KLA Tencor - Part of the 4th Industrial Revolution

May 20, 2019

By Robert Swift

So where can I find a company making a profit; paying a dividend; on a reasonable valuation and yet not have to give up being part of the '4th Industrial Revolution'? If 50 is the new 40, then is negative the new positive?

We ask this in the light of two recent Initial Public Offerings (IPOs) where neither company has made a profit, is not about to make a profit, and is quite possibly never going to make a profit. We are of course referring to Lyft and Uber – the ride companies with other bits added.

Regardless of this apparently small problem over profitability, the companies were initially capitalised at USD 25billion for Lyft and USD 80billion for Uber. Both are less valuable than this now, investors are apparently clearly 'pretty relaxed' about the long-term prospects for both with price to sales ratios at over 6x for both. To put that into perspective the S&P 500 trades on about 2x price to sales.

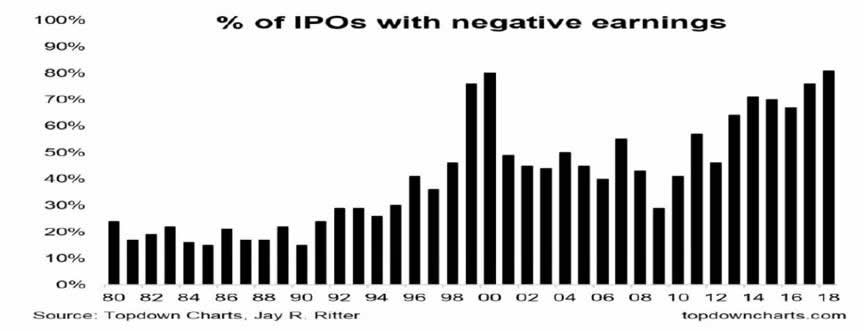

There has been a trend recently toward more IPOs with negative earnings and we show a chart below which ought to give pause for thought. How come investors again don't care about investing hard earned savings into loss making entities? Cynically we note that the Private Equity pools need to recycle capital and will be wanting to exit investments made about a decade ago and are perfectly capable of working with Wall Street to get junk and unready companies into the marketplace. It's been done many times. Caveat emptor.

Nonetheless, we are at levels of 'irrational exuberance' in some parts of the stock-market where we were in 1999/2000. Remember what happened next?

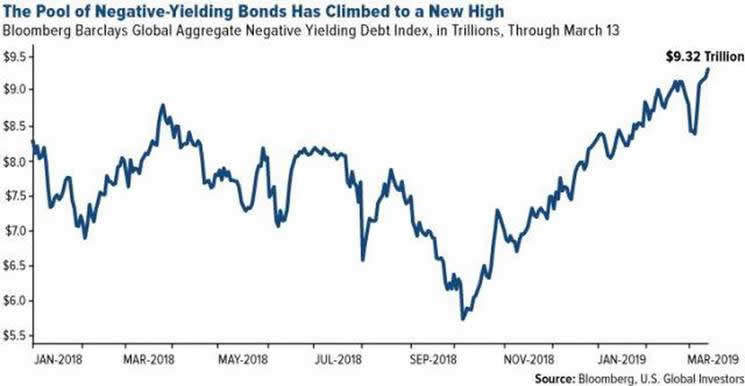

Just because equity investors can be overly optimistic doesn't mean that bond investors don't know how to make some apparently weird decisions too. See below for the size of the bond pool where negative yields are 'on offer'. About 16% of the outstanding government bond universe now has a negative yield!

To be clear a negative yield is where you will definitely get a lower face value back at redemption than you lent to the borrower and you PAY the borrower for the privilege of parking YOUR money with them. It is of course possible to lose money on a positive yield bond investment where maturity at 100% is lower than you might have paid, but pretty whacky to have to pay interest to the borrower rather than the other way around? So what is going on?

Negative yields only occur in bond markets where investors are nervous, the borrower is of the highest quality and investors are happy with a return of capital rather than a return on capital. The rapid growth of the negative yielding pool would indicate that many investors are now more nervous of investing with riskier borrowers and/or being driven into these bonds by monetary policy and indexing pressures. So if bond investors are becoming more nervous, how come equity investors are getting 'more relaxed'?

