September 2022 Update

Update on August Events and Performance

August saw a return of ‘risk-off’ and the equity markets declined. Value beat Growth. The diversified global trust declined by c.1.5% in A$ but outperformed the benchmark by almost 1% and the Global 30, a value and dividend focussed strategy declined c.0.5% in A$ and outperformed its benchmark by a little. Our infrastructure strategy declined less than 1% (A$) and is flat over the year to end August compared to the general equity market decline of almost 10% (A$).

The US$ rose against most currencies as the combination of higher US rates, the Fed balance sheet shrinkage, and a rising share of GDP being taken up by US$ based commodities (notably) energy, created a ‘short squeeze’. The Jackson Hole speech was brief and aggressive. Interestingly it also seemed to call for concerted action by other central banks. We read this as the Fed becoming concerned about an overvalued US$ driven by interest rate differentials. The Yen is getting very oversold. The Euro has problems about which we have frequently commented. The ECB will raise at least once but credibility is eroding.

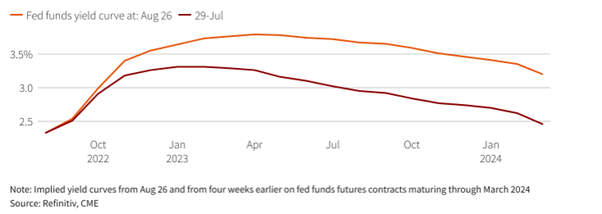

The chart below shows the forward rate expectations in the USA and the upward flattening over the month as markets came to believe the Fed has the necessary resolve.

For the moment the destruction of DEMAND through tighter monetary policy is the chosen path. This inflation is however fundamentally NOT a DEMAND problem but a SUPPLY problem, particularly the issue of energy inputs. Energy costs have been inflated by an unachievable, unaffordable, and undesirable Net Zero target. Currently renewables technology is not capable of providing energy at the same price and flexibility/usability as oil gas and other carbon-based fuels. It is very likely therefore that we see some form of rehabilitation of oil and gas producers and distributors by both politicians and the market. If we don’t then we will see many more street protests.

https://www.grid.news/story/global/2022/07/06/war-protest-and-spiking-prices-how-spiralling-inflation-is-setting-the-world-on-fire/

Our favourite stocks in this regard are owned in all 3 strategies – oil and gas pipeline companies and engineering specialists in grid maintenance. Currently in the USA the Biden administration appears to be countering monetary tightening with fiscal incontinence (Inflation Reduction Act et al). Handing out “stimmy cheques” is not the answer to the Supply side challenge but will serve to keep upward pressure on prices. Consequently, we expect the equity market to be volatile with these mixed messages from policy makers.

We made very few changes to all portfolios and remain underweight Europe and the Euro and overweight Japan and the Yen. We hold a little cash and expect to re-invest that during the late September October period which is shaping up to be a traditionally wobbly month.

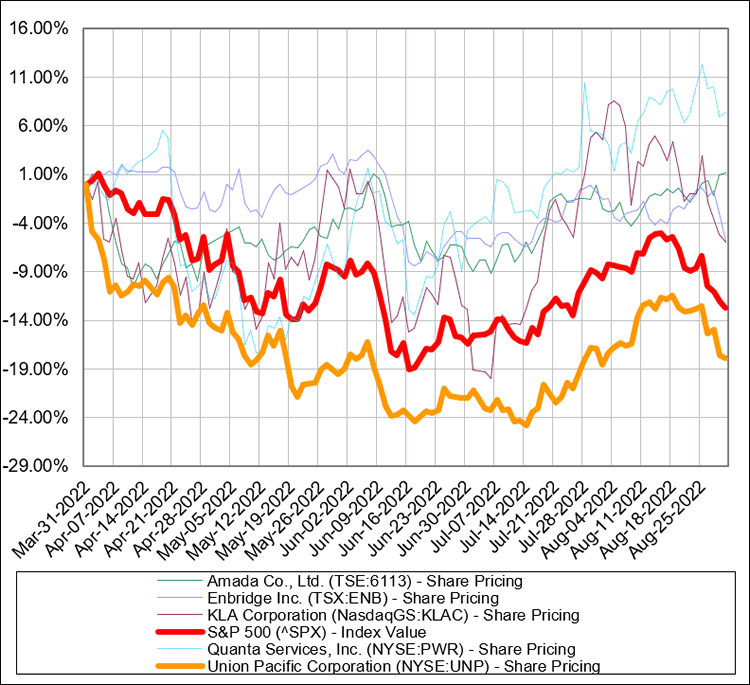

We argued recently that it was most definitely time to switch from expensive and momentum driven stocks to ones which did useful things, like repairing and building an economy’s capital stock.

https://www.delftpartners.com/news/views/faangs-for-the-memories-but-its-time-to-quake.html

The ones we suggested – QUAKE – Quanta Union Pacific Amada KLA Corp and Enbridge are charted below vs the S&P500 (red) over the last 6 months. Only one stock Union Pacific (orange) has fared worse.

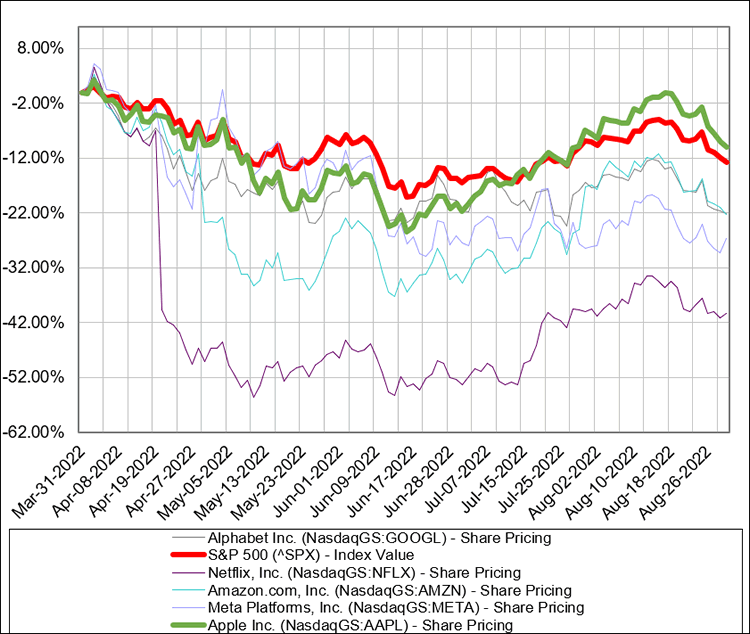

The chart below shows the returns for the FAANG stocks. We got one wrong, APPLE (Green – (of course!)). The rest have underperformed the S&P 500 (Red) and most definitely the stocks we identified as ‘useful’ in the chart above.

This comparison ignores dividends, currency shifts (weaker Yen) and other "small beer" but since we favour dividend paying stocks, that would improve the relative return of QUAKE if we included them.

There’s still time to get set in the stocks which meet needs and not wants.

Delft Partners September 2022

DISCLAIMER

This report provides general information only and does not take into account the investment objectives, financial circumstances or needs of any person. To the maximum extent permitted by law, Delft Partners Pty Ltd, its directors and employees accept no liability for any loss or damage incurred as a result of any action taken or not taken on the basis of the information contained in the report or any omissions or errors within it. It is advisable that you obtain professional independent financial, legal and taxation advice before making any financial investment decision. Delft Partners Pty Ltd does not guarantee the repayment of capital, the payment of income, or the performance of its investments. Delft Partners operates as owner of API Capital Advisory Pty Ltd AFSL 329133.