Corporate America: An Update On Q1 Results & Beware Inflation

May 2021

By Delft Partners

A quick update on corporate America. Recent results for q1 have generally been very good, especially in operationally leveraged businesses such as UPS, FDX, UNP. Also striking is the commentary from ‘old school’ companies that actually make things. Order books are generally good, margins are holding and capital investment expansion plans are being prepared (which we think a good thing). Results from HON, PCAR, PWR JCI have beaten on revenue, earnings or both. Euphoria is almost tangible along with complacency.

We own many of these companies. UPS has outperformed AMZN over the last 12 months so you really should remember that there is a diverse choice out there.

www.delftpartners.com/diversified-global-equity-trust

Prices however are another issue and that is the point of this update. Both input and selling prices are under upward pressure and it is pretty clear that the end user is going to be asked to pay more in the future if not already. We cite a collection of recent comments from USA companies below:-

- Procter & Gamble (NYSE:PG): "The commodity challenges we face next year will, obviously, be larger next fiscal year."

- Honeywell (NYSE:HON): Inflation "is taking hold. That -- there's no doubt about it. We knew it. We see it."

- Kimberly-Clark (NYSE:KMB): "... sharp rises in input costs ..."

- Coca-Cola (NYSE:KO): We're "closely monitoring upward pressure in such inputs such as high-fructose corn syrup, PET, metals, and other packaging materials ..."

- PepsiCo (NASDAQ:PEP): There "is certainly higher input inflation, but it's been factored into the '21 guidance, notably, in terms of agricultural and packaging ..."

- Boston Beer (NYSE:SAM): The "input costs are going up because the phase is still coming into our costs of materials and ingredients and packaging materials."

- Celanese (NYSE:CE): "I mean, we're certainly feeling the inflationary factor."

- Crown Holdings (NYSE:CCK): Delivered "aluminum in North America at round $1.28 a pound versus $0.75 last year at this time, so an increase of 70%."

- Steel Dynamics (NASDAQ:STLD): "... higher average selling values were offset by significantly higher input costs."

- Mattel (NASDAQ:MAT): "... despite the cost inflation we're seeing and the impact it's having on gross margin ..."

- Whirlpool (NYSE:WHR): Our actions "will offset the impact of global supply constraint and rising input costs."

- Snap-on (NYSE:SNA): We've "got material inflation in these numbers."

- GATX (NYSE:GATX): The "increased price of steel is increasing the cost of a car across the board."

- Dover (NYSE:DOV): "... I get it that the Fed doesn't want to recognize inflation. But there is inflation."

- Sonoco Products (NYSE:SON): "Our industrial segment was hit the hardest with price/cost challenges due to the higher OCC costs.

We know that The Fed isn’t going to say “gee we’re worried about inflation and inflation expectations” because they have about 55% of the USA debt pile maturing in the next 3 years, and they don’t want to pay more interest by spooking the bond market. So, if you ask a central banker whether they’re worried about inflation you should remember the Mandy Rice Davies’ response in the Profumo affair. You will get the obvious denial.

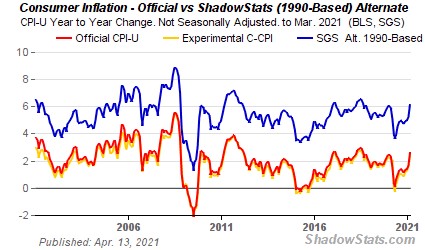

To check out what inflation is probably currently under way check out www.shadowstats.com Chart by permission below

Inflation matters because it will set the clearing price of the longer-term treasury notes and bonds which in turn serve as the discounting mechanism for future dividends and earnings from stocks. As yields rise, future cash flows become relatively less certain and valuable which means dividend yields and true earnings will matter. Already the market is waking up to this fact and the SPAC craze appears to be under pressure with a large number of them now trading below their issue price.

Inflation and Regulation are the two big killers of bull markets and we have both coming to the party.

Simply put, we may well be in 1968 all over again when President Johnson had just introduced his ‘Great Society’ with policies on Clean Air, Education, Infrastructure, and Civil Rights. Sound familiar? He of course had to pay for the Vietnam war too and we now pay for the war on Covid. This era ended with a nasty commodity shock, the peaking of the ’Nifty Fifty’ on the stock market and some pretty poor equity returns for a decade or more.

It’s not too late to return to sound money, and inflation may well prove to be transitory, but it will be going up soon and at the least will test the market’s nerves. We think that Chairman Powell is subtly trying to wean the stock market off the opium of forever easy money. This is essential if painful for some such as overleveraged hedge funds and companies.

For example, his purchases of bonds and mortgages per month have remained static in $ terms even as the deficits have ballooned under the spending plans. He did not even hint that Archegos or Greensill required general bailouts despite billion dollar losses, and so far he has explicitly failed to mention Yield Curve Control.

www.delftpartners.com/news/views/some-thoughts-on-jackson-hole

We could be wrong – we often are. But you may want to invest as if we are wrong? Why?

If we’re wrong, and we get higher levels of QE, it may seem like a free money party, but such things won’t last because if something can’t go on forever it won’t.

Thus, as inflation becomes embedded; bond yields will rise more than they have to and we may see a return to the era of controlled capital allocation starting with the yield curve control they have studiously so far failed to mention. This will be worse than taking the medicine now.

www.delftpartners.com/news/views/a-fictitious-memo-to-jay-powell-from-a-staffer-at-the-fed

So be defensive with duration in fixed income. Favour small cap equity over large ones since government regulation is always aimed at large company practices (will AMZN ever pay a decent amount of tax?), and favour earnings and cash flow over concepts and high multiples.

For Australian based investors please check out our portfolio holdings by contacting Tamim the trustee of the unit trusts for Asia small companies, and Global equities.

As always please email us with any questions or comments

DISCLAIMER

This report provides general information only and does not take into account the investment objectives, financial circumstances or needs of any person. To the maximum extent permitted by law, Delft Partners Pty Ltd, its directors and employees accept no liability for any loss or damage incurred as a result of any action taken or not taken on the basis of the information contained in the report or any omissions or errors within it. It is advisable that you obtain professional independent financial, legal and taxation advice before making any financial investment decision. Delft Partners Pty Ltd does not guarantee the repayment of capital, the payment of income, or the performance of its investments. Delft Partners operates as owner of API Capital Advisory Pty Ltd AFSL 329133.