Singapore's legacy for the fourth generation of the People's Action Party

14th July 2020

By Kevin N. Smith, Delft Partners

The recent election in Singapore provided a gentle reminder to the ruling People’s Action Party that their hold on power should not be taken for granted. Singapore has generated significant financial wealth to deal with the impact of the Covid-19 pandemic and plans are underway that will underpin the short-term economic recovery as well as Singapore’s long-term reputation for competitiveness and innovation. The local equity market remains small and has not reflected the broad economic success of the country, nevertheless, we are able to find excellent small to mid-sized companies in Singapore to include in our Asian portfolio.

Following just nine days (the normal amount) of campaigning and no opinion polls, Singapore held a general election on Friday 10th July, the result was never in doubt, a win for the People’s Action Party (PAP), however, the scale of victory winning 83 seats or 89% of those up for grabs, would have disappointed the Prime Minister Lee Hsien Loong and his Party. Since the creation of the city state in 1965 the PAP has always won at least 93% of the parliamentary seats. Prime Minister Lee expressed disappointment when he said “it is not as strong a mandate as I’d hoped for, but it’s a good mandate” and “the results reflect the pain and uncertainty that Singaporeans feel in this crisis”. While the opposition Workers’ Party now has 10 seats in parliament, their previous best total was 6 seats in 2011, the PAP retains their ability to amend the constitution which they have done more than 50 times. Prime Minister Lee has indicated his plan to step aside by the time he turns 70 in the year 2022. His most likely successor, the Deputy Prime Minister and Finance Minister Heng Swee Keat was pushed to a tight result in his East Coast constituency. Prime Minister Lee wants to hand over Singapore in “good working order” for the next generation of PAP officials, the 4G, fourth generation.

In 2020 the “good working order” for Singapore is being tested more severely than at any time since the campaign for Britain to relinquish its colonial rule that was championed by Lee Kuan Yew, father of the current Prime Minister. Singapore initially merged with other former British territories to form Malaysia in 1963 and subsequently became a sovereign city state in 1965. Lee Kuan Yew remained as Prime Minister until his retirement in the 1990 and subsequently maintained a guiding hand to his successors as Senior Minister and Minister Mentor for a further two decades until 2011. From 1965 the PAP obtained an overwhelming parliamentary control at every election and Lee Kwan Yew set about transforming Singapore with policies focused on long-term social and economic planning with English as the common language and mandated bilingualism in schools to ensure preservation of ethnic identity. Singapore has been criticized for limits applied to public protests, control of the media and severe penalties associated with chewing gum and littering. The end result has been an economy that has grown at the rate of 6.5% per annum in the past 50 years to become one of the wealthiest economies in the world. Singapore has been hit hard by Covid-19 with more than 45,000 cases to date, the economy is likely to see the GDP fall by 7% in 2020. The government has responded by announcing special budget support of USD 67 billion equivalent to USD 11,500 per person which will help cushion some of the economic impact of Covid-19. The Singapore government has maintained zero foreign debt since 1995, so there is plenty of scope to fund the economic response to Covid-19. Temasek Holdings which acts as manager for some of Singapore’s sovereign wealth has assets in excess of USD 215 billion.

The PAP will have been pleased to withstand the pressure of their former member Tan Cheng Bock in the Progress Singapore Party supported by the Prime Minister’s brother. The Progress Singapore Party failed to win any seats. In addition to their ten elected seats the Workers’ Party will gain two additional seats under the non-constituency member of parliament (NCMP) rules. The NCMP were introduced via a constitutional amendment in the 1980s following four successive clean sweeps for the PAP. There are twelve NCMP seats in parliament and they have the same voting rights as elected MPs.

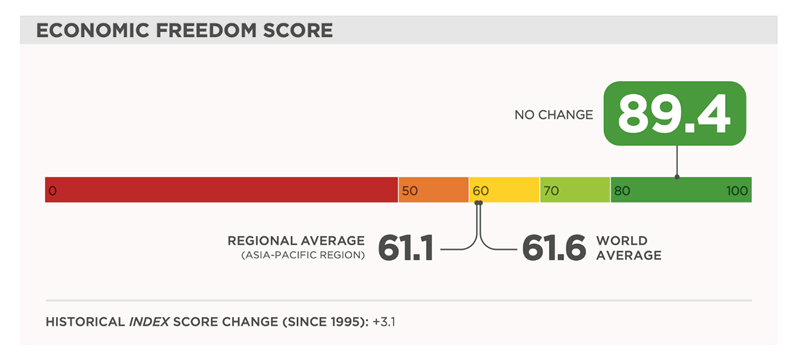

In the early years of Singapore under Lee Kuan Yew, the natural deep harbour was utilized to develop a maritime transport and shipbuilding hub for the region. Singapore then developed as a centre for electronics manufacturing for multinational companies and petroleum refining in the region. In the 1990s Singapore built on their success in the electronics field to develop a strong base in the biotechnology industry. In the aftermath of the dotcom bubble and SARS in 2003, Singapore relaxed the ban on casinos which resulted in the building of two world class integrated resort casinos, the Marina Bay Sands and Resorts World Sentosa. In recent years Singapore has become the destination of choice for private banking. The number of single-family offices managing private wealth assets in Singapore has quadrupled in the past five years. Singapore has taken market share away from Hong Kong and Switzerland to become the most popular location for offshore wealth management. Singapore’s ability to adapt explains the economic success that has been achieved in the past 55 years. According to the 2020 Index of Economic Freedom, Singapore with a score of 89.4 is the world’s freest economy.

