Thoughts (and Hopes) following the Jackson Hole Speech by Jay Powell

2nd September 2020

- Possibly unleashing our inner Sherlock Holmes, what was NOT said last night seems quite important. (The Curious Incident of the Dog in the Night)

- What was NOT said was anything about Yield Curve Containment or the management of the interest rates on longer term securities (YCC).

- We thus hope that the market is once again going to be allowed to function with minimal intervention. The USA yield curve is already steepening and will steepen further if allowed.

- This steepening will have implications for a variety of equity styles or factors – Small, Asia, Financials and thus even Value may begin the long road back?

- The equity market is undeniably complacent, and it would be no surprise to have an ‘October shock’. Rising long term interest rates could be the catalyst.

- We are NOT saying SELL equities – rotation and diversification is our message.

- What seems to have happened is that bond investors have assumed a steepening is desirable and no YCC will produce the return of a risk premium; equity investors believe it’s another free put option and ‘game on’. We side with bond investors on this one.

- While Jay Powell appears to be doubling (quadrupling?) down on the Greenspan Bernanke Yellen yield curve experiment (which has failed to produce real growth) by holding and signalling short rates to be kept low, he seems to be signalling that it’s time we let the market decide the level of longer term interest rates?

- No YCC now doesn’t mean rhetoric won’t change if long yields back up aggressively – there is a veritable mountain of debt to be financed and funded, so it would be painful and unhelpful for the government if rates go too far, but it DOES mean the injection of uncertainty and the removal of a put option for bond and equity investors – risk premiums should rise – long bond prices will fall; equity assets which have priced themselves off ultra-low long rates and a flat yield curve, for ever now look VERY vulnerable.

- Thank goodness there is no YCC because at some point we will have to address the consequences and costs of suppressing market clearing prices for low quality/worthless/loss making assets which has been done for years. Capitalism is all about allowing failure to occur.

- As ever predicting interest rate prices is futile BUT inferring problems/opportunities from the various prices at the various prices is useful.

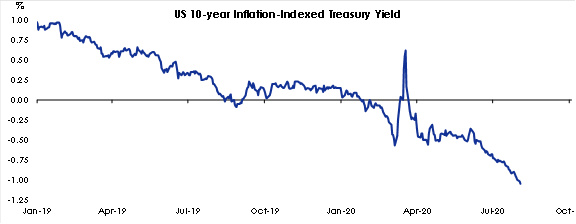

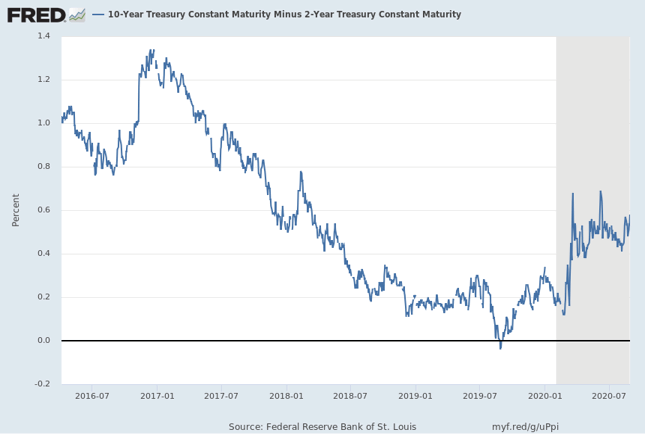

The Charts below should give some indication of the extent to which inflation IS expected BUT the rise of long-term rates is NOT. Previously a steeper yield curve favours Small, Financials Asia and Value as a style but you have to go way back to recall such an "outrageous situation". Many 'teenage scribblers' from today weren't around then.

The US 10-year yield tests the top of its channel

Hopes of yield curve control have driven real yields lower

No comment on Yield Curve Control – the Curve is already Steepening

DISCLAIMER

This report provides general information only and does not take into account the investment objectives, financial circumstances or needs of any person. To the maximum extent permitted by law, Delft Partners Pty Ltd, its directors and employees accept no liability for any loss or damage incurred as a result of any action taken or not taken on the basis of the information contained in the report or any omissions or errors within it. It is advisable that you obtain professional independent financial, legal and taxation advice before making any financial investment decision. Delft Partners Pty Ltd does not guarantee the repayment of capital, the payment of income, or the performance of its investments. Delft Partners operates as owner of API Capital Advisory Pty Ltd AFSL 329133.