Time to Move on? Go East?

28th August 2020

We have been suggesting for a little while that the RELATIVE performance of the USA equity market is peaking. We have favoured Japan and now increasingly China and Hong Kong too. We still avoid Thailand, Indonesia, India and Malaysia for a number of different reasons. Vietnam is interesting and a favoured destination for FDI but hard to buy. The best way to play that may be through HK listings such as LUKS Group (HK:366).

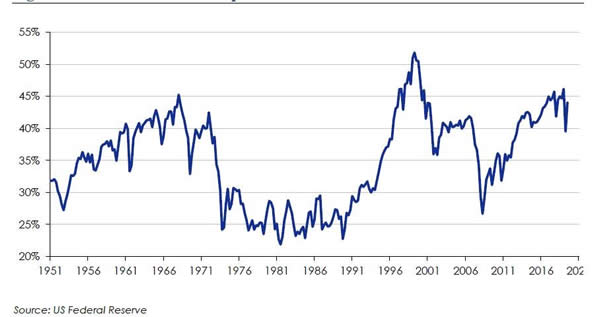

See the chart below for why we think the USA is now going to lag. Once all buyers are in, where is the marginal buyer going to come from?

USA Investor Allocation to Equities

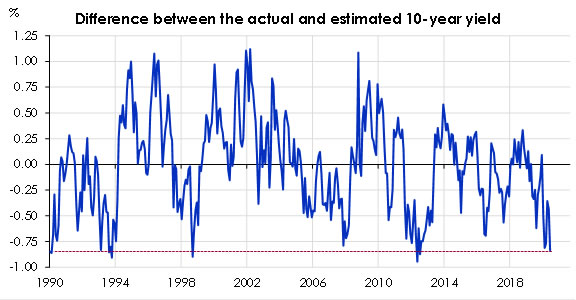

We are also increasingly concerned about the growing disparity between bond yields and inflation especially within the USA. Breakeven rates are rising; inflation expectations are rising and if this continues, the USA 10-year note won’t be yielding less than 1% much longer.

The blue line versus the black line shows the extent to which yields are below their ‘normal’ level in the USA.

We appreciate that the Federal Reserve has been intervening in the yield curve to keep rates ‘under control’ but more of this is not necessarily in the best interests of investors? Be careful what you wish for. Once markets get rigged, and price signals removed, it isn’t really a market in which to participate? Governments deciding what prices should be is not the stuff of ‘capitalism’. It should and will end and the long-term rates will revert - upwards. If intervention never stops then we have capital controls. The investing backdrop is very different in that scenario.

(If you wish to see what the 'true' rate of inflation is then please visit http://www.shadowstats.com/alternate_data/inflation-charts)

They have calculated the inflation rate today as if there had not been persistent adjustments to the index – its composition and calculation. Funnily enough (sic) these adjustments have all served to lower ‘inflation’. We know it will once again become visible and obvious – politicians are good at inflation. It always appears painless at first. You just need to be prepared).

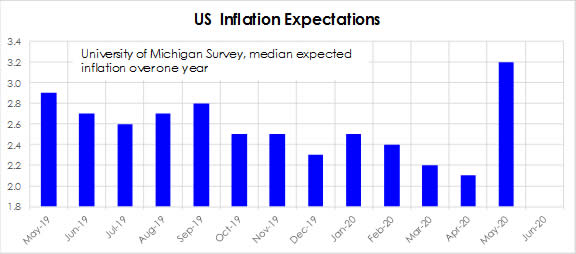

Expectations about this reversion in inflation are becoming apparent.

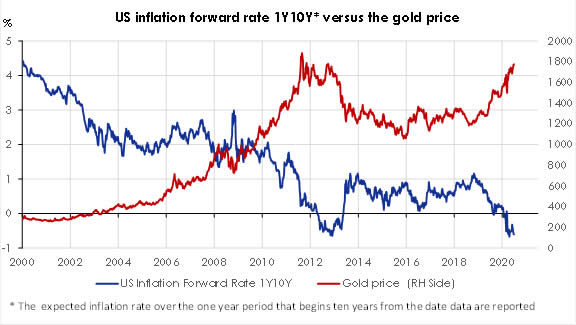

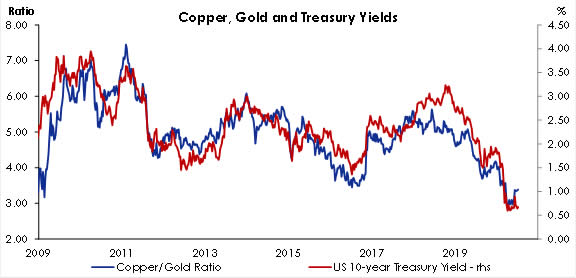

Investors have hitherto piled into Gold rather than look for investments in cyclical companies and companies which deal in, and with, commodities. Gold in fact is NOT the best inflation hedge. If it were the lines below would move in tandem.