Maybe the deliberate ploy by central banks to force investors into riskier assets including loss making equities, by making safe investments such as bonds less attractive, is having an impact and 'risk on' in buying any (loss making) equity regardless of valuation is now a default setting. "If bonds are REALLY expensive then let's take lots of risk in equities especially ones with growth"?

We think as a default setting it's gone too far and use the chart below to show just how stretched is the relationship between Value equities and Growth equities. This is from the USA but also applies globally. Full disclosure – we are more Value oriented in our approach and prefer dividends to no dividends because of the time value of money. We have hung on grimly while the marginal excess returns of momentum over value strategies gets wider. We would like to see, and are planning for, this particular frenzy to come to an end!

KLA Tencor

We're often criticised for our Value bias on the basis that we don't understand we are at the start of the 4th industrial revolution and growth and innovation matters more than profits and dividends from 'dying companies'. Our response is that we can and do invest in new technology, just not at high prices, and we can also find companies with profits and dividends too, refer to our articles on what technology means to us:

- Technology Stocks are not just about the software and hardware

- What do we mean by a Technology Stock?

How then do we protect ourselves from a sudden reversal away from 'risk on' momentum investing styles, and yet participate in continued change and new opportunities? It's simple really. Find misunderstood companies on lower multiples which pay a dividend as proof of profits and share-holder respect! There are quite a few of them.

A brief description of a recent inclusion of KLA Tencor into the portfolio can illustrate this. We believe investing in this type of company is far better than punting on loss making entities at IPO or even buying negative yielding bonds no matter how safe or how much of the index they represent. We also own Hitachi High Technologies which operates in a related tech space to KLA, so 'high conviction' seems an appropriate name for our focused global equity strategy.

KLA-Tencor Corp. (KLAC) is the leading supplier of process control equipment used in the fabrication of integrated circuits. Integrated circuits are small chips that perform functions in the digital world such as memory storage, timers for automated processes, amplifiers etc. They are already ubiquitous and growing very rapidly. Before they are installed into gadgets, they need to be tested to ensure that they work. KLA Tencor focusses on this testing.

Process control systems in which KLA Tencor specialise, are used to analyse product and process quality at critical junctures (mostly the back end when the whole IC Package has been assembled) of the manufacturing process. Small increases in yields, the percentage of the IC package that works, are very valuable to the semi-conductor makers since this means significant increases in profits to them.

The company was formed in April 1997, when KLA merged with Tencor Corporation to become the single largest provider of process control equipment in the world. Recently they acquired Orbotech from Israel which cements this position and diversifies the product line-up. Market share is in excess of 70% so as dominant in this space as Google is/was in online ads? The global market is probably above $6bn and growing so a 70% share is worth over $4bn in revenue.

The challenge is that the market and pricing of ICs and the testing equipment is cyclical around a long-term growth rate and the companies can be both financially and operationally leveraged to this cycle. Consequently, it pays to invest while the news flow is not great but as best you can predict, the trough in operating profitability has been reached. The current news is indeed not great with Wafer Fabrication Equipment spend expected to be down more than 15% in 2019 after a glut in prior years driven by smart phone growth in China.

A product shift however appears to be underway with a move to higher densities (more stuff on a wafer ~ 7nm width) and 3G logic and memory chips which effectively will see the Central Processing Unit built directly into the memory. Currently there is a lag, where the CPU issues an instruction and the memory retrieves, reacts and transmits back. If the lag can be overcome then for things like self-driving cars and gaming, reaction times will be reduced significantly. Consequently, 3D is a definite part of any 4th industrial revolution and the required capital expenditure to design and test these new chips will find its way to KLA.

The stock trades at a forward P/E ratio of around 13x and has a dividend yield of over 2.5%. The P/E ratio has ranged from 13.5 x to as high as 25x so if we see an upswing in WFE spend on the horizon this stock has plenty of upside. In the meantime, the dividend yield is better than that available on USA and Australian government bonds and certainly than that available in the negative yield cohort!

We like Uber as a consumer however as an investor we prefer KLA!