Table One

Source: 2020 Index of Economic Freedom

Source: 2020 Index of Economic Freedom

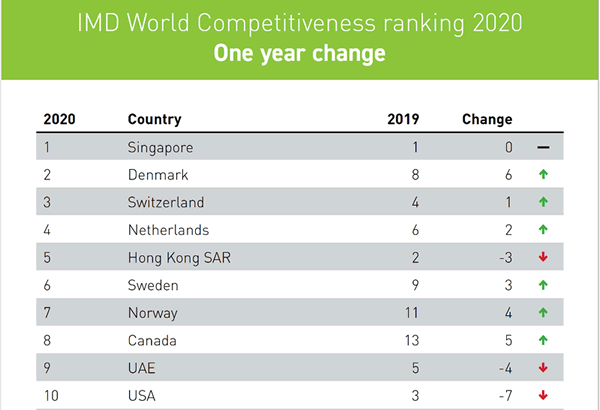

In the 2020 global competitiveness rankings published by IMD, Singapore retained top position while the United States dropped from third to tenth position. Each country in the survey was assessed in four broad areas: economic performance, government efficiency, business efficiency and infrastructure. Singapore had strong performance in all four areas. Singapore is also a strong performer in global surveys of innovation, in the most recent Bloomberg survey Singapore ranked third behind Germany and South Korea. Singapore’s greatest strength in that survey was in the field of education with the highest score for tertiary efficiency globally thanks to 85% gross enrollment in higher education.

Table Two

Source: IMD Global Competitiveness Survey June 2020

Source: IMD Global Competitiveness Survey June 2020

The Singapore government recently announced that it will set aside more than USD 14 billion to support research in “high impact areas” as part of a five-year research and development plan designed to improve innovation in the country.

All of this economic, competitiveness and innovation success has not reflected in the performance of the equity market which in the past decade increased by 2.6% per annum, significantly less than the world index which increased by 10.6% per annum. Singapore has not been able to create a critical mass in the local equity market in the past two decades and has just 22 constituents counted in the MSCI Singapore Index which covers 85% of the free float market capitalization. Those 22 companies had a market value of USD 203.7 billion at the end of June 2020 and accounted for just 2.4% of the Asian region. In the most recent rebalancing by the MSCI, Singapore lost four companies with an index value of USD 613 million from the regional and global indices.

Our investments in Singapore are focused on the small to mid-sized segment and there are 50 companies that meet our size requirement between USD 500 million and USD 10 billion free float market capitalization out of more than 3,000 companies within that size range in the region. There are companies in Singapore that we like and hold in our Asian portfolio, for example, we recently highlighted home grown supermarket group Sheng Siong that has been very clever with their shop locations within Housing Development Board property complexes and has grown much faster than the international competitors in the market. Sheng Siong reported first quarter earnings per share up 48% and our analysis of the value, momentum and quality (VMQ) characteristics of the company puts it in the top 5% of all companies across the region.

Another Singaporean company that we hold in our Asian portfolio is Venture Corporation, a business that is a leading global provider of technology services, products and solutions.

To quote from Venture’s annual results presentation they anticipate “a stronger second half of 2020, supported by traction with its new and existing partners across multiple technology domains, such as Life Science, Healthcare & Wellness, Instrumentation and Networking & Communications. As the Group’s manufacturing footprint is mostly located in Southeast Asia, the Group is well positioned to capture new business opportunities as businesses continue to diversify their global supply chain network.” In our analysis of VMQ characteristics, Venture scores in the top 10% of all companies in the region and the balance sheet with more than USD 500 million of net cash is particularly strong.

In conclusion, the recent election in Singapore provided a gentle reminder to the ruling People’s Action Party that their hold on power should not be taken for granted. Singapore has generated significant financial wealth to deal with the impact of the Covid-19 pandemic and plans are underway that will underpin the short-term economic recovery as well as Singapore’s long-term reputation for competitiveness and innovation. Performance of the equity market in the past two decades hasn’t reflected the economic success of the Singapore, and while the market will always be a small component of the region, there are excellent companies in Singapore that are competitive on a local, regional or global basis.

DISCLAIMER

This report provides general information only and does not take into account the investment objectives, financial circumstances or needs of any person. To the maximum extent permitted by law, Delft Partners Pty Ltd, its directors and employees accept no liability for any loss or damage incurred as a result of any action taken or not taken on the basis of the information contained in the report or any omissions or errors within it. It is advisable that you obtain professional independent financial, legal and taxation advice before making any financial investment decision. Delft Partners Pty Ltd does not guarantee the repayment of capital, the payment of income, or the performance of its investments. Delft Partners operates as owner of API Capital Advisory Pty Ltd AFSL 329133.