A better inflation hedge is probably Copper or Iron Ore? The chart below shows that the price of Copper RELATIVE to Gold rises when inflation rises. We think this is beginning to happen.

At this juncture therefore one should be investing in cyclical companies including raw materials suppliers such as NOF Corporation, Tokuyama Corporation, Dowa Holdings, Heidelberg Cement, Itochu, Anhui Conch Cement, Rio Tinto – all of these we own in one or more of our strategies.

Many of these are based in Asia and you should also be reviewing Asia including Japan. Much is being written about the growing friction in trade and intellectual capital between China and the USA and it is becoming apparent that we are going to see the pursuit of ‘National Industrial Policies again – much like the1950’s. China is already trialling a digital currency to avoid potential embargoes on using the US$ in SWIFT, the worldwide banking settlements system, and is also frantically pursuing technological independence from USA patents. (As an aside the reduction in global FDI, duplicate supply chains, and trade tariffs can only have upward pressure on prices of goods. Anyone expecting bond yields to remain negative for the next few years cannot really believe in free markets?)

In the short-term China will also look to boost its domestic economy. This process has started. Investors have shunned China/Hong Kong (and to a lesser extent Japan) and have favoured only a few USA ‘technology’ companies. Look wider afield.

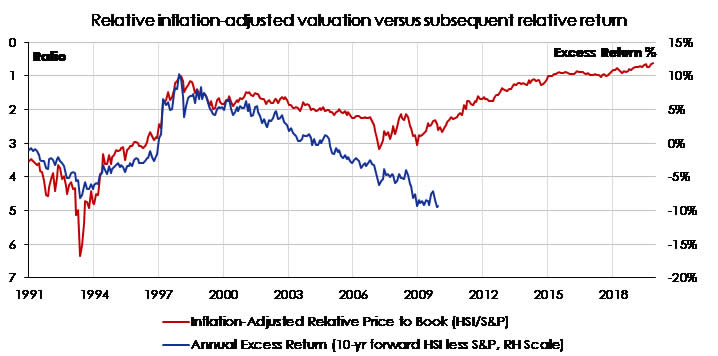

Hong Kong, increasingly a proxy for Chinese companies, is cheap relative to the USA. This is the redline in the chart below. This is in real time. The blue line is the subsequent 10-year return of the Hong Kong Index minus the USA S&P 500. In the next 10 years this line will likely rise toward the red line – in other words Hong Kong will increasingly outperform.

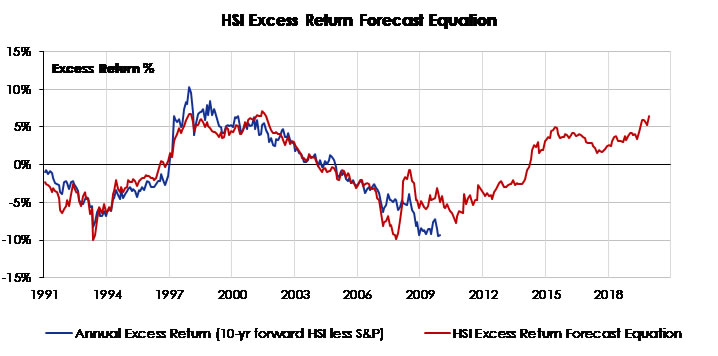

Adding in other variables gives us an excess return forecast.

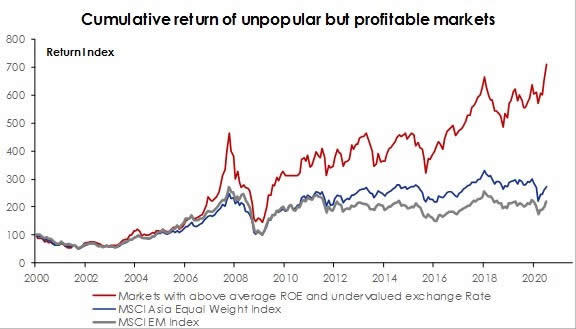

Hong Kong and China are out of favour, but this is precisely the time to be investing – when they are neglected. The chart below shows the return of a strategy that automatically rebalances back to unpopular markets with profitable companies. The cumulative returns of this country rotation strategy are appealing.

