June 2024 Update

June, 2024

Onwards and Upwards?

Equity markets were very healthy in May, nearly doubling the year-to-date returns in many cases. European equity markets managed to edge out the US. Europe benefitted from greater investors' convictions that the ECB would be one of the first major central banks to cut interest rates. The good US equity market return was helped by the strong performance of tech stocks. US markets remain VERY narrow which is not healthy. Some early signes of EPS upgrades in the 'S&P493' are encouraging.

Asian equity markets were mixed in May, not helped by some stuttering in the performance of Japanese equities. This is not surprising after such a strong 12 month performance. We had trimmed slightly a few weeks back by selling Zozo and Itochu. We reinvested in Swire Group in Hong Kong, Tenet Healthcare, and Ebay in the USA for the global strategies. The Japanese economy showed some signs of slowing, and the Yen remained under downward pressure.

China's equity market also went quiet, consolidating after some strong gains in previous months. Property developers in China remain in peril. A recent visit to Japan confirmed growth potential if only by reducing labour intensity and inefficiency and embracing digitisation and technology. It remains paradoxical that the country which produces so many innovative hardware products struggle to implement them in the service sector. Share buy-back announcements continue apace in Japan.

The Global Equity trust rose 1.6% and the value biased Global 30 was flat. Both underperformed respective indices slightly in May but over the last year are ahead by c.2% each. The global listed infrastructure strategy rose c3% and is ahead of the benchmark by over 10% over the last year. We will be reducing tracking error in this strategy shortly as part of the risk control/common sense approach to portfolio construction. Trees don't grow to the sky and relative valuations within the infrastructure universe are stretched.

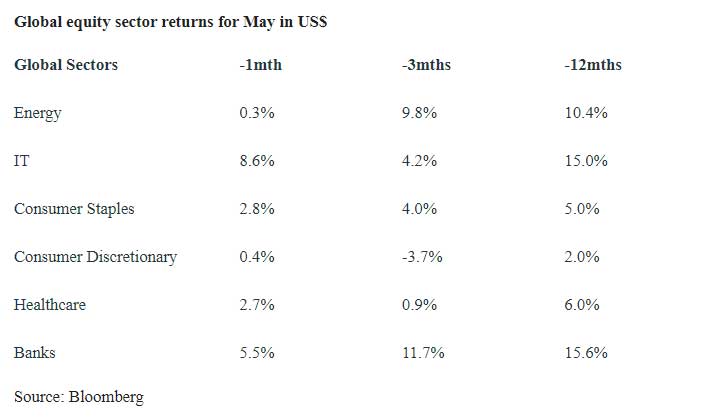

Equity sector performance

After last month's profit taking, the tech sector had another good performance in May. Nvidia reported another excellent quarter's performance, leading to a further sharp rise in share price. The energy sector went into reverse as the oil price slipped back, unwinding a quarter of recent gains. Consumer discretionary stocks are hurting, with consumers cutting back on large purchases due to the damage to their spending power from inflation.

We surmised a couple of months ago that the equity markets would just keep chugging along, and it would be best to stay invested. https://www.delftpartners.com/news/views/march-2024-keep-on-truckin.html

Base effects on annual growth rates, inflation and earnings would start to turn positive, meaning that they will be moving in the right direction at least for a little while. Annual historic growth up, inflation down!

The one area that provides us with real concern is the real estate market especially the office market where large debts, falling rents and overbuilding have created the ingredients for severe markdowns. This is beginning to happen. We quote from a broker update - "Buyers of the AAA portion of a $308 million note backed by the mortgage on a building in midtown Manhattan got back less than three-quarters of their original investment after the loan was sold at a steep discount. It's the first such loss of the post-crisis era, says Barclays. As for the five groups of lower ranking creditors? They got wiped out. Market watchers say the fact the pain is reaching all the way up to top-ranked holders, overwhelming safeguards put in place to ensure their full repayment, is a testament to how deeply distressed pockets of the US commercial real estate market have become."

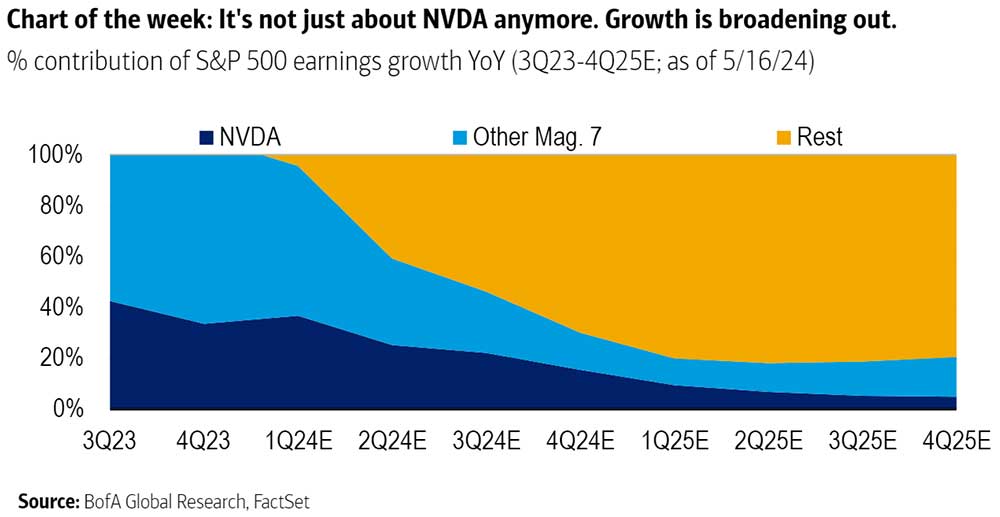

Countering this concern is a welcome broadening of the USA market. It was never healthy for 1 or even 5 or 7 stocks to be responsible for all the earnings growth and index performance and the chart below gives us encouragement that the other thousands of stocks are going to receive more attention from investors.

May saw some significant moves in holdings with International Paper +28%, Qualcomm + 23%, Teradyne, + 21%. Detractors were CVS -12%, Ebara -12% and Kajima -12%.

In the listed infrastructure strategy the need for a better grid, with AI processing demands and renewables requiring connectivity, stocks such as Vistra +30%, Constellation Energy + 17% and Sterling Infrastructure + 20% continued to run. The global listed infrastructure strategy is up over 25% in the course of one year and has an annualised return of over 11% with much lower levels of volatility than the general equity market since its inception several years ago. It represent a sensible way to hedge inflation and is likely to outperform other yield investments especially bonds.

Delft Partners June 2024

DISCLAIMER

This report provides general information only and does not take into account the investment

objectives, financial circumstances or needs of any person. To the maximum extent permitted by law,

Delft Partners Pty Ltd, its directors and employees accept no liability for any loss or damage

incurred as a result of any action taken or not taken on the basis of the information contained in

the report or any omissions or errors within it. It is advisable that you obtain professional

independent financial, legal and taxation advice before making any financial investment decision.

Delft Partners Pty Ltd does not guarantee the repayment of capital, the payment of income, or the

performance of its investments. Delft Partners operates as owner of API Capital Advisory Pty Ltd

AFSL 329133.