July 2023 Update

The 'Storm Clouds' are still there.

July, 2023

Markets continued to rise in the 2nd quarter, led by NASDAQ now up almost 40% since January. Year to date the S&P 500 has risen about 14% and Japan 20%. Growth has outperformed value in by an extent that last led to a snap back the other way. Over the last 3 years the styles have fluctuated with respect to popularity with investors although the value index has outperformed growth by a little over 1% p.a. and experienced less volatility. Favouring growth now is shutting the stable door after the horse has bolted.

After this run, we would anticipate market rotation back to value.

Using the S&P definitions and for 3 years to end June 2023 in US$:

Global Growth +9.59% p.a.

Global Value + 12.59% p.a.

Global Mkt Cap + 11.14%

We didn't anticipate such a strong rally in growth but our aversion to market timing by not holding large amounts of cash has reduced the drag on performance due to style effects. The diversified trust rose 3.8% , the Global 30, a value strategy, rose 2.1% and the Infrastructure strategy rose 2.3%. The global strategies underperformed benchmarks but the global infrastructure outperformed.

Through a joint venture with a SFC licenced firm in Hong Kong, AOP Capital, we also offer an Asia dividend 'champions' strategy and a Future Food and Agriculture Fund. The former rose 4.5% in US$ terms in the 2nd quarter and is up 10.7% ytd. The latter declined 5.9% as investors switched from focussing on 'needs to wants'.

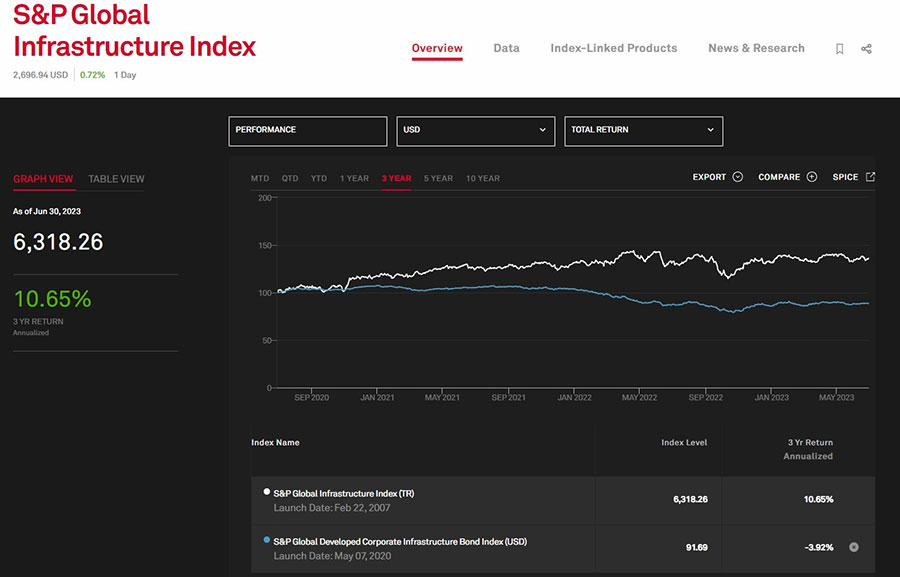

The performance of infrastructure equity relative to infrastructure debt is worth highlighting. Since we identified inflation as a threat about 2-3 years ago, against which the best hedge would be certain equities, such as infrastructure, the listed equity infrastructure performance has been notably better than that of the debt index.

https://www.delftpartners.com/news/views/a-fictitious-memo-to-jay-powell-from-a-staffer-at-the-fed.html

https://www.delftpartners.com/news/views/Investing-during-this-new-paradigm.html

https://www.delftpartners.com/news/views/from-zirp-to-splurge.html

https://www.delftpartners.com/news/views/corporate-america-an-update-on-q1-results-and-beware-inflation.html

Our stance continues to be that capital stock in most countries needs significant uplift in maintenance expenditures, let alone expansion spending. Infrastructure stocks will return to the limelight once the AI frenzy is over.

The USA passed the debt ceiling increase and the Biden administration continues to try and spend money as we knew they would. Given the destination of this spending is unlikely to improve productivity and the impact of higher interest rates on reducing hiring and consumer confidence, we think a period of stagflation is very likely. Probably in most countries.

https://www.delftpartners.com/news/views/Investing-during-this-new-paradigm.html

Europe entered a technical recession and a recent visit there would indicate financially stretched households, markedly increased prices since our last visit two years prior, and a large amount of dis-satisfaction with political and economic trends. The ECB is way behind the curve even with (because?) rates at 3.5% are at a 22 year high and inflation is unlikely to fall given the still negative real yields and poorly allocated spending which will not raise growth potential - quite the opposite. A policy rate of 3.5% compares with an EU average annual inflation rate of over 5%.

As we write this France is enduring another series of widespread riots. If you think these are only directly attributable to the shooting in Nanterre, near Paris, then you are 'not listening'! The AfD in Germany won its first elected position in Thuringia. Current economic policy in Europe appears to be causing many problems and will have to change. Tax more and spend more is our best guess - which will have implications for the kind of investments to own.

In an illustration of why balance sheets matter, Thames Water, a highly leveraged water utility serving about a quarter of England's population, is seeking a government (aka tax-payer funded) bailout. Debt servicing costs on at least GBP 15bn (the company's revenues are c. GBP 2bn) have constrained the firm's ability to meet rising chemical costs, energy costs, and necessary capital investment to improve outdated infrastructure. It's not listed on the LSE but other water companies are (Severn Trent, United Utilities, and Pennon Group) and these will suffer hits to sentiment if not their actual financials. We own none of these in any strategy. Re-nationalisation is also a possibility if (when?) the Labour party becomes elected in the UK. Core inflation in the UK is running at over 7% and the bank base rate at 5% so still negative in real terms.

There is probably more rate pain to come everywhere with the exception of China which of course struggles with its own years of mis-allocated capital.

There were some significant price moves in Japanese stocks in the quarter.

- Advantest rose 61% - https://www.delftpartners.com/news/views/advantage-advantest.html

- Ibiden 59%

- Kajima 38%

- Itochu 33%

- Canon 29%

It's our favourite market. We think the Yen undervalued and every month that goes by when Japanese inflation comes in lower than inflation elsewhere (particularly Germany which is the main global competitor in machinery market share) then Japanese companies become even more competitive and likely to win business.

And of course some price declines

- Anhuui Conch - 23%

- Andritz - 22%

- Alibaba - 19%

- Valero -14%

We made few changes to the portfolios in the second quarter. We added a little to Marathon Petroleum in the global diversified strategy and sold Intel re-investing in Applied Materials. We took profits in Hoya and re-invested in NGK Insulators which manufactures and services high-quality and highly reliable ceramic insulators and equipment for power transmission, substations, and distribution, both in Japan and overseas. It trades on a P/E of 9 and a yield of 3%. Regardless of energy or power source, transmission to end markets will be needed.

We intend to remain fully invested and unhedged for Australian based investors.

Delft Partners July 2023

DISCLAIMER

This report provides general information only and does not take into account the investment

objectives, financial circumstances or needs of any person. To the maximum extent permitted by law,

Delft Partners Pty Ltd, its directors and employees accept no liability for any loss or damage

incurred as a result of any action taken or not taken on the basis of the information contained in

the report or any omissions or errors within it. It is advisable that you obtain professional

independent financial, legal and taxation advice before making any financial investment decision.

Delft Partners Pty Ltd does not guarantee the repayment of capital, the payment of income, or the

performance of its investments. Delft Partners operates as owner of API Capital Advisory Pty Ltd

AFSL 329133.