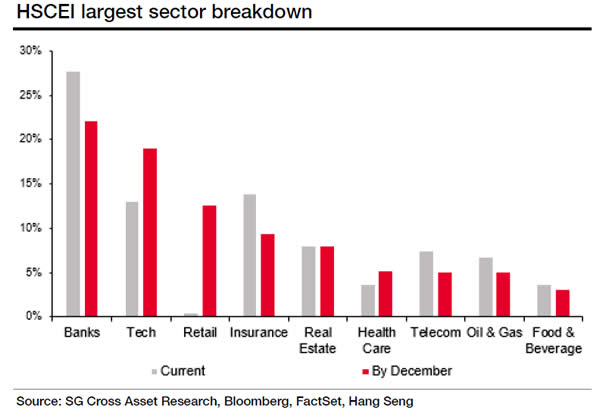

One should also note that the COMPOSITION of the Hong Kong indexes is going to change a bit and more 'digital age' companies are going to be included in the indices. A number of Chinese companies have listed on NASDAQ, in order to avoid the HK rule regarding no dual class structures, but these rules have changed in Hong Kong (now there's a surprise?) and many Chinese companies will be forced to de-list in the USA and will therefore list in Hong Kong. Alibaba is one such which is now listed (HK:9988). The index agencies won't include them straightaway but over the next few years they will. One of the largest fund management trends has been indexing and it is therefore likely there will be a number of passive buyers and buyers attempting to 'jump the index weighting gun'.

The sector changes likely can be seen in the chart below which postulates the sector composition by end December 2020. Compare the grey (today) with the red.

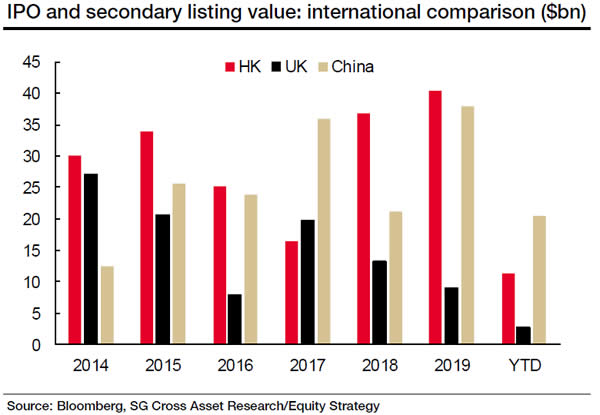

The following chart should give some indication of the likely capital amounts that will be raised and flow into HK relative to London.

Cheap markets, strong fiscal positions, strong capital expenditures and deepening capital markets. What else could one want as an investor?

The advice used to be many years ago to "Go West young man"... in order to grow and prosper. The origins of this phrase are obscure but generally ascribed to Horace Greeley a newspaper editor. We couldn’t resist repeating the jibe about Washington DC in the phrase either, so here is the quotation.

"Washington is not a place to live in. The rents are high, the food is bad, the dust is disgusting, and the morals are deplorable. Go West, young man, go West and grow up with the country."

- attributed to Horace Greeley, New-York Daily Tribune, July 13, 1865[1][2]

He meant keep going West within the USA, but it also came to be a slogan used to entice the brighter Brits out to the USA.

Right now, however, our [investment] advice would be "Go East" or if you prefer, "Keep going West until you get to Asia"

DISCLAIMER

This report provides general information only and does not take into account the investment objectives, financial circumstances or needs of any person. To the maximum extent permitted by law, Delft Partners Pty Ltd, its directors and employees accept no liability for any loss or damage incurred as a result of any action taken or not taken on the basis of the information contained in the report or any omissions or errors within it. It is advisable that you obtain professional independent financial, legal and taxation advice before making any financial investment decision. Delft Partners Pty Ltd does not guarantee the repayment of capital, the payment of income, or the performance of its investments. Delft Partners operates as owner of API Capital Advisory Pty Ltd AFSL 329133.