September 2023 Update

Remember October is just round the corner

September, 2023

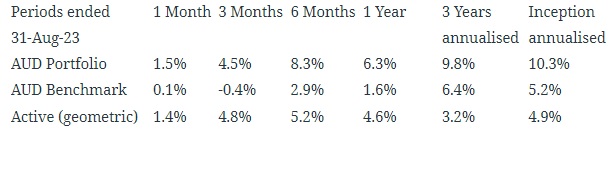

Global equities rose about 2% in A$ terms in August but declined over 2% in US$ terms. The A$ was heavily sold as interest rate differentials are currently in vogue and the RBA is believed to be 'done', unlike the Fed. We chose our currency risk to be unhedged and have benefitted from this stance. All strategies outperformed with the GHC30, a Global Value biased portfolio and the Global Listed Infrastructure particularly strong. The Global listed infrastructure returns are listed below for reference.

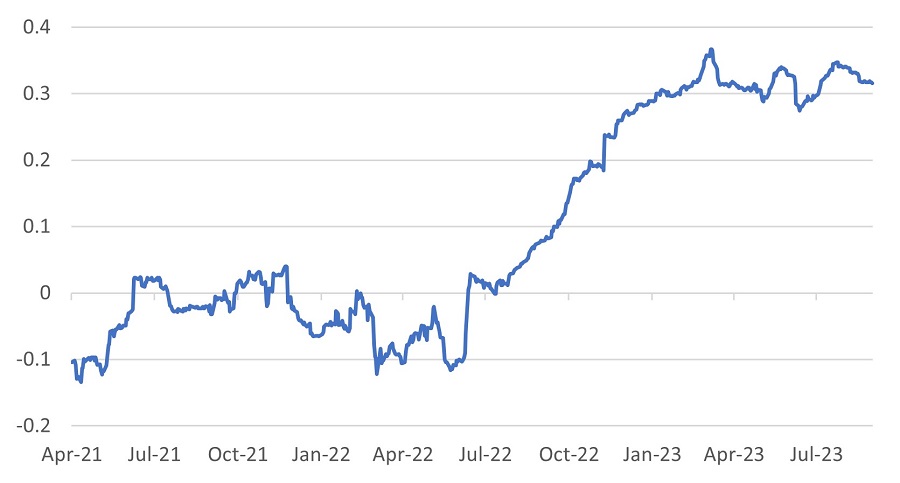

August also saw a repeat of the 2022 syndrome with respect to asset correlations. Just as in 2022, both equities and bond markets delivered negative returns in August. The basic tenet of a diversified multi-asset portfolio is that equities and bonds are negatively correlated. The chart below shows the rising correlation between Global Equities (TR) and the Global Aggregate Bond Index (TR)

If this continues it makes the reduction of return volatility via diversification, harder. A suggestion we make is to seek diversification within equities and given the popularity of Growth and the US, we would suggest a contrary approach with Value and Japan as overweights.

Although equities have notched up decent gains since the start of the year, the markets overall have found it tough to shake off the inflation worries, which has weighed on both equities and bonds.

The US equity market has moved to discount only a marginal risk of a further Fed funds rate increase and five rate cuts by the end of next year. In our view, the market is getting it wrong. We anticipate no cuts for at least 6 months. Even as recently as the end of last week, the Federal Reserve Bank of Cleveland President Loretta Mester was perhaps only acknowledging the market's predicament when she noted that US inflation remains too high, and the labour market is still strong. Mester is only one among many voices at the Fed, but it only highlights the widening gap between the Fed's perception and the market's hopes.

US policy at the moment is confused and confusing. Treasury has its foot on the accelerator via massive fiscal stimulus and the Fed on the brake. Something unpredictable is likely to happen in capital markets. We note again the mounting problems in getting money out of illiquid asset funds such as property when managers gate. Carrying values are too high and bank provisioning is likely to rise. Defaults cause correlations to rise and diversification becomes an illusion. We remain underweight banks which always are at the epicentre. To invest in banks, we would now like to see dramatically higher provisioning, and we'd be happy to swim against the resultant tide of selling pressure.

If the cage fight between Messrs Musk and Zuckerberg is to occur, we think the warmup act should be Yellen vs Powell. Whomever wins gets to decide brake or accelerator - choose either one please or at least use together in a coordinated fashion?

The absence of interest in Japan over many years means that developments there are ignored: dangerously so. The new BoJ governor is sensibly tiptoeing away from the Yield Curve Control which characterised the previous administration. Interest rates are thus free to rise a little more in Japan, making Japanese debt instruments more attractive, and when volatility strikes global markets, the Yen tends to strengthen as capital is brought back. Japan is a net creditor nation of size and the adage that "it matters not so much what you think of Japan's bond market but more what they think of yours" is appropriate here. Given that the US needs to issue debt to the tune of a short US$ 1 TRILLION, in Q4 2023, and Japan is the largest foreign holder of US debt at over $1 trillion any difficulty in persuading Japanese investors to buy US debt at current yields might be a catalyst?….just saying. It is October next up and that can be a fun ride.

As authorities in China continued to provide a drip feed of policy adjustments to help prop up the economy, Chinese asset markets stabilised last week, and investors heaved a sigh of relief and chased highly geared companies, aka property stocks. The measures announced were mainly in the housing market. The proposal to lower the minimum down-payment ratio for mortgages was the first nationwide demand-side policy easing since 2015. A safer way to play any successful Chinese asset price support policy could be oil stocks, WDS, XOM, CNOOC, and materials companies BHP and RIO? All owned in the global equity strategies.

Significant upward price changes in August were in recently acquired UBS, (CS may have been the "Sale of the Century"?

https://en.wikipedia.org/wiki/Sale_of_the_Century_(Australian_game_show)) and Morinaga the Japanese dairy company, as well as long held Sterling Infrastructure, Amada, NYK and Seagate. We trimmed the last and took profits.

Falls in ENN (The Chinese energy infrastructure company) Dicks Sporting Goods whose profits fell short of estimates due to 'shrinkage', a retailer euphemism for customer or employee theft. We also sold Johnson Controls since the poor state of the commercial real estate market is likely to dampen demand for their real estate related products.

Delft Partners September 2023

DISCLAIMER

This report provides general information only and does not take into account the investment

objectives, financial circumstances or needs of any person. To the maximum extent permitted by law,

Delft Partners Pty Ltd, its directors and employees accept no liability for any loss or damage

incurred as a result of any action taken or not taken on the basis of the information contained in

the report or any omissions or errors within it. It is advisable that you obtain professional

independent financial, legal and taxation advice before making any financial investment decision.

Delft Partners Pty Ltd does not guarantee the repayment of capital, the payment of income, or the

performance of its investments. Delft Partners operates as owner of API Capital Advisory Pty Ltd

AFSL 329133.