zfCy_bE7RewF2

Getting the monetary 'cold turkey' nicely balanced will be a challenge for central bankers. As we "go to press" we read that Janet Yellen has 'apologised' for underestimating inflation and making a mistake. We never thought central bankers would apologise (https://www.delftpartners.com/news/views/when-1-plus-1-does-make-3.html) however, we would argue to finally admit a mistake but to blame the error on being too successful with Covid prevention, as she appears to have done, is a bit of a stretch? Nonetheless the real challenge is to now withdraw the silly money of the last 20+ years and have the 'minerals' to live with the howls of pain, many of which will emanate from powerful vested interest groups with lobbying $ to spend.

Importantly the sources of this inflation are different from the last nasty bout in the 1970s but that this will NOT be recognised for a while. Again the solution is for investment incentives to promote the supply side not restrict the demand side. This delay in recognition in the root cause of the problem, will permit smarter investors to 'get set' in the right stocks now. The right stocks are companies which provide raw materials and make, produce, repair and maintain a country's capital stock. It's not going to be SPACs or NFTs or even (especially?) Meta that solves this. We stated that it wouldn't need 9 interest rate increases as Wall Street was suggesting in March. Given the effects of QT or the shrinking of the Fed balance sheet as it runs off its bond portfolios, the de facto tightening will be a lot more painful than would appear.

https://www.delftpartners.com/news/views/a-comment-on-the-april-decline-and-some-suggestions-for-what-to-do.html

"We have been told that 'tightening' is an imminent rise of 50 basis points in the Fed Funds rate (the short end) but also need to bear in mind that the size of the Fed balance sheet is going to be reduced. This represents an additional source of tighter monetary policy and so the effective tightening of policy is greater and quicker than most realise." [Delft Partners' April Market Commentary 2022]

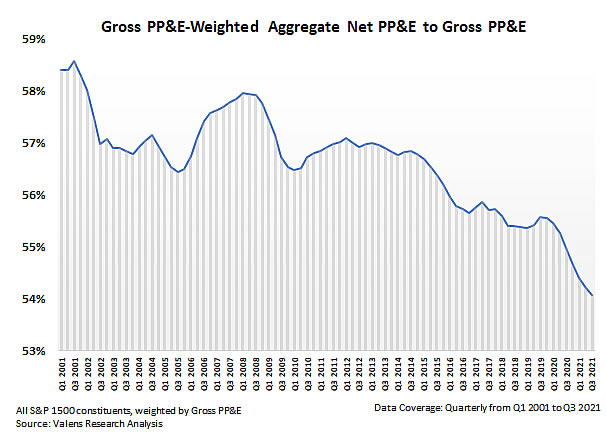

It's actually not interest rate increases that need to squeeze out excessive wage demands to reduce inflation, it's the lack of supply and competition that has created the problem. See the chart below which illustrates the net disinvestment by listed US companies. They prefer buy backs which are currently running at about $900bn p.a. and essentially favour short term profits over long term sustainability. This has to change. Wages have to rise relative to profits and relative to the rewards for not working productively.

Given the mistakes made in the Green transition in NOT investing in energy security, nor raw materials, can policy makers quickly admit their mistake? ("No and currently they appear to be interfering more by not removing green taxes and yet providing hand-outs funded by windfall profits' taxes!"- Ed) Hope for success and plan for failure.

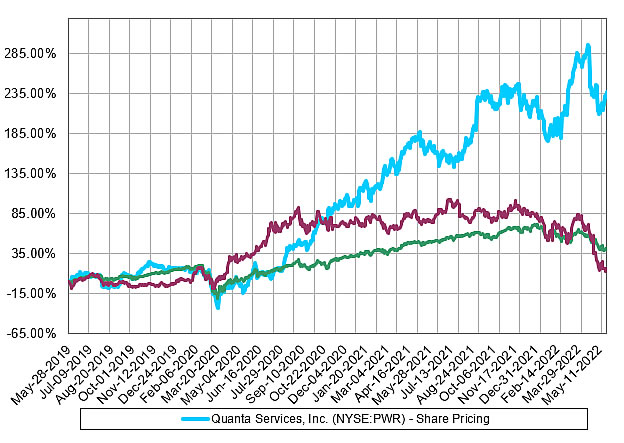

We'll sign off with a chart of the price performance of 3 entities over the last 3 years.

The blue line is a long standing favourite of ours - Quanta Services held in both the global trust and the listed global infrastructure strategy. They provide essential services to the gas and electric power grid. The green line is the S&P 500. The magenta line is everyone's favourite stock - Amazon.

As Gordon Gekko once said, "Ever wonder why fund managers can't beat the S&P 500? 'Cause they're sheep and sheep get slaughtered"

Your call.

Delft Partners June 2022

DISCLAIMER

This report provides general information only and does not take into account the investment objectives, financial circumstances or needs of any person. To the maximum extent permitted by law, Delft Partners Pty Ltd, its directors and employees accept no liability for any loss or damage incurred as a result of any action taken or not taken on the basis of the information contained in the report or any omissions or errors within it. It is advisable that you obtain professional independent financial, legal and taxation advice before making any financial investment decision. Delft Partners Pty Ltd does not guarantee the repayment of capital, the payment of income, or the performance of its investments. Delft Partners operates as owner of API Capital Advisory Pty Ltd AFSL 